How To Calculate Effective Tax Rate

Determining your effective tax rate is an essential aspect of understanding your financial situation and making informed decisions. It provides valuable insights into the actual percentage of your income that goes towards taxes, allowing you to optimize your financial planning and tax strategies. In this comprehensive guide, we will delve into the steps and calculations involved in determining your effective tax rate, offering practical examples and insights to ensure a clear understanding of this critical financial metric.

Understanding the Effective Tax Rate

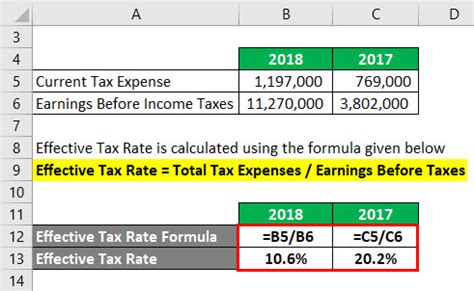

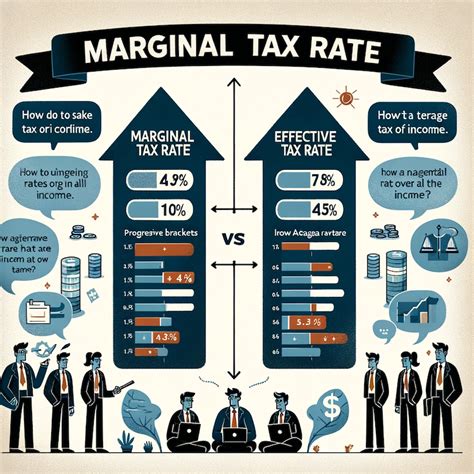

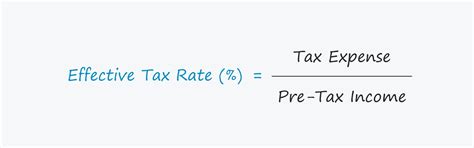

The effective tax rate represents the percentage of your income that is allocated to taxes. It is calculated by dividing the total tax you owe by your total income before taxes. This metric provides a more accurate representation of your tax liability compared to the marginal tax rate, which only considers the tax bracket your highest income falls into.

By understanding your effective tax rate, you can make informed decisions regarding tax planning, investments, and financial goals. It allows you to evaluate the impact of various income streams, deductions, and tax credits on your overall tax liability. Let's explore the step-by-step process of calculating your effective tax rate.

Step 1: Gather Relevant Income and Tax Information

To calculate your effective tax rate accurately, you need to gather all the necessary income and tax-related data. Here's a list of the information you'll require:

- Gross income: This includes your total earnings before any deductions, such as salary, bonuses, investment income, rental income, and any other taxable income sources.

- Deductions: Note down all the allowable deductions, including standard deductions, itemized deductions (e.g., mortgage interest, state and local taxes, charitable contributions), and any other applicable deductions.

- Tax credits: Identify the tax credits you are eligible for, such as the Child Tax Credit, Education Credits, or any other tax-saving credits.

- Taxable income: Calculate your taxable income by subtracting your total deductions from your gross income.

- Tax liability: Determine the amount of tax you owe based on your taxable income and applicable tax rates.

For example, let's consider a hypothetical scenario. John has a gross income of $80,000. He claims the standard deduction of $12,950 and has itemized deductions totaling $4,000. Additionally, he is eligible for a Child Tax Credit of $2,000. To calculate his taxable income, we subtract the deductions from his gross income: $80,000 - $12,950 (standard deduction) - $4,000 (itemized deductions) = $63,050.

Step 2: Calculate Your Tax Liability

Now that you have determined your taxable income, it's time to calculate your tax liability. This involves applying the applicable tax rates to your taxable income. The tax rates and brackets vary depending on your filing status (single, married filing jointly, head of household, etc.) and the tax year. You can find the tax rate schedules on the official IRS website or consult a tax professional.

Continuing with John's example, let's assume he is a single filer for the current tax year. The tax rate schedule for single filers has seven brackets, ranging from 10% to 37%. To calculate his tax liability, we apply the corresponding tax rates to each bracket of his taxable income.

| Tax Bracket | Tax Rate | Taxable Income Range | Tax Calculation |

|---|---|---|---|

| 10% | 10% | $0 - $10,400 | $63,050 - $10,400 = $52,650 x 0.10 = $5,265 |

| 12% | 12% | $10,401 - $41,775 | $41,775 - $10,401 = $31,374 x 0.12 = $3,764.88 |

| 22% | 22% | $41,776 - $89,075 | $63,050 - $41,776 = $21,274 x 0.22 = $4,680.28 |

| Total Tax Liability | $5,265 + $3,764.88 + $4,680.28 = $13,709.88 |

John's total tax liability for this scenario is $13,709.88.

Step 3: Determine Your Effective Tax Rate

With your tax liability calculated, you can now determine your effective tax rate. This is a simple calculation: divide your total tax liability by your gross income before deductions.

In John's case, his effective tax rate would be: $13,709.88 / $80,000 = 0.171375, which can be expressed as 17.14% when rounded to two decimal places.

Interpreting Your Effective Tax Rate

The effective tax rate provides valuable insights into your financial situation. It allows you to compare your tax burden with that of others in similar income brackets and make informed decisions regarding tax planning strategies. A higher effective tax rate may indicate the need to explore tax-efficient investments, optimize deductions, or seek professional tax advice.

Additionally, understanding your effective tax rate can help you assess the impact of tax-related decisions, such as contributing to retirement accounts, maximizing deductions, or utilizing tax credits. It empowers you to make strategic choices to minimize your tax liability and optimize your overall financial well-being.

Frequently Asked Questions

How does the effective tax rate differ from the marginal tax rate?

+The marginal tax rate refers to the tax rate applied to your highest income bracket, while the effective tax rate represents the overall percentage of your income allocated to taxes. The effective tax rate provides a more accurate representation of your tax liability, considering all income and deductions.

Can my effective tax rate be negative?

+Yes, it is possible for your effective tax rate to be negative if your tax credits and deductions exceed your tax liability. In such cases, you may be eligible for a tax refund.

Are there any tax strategies to reduce my effective tax rate?

+Yes, there are several strategies to consider. Maximizing deductions, contributing to tax-advantaged retirement accounts, and exploring tax-efficient investment options can help reduce your taxable income and, consequently, your effective tax rate. Consulting a tax professional can provide personalized advice based on your specific circumstances.

How often should I calculate my effective tax rate?

+It is beneficial to calculate your effective tax rate annually, especially when there are significant changes in your income, deductions, or tax laws. Regularly assessing your effective tax rate allows you to stay informed and make timely adjustments to your tax planning strategies.

Calculating your effective tax rate is a valuable exercise to gain a comprehensive understanding of your tax liability. By following these steps and staying informed about tax regulations, you can make informed decisions to optimize your financial well-being and tax strategies.