Tax Calculator Washington State

Welcome to this comprehensive guide on the Tax Calculator for Washington State, an essential tool for individuals and businesses alike. Washington State, known for its vibrant economy and diverse industries, has a unique tax landscape that requires careful navigation. This article will delve into the specifics of the tax calculator, offering an in-depth analysis and practical insights.

Understanding the Tax Landscape of Washington State

Washington State operates on a progressive tax system, meaning tax rates increase as income levels rise. This approach ensures fairness and contributes significantly to the state’s revenue generation. The tax calculator is a crucial tool for individuals and businesses to navigate this complex system efficiently.

The state's tax structure is designed to support various sectors, including technology, aerospace, and agriculture, which are key drivers of its economy. Understanding the nuances of this tax system is vital for effective financial planning and compliance.

Key Tax Components in Washington State

Washington State levies several types of taxes, each serving a specific purpose in funding state operations and services. These include:

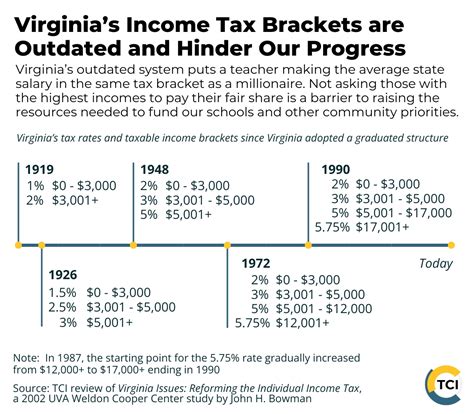

- Income Tax: A progressive tax applied to personal and business income, with rates varying based on income brackets.

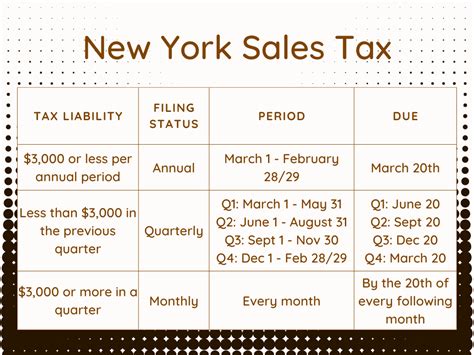

- Sales and Use Tax: A consumption tax levied on the sale or use of goods and services within the state.

- Business and Occupation (B&O) Tax: A gross receipts tax imposed on businesses, calculated as a percentage of revenue.

- Property Tax: A tax on real estate and personal property, determined by the assessed value of the property.

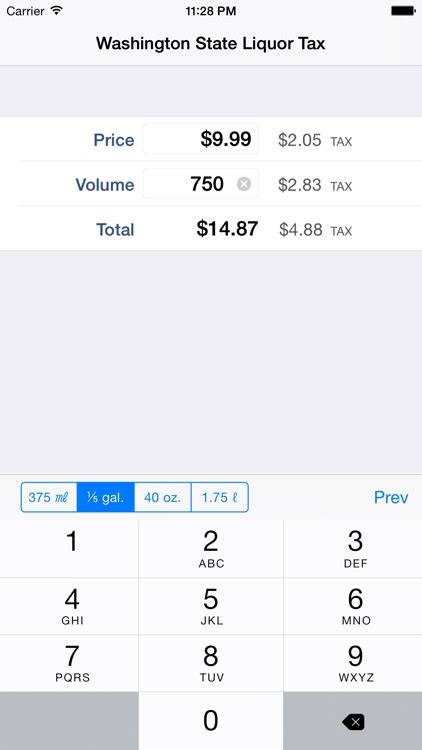

- Excise Taxes: Taxes on specific goods like fuel, tobacco, and alcohol, often used to fund specific state programs.

Each of these tax components plays a crucial role in Washington State's fiscal health and requires careful consideration when calculating taxes.

The Role of the Tax Calculator

The Tax Calculator is a sophisticated online tool designed to assist taxpayers in Washington State. It provides an accurate and efficient way to estimate tax liabilities, offering a comprehensive view of an individual’s or business’s tax obligations.

The calculator takes into account various factors, including income levels, deductions, and credits, to provide a detailed breakdown of tax liabilities. This not only helps in financial planning but also ensures compliance with the state's tax regulations.

Key Features of the Tax Calculator

The Tax Calculator boasts several features that make it an indispensable tool for taxpayers:

- Real-Time Calculations: The calculator uses up-to-date tax rates and regulations, ensuring accurate estimates.

- User-Friendly Interface: Designed with simplicity in mind, it allows users to input data easily and navigate the calculations seamlessly.

- Detailed Reports: It generates comprehensive reports, providing a clear overview of tax liabilities, including breakdowns of different tax components.

- Scenario Analysis: Users can input different income or deduction scenarios to understand the impact on their tax obligations, aiding in strategic financial planning.

- Data Security: The calculator employs robust security measures to protect users’ sensitive financial information.

Benefits of Using the Tax Calculator

Adopting the Tax Calculator offers a multitude of advantages for taxpayers in Washington State.

Precision and Accuracy

The calculator’s precision ensures that taxpayers can make informed decisions about their financial strategies, minimizing the risk of errors and penalties.

Time and Cost Efficiency

By automating complex tax calculations, the calculator saves valuable time and resources, allowing individuals and businesses to focus on their core activities.

Compliance and Peace of Mind

Using this advanced tool ensures compliance with Washington State’s tax regulations, providing taxpayers with the assurance that they are meeting their obligations accurately.

Case Studies: Real-World Applications

To illustrate the practical benefits of the Tax Calculator, let’s explore a couple of case studies:

Small Business Owner: John’s Story

John, a small business owner in Seattle, utilized the Tax Calculator to estimate his business’s tax liabilities for the year. The calculator’s detailed reports helped him understand the breakdown of his B&O tax, allowing him to strategize and optimize his tax payments. By leveraging the scenario analysis feature, John could forecast the impact of potential business growth on his tax obligations, aiding in long-term planning.

Individual Taxpayer: Sarah’s Experience

Sarah, a resident of Washington State, used the Tax Calculator to estimate her personal income tax. The calculator’s user-friendly interface made it easy for her to input her financial details, and the real-time calculations provided an accurate estimate of her tax liability. This helped Sarah budget effectively and plan for her tax payments, ensuring a stress-free tax season.

Technical Specifications and Performance

The Tax Calculator is a robust and reliable tool, built to handle a high volume of calculations with precision and speed. Here are some technical specifications:

| Specification | Details |

|---|---|

| Data Storage | Utilizes secure cloud-based storage for user data, ensuring scalability and accessibility. |

| Calculation Engine | Powered by advanced algorithms, capable of handling complex tax scenarios with accuracy. |

| User Capacity | Designed to support thousands of simultaneous users, ensuring smooth performance during peak tax seasons. |

| Security Protocols | Implements industry-leading security measures, including data encryption and multi-factor authentication. |

The Tax Calculator's performance is regularly monitored and optimized to ensure it remains a reliable resource for taxpayers.

Future Implications and Developments

As technology advances and tax regulations evolve, the Tax Calculator is poised for continued development and improvement. Here are some potential future enhancements:

- Integration with Financial Software: Future versions may integrate with popular financial management tools, streamlining the data input process.

- AI-Assisted Calculations: Leveraging AI technologies could enhance the calculator's accuracy and provide personalized tax planning recommendations.

- Mobile Accessibility: Developing a mobile app could make the calculator more accessible and convenient for on-the-go users.

- Real-Time Tax Law Updates: Integrating a system to automatically update tax rates and regulations would ensure users always have the most current information.

These potential developments showcase the Tax Calculator's commitment to staying at the forefront of tax calculation technology.

Conclusion

The Tax Calculator for Washington State is a powerful tool, offering precision, efficiency, and peace of mind to taxpayers. By understanding the complex tax landscape of the state and leveraging the advanced features of this calculator, individuals and businesses can navigate their tax obligations with confidence.

As Washington State continues to thrive economically, tools like the Tax Calculator will play a pivotal role in supporting its growth and ensuring compliance.

How often are the tax rates and regulations updated in the calculator?

+

The Tax Calculator is updated on a quarterly basis to ensure it reflects the latest tax rates and regulations. This ensures that users have access to accurate and up-to-date information when calculating their tax liabilities.

Can the Tax Calculator handle complex tax scenarios, such as multiple income streams or business structures?

+

Absolutely! The Tax Calculator is designed to accommodate a wide range of tax scenarios. It can handle multiple income sources, business structures, and various deductions, providing a comprehensive tax estimate for complex situations.

Is my data secure when using the Tax Calculator?

+

Yes, the Tax Calculator employs robust security measures to protect user data. All data is encrypted during transmission and storage, and the platform adheres to strict data privacy standards. Users can have peace of mind knowing their information is secure.