Inheritance Tax Illinois

Inheritance tax is a topic that often raises questions and concerns for individuals and families, especially when it comes to estate planning and wealth transfer across generations. In the state of Illinois, the inheritance tax system operates differently compared to some other states in the US. Understanding the intricacies of this tax is crucial for residents and anyone with assets or property in the state. This article aims to provide a comprehensive guide to inheritance tax in Illinois, covering the tax structure, exemptions, rates, and strategies to minimize its impact on your estate.

Understanding Inheritance Tax in Illinois

Inheritance tax, also known as an estate tax, is a levy imposed on the transfer of property, assets, or money from a deceased person’s estate to their beneficiaries. Unlike the federal estate tax, which applies to estates exceeding a certain value nationwide, Illinois has its own unique inheritance tax system. It is important to note that Illinois is one of the few states that still impose an inheritance tax, making it a crucial consideration for residents and estate planners.

The inheritance tax in Illinois is a tax on the privilege of receiving property from a deceased person's estate. It is based on the relationship between the deceased individual, known as the decedent, and the recipient of the property, called the beneficiary. The tax rates and exemptions vary depending on this relationship, as well as the value of the assets being transferred.

Tax Rates and Exemptions

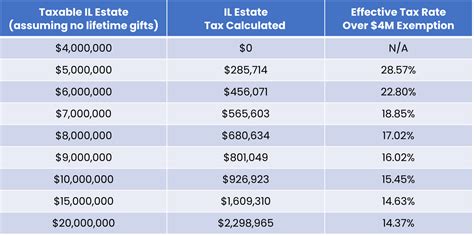

Illinois inheritance tax rates are progressive, meaning they increase as the value of the estate or gift increases. The tax rates are as follows:

| Relationship to Decedent | Tax Rate on Estates/Gifts over $25,000 |

|---|---|

| Spouse | 0% |

| Child, Parent, Grandchild, Sibling | 1.5% |

| Other Relatives, including Nieces, Nephews, Cousins, and In-Laws | 10% |

| Non-Relatives, including Friends and Business Associates | 18% |

It's important to note that these rates are applied to the portion of the estate or gift that exceeds the $25,000 exemption. For example, if a grandchild receives an inheritance of $100,000, the first $25,000 is exempt, and the remaining $75,000 is taxed at a rate of 1.5%. This progressive structure aims to ensure fairness and prevent the excessive burden of inheritance tax on smaller estates.

Exemptions and Deductions

Illinois offers certain exemptions and deductions to reduce the impact of inheritance tax. Here are some key exemptions to consider:

- Spousal Exemption: As mentioned earlier, transfers to a surviving spouse are completely exempt from inheritance tax. This exemption ensures that a spouse can inherit assets without any tax liability.

- Family Farm Exemption: Illinois provides a special exemption for family farms. If a farm has been in the same family for at least five years and meets certain requirements, it may be exempt from inheritance tax, allowing the family to keep the farm intact.

- Charitable Gifts: Donations to qualified charitable organizations are exempt from inheritance tax. This allows individuals to support causes close to their hearts while reducing their tax burden.

- Business Entity Exemption: Certain business entities, such as corporations and limited liability companies (LLCs), may be exempt from inheritance tax if they meet specific criteria. This exemption encourages the continuation of family-owned businesses.

Strategies to Minimize Inheritance Tax

While the inheritance tax system in Illinois may seem complex, there are strategies that individuals and families can employ to minimize its impact on their estates. Here are some effective approaches:

Gift Giving During Lifetime

One of the most straightforward ways to reduce inheritance tax is by making gifts during your lifetime. Illinois, like many other states, has an annual gift tax exclusion, which allows individuals to gift a certain amount to each recipient without triggering gift taxes. By making strategic gifts each year, you can gradually reduce the size of your estate and potentially lower your inheritance tax liability.

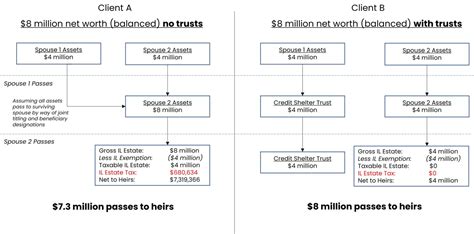

Utilizing Trusts

Trusts can be powerful tools for estate planning and minimizing inheritance tax. By establishing a trust, you can control the distribution of your assets while potentially reducing tax liabilities. There are various types of trusts, such as irrevocable trusts and charitable trusts, that can be tailored to your specific needs and goals. Working with an experienced estate planning attorney can help you navigate the complexities of trust creation and ensure maximum tax efficiency.

Charitable Giving

In addition to the exemption for charitable gifts, making donations to qualified charitable organizations can have tax benefits beyond inheritance tax. Charitable contributions may be tax-deductible, which can reduce your overall tax burden. Furthermore, by establishing a charitable foundation or donor-advised fund, you can support causes you care about while potentially reducing your estate’s value and inheritance tax liability.

Business Succession Planning

If you own a business, proper succession planning is crucial. By structuring your business in a way that takes advantage of the business entity exemption, you can ensure the smooth transfer of ownership to the next generation while minimizing tax consequences. Working with a business attorney and a tax professional can help you navigate the complexities of business succession and tax optimization.

Future Implications and Considerations

The inheritance tax landscape is subject to change, and it is important to stay informed about potential reforms or updates to the tax system. While Illinois currently imposes an inheritance tax, there have been ongoing discussions and proposals to abolish or reform this tax. Staying up-to-date with legislative changes can help you make informed decisions about your estate planning strategies.

Additionally, it is essential to consider the impact of inheritance tax on your overall financial plan. Working with a financial advisor or estate planning specialist can help you develop a comprehensive strategy that aligns with your goals, ensures financial security for your beneficiaries, and minimizes tax liabilities.

Conclusion

Understanding the intricacies of inheritance tax in Illinois is a crucial step in effective estate planning. By familiarizing yourself with the tax rates, exemptions, and available strategies, you can make informed decisions to minimize the impact of inheritance tax on your estate. Remember, seeking professional advice from attorneys, tax experts, and financial advisors can provide tailored guidance to ensure your assets are protected and distributed according to your wishes.

Are there any exceptions to the inheritance tax rates in Illinois for certain types of property or assets?

+Yes, there are certain exceptions and exemptions that can apply to specific types of property or assets. For instance, life insurance proceeds paid to a beneficiary are generally exempt from inheritance tax. Additionally, certain types of retirement accounts and pension plans may also be exempt. It’s important to consult with a tax professional to understand the specific exemptions that may apply to your situation.

How does the inheritance tax in Illinois compare to other states in terms of rates and exemptions?

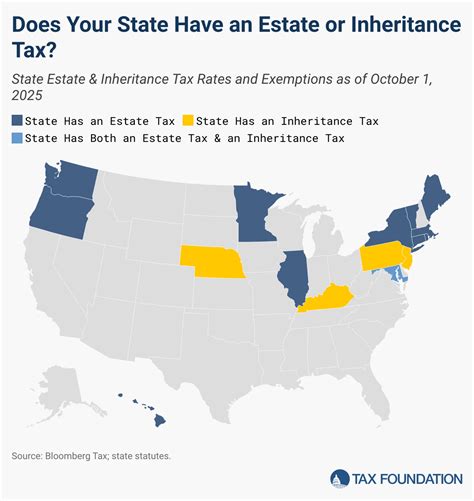

+Illinois has one of the highest inheritance tax rates in the country, especially for non-relatives and distant relatives. However, it’s important to note that many states have completely abolished inheritance taxes or have much lower rates. Comparing Illinois’ rates to other states can provide a broader perspective on the tax landscape and help you make informed decisions about your estate planning.

Can I structure my estate to avoid inheritance tax altogether in Illinois?

+While complete avoidance of inheritance tax may not be feasible, there are strategies that can significantly reduce your tax liability. Utilizing trusts, making lifetime gifts, and taking advantage of available exemptions can help minimize the impact of inheritance tax. However, it’s essential to consult with an estate planning attorney to explore the best options for your specific circumstances.