Forsyth Property Tax

The topic of property taxes is of great interest to homeowners and investors alike, as it directly impacts their financial planning and overall cost of living. In this comprehensive guide, we will delve into the intricacies of property taxes in Forsyth County, North Carolina, providing an expert analysis of the rates, assessment processes, and strategies to optimize your tax obligations.

Understanding Forsyth Property Taxes

Property taxes are a crucial source of revenue for local governments, including Forsyth County. These taxes are levied on real estate properties, such as homes, land, and commercial buildings, and contribute to funding essential public services like education, infrastructure development, and public safety.

Forsyth County, with its vibrant communities and diverse neighborhoods, has a unique property tax landscape. Understanding this landscape is essential for homeowners and investors to make informed decisions and effectively manage their financial responsibilities.

Property Tax Rates in Forsyth County

The property tax rate in Forsyth County is determined by the county’s fiscal policies and budget requirements. As of the most recent assessment, the general tax rate stands at 0.745 per 100 of assessed property value. This rate is subject to change annually based on budgetary needs and state regulations.

In addition to the general tax rate, Forsyth County also imposes specific tax rates for various purposes. For instance, the county levies a 0.25% tax rate for capital projects and a 0.5% rate for school bonds. These additional tax rates contribute to funding specific initiatives and infrastructure developments.

It's important to note that property tax rates can vary within the county, as different municipalities and districts may have their own tax structures. For example, the city of Winston-Salem, the county seat of Forsyth, may have a slightly different tax rate compared to unincorporated areas of the county.

| Tax Category | Tax Rate |

|---|---|

| General Tax Rate | $0.745 per $100 |

| Capital Projects | 0.25% |

| School Bonds | 0.5% |

These tax rates are applied to the assessed value of a property, which is determined through a comprehensive assessment process. The county's tax assessors evaluate properties based on factors such as location, size, improvements, and market trends.

Property Assessment and Valuation

Property assessment is a critical component of the property tax system. In Forsyth County, the process of assessing property values is handled by the Forsyth County Tax Department. This department employs a team of skilled assessors who utilize a combination of market analysis, sales data, and physical inspections to determine the fair market value of each property.

The assessment process aims to ensure that property taxes are levied fairly and equitably. Assessors take into account various factors, including recent sales of similar properties, construction costs, and any improvements made to the property. By analyzing these elements, they can assign an accurate assessed value to each property, which forms the basis for calculating property taxes.

It's important for property owners to understand that the assessed value of their property may not always align with its market value. While the assessment process aims for accuracy, market conditions and individual circumstances can sometimes lead to discrepancies. In such cases, property owners have the right to appeal their assessed value through a formal process outlined by the Forsyth County Tax Department.

During the assessment process, property owners receive a notice of valuation, which details the assessed value of their property. This notice serves as a crucial tool for property owners to review and understand the basis of their property taxes. It is recommended that property owners carefully examine this notice and seek clarification or dispute the valuation if they believe it is inaccurate.

Factors Influencing Property Taxes

Several factors can impact the amount of property taxes a homeowner or investor owes. Understanding these factors is crucial for effective financial planning.

- Property Value: As mentioned, the assessed value of a property is a key determinant of property taxes. Higher-valued properties generally attract higher tax obligations.

- Location: Property taxes can vary significantly based on the location of the property. Urban areas with higher land values and access to amenities often have higher tax rates compared to rural areas.

- Improvements: Any improvements made to a property, such as renovations or additions, can increase its assessed value and, consequently, the property taxes. It's essential to consider the potential tax implications when planning property improvements.

- Tax Exemptions and Credits: Forsyth County offers various tax exemptions and credits to eligible property owners. These can include homestead exemptions for primary residences, veteran exemptions, and tax credits for energy-efficient improvements. Taking advantage of these incentives can help reduce tax obligations.

By understanding these factors and staying informed about local tax policies, property owners can make informed decisions and potentially reduce their tax liabilities.

Strategies for Optimizing Forsyth Property Taxes

Optimizing property taxes requires a proactive approach and a thorough understanding of the local tax landscape. Here are some strategies to consider when managing your Forsyth property taxes:

Stay Informed about Tax Policies

Forsyth County regularly updates its tax policies and procedures. It’s crucial to stay informed about any changes in tax rates, assessment methodologies, and eligible exemptions. Subscribing to official newsletters or following local government websites can provide valuable updates.

By staying informed, property owners can anticipate potential changes and plan accordingly. For instance, understanding the timeline for reassessments can help homeowners prepare for potential changes in their property's assessed value.

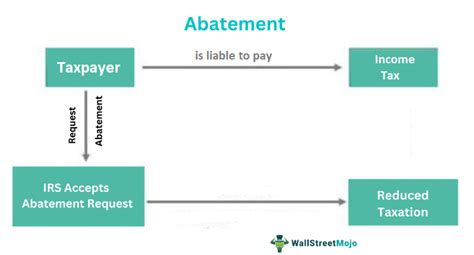

Appeal Your Property Assessment

If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal. The Forsyth County Tax Department provides a clear process for property owners to challenge their assessments. This process typically involves submitting evidence, such as recent sales data or appraisals, to support your claim.

Successfully appealing your property assessment can result in a reduction in your assessed value, leading to lower property taxes. It's important to gather all relevant information and present a strong case to increase your chances of a successful appeal.

Utilize Tax Exemptions and Credits

Forsyth County offers a range of tax exemptions and credits that can significantly reduce your property tax obligations. Some of these incentives include:

- Homestead Exemption: This exemption reduces the taxable value of your primary residence, providing a significant tax savings for homeowners.

- Veteran Exemption: Forsyth County recognizes the service of veterans by offering property tax exemptions based on their eligibility and service record.

- Elderly Exemption: Senior citizens may be eligible for a reduced property tax rate based on their age and income.

- Energy-Efficient Improvements: Property owners who make energy-efficient upgrades to their homes may qualify for tax credits, encouraging environmentally friendly practices.

Understanding the eligibility criteria and applying for these exemptions and credits can help you optimize your tax obligations and contribute to a more sustainable community.

Strategic Property Improvements

While improvements to your property can increase its assessed value and, consequently, your property taxes, strategic improvements can also provide long-term benefits. Certain improvements, such as energy-efficient upgrades or renovations that increase the property’s overall value, may be more tax-efficient in the long run.

When planning property improvements, consider consulting with tax professionals or real estate experts to understand the potential tax implications. By making informed decisions, you can ensure that your improvements not only enhance your property but also optimize your tax obligations.

Conclusion: Navigating Forsyth Property Taxes

Property taxes are an essential component of local governance and community development. By understanding the property tax landscape in Forsyth County, homeowners and investors can make informed decisions and effectively manage their financial responsibilities.

Staying informed about tax policies, assessing property values accurately, and utilizing available exemptions and credits are key strategies for optimizing your property tax obligations. Additionally, seeking professional advice and staying engaged with local tax authorities can provide valuable insights and support in navigating the complex world of property taxes.

As Forsyth County continues to thrive and evolve, staying proactive and informed will ensure that property owners can contribute to the community's growth while effectively managing their financial commitments.

How often are property values reassessed in Forsyth County?

+

Property values in Forsyth County are typically reassessed every eight years, although this can vary based on market conditions and other factors. It’s advisable to check with the Forsyth County Tax Department for the most accurate and up-to-date information on reassessment schedules.

What documentation is required to appeal a property assessment?

+

When appealing a property assessment, you’ll need to provide documentation supporting your claim. This may include recent sales data of comparable properties, professional appraisals, or evidence of significant changes to your property’s condition or value. It’s recommended to consult the Forsyth County Tax Department’s guidelines for a comprehensive list of required documentation.

Are there any online resources available to estimate my property taxes in Forsyth County?

+

Yes, the Forsyth County Tax Department provides an online property tax estimator tool. This tool allows property owners to estimate their annual property taxes based on the assessed value of their property. It’s a convenient way to get a rough estimate of your tax obligations and plan your finances accordingly.

How can I stay updated with the latest tax policies and changes in Forsyth County?

+

To stay informed about tax policies and changes in Forsyth County, you can subscribe to the Forsyth County Tax Department’s newsletter, which provides regular updates on tax-related matters. Additionally, you can follow their official website and social media channels for timely announcements and important notifications.

Are there any tax incentives for green or sustainable improvements to my property in Forsyth County?

+

Forsyth County does offer tax incentives for property owners who make energy-efficient or environmentally friendly improvements to their homes. These incentives may include tax credits or exemptions, encouraging property owners to adopt sustainable practices. It’s recommended to consult with the Forsyth County Tax Department or a tax professional for specific details and eligibility criteria.