Sales Tax Rate Texas

Texas, known for its vibrant economy and diverse business landscape, has a sales tax system that plays a crucial role in the state's revenue generation. Understanding the intricacies of the sales tax rate in Texas is essential for businesses operating within its borders, as well as for consumers who want to navigate their financial obligations effectively.

Sales Tax Basics in Texas

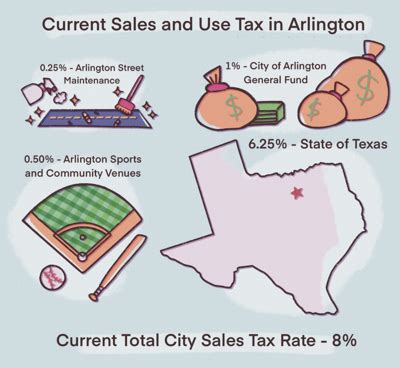

Texas imposes a sales and use tax on the sale, lease, or rental of most goods, as well as taxable services. The sales tax is a percentage of the sales price of a taxable item and is collected by the seller from the buyer at the time of the sale. The state sales tax rate in Texas is 6.25%, which serves as the foundation for the state’s tax structure. However, it’s important to note that local municipalities and counties can also impose additional sales taxes, leading to varying tax rates across different regions within the state.

Statewide Sales Tax Rate

The statewide sales tax rate of 6.25% applies uniformly across Texas. This rate is set by the Texas Comptroller of Public Accounts and is applicable to most retail sales, leases, and rentals of tangible personal property, as well as certain services. The state sales tax is a crucial component of Texas’s revenue stream, contributing significantly to the funding of essential public services and infrastructure development.

Key Exemptions and Special Rates

While the 6.25% state sales tax rate is standard, there are specific exemptions and special rates that apply to certain goods and services. For instance, Texas offers a zero sales tax on most groceries, prescription drugs, and non-prescription medicines, providing relief to consumers on essential items. Additionally, certain services like legal and professional services are also exempt from sales tax.

Local Sales Tax Rates

In addition to the state sales tax, Texas allows local governments to levy additional sales taxes. These local taxes, known as local option sales taxes, can be imposed by cities, counties, and special purpose districts. The rates for these local taxes vary significantly, leading to a range of effective sales tax rates across the state. For instance, while some areas may have a combined state and local sales tax rate of 6.25%, others could see rates as high as 8.25% or more.

| County | State Sales Tax | Local Sales Tax | Total Sales Tax Rate |

|---|---|---|---|

| Harris County | 6.25% | 2.0% | 8.25% |

| Dallas County | 6.25% | 1.5% | 7.75% |

| Tarrant County | 6.25% | 1.5% | 7.75% |

| Bexar County | 6.25% | 1.0% | 7.25% |

| Travis County | 6.25% | 0.75% | 7.0% |

Sales Tax for Online Sales

With the rise of e-commerce, Texas has implemented rules for online sales. Generally, out-of-state sellers with no physical presence in Texas are not required to collect Texas sales tax. However, these sellers may be required to collect and remit Texas sales tax if they meet certain economic thresholds, known as the economic nexus standards. These standards are set by the Texas Comptroller’s office and are subject to change, so businesses engaging in online sales should stay updated on the latest regulations.

Use Tax and Compliance

It’s important to note that while the sales tax is collected by businesses, the use tax is the responsibility of the consumer. Use tax applies when sales tax is not collected, such as in online purchases from out-of-state sellers. Consumers are required to report and pay use tax on these purchases, although compliance can be challenging to enforce.

Impact on Businesses and Consumers

The sales tax rate in Texas has significant implications for both businesses and consumers. For businesses, particularly those with physical stores, the sales tax can affect pricing strategies and competitiveness. Businesses must ensure compliance with the complex tax system, including understanding the different rates across the state and ensuring proper collection and remittance.

For consumers, the sales tax rate directly influences their purchasing decisions and overall cost of living. The variation in rates across the state can lead to differences in the cost of goods and services, impacting consumers' choices and perceptions of value.

Sales Tax and Economic Development

The sales tax also plays a critical role in Texas’s economic development. The revenue generated from sales tax is a significant source of funding for various state and local projects, including infrastructure development, education, and public safety. The tax system, with its varying rates and exemptions, can also influence business attraction and retention, as companies consider the overall tax climate when deciding where to locate.

Future Implications and Potential Changes

The sales tax landscape in Texas is subject to change, particularly as the state’s economy and population continue to grow and evolve. Potential changes could include adjustments to the state sales tax rate, revisions to local option sales taxes, or modifications to the economic nexus standards for online sellers. Additionally, discussions around tax reform and the potential for a statewide tax restructuring are always on the table, given the dynamic nature of the Texas economy.

As the state's fiscal needs evolve, so too may the sales tax system. Businesses and consumers alike should stay informed about any changes to the sales tax rate and its implications, as these changes can have a significant impact on their operations and financial obligations.

Conclusion

The sales tax rate in Texas is a complex yet critical component of the state’s fiscal landscape. With a statewide rate of 6.25% and the potential for additional local taxes, the sales tax system in Texas can significantly impact businesses and consumers alike. Understanding the intricacies of this system is essential for effective financial planning and compliance, ensuring that businesses can operate efficiently and consumers can make informed decisions.

What is the sales tax rate in Texas for 2023?

+The statewide sales tax rate for 2023 in Texas remains at 6.25%, which is the standard rate across the state. However, it’s important to note that local option sales taxes may vary, leading to different effective sales tax rates in different areas.

Are there any special sales tax rates for certain industries in Texas?

+Yes, Texas offers specific sales tax rates for certain industries. For instance, the sale of certain types of machinery and equipment is subject to a 1.5% sales tax rate. Additionally, certain services, like legal and professional services, are exempt from sales tax.

How do I calculate the total sales tax I need to pay in Texas if I’m a consumer or a business owner?

+To calculate the total sales tax, you first need to determine the applicable sales tax rate for your location. This includes both the statewide rate of 6.25% and any additional local taxes. Then, apply this rate to the taxable portion of your purchase or sale. For example, if the total taxable amount is 100 and the sales tax rate is <strong>8.25%</strong> (including both state and local taxes), the sales tax due would be 8.25.

Are there any plans to change the sales tax rate in Texas in the near future?

+As of my last update in January 2023, there were no imminent plans to change the statewide sales tax rate in Texas. However, local option sales taxes can be subject to change, and it’s always a good idea to stay informed about any potential changes in your specific area. Additionally, the state’s tax policies are subject to legislative review and potential amendments, so it’s important to stay updated on any new developments.