Tax Deduction For 529 Plan

The 529 plan, an innovative education savings tool, has become a popular choice for parents and individuals aiming to secure their future educational expenses. This article delves into the tax implications of these plans, exploring the benefits and intricacies that make them an attractive financial strategy. With a focus on tax deduction, we'll uncover how these plans can provide significant advantages, ensuring a thorough understanding of this crucial aspect of financial planning.

Unraveling the Tax Benefits of 529 Plans

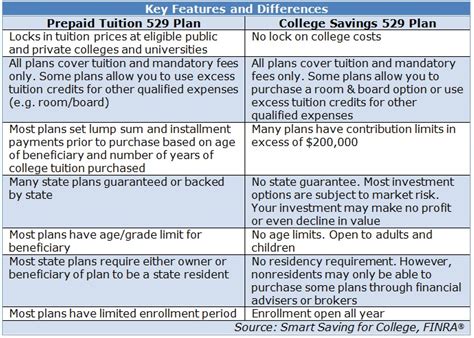

529 plans, officially known as “Qualified Tuition Programs,” offer a unique opportunity for tax-efficient savings. Introduced by the Taxpayer Relief Act of 1997, these plans have evolved into a cornerstone of educational funding strategies, providing a range of tax benefits that can significantly reduce the overall cost of education.

Understanding the Tax Deduction Process

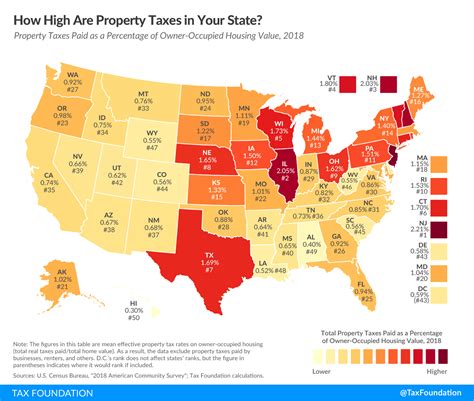

The tax deduction associated with 529 plans operates on a state-level basis, with variations across different jurisdictions. In essence, when you contribute to a 529 plan, you’re entitled to a tax deduction or a tax credit, depending on the state’s specific regulations. This deduction is applicable on your state income tax return, effectively reducing the taxable income and, consequently, the amount of tax you owe.

| State | Deduction/Credit Type | Maximum Deduction/Credit Amount |

|---|---|---|

| California | Deduction | $15,000 per year |

| New York | Credit | $10,000 per year |

| Florida | Deduction | $4,000 per account holder |

| Texas | Deduction | $8,000 per year |

| Illinois | Credit | $250 per contributor |

It's crucial to note that not all states offer tax deductions or credits for 529 plan contributions. Currently, about 34 states and the District of Columbia provide some form of tax benefit. However, even in states without such incentives, the federal tax benefits of 529 plans still make them a compelling choice for educational savings.

Maximizing Tax Benefits with Strategic Contributions

To optimize the tax benefits of 529 plans, it’s essential to plan contributions strategically. For states offering deductions, front-loading contributions—maximizing the initial contribution amount—can be advantageous. This strategy allows for a larger deduction in the year of contribution, potentially reducing taxable income significantly.

Furthermore, for states with annual contribution limits, spreading contributions evenly throughout the year can help ensure you don't exceed these limits and miss out on potential tax benefits. It's a delicate balance, and understanding the specific regulations for your state is key to maximizing these benefits.

The Impact of Tax-Free Growth and Distributions

One of the most significant advantages of 529 plans is the tax-free growth of investments within the plan. Earnings on investments, such as interest, dividends, and capital gains, accumulate tax-free, meaning they’re not subject to federal or state taxes. This growth can compound over time, leading to substantial savings.

Additionally, when distributions are made for qualified educational expenses, they're tax-free at the federal level and in most states. This means that the money you withdraw to pay for tuition, room and board, books, and other eligible expenses is not taxed, further reducing the overall cost of education.

| Expense Type | Eligibility for Tax-Free Distribution |

|---|---|

| Tuition | ✓ |

| Room and Board | ✓ |

| Books and Supplies | ✓ |

| Computers and Related Technology | ✓ |

| Student Loans (if used to pay for qualified expenses) | ✓ |

Real-World Example: A Case Study on Tax Savings

Let’s consider a hypothetical scenario to illustrate the tax benefits of 529 plans. Imagine a family in California, one of the states offering a state income tax deduction for 529 plan contributions.

The family contributes $10,000 to a 529 plan in one year, taking advantage of the state's $15,000 annual deduction limit. This contribution reduces their taxable income by $10,000, potentially saving them thousands of dollars in state income taxes, depending on their tax bracket.

Furthermore, the investments within the plan grow tax-free over the years. When the time comes to use the funds for qualified educational expenses, the distributions are also tax-free. This dual benefit of tax-free growth and distributions can significantly reduce the overall cost of education.

Conclusion: The Comprehensive Tax Strategy of 529 Plans

529 plans offer a comprehensive tax strategy for those planning for future educational expenses. From state tax deductions and credits to federal tax-free growth and distributions, these plans provide a range of benefits that can make a substantial difference in the financial burden of education.

While the specifics vary from state to state, the core advantages remain consistent. By understanding these tax implications and planning strategically, individuals can maximize the benefits of 529 plans, ensuring a more secure financial future for their educational pursuits.

Are 529 plans suitable for everyone, regardless of income level?

+529 plans can be beneficial for individuals across income levels. While the tax benefits may vary based on state regulations, the primary advantage of tax-free growth and distributions remains consistent. Additionally, the ability to choose from a wide range of investment options within the plan allows for customization based on financial goals and risk tolerance.

Can I use a 529 plan for K-12 expenses, or is it solely for higher education?

+Some states do allow 529 plans to be used for K-12 expenses, including private school tuition. However, the rules and eligible expenses can vary significantly from state to state. It’s essential to check the specific regulations for your state to understand the scope of eligible expenses.

What happens if I change my mind about the beneficiary or decide not to use the funds for education?

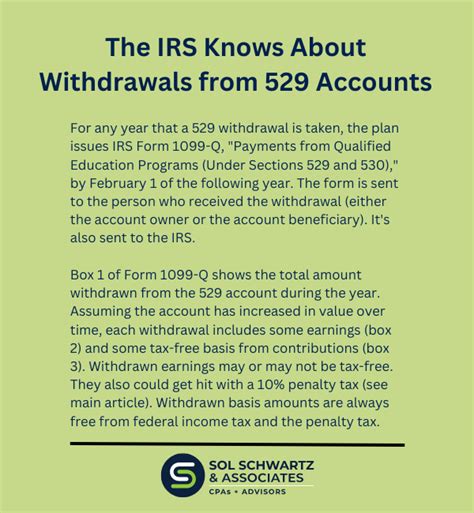

+If you change your mind about the beneficiary or decide not to use the funds for education, there are a few options. You can change the beneficiary to another qualifying family member, such as a sibling or cousin. You can also withdraw the funds, but be aware that non-qualified withdrawals may be subject to taxes and a 10% penalty.

Are there any income limits or restrictions for contributing to a 529 plan?

+Income limits for contributing to a 529 plan vary by state. Some states have no income restrictions, while others have specific limits. It’s important to check the regulations for your state to understand any potential restrictions.