Jacksonville Property Tax

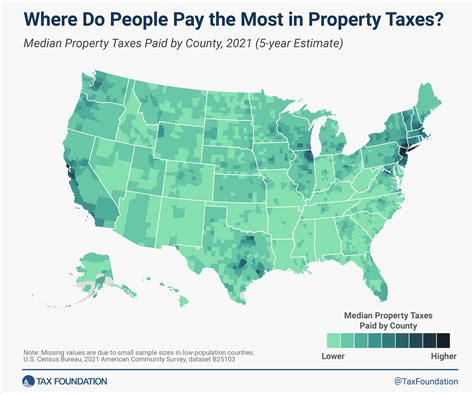

Understanding property taxes is essential for homeowners and investors alike, as they play a significant role in the overall cost of owning a property. In Jacksonville, Florida, property taxes are an important consideration, and they can vary depending on various factors. This article aims to provide an in-depth analysis of Jacksonville's property tax system, exploring its workings, the factors that influence tax rates, and the implications for homeowners and investors. By delving into the specifics, we can offer a comprehensive guide to navigating the world of property taxes in this vibrant city.

Unraveling the Complexity of Jacksonville Property Taxes

The property tax system in Jacksonville, like in many other regions, is a complex mechanism designed to fund essential public services and infrastructure. It involves a meticulous process of assessment, valuation, and tax calculation, all of which contribute to the final property tax bill that homeowners receive annually. This section aims to demystify this process, shedding light on each step and its significance.

The Assessment Process: How Jacksonville Values Properties

Property assessment is the first crucial step in determining property taxes. In Jacksonville, the property appraiser’s office is responsible for this task. They employ a team of trained professionals who regularly inspect and evaluate properties, considering factors such as location, size, improvements, and recent sales data. This process ensures that property values are kept up-to-date, providing a fair basis for tax calculations.

The appraiser's office uses a variety of methods, including cost approach, sales comparison approach, and income approach, to determine the just value of each property. This just value, as defined by Florida law, is the fair market value of the property as of January 1st of the tax year. It's this value that forms the basis for tax assessments.

Once the just value is determined, the property falls under one of three classifications: residential, commercial, or agricultural. Each classification has its own unique assessment considerations, with residential properties often benefiting from homestead exemptions, which we'll explore in more detail later.

Tax Rates and Millage: Understanding the Numbers

After the property assessment, the next critical step is the application of tax rates, often referred to as the millage rate. A millage rate is the tax rate per thousand dollars of assessed property value. In Jacksonville, this rate is set annually by the various taxing authorities, including the city, county, and school board. These entities determine their budgets and then set the millage rate required to fund those budgets.

The millage rate is expressed in decimals, with one mill equivalent to $1 of tax for every $1,000 of assessed value. For instance, if a property has an assessed value of $200,000 and the millage rate is 10.00, the property owner would pay $2,000 in taxes ($200,000 x 0.010). It's important to note that Jacksonville's millage rate can vary from year to year, depending on the budgetary needs of the taxing authorities.

| Taxing Authority | 2023 Millage Rate |

|---|---|

| Jacksonville City | 4.3675 |

| Duval County | 4.7585 |

| Jacksonville School Board | 8.1299 |

These rates are combined to form the total millage rate for a property, which is then applied to the assessed value to calculate the property tax.

The Role of Exemptions and Discounts

Jacksonville, like many other localities, offers various exemptions and discounts to reduce the property tax burden on certain property owners. These incentives are designed to promote homeownership, support seniors, and encourage economic development.

One of the most significant exemptions is the Homestead Exemption, available to homeowners who permanently reside on their property. This exemption reduces the assessed value of the property, directly lowering the tax bill. For example, the Save Our Homes (SOH) Amendment provides an annual increase cap of 3% on the assessed value of homesteaded properties, ensuring that homeowners are not faced with excessive tax increases year over year.

Other notable exemptions include the Senior Exemption, which offers a $50,000 exemption for homeowners aged 65 or older, and the Widow/Widower Exemption, which provides a $500 exemption for those who have lost their spouse. Additionally, Jacksonville offers various Economic Development Incentives, such as the Brownfield Redevelopment Incentive and the Qualified Target Industry Tax Refund, aimed at attracting and retaining businesses.

The Impact of Property Taxes on Homeownership and Investment

Property taxes are an essential consideration for both homeowners and investors, as they directly affect the overall cost of owning a property and can influence investment strategies.

Homeowners: Navigating Property Taxes

For homeowners in Jacksonville, property taxes are a significant part of the cost of homeownership. While the city offers various exemptions and incentives to reduce the tax burden, understanding and managing these taxes is crucial. Here are some key considerations for homeowners:

- Annual Tax Bills: Property taxes are typically paid annually, and the bill is usually sent out by the tax collector's office. It's essential to ensure timely payment to avoid penalties and interest.

- Budgeting and Planning: Property taxes should be factored into the overall budget for a household. Understanding the tax rate and the assessed value of the property can help in financial planning.

- Claiming Exemptions: Homeowners should be aware of the exemptions they are eligible for and ensure they claim them. This can involve filling out the necessary paperwork and providing supporting documentation.

- Appealing Assessments: If a homeowner believes their property has been overvalued, they have the right to appeal the assessment. This process involves submitting an appeal to the Property Appraiser's Office, providing evidence to support the claim, and potentially attending a hearing.

Investors: Strategies and Considerations

For investors, property taxes are a critical component of the overall investment strategy. Here’s how property taxes can influence investment decisions and strategies:

- Rental Properties: When investing in rental properties, property taxes are typically passed on to tenants through the rent. However, investors need to ensure that the rent covers these expenses and provides a sufficient return on investment.

- Tax Benefits: Investors can also benefit from certain tax incentives and exemptions. For instance, the Qualified Business Income deduction allows for a 20% deduction on rental income, which can significantly reduce the tax burden.

- Cost-Benefit Analysis: When considering investment properties, investors should factor in property taxes as part of their cost-benefit analysis. This involves understanding the tax rates, exemptions, and potential for tax savings, and weighing these against the expected returns from the investment.

- Long-Term Strategies: For long-term investors, property taxes can be a significant factor in the overall profitability of an investment. Strategies such as purchasing properties in areas with lower tax rates or those eligible for tax incentives can enhance the investment's long-term viability.

A Comprehensive Guide to Jacksonville Property Tax Calculations

Understanding how property taxes are calculated in Jacksonville is crucial for homeowners and investors alike. This section provides a step-by-step guide to the calculation process, breaking it down into simple, understandable components.

Step 1: Determine the Property’s Just Value

The first step in calculating property taxes is to determine the property’s just value. As mentioned earlier, this is the fair market value of the property as of January 1st of the tax year. It’s important to note that this value can change annually, depending on market conditions and any improvements made to the property.

The just value is determined by the property appraiser's office, and homeowners can access this information on their annual Notice of Proposed Property Taxes (TRIM Notice). This notice also provides the property's classification (residential, commercial, or agricultural) and any applicable exemptions.

Step 2: Calculate the Assessed Value

Once the just value is determined, the next step is to calculate the assessed value. This value is what the property taxes are actually based on, and it can be lower than the just value due to exemptions and assessments. Here’s how it’s calculated:

- For Residential Properties, the assessed value is 100% of the just value, but it can be reduced by any applicable exemptions, such as the Homestead Exemption or the Senior Exemption.

- For Commercial Properties, the assessed value is typically 100% of the just value, but certain incentives and programs may offer assessments below this value.

- For Agricultural Properties, the assessed value is often a percentage of the just value, with specific formulas applied based on the type of agricultural use.

Step 3: Apply the Millage Rate

The final step in calculating property taxes is to apply the millage rate to the assessed value. As mentioned earlier, the millage rate is the tax rate per thousand dollars of assessed property value. Here’s the formula:

Property Tax = Assessed Value x Millage Rate

For example, if a residential property has an assessed value of $200,000 and the combined millage rate is 10.00, the property tax calculation would be:

Property Tax = $200,000 x 0.010 = $2,000

This calculation provides the annual property tax liability for the property owner.

The Future of Property Taxes in Jacksonville

As Jacksonville continues to grow and evolve, the property tax system will likely undergo changes and adaptations. Here are some key trends and potential future developments:

Population Growth and Urban Development

Jacksonville’s population is expected to continue growing, which will likely lead to increased demand for housing and commercial spaces. This growth can drive up property values, potentially leading to higher property taxes. However, it can also create opportunities for investors, especially in developing areas where property values may appreciate rapidly.

Technology and Assessment Accuracy

Advancements in technology are likely to enhance the accuracy and efficiency of property assessments. For instance, the use of drones and advanced mapping technologies can provide more detailed and up-to-date information on properties. This can lead to fairer assessments and potentially reduce disputes over property values.

Economic Development Initiatives

Jacksonville may continue to offer and expand economic development incentives to attract and retain businesses. These incentives, such as the Qualified Target Industry Tax Refund, can significantly reduce the property tax burden for eligible businesses, making Jacksonville an attractive location for investment and job creation.

Tax Reform and Exemptions

While Jacksonville’s property tax system is relatively stable, there may be calls for reform, especially if property values increase significantly. This could lead to changes in assessment methods, tax rates, or the introduction of new exemptions. Staying informed about any proposed changes is crucial for both homeowners and investors.

How often do property taxes change in Jacksonville?

+Property taxes in Jacksonville can change annually. The millage rate, which is set by various taxing authorities, can vary from year to year based on budgetary needs. Additionally, the assessed value of a property can change due to market conditions, improvements, or changes in exemptions.

What is the average property tax rate in Jacksonville?

+The average effective property tax rate in Jacksonville is approximately 1.07% as of 2022. However, this rate can vary significantly based on the property’s location, value, and classification.

Are there any online tools to estimate property taxes in Jacksonville?

+Yes, the Duval County Property Appraiser’s Office provides an online property tax estimator tool. This tool allows homeowners and investors to estimate their property taxes based on the property’s location and value. It’s a useful resource for budgeting and planning.

Can property taxes be appealed in Jacksonville?

+Absolutely. If a homeowner or investor believes their property has been overvalued or incorrectly assessed, they have the right to appeal. The process involves submitting an appeal to the Property Appraiser’s Office, providing evidence to support the claim, and potentially attending a hearing.

What are some tips for reducing property taxes in Jacksonville?

+There are several strategies to potentially reduce property taxes in Jacksonville. These include claiming applicable exemptions (e.g., Homestead Exemption, Senior Exemption), appealing assessments if the property is overvalued, and taking advantage of economic development incentives for businesses. Additionally, keeping up with maintenance and improvements can help ensure the property’s value is accurately reflected.