Maine Excise Tax Calculator

For those living in the beautiful state of Maine, understanding the intricacies of excise tax is crucial. This article will delve into the specifics of the Maine Excise Tax, providing an in-depth guide to help residents and businesses navigate this tax with ease. From calculating the tax to exploring real-world examples and implications, we'll cover it all.

Understanding Maine’s Excise Tax

Maine’s excise tax is a type of consumption tax imposed on certain goods and services within the state. It is an important revenue source for the state government, funding various public services and infrastructure projects. Unlike a sales tax, which is typically charged at the point of sale, excise taxes are often levied on specific items like fuel, tobacco, and certain types of vehicles.

The state of Maine has a comprehensive excise tax system, with different rates and regulations applied to various products and services. These taxes contribute significantly to the state's overall revenue, playing a crucial role in its financial stability and ability to provide essential services to its residents.

Key Components of Maine’s Excise Tax

The excise tax system in Maine is complex, encompassing a range of taxes on different goods and services. Here are some of the key components:

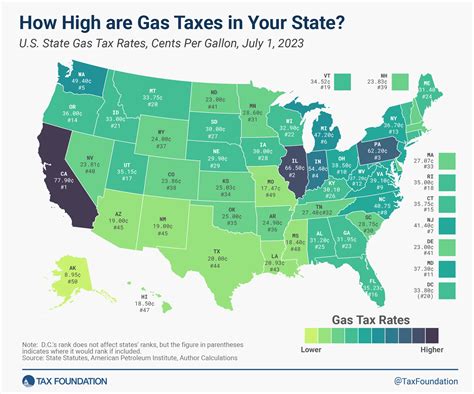

- Fuel Excise Tax: One of the most notable excise taxes in Maine is the fuel excise tax. This tax is imposed on gasoline, diesel, and other motor fuels. The rate can vary depending on the type of fuel and its intended use. For instance, the tax on diesel fuel used for home heating may differ from that used for transportation.

- Tobacco Excise Tax: Maine also levies a significant excise tax on tobacco products. This tax applies to cigarettes, cigars, and other tobacco-related items. The revenue generated from this tax often funds health initiatives and tobacco control programs.

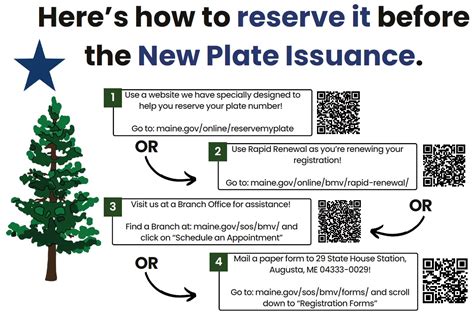

- Vehicle Excise Tax: Another notable excise tax is the vehicle excise tax. This tax is imposed on the registration of certain types of vehicles, such as cars, trucks, and motorcycles. The tax rate can vary based on factors like the vehicle's age, weight, and purpose.

- Alcoholic Beverage Excise Tax: Maine imposes excise taxes on alcoholic beverages, including beer, wine, and spirits. These taxes are often calculated based on the volume or alcohol content of the beverage. The revenue from these taxes is crucial for funding alcohol education and prevention programs.

- Other Excise Taxes: In addition to the above, Maine has a range of other excise taxes. These can include taxes on amusement activities, certain types of services, and even on the sale of certain luxury items. The rates and applicability of these taxes vary widely.

Understanding these specific excise taxes is essential for individuals and businesses operating in Maine. It ensures compliance with the state's tax laws and helps contribute to the overall financial health of the state.

Calculating Maine Excise Tax

Calculating the excise tax in Maine involves understanding the specific tax rates and regulations for each category of goods and services. While the state provides guidelines and resources to assist taxpayers, the process can be complex, especially for those unfamiliar with the system.

Fuel Excise Tax Calculation

Let’s consider an example to illustrate the calculation of the fuel excise tax. Suppose you own a small business in Maine that operates a fleet of diesel trucks. The tax rate for diesel fuel used for transportation is set at $0.29 per gallon. If your business consumes 10,000 gallons of diesel fuel in a month, the excise tax calculation would be as follows:

| Tax Rate | Fuel Quantity | Excise Tax |

|---|---|---|

| $0.29/gallon | 10,000 gallons | $2,900 |

So, for this scenario, your business would owe an excise tax of $2,900 for the month's diesel fuel consumption.

Tobacco Excise Tax Calculation

Now, let’s look at the calculation for tobacco excise tax. In Maine, the tax rate for cigarettes is $2.00 per pack of 20 cigarettes. If you sell 1,000 packs of cigarettes in a month, the excise tax calculation would be:

| Tax Rate | Quantity Sold | Excise Tax |

|---|---|---|

| $2.00/pack | 1,000 packs | $2,000 |

In this case, the excise tax owed on the sale of cigarettes would be $2,000.

Vehicle Excise Tax Calculation

For vehicle excise tax, the calculation can be more complex as it often involves various factors. Let’s consider a scenario where you own a car with a gross weight of 3,500 pounds. The tax rate for vehicles in this weight category is $30 per 1,000 pounds. To calculate the excise tax for your car, you would perform the following steps:

- Determine the tax rate per 1,000 pounds: $30.

- Calculate the gross weight of your vehicle: 3,500 pounds.

- Divide the gross weight by 1,000: 3,500 / 1,000 = 3.5.

- Multiply the result by the tax rate: 3.5 x $30 = $105.

So, for this scenario, the excise tax on your vehicle would be $105.

Real-World Implications and Strategies

Understanding how to calculate excise taxes is crucial, but it’s equally important to consider the real-world implications and strategies for managing these taxes effectively.

Impact on Businesses

For businesses operating in Maine, excise taxes can significantly impact their bottom line. These taxes are often passed on to consumers, affecting pricing strategies and competitiveness. For instance, a business selling fuel or tobacco products may need to carefully consider its pricing to remain competitive while also meeting its tax obligations.

Additionally, businesses must stay informed about any changes in tax rates or regulations. Regularly reviewing and updating tax strategies is essential to ensure compliance and minimize the financial burden of excise taxes.

Strategies for Tax Management

To effectively manage excise taxes, businesses and individuals can employ various strategies:

- Stay Informed: Keep up-to-date with the latest tax rates and regulations. The Maine Revenue Services provides resources and updates to assist taxpayers.

- Record-Keeping: Maintain accurate records of all transactions related to excise-taxable items. This ensures proper tax calculation and simplifies the tax filing process.

- Seek Professional Advice: For complex tax situations, consulting with tax professionals or accountants can provide valuable insights and ensure compliance.

- Explore Tax Incentives: Maine may offer tax incentives or credits for certain activities or investments. Exploring these opportunities can help reduce the overall tax burden.

- Automate Tax Calculations: Utilizing tax calculation software or services can streamline the process and reduce the risk of errors.

By implementing these strategies, businesses and individuals can navigate the complexities of Maine's excise tax system more efficiently and effectively.

Future Implications and Trends

The landscape of excise taxes in Maine is subject to change, and understanding future trends can help businesses and individuals prepare for potential shifts.

Potential Changes in Tax Rates

Tax rates are often adjusted to reflect changes in the economy, inflation, or policy priorities. Maine’s excise tax rates may be revised periodically to meet these changing conditions. For instance, if the state faces budget constraints, it might consider increasing certain excise tax rates to generate additional revenue.

Staying informed about proposed tax changes is crucial for businesses and individuals to anticipate and plan for potential increases or decreases in tax obligations.

Expanding Excise Tax Categories

Maine may also consider expanding its excise tax categories to include new products or services. This could be driven by various factors, such as emerging industries or a need to address specific social or environmental concerns. For example, the state might introduce excise taxes on certain electronic devices or online services to keep up with technological advancements.

Being aware of potential new tax categories can help businesses prepare and adapt their operations accordingly.

Emphasis on Compliance and Enforcement

As the state seeks to maximize revenue collection, it may place a greater emphasis on compliance and enforcement of excise tax regulations. This could mean increased audits and stricter penalties for non-compliance.

Businesses should ensure they have robust tax compliance processes in place to minimize the risk of audits and potential penalties.

Conclusion

Maine’s excise tax system is a critical component of the state’s revenue generation, impacting both individuals and businesses. Understanding the specifics of these taxes, from calculation methods to real-world implications, is essential for effective tax management. By staying informed, adopting strategic tax practices, and keeping an eye on future trends, taxpayers can navigate the complexities of Maine’s excise tax landscape with confidence.

What is the difference between sales tax and excise tax in Maine?

+Sales tax is charged on the sale of goods and services at the point of sale, while excise tax is levied on specific goods and services, often at different stages of production or distribution. Excise taxes are typically more targeted and can vary based on the product or service.

Are there any exemptions or credits available for Maine’s excise taxes?

+Yes, Maine offers various exemptions and credits for certain excise taxes. For instance, there are exemptions for certain types of fuel used for off-road purposes, and credits are available for certain energy-efficient vehicles. It’s important to stay informed about these opportunities.

How often are Maine’s excise tax rates reviewed and adjusted?

+Maine’s excise tax rates are typically reviewed annually or bi-annually. Adjustments can be made to reflect changes in the economy, inflation, or the state’s financial needs. It’s crucial for taxpayers to stay updated on any rate changes.