New Jersey Estimated Tax Payments

When it comes to managing your tax obligations, understanding the estimated tax payment process is crucial, especially for residents of New Jersey. Estimated tax payments are a way for individuals and businesses to pay their taxes throughout the year, rather than in a single lump sum when filing their annual tax return. This system ensures a more manageable cash flow and helps individuals stay compliant with tax regulations. In this comprehensive guide, we will delve into the world of New Jersey estimated tax payments, exploring the why, how, and when of this essential financial process.

The Purpose of Estimated Tax Payments

Estimated tax payments are designed to cover the tax liabilities of individuals whose income is not subject to income tax withholding. This includes self-employed individuals, freelancers, business owners, and anyone else whose income is not taxed at the source. By making regular estimated tax payments, taxpayers can avoid penalties for underpayment of taxes and ensure they are meeting their financial obligations to the state of New Jersey.

In the Garden State, estimated tax payments are particularly important due to the state's progressive tax system. New Jersey's income tax rates range from 1.47% to 10.75%, depending on income brackets, and these rates can change annually. Therefore, accurate estimated tax payments are crucial to avoid unexpected tax bills or penalties.

Understanding the Estimated Tax Payment Schedule

New Jersey’s estimated tax payment schedule is divided into four payment periods, each with its own due date. These due dates are based on the taxpayer’s tax year, which can be a calendar year (January 1 to December 31) or a fiscal year (any 12-month period ending in a month other than December). It’s essential for taxpayers to understand which tax year they are operating under to ensure they meet the correct payment deadlines.

Estimated Tax Payment Due Dates

For taxpayers on a calendar year basis, the estimated tax payment due dates are as follows:

- First Payment Period: April 15th

- Second Payment Period: June 15th

- Third Payment Period: September 15th

- Fourth Payment Period: January 15th of the following year

For those on a fiscal year, the due dates are adjusted to align with the end of their fiscal year. For example, if your fiscal year ends on March 31st, the first estimated tax payment would be due on April 15th, and subsequent payments would follow the same schedule as above.

Calculating Your Estimated Tax Payments

Calculating your estimated tax payments involves estimating your annual income and tax liability. The New Jersey Division of Taxation provides a Worksheet for Estimating Individual Income Tax to help taxpayers determine their estimated tax payments. This worksheet considers factors such as income, deductions, and credits to arrive at an estimated tax liability.

It's important to note that estimated tax payments are based on the previous year's tax liability. Therefore, if your income or deductions change significantly from one year to the next, you may need to adjust your estimated payments accordingly to avoid penalties.

Safe Harbor Method

The Safe Harbor Method is an alternative approach to calculating estimated tax payments. Under this method, taxpayers can avoid penalties if their estimated tax payments are at least 100% of the previous year’s tax liability (or 110% if their adjusted gross income was over $150,000). This method provides a simpler way to ensure compliance without the need for complex calculations.

Making Your Estimated Tax Payments

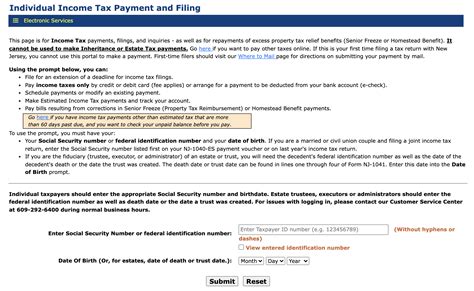

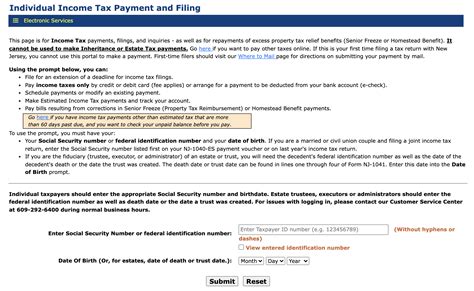

New Jersey offers several methods for making estimated tax payments, including:

- Electronic Funds Transfer (EFT): Taxpayers can use the New Jersey Division of Taxation’s EFT system to make payments directly from their bank account. This method is secure and provides confirmation of payment.

- Credit Card: Estimated tax payments can also be made using a credit card through a third-party payment processor. This option may incur additional fees.

- Check or Money Order: Traditional methods of payment are also accepted. Taxpayers can mail a check or money order made payable to the “New Jersey Division of Taxation” to the address provided on the estimated tax payment form.

It's important to include the correct information, such as your Social Security Number or Employer Identification Number, on all payment forms to ensure proper crediting of your account.

Adjusting Your Estimated Tax Payments

Life circumstances and financial situations can change, and as a result, your estimated tax payments may need to be adjusted. If you anticipate a significant change in income or deductions, it’s essential to recalculate your estimated tax payments to avoid penalties.

The New Jersey Division of Taxation allows taxpayers to request an extension for making estimated tax payments. However, it's important to note that an extension to file does not extend the time to pay estimated taxes. Penalties and interest may still apply if estimated tax payments are not made on time.

Penalties and Interest for Underpayment

The New Jersey Division of Taxation imposes penalties and interest for underpayment of estimated taxes. The penalty for underpayment is 5% of the amount underpaid, and interest is charged at the federal short-term rate plus 3%. These penalties can add up quickly, so it’s crucial to make accurate estimated tax payments to avoid unnecessary financial burdens.

The Importance of Record-Keeping

Proper record-keeping is essential when it comes to estimated tax payments. Taxpayers should maintain records of their income, deductions, estimated tax payments, and any changes made to their financial situation. These records can be crucial in the event of an audit or if there are questions about your tax obligations.

The New Jersey Division of Taxation recommends keeping records for at least three years from the date the tax return was filed (or two years from the date the tax was paid, whichever is later). This ensures that you have the necessary documentation to support your tax filings and estimated tax payments.

Conclusion: Navigating New Jersey’s Estimated Tax Landscape

Understanding and staying compliant with New Jersey’s estimated tax payment system is an essential part of financial management for self-employed individuals and businesses. By following the estimated tax payment schedule, accurately calculating your payments, and staying informed about changes to tax laws and rates, you can ensure you meet your tax obligations without incurring penalties.

Remember, the key to successful tax management is staying informed, keeping accurate records, and seeking professional advice when needed. The world of taxes can be complex, but with the right knowledge and tools, navigating New Jersey's estimated tax landscape can be a straightforward process.

How do I know if I need to make estimated tax payments in New Jersey?

+If you are self-employed, a freelancer, or have income from sources that do not withhold taxes, you are likely required to make estimated tax payments. Additionally, if you expect your income tax liability to be over $1,000 for the year, you should consider making estimated payments to avoid penalties.

Can I pay my estimated taxes in full at the end of the year instead of making periodic payments?

+While you are not required to make periodic estimated tax payments, doing so can help you avoid penalties for underpayment. If you choose to pay your estimated taxes in full at the end of the year, you may still be subject to penalties if your payment is not sufficient to cover your tax liability.

What happens if I miss an estimated tax payment deadline in New Jersey?

+If you miss an estimated tax payment deadline, you may be subject to penalties and interest. It’s important to note that the penalty for underpayment is separate from any penalty for late payment. Therefore, it’s crucial to make timely payments to avoid additional financial burdens.

Can I request an extension for making my estimated tax payments in New Jersey?

+Yes, you can request an extension for making your estimated tax payments. However, it’s important to note that an extension to file does not extend the time to pay estimated taxes. Penalties and interest may still apply if estimated tax payments are not made on time, even with an extension.