Sales Tax Vehicle Illinois

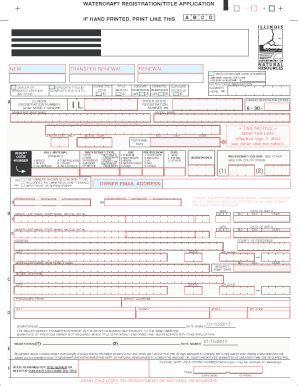

The process of registering and titling a vehicle in Illinois involves various fees and taxes, including the Sales Tax on Vehicles, which is an important consideration for both residents and out-of-state buyers. This tax plays a significant role in the overall cost of vehicle ownership and is essential to understand when planning to purchase a new or used car in the state. In this comprehensive guide, we will delve into the intricacies of the Sales Tax Vehicle Illinois, covering its calculation, exemptions, and implications for vehicle buyers.

Understanding the Sales Tax Vehicle Illinois

The Sales Tax on Vehicles in Illinois is a state-imposed tax that is applicable to the purchase of motor vehicles, including cars, trucks, motorcycles, and certain other types of motorized transportation. This tax is collected by the Illinois Department of Revenue and contributes to the state’s revenue, funding various public services and infrastructure projects.

The sales tax rate for vehicles in Illinois is set at 6.25% of the purchase price. This rate is applied uniformly across the state and is in addition to any applicable local sales taxes, which can vary by county. The combined state and local sales tax rates can significantly impact the overall cost of a vehicle purchase, making it essential for buyers to consider these taxes in their financial planning.

The sales tax on vehicles is calculated based on the total purchase price of the vehicle, including any additional fees, options, and accessories. It is important to note that the sales tax is not applied to the trade-in value of a vehicle, but rather to the net purchase price after any trade-in credits have been applied.

Example of Sales Tax Calculation

Let’s consider an example to illustrate the calculation of the Sales Tax Vehicle Illinois. Suppose you are purchasing a new car in Illinois with a total purchase price of $30,000. The sales tax on this purchase would be calculated as follows:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $30,000 x 0.0625

Sales Tax = $1,875

Therefore, in this example, the sales tax on the vehicle would amount to $1,875, which is added to the purchase price to determine the total cost of the vehicle.

Exemptions and Special Considerations

While the Sales Tax Vehicle Illinois is generally applicable to most vehicle purchases, there are certain exemptions and special cases to be aware of. Understanding these exceptions can help buyers optimize their financial strategies and potentially reduce their tax burden.

Leased Vehicles

For individuals leasing a vehicle in Illinois, the sales tax is calculated differently. Instead of applying the tax to the full purchase price, the tax is based on the monthly lease payment. This means that the sales tax is spread out over the duration of the lease, making the upfront cost of leasing more manageable.

The sales tax rate for leased vehicles is still 6.25%, but it is applied to the monthly payment rather than the total purchase price. This approach provides a more affordable option for those who prefer leasing over purchasing.

Exemptions for Certain Vehicles

Illinois offers exemptions from the Sales Tax on Vehicles for specific types of vehicles. These exemptions are typically granted to support particular industries or promote specific initiatives.

- Alternative Fuel Vehicles: Certain vehicles that run on alternative fuels, such as electric, hybrid, or hydrogen-powered cars, may be eligible for a sales tax exemption or reduction. These incentives aim to encourage the adoption of environmentally friendly transportation options.

- Agricultural Vehicles: Vehicles primarily used for agricultural purposes, such as tractors and farm equipment, are often exempt from the sales tax. This exemption recognizes the unique needs and economic considerations of the agricultural industry.

- Disability-Related Vehicles: Vehicles adapted for individuals with disabilities or purchased specifically for their use may qualify for a sales tax exemption. This exemption aims to ensure equal access to transportation for those with disabilities.

It is important to note that the eligibility criteria and specific requirements for these exemptions can vary, and interested buyers should consult the Illinois Department of Revenue's guidelines for detailed information.

Vehicle Trade-Ins and Transfers

When trading in a vehicle or transferring ownership, the sales tax implications can be more complex. In general, the sales tax is calculated based on the difference between the purchase price of the new vehicle and the trade-in value of the old vehicle. This difference is known as the “taxable gain.”

If the trade-in value exceeds the purchase price of the new vehicle, the taxable gain is zero, and no sales tax is due on the transaction. However, if the purchase price is higher than the trade-in value, the sales tax is calculated based on the positive difference.

Sales Tax Implications for Out-of-State Buyers

For individuals purchasing a vehicle in Illinois but residing in another state, the sales tax considerations can be more intricate. Out-of-state buyers may be subject to different tax rates and regulations in their home state, making it crucial to understand the potential tax implications before making a purchase.

In general, out-of-state buyers are responsible for paying the sales tax in the state where the vehicle is registered. This means that if you purchase a vehicle in Illinois and register it in another state, you will need to pay the sales tax to the appropriate tax authority in your home state.

Additionally, some states have reciprocity agreements with Illinois, which can simplify the tax process for out-of-state buyers. These agreements allow buyers to pay the sales tax in their home state, even if the vehicle was purchased in Illinois. It is essential to research and understand the tax laws and reciprocity agreements in both Illinois and your home state to ensure compliance.

Reciprocity Agreements and Use Tax

Reciprocity agreements between states aim to prevent double taxation and ensure fairness for out-of-state buyers. These agreements typically allow buyers to pay the sales tax in their home state, provided they register and title the vehicle there. Illinois has reciprocity agreements with several neighboring states, including Indiana, Iowa, Kentucky, Michigan, Missouri, and Wisconsin.

However, if your home state does not have a reciprocity agreement with Illinois, you may be subject to a use tax instead of the sales tax. The use tax is applied to out-of-state purchases and is intended to ensure that all purchases, regardless of where they are made, are subject to taxation. The use tax rate is usually equivalent to the sales tax rate in your home state.

Preparing for the Sales Tax Payment

When purchasing a vehicle in Illinois, it is essential to plan for the sales tax payment. Here are some steps to ensure a smooth and compliant transaction:

- Research Sales Tax Rates: Understand the applicable sales tax rates, both at the state and local levels, to accurately calculate the tax due on your vehicle purchase.

- Calculate the Tax: Use the provided formula or seek assistance from a tax professional to accurately calculate the sales tax based on the purchase price of the vehicle.

- Budget Accordingly: Include the sales tax in your overall budget for the vehicle purchase to ensure you have sufficient funds to cover the total cost.

- Consider Financing Options: If you are financing the vehicle, discuss the sales tax payment with your lender to understand how it fits into your financing arrangement.

- Seek Professional Advice: Consult with a tax professional or the Illinois Department of Revenue for guidance on any specific tax scenarios or exemptions that may apply to your situation.

Future Implications and Tax Strategies

Understanding the Sales Tax Vehicle Illinois is not only crucial for immediate vehicle purchases but also for long-term financial planning. Here are some considerations and strategies to keep in mind:

Tax Strategies for Vehicle Ownership

- Timing of Purchases: Consider the timing of your vehicle purchase to potentially benefit from sales tax exemptions or reductions, such as those offered for alternative fuel vehicles or during certain promotional periods.

- Leasing vs. Buying: Evaluate the financial implications of leasing versus purchasing a vehicle, taking into account the sales tax calculations for each option.

- Trade-In Strategies: Optimize your trade-in value to minimize the taxable gain and reduce your sales tax burden. Negotiate trade-in values and consider the timing of your trade-in to maximize your savings.

Future Tax Reforms and Initiatives

Stay informed about potential changes in tax laws and initiatives in Illinois. The state may introduce new incentives or adjust existing tax structures to promote certain industries or support specific initiatives. Being aware of these changes can help you make informed decisions and potentially benefit from future tax reforms.

Additionally, keep an eye on federal tax incentives or programs that may impact vehicle purchases. For example, federal tax credits for electric vehicles can significantly reduce the overall cost of ownership, making these vehicles more affordable and environmentally friendly options.

Conclusion

The Sales Tax Vehicle Illinois is an integral part of the vehicle registration and titling process in the state. Understanding the calculation, exemptions, and implications of this tax is essential for both residents and out-of-state buyers. By staying informed and considering the various tax scenarios and strategies, you can make more informed decisions when purchasing a vehicle and potentially reduce your tax burden.

Remember to consult official sources, such as the Illinois Department of Revenue, for the most up-to-date information on sales tax rates, exemptions, and regulations. Additionally, seeking professional advice from tax experts can provide personalized guidance tailored to your specific circumstances.

How is the sales tax on vehicles calculated in Illinois?

+The sales tax on vehicles in Illinois is calculated as a percentage of the purchase price. The current rate is 6.25%, which is applied to the total purchase price, including any additional fees and accessories. The tax is calculated as follows: Sales Tax = Purchase Price x Sales Tax Rate.

Are there any exemptions from the sales tax on vehicles in Illinois?

+Yes, there are certain exemptions and special considerations for specific types of vehicles. These include exemptions for alternative fuel vehicles, agricultural vehicles, and disability-related vehicles. It is important to consult the Illinois Department of Revenue’s guidelines for detailed information on eligibility criteria and requirements.

What happens if I purchase a vehicle in Illinois but reside in another state?

+Out-of-state buyers are responsible for paying the sales tax in the state where the vehicle is registered. If your home state has a reciprocity agreement with Illinois, you may pay the sales tax in your home state. Otherwise, you may be subject to a use tax, which is equivalent to the sales tax rate in your home state.

How can I prepare for the sales tax payment when purchasing a vehicle in Illinois?

+To prepare for the sales tax payment, research the applicable sales tax rates, calculate the tax based on the purchase price, and include it in your overall budget. Consider seeking advice from a tax professional or the Illinois Department of Revenue for specific guidance. Additionally, discuss financing options with your lender to understand how the sales tax fits into your financing arrangement.