Tax Exempt Form Ny

In the complex world of taxation, understanding the nuances of tax exemptions can be crucial for individuals and businesses alike. This comprehensive guide aims to delve into the intricacies of the Tax Exempt Form NY, providing an expert analysis of its purpose, applicability, and impact on taxpayers in New York State.

Understanding the Tax Exempt Form NY

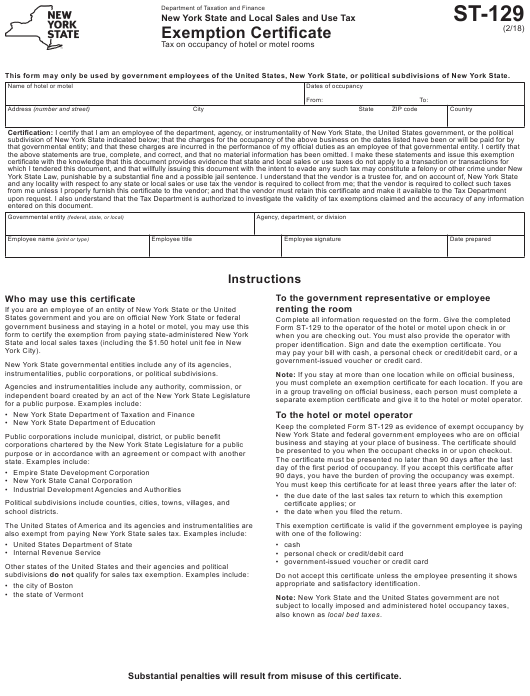

The Tax Exempt Form NY, officially known as the Form ST-124, Sales and Use Tax Exemption Certificate for Institutions of Governmental Agencies, is a crucial document for entities claiming tax-exempt status for their purchases in New York State. This form is an essential tool for organizations and individuals who qualify for tax exemption under various provisions of New York State law.

Issued by the New York State Department of Taxation and Finance, this form is a legal document that certifies the tax-exempt status of the entity named on it. It is designed to streamline the process of claiming tax exemptions and to ensure that eligible entities are not subjected to sales and use taxes on their purchases.

Eligibility and Purpose

The Tax Exempt Form NY is primarily intended for governmental agencies, nonprofit organizations, and certain other tax-exempt entities. These entities are eligible for tax exemption based on their legal status and the nature of their operations. For instance, government agencies are exempt because they are public bodies, while nonprofit organizations may be exempt due to their charitable, educational, or religious purposes.

The form serves as a crucial tool for these entities to demonstrate their tax-exempt status to vendors and suppliers. When an eligible entity presents this form to a vendor, it allows the vendor to make tax-exempt sales to the entity without charging sales tax. This exemption applies to a wide range of purchases, including tangible personal property, certain services, and real property.

| Entity Type | Tax Exempt Status |

|---|---|

| Government Agencies | Exempt due to public body status |

| Nonprofit Organizations | Exempt based on charitable, educational, or religious purposes |

| Certain Exempt Entities | Exemption varies based on specific legal provisions |

The Application Process

Obtaining the Tax Exempt Form NY is a straightforward process, but it requires careful attention to ensure the entity meets all eligibility criteria.

Step-by-Step Guide

- Determine Eligibility: Start by confirming your entity’s eligibility for tax exemption under New York State law. This can involve reviewing your organization’s charter, bylaws, or other legal documents.

- Gather Necessary Documents: Collect any required supporting documents, such as articles of incorporation, nonprofit status confirmation, or government agency identification.

- Complete the Form: Download and fill out the Form ST-124 accurately and completely. Ensure you provide all required information, including your entity’s name, address, and tax-exempt identification number.

- Sign and Submit: Have an authorized representative of your entity sign the form, and then submit it to the New York State Department of Taxation and Finance either by mail or through their online portal.

- Wait for Approval: The department will review your application and, if approved, issue you a Tax Exempt Form NY. This process typically takes several weeks, but can vary based on the volume of applications.

It's important to note that the Tax Exempt Form NY has an expiration date, typically two years from the date of issuance. Entities must renew their tax-exempt status by completing a new application before the expiration date to maintain their tax-exempt privileges.

Renewal Process

The renewal process for the Tax Exempt Form NY is similar to the initial application. Entities should start the renewal process well in advance of the expiration date to ensure continuous tax-exempt status.

- Check Expiration Date: Review your current Tax Exempt Form NY to determine the expiration date.

- Re-Evaluate Eligibility: Confirm that your entity still meets the eligibility criteria for tax exemption.

- Complete Renewal Form: Download and fill out the renewal form, providing updated information if necessary.

- Submit Renewal Application: Send your renewal application to the New York State Department of Taxation and Finance before the expiration date of your current form.

- Wait for Renewal Approval: The department will process your renewal application, and if approved, issue you a new Tax Exempt Form NY with a fresh expiration date.

Using the Tax Exempt Form NY

Once an entity receives its Tax Exempt Form NY, it can begin using it to make tax-exempt purchases. The form is a legally binding document that certifies the entity’s tax-exempt status, and vendors must honor it as long as it is valid.

Presenting the Form

When making a purchase, the entity should provide a copy of the Tax Exempt Form NY to the vendor before the transaction. The vendor will review the form and, if satisfied with its validity, will proceed with the sale without charging sales tax.

It's important to note that vendors may require additional documentation, such as a copy of the entity's tax-exempt certificate or a letter from the Department of Taxation and Finance confirming the entity's tax-exempt status. Entities should be prepared to provide these documents if requested.

Record-Keeping

Entities should maintain a copy of their Tax Exempt Form NY, along with any supporting documents, in their records. This documentation is essential for auditing purposes and can help entities demonstrate their tax-exempt status if questioned by the Department of Taxation and Finance or other authorities.

Entities should also keep records of all tax-exempt purchases made using the Tax Exempt Form NY. These records should include the date of purchase, the vendor's name and address, a description of the goods or services purchased, and the amount of the transaction. This documentation is crucial for accounting purposes and can help entities manage their finances effectively.

The Impact of Tax Exemptions

Tax exemptions, as facilitated by the Tax Exempt Form NY, can have a significant impact on the finances of eligible entities. By eliminating sales and use taxes on their purchases, these entities can reduce their operating costs, which can lead to increased efficiency and improved services.

Financial Benefits

The financial benefits of tax exemptions can be substantial. For example, consider a nonprofit organization that purchases office supplies and equipment regularly. By using the Tax Exempt Form NY, this organization can avoid paying sales tax on these purchases, potentially saving thousands of dollars annually.

Similarly, government agencies and certain other exempt entities can realize significant savings on large-scale purchases, such as vehicles, real estate, or specialized equipment. These savings can be redirected towards core missions and operations, enhancing the entity's overall efficiency and effectiveness.

Social and Economic Impact

Beyond the financial benefits, tax exemptions can also have broader social and economic impacts. For instance, nonprofit organizations often use their tax-exempt status to further their charitable, educational, or religious missions, which can lead to improved social welfare and community development.

Furthermore, by exempting certain entities from sales and use taxes, the state of New York encourages economic activity and investment. This can lead to job creation, business growth, and overall economic development, benefiting the state and its residents.

Conclusion

The Tax Exempt Form NY is a powerful tool for eligible entities to claim their rightful tax-exempt status and enjoy the associated benefits. By understanding the application process, using the form effectively, and maintaining proper records, entities can maximize the advantages of their tax-exempt status.

As with any tax matter, it is essential to stay informed and seek professional advice when needed. The world of taxation can be complex, and staying updated with the latest regulations and requirements is crucial for compliance and optimal financial management.

What happens if I make a mistake on the Tax Exempt Form NY application or renewal?

+

Mistakes on the application or renewal can delay the process and may require resubmission. It’s important to review the form carefully before submission. If you do make a mistake, contact the New York State Department of Taxation and Finance for guidance on how to correct it.

Are there any penalties for claiming tax exemption incorrectly or fraudulently?

+

Yes, claiming tax exemption incorrectly or fraudulently can result in significant penalties, including fines and potential criminal charges. It’s crucial to ensure you are eligible for tax exemption before claiming it and to maintain accurate records to support your claim.

How often should I review my tax-exempt status?

+

It’s a good practice to review your tax-exempt status annually to ensure you still meet the eligibility criteria. Changes in your organization’s structure, operations, or legal status may impact your tax-exempt status, so regular reviews are essential.

Can I use the Tax Exempt Form NY for online purchases?

+

Yes, the Tax Exempt Form NY can be used for online purchases. When making an online purchase, you may need to provide the vendor with a digital copy of the form or a unique tax-exempt identification number. Check with the vendor for their specific requirements.

What if I’m not sure if my purchase is eligible for tax exemption?

+

If you’re unsure about the taxability of a purchase, it’s best to consult with a tax professional or the New York State Department of Taxation and Finance. They can provide guidance on specific situations and help you understand your rights and obligations as a tax-exempt entity.