Trump No Tax On Overtime

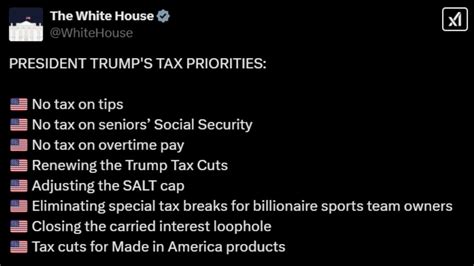

In a significant move that has garnered attention across the United States, the Trump administration's proposal to eliminate taxes on overtime pay has sparked a lively debate among economists, policymakers, and the general public. The idea, often referred to as the "Trump No Tax on Overtime" initiative, aims to boost the take-home pay of millions of American workers who frequently put in extra hours beyond their regular work schedules.

This article delves into the intricacies of this proposal, examining its potential impact on the economy, workers' rights, and the overall financial landscape of the country. By analyzing the key aspects of the initiative, we aim to provide a comprehensive understanding of its implications and the ongoing discussions surrounding it.

Understanding the Trump No Tax on Overtime Proposal

The Trump administration’s proposal to remove taxes on overtime pay is a bold step towards recognizing and incentivizing the hard work of millions of Americans. This initiative, if implemented, would mean that employees working overtime hours would no longer have to pay federal taxes on the additional income earned from those extra hours.

Currently, the Fair Labor Standards Act (FLSA) mandates that employers must pay overtime wages at a rate of 1.5 times the regular hourly rate for hours worked beyond the standard 40-hour workweek. However, the Trump administration's proposal seeks to exempt this overtime pay from federal taxation, effectively increasing the net take-home pay for workers.

Key Details of the Proposal:

- Target Audience: The initiative primarily benefits employees earning less than $47,476 annually, as this is the threshold below which the FLSA mandates overtime pay.

- Tax Exemption: The proposal suggests a complete exemption of federal taxes on overtime earnings, including income tax, Medicare, and Social Security taxes.

- Potential Impact: It is estimated that this move could result in a significant boost to the take-home pay of millions of workers, especially in industries like retail, hospitality, and healthcare, where overtime work is common.

| Industry | Average Overtime Hours/Week |

|---|---|

| Retail Trade | 3.4 hours |

| Accommodation and Food Services | 3.9 hours |

| Healthcare and Social Assistance | 3.5 hours |

According to the Bureau of Labor Statistics, approximately 10.4 million American workers are eligible for overtime pay, and the Trump administration's proposal aims to ensure that these workers receive the full benefit of their hard work without the burden of additional taxation.

Potential Benefits and Impact on the Economy

The Trump administration’s proposal to exempt overtime pay from taxation has the potential to create a ripple effect throughout the economy, impacting not only workers’ financial well-being but also various sectors and industries.

Increased Disposable Income

By eliminating taxes on overtime earnings, workers would have more disposable income at their disposal. This increased purchasing power could lead to a boost in consumer spending, which is a key driver of economic growth. Industries such as retail, entertainment, and hospitality might experience a surge in demand as workers feel more financially secure and inclined to spend.

Stimulating the Economy

The additional income from tax-free overtime could also encourage workers to invest in various sectors. This influx of investment could drive innovation and growth in industries like technology, healthcare, and renewable energy. The increased capital available for investment might lead to the creation of new businesses and the expansion of existing ones, further contributing to economic growth.

Impact on Industries

Different industries would likely experience varying levels of impact. Sectors with a higher proportion of overtime workers, such as manufacturing, construction, and transportation, might see a more pronounced effect. These industries could benefit from increased productivity and efficiency as workers are incentivized to work longer hours without the financial burden of overtime taxes.

| Industry | Percentage of Workers with Overtime Pay |

|---|---|

| Manufacturing | 20.6% |

| Construction | 18.4% |

| Transportation and Warehousing | 14.3% |

However, it is important to note that the impact on industries could also be influenced by other factors, such as labor market dynamics and industry-specific regulations.

Considerations and Potential Challenges

While the Trump No Tax on Overtime proposal presents numerous benefits, it is essential to consider potential challenges and implications that could arise.

Impact on Government Revenue

Eliminating taxes on overtime pay would result in a reduction of federal tax revenue. This could pose a challenge for the government’s fiscal policies and might require adjustments to maintain budgetary balance. The potential loss of revenue could impact government programs and services, especially those funded by federal taxes.

Fairness and Equity Concerns

The proposal might raise concerns about fairness and equity. Workers who do not typically work overtime hours, such as those in salaried positions or industries with strict work hour regulations, might perceive this initiative as favoring certain groups. Ensuring that all workers feel valued and respected, regardless of their work hours, is crucial for maintaining a positive workplace environment.

Work-Life Balance

While the proposal aims to incentivize overtime work, it is essential to consider the potential impact on work-life balance. Employees might feel pressured to work longer hours to take advantage of the tax exemption, leading to potential burnout and decreased productivity in the long run. Encouraging a healthy work-life balance should be a priority to maintain a sustainable and productive workforce.

International Perspective and Comparative Analysis

When examining the Trump No Tax on Overtime proposal, it is beneficial to consider international perspectives and how other countries handle overtime pay and taxation.

International Overtime Policies

Overtime policies and regulations vary widely across different countries. For instance, in some European countries, overtime work is strictly regulated, and employers are required to provide additional compensation or time off in lieu of overtime hours. In contrast, in the United States, overtime regulations are less stringent, and the FLSA sets the minimum standards for overtime pay.

Comparative Tax Treatment

The tax treatment of overtime pay also differs internationally. While the Trump administration’s proposal seeks to exempt overtime pay from federal taxation, other countries have different approaches. Some nations impose additional taxes on overtime earnings, while others have a more straightforward taxation system that applies the same tax rates to all income, including overtime pay.

| Country | Overtime Tax Treatment |

|---|---|

| Canada | Overtime earnings are taxed at the same rate as regular income. |

| United Kingdom | Overtime pay is included in the calculation of taxable income, and the standard income tax rates apply. |

| Japan | Overtime pay is subject to a special overtime tax rate, which is higher than the regular income tax rate. |

Comparing these international approaches provides valuable insights into the potential implications and considerations for the Trump No Tax on Overtime proposal.

Conclusion and Future Outlook

The Trump administration’s proposal to eliminate taxes on overtime pay is a complex and multifaceted initiative with the potential to bring about significant changes to the U.S. economy and the financial well-being of millions of workers. While the proposal aims to boost take-home pay and stimulate economic growth, it also presents challenges and considerations that require careful examination.

As the debate surrounding this initiative continues, it is crucial to engage in constructive dialogue, considering the potential benefits and challenges. The Trump No Tax on Overtime proposal offers an opportunity to explore innovative ways to support workers and stimulate economic growth, but it must be approached with a comprehensive understanding of its implications.

The future of this proposal remains uncertain, but the ongoing discussions and analyses will undoubtedly shape the economic policies and financial landscape of the United States in the years to come.

How will the Trump No Tax on Overtime proposal impact workers’ take-home pay?

+

The proposal aims to increase workers’ take-home pay by exempting overtime earnings from federal taxes. This means that workers will receive a higher net income for their overtime work, potentially boosting their disposable income.

What industries are likely to be most affected by this proposal?

+

Industries with a higher proportion of overtime workers, such as manufacturing, construction, and transportation, are likely to experience a more significant impact. These industries might see increased productivity and efficiency as workers are incentivized to work longer hours.

How might this proposal affect the government’s revenue?

+

Eliminating taxes on overtime pay will result in a reduction of federal tax revenue. This could impact government programs and services funded by federal taxes, potentially requiring adjustments to maintain budgetary balance.