Check On My Nys Tax Refund

Staying on top of your tax refunds is an important financial task, and the process can sometimes be complex, especially when dealing with state taxes. This guide will provide an in-depth look at how to check on your New York State tax refund status, offering a comprehensive step-by-step process and valuable insights to ensure a smooth and efficient experience.

Understanding the New York State Tax Refund Process

New York State’s tax refund process is designed to be efficient and transparent, offering several methods to check the status of your refund. Whether you’ve filed your taxes online, by mail, or through a tax professional, there are convenient ways to track the progress of your refund.

The New York State Department of Taxation and Finance handles tax refunds, and they provide a range of tools and resources to help taxpayers. It's essential to understand the typical timeline for refunds and the factors that can impact the processing time.

In general, the sooner you file your taxes, the sooner you can expect your refund. However, various factors, such as the complexity of your tax return, any errors or omissions, and the volume of tax returns being processed, can affect the speed of your refund.

Timeline for New York State Tax Refunds

According to the official guidelines, the average processing time for a New York State tax refund is between 21 and 28 days from the date of receipt. However, it’s important to note that this is an estimate, and refunds can take longer under certain circumstances.

For instance, if your tax return is selected for review or audit, the processing time can extend significantly. Additionally, if you file your return close to the deadline or during the peak tax season, it may take longer for your refund to be processed due to the high volume of returns being handled.

| Filing Method | Estimated Processing Time |

|---|---|

| E-filing with Direct Deposit | Approximately 21 days |

| Paper Return with Check | Approximately 28 days |

Methods to Check Your New York State Tax Refund Status

New York State offers several convenient methods to check the status of your tax refund. Each method provides real-time information, ensuring you can stay informed about the progress of your refund.

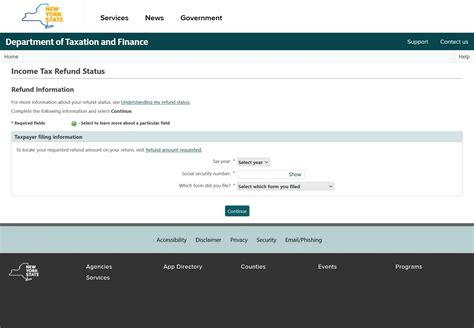

Online Refund Status Check

The most common and efficient way to check your New York State tax refund status is through the Online Refund Status Check tool on the Department of Taxation and Finance’s website. This tool provides an easy-to-use interface, allowing you to quickly and securely check the status of your refund.

To use this tool, you'll need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as the exact amount of your expected refund. This information is crucial for security purposes and to ensure that you're checking the status of your own refund.

The Online Refund Status Check tool provides up-to-date information, indicating whether your refund has been processed, is still being processed, or if there are any issues with your return that require attention.

Refund Hotline

If you prefer a more personal approach or have additional questions about your refund, you can call the New York State Tax Refund Hotline. This service is available to provide assistance and answer your queries about the status of your refund.

The hotline number is 1-518-485-7636, and it's recommended to call between 8 a.m. and 4:30 p.m. on weekdays. When calling, have your SSN or ITIN and the exact amount of your expected refund ready to provide to the representative.

Mobile App

For those who prefer mobile convenience, the NYS Tax Refunds App is available for both iOS and Android devices. This app provides a simple and secure way to check your refund status on the go.

To use the app, you'll need to download it from the App Store or Google Play and create an account. Once logged in, you can access your refund information and stay updated on its progress.

Written Inquiry

If you prefer a more traditional approach or have concerns about providing your information online, you can send a written inquiry to the New York State Department of Taxation and Finance.

To do this, you'll need to include your full name, SSN or ITIN, current address, and a daytime phone number where you can be reached. It's essential to include as much detail as possible about your refund, such as the date you filed your return and the estimated amount of your refund.

Send your written inquiry to the following address:

New York State Department of Taxation and Finance

Refund Inquiries Unit

PO Box 4137

Albany, NY 12204

Please note that written inquiries may take longer to process compared to the online or hotline methods.

Factors Affecting Your New York State Tax Refund

Several factors can influence the processing time and amount of your New York State tax refund. Understanding these factors can help you anticipate any potential delays or adjustments to your refund.

Errors and Omissions

One of the most common reasons for delays in tax refunds is errors or omissions on your tax return. This can include mistakes in calculations, incorrect personal information, or missing forms or documents.

If the Department of Taxation and Finance identifies errors or omissions, they may send you a notice requesting additional information or clarifying details. Responding promptly to these notices is crucial to avoid further delays in processing your refund.

Tax Law Changes

Changes in tax laws can also impact your refund. Whether it’s a new tax credit, an updated deduction, or a change in tax rates, these changes can affect the amount of your refund.

It's essential to stay informed about any tax law changes that may impact your return. The Department of Taxation and Finance provides resources and updates on their website to help taxpayers understand these changes and their potential impact on refunds.

Identity Verification

In an effort to prevent fraud, the Department of Taxation and Finance may require additional identity verification steps for certain taxpayers. This is particularly common for those who claim certain tax credits or have significant changes in their tax situation from the previous year.

If you're selected for identity verification, you may need to provide additional documentation or complete a specific process to confirm your identity. This step is crucial to ensure the security of your refund and to prevent fraudulent activities.

What to Do If Your New York State Tax Refund Is Delayed

If you’ve checked the status of your refund and it appears to be delayed, there are several steps you can take to investigate the issue and potentially expedite the process.

Contact the Department of Taxation and Finance

If your refund is taking longer than expected, the first step is to contact the New York State Department of Taxation and Finance. You can reach out to them through the Refund Hotline or via a written inquiry, as mentioned earlier.

When contacting them, provide as much detail as possible about your refund, including the date you filed your return, the estimated amount of your refund, and any correspondence or notices you've received.

Review Your Tax Return

It’s essential to review your tax return carefully to identify any potential errors or omissions that may have caused a delay. Double-check your calculations, ensure all forms and schedules are complete and accurate, and verify that you’ve included all necessary supporting documents.

If you find any errors, correct them and refile your return as soon as possible. This may involve amending your original return or submitting additional forms or documents.

Check Your Bank Account

If you’ve filed your return electronically and opted for direct deposit, ensure that your bank account information is correct and up-to-date. Double-check with your bank to confirm that there are no issues with your account that could be preventing the deposit of your refund.

If there are any discrepancies, contact the Department of Taxation and Finance to provide updated banking information.

Conclusion: Stay Informed and Proactive

Checking the status of your New York State tax refund is a straightforward process, thanks to the various tools and resources provided by the Department of Taxation and Finance. By staying informed and proactive, you can ensure a smooth and timely refund process.

Remember to file your taxes accurately and on time, and keep track of any changes in tax laws or requirements. If you encounter any issues or delays, don't hesitate to reach out to the Department for assistance. They are there to help you navigate the tax refund process and ensure you receive your refund as promptly as possible.

FAQ

What if I don’t have my tax return information handy when checking my refund status online?

+If you don’t have your tax return information readily available, you can still check your refund status by contacting the New York State Tax Refund Hotline at 1-518-485-7636. They can provide you with the necessary details over the phone.

How often can I check the status of my New York State tax refund?

+You can check the status of your refund as often as you like using the online tool or the mobile app. However, it’s recommended to check at regular intervals rather than multiple times a day, as this can impact the efficiency of the system.

What should I do if I receive a notice requesting additional information about my tax return?

+If you receive a notice requesting additional information, it’s crucial to respond promptly. Gather the requested documents or details and send them to the address provided in the notice. This will help expedite the processing of your refund.

Can I track my New York State tax refund by mail?

+While it’s not possible to track your refund status specifically by mail, you can send a written inquiry to the Department of Taxation and Finance. They will respond to your inquiry with the status of your refund and any necessary updates.

How long does it take to receive a response from the Department of Taxation and Finance when contacting them about my refund status?

+Response times can vary depending on the method of contact and the volume of inquiries. Generally, you can expect a response within 10-14 business days for written inquiries and a shorter wait time for phone calls or online inquiries.