Lake County Illinois Property Taxes

Lake County, Illinois, is renowned for its beautiful landscapes, thriving communities, and a diverse range of residential and commercial properties. However, one aspect that often tops the list of concerns for both homeowners and investors is property taxes. Understanding the ins and outs of Lake County's property tax system is crucial for making informed decisions about real estate in this region.

In this comprehensive guide, we delve into the intricacies of Lake County property taxes, exploring the factors that influence tax assessments, the assessment process itself, and the strategies that can help you navigate this complex but vital aspect of homeownership.

Understanding Lake County Property Taxes

Lake County’s property tax system is a critical component of the county’s overall revenue stream, funding essential services such as education, public safety, infrastructure, and more. Property taxes are levied on both residential and commercial properties, with the amount owed determined by the property’s assessed value and the applicable tax rate.

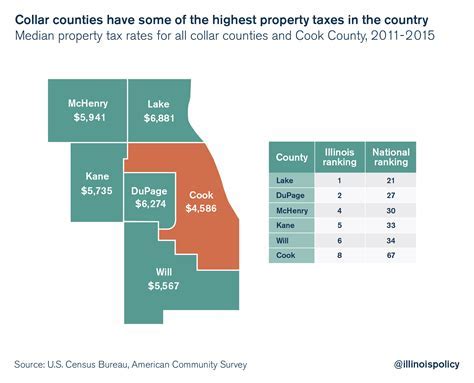

The property tax rate in Lake County is established annually by the county board and various taxing districts. These rates can vary significantly depending on the specific location within the county and the services provided by the taxing district. It's important to note that the tax rate is expressed as a percentage of the property's assessed value, which can make it challenging to predict the exact tax burden without a detailed understanding of the assessment process.

Factors Influencing Property Tax Assessments

Several key factors influence the assessment of property taxes in Lake County, each playing a significant role in determining the final tax bill. These factors include:

Property Type and Location

The type of property and its location within Lake County are fundamental considerations in the assessment process. Residential properties, commercial properties, and vacant land are taxed differently, with unique assessment methodologies applied to each category. Additionally, properties within different townships and municipalities may face varying tax rates and assessment practices.

Assessed Value

The assessed value of a property is a critical determinant of the tax liability. In Lake County, the assessed value is typically calculated as a percentage of the property’s fair market value. The assessment percentage varies based on the property type and can be subject to change over time. It’s important to note that the assessed value may not always align with the property’s actual market value, especially in a dynamic real estate market like Lake County.

Market Conditions and Recent Sales

The real estate market in Lake County is influenced by a multitude of factors, including economic conditions, demographic trends, and local developments. Assessors take into account recent sales of comparable properties when determining the assessed value of a specific property. This ensures that tax assessments remain in line with the prevailing market conditions, although it can sometimes lead to discrepancies between the assessed value and the property’s actual resale value.

Improvement and Upgrades

Improvements or upgrades made to a property can significantly impact its assessed value. Adding a new wing to your home, installing a swimming pool, or even making substantial renovations can increase the property’s assessed value, leading to higher property taxes. It’s crucial to understand how such improvements are valued and taxed to make informed decisions about property enhancements.

The Property Tax Assessment Process

The property tax assessment process in Lake County is a meticulous and regulated procedure, designed to ensure fairness and accuracy in tax assessments. Here’s an overview of the key steps involved:

Initial Assessment

The assessment process begins with an initial evaluation of the property’s characteristics, including its size, location, and recent sales data. Assessors may visit the property to verify its physical attributes and ensure the information on record is accurate. This initial assessment forms the basis for determining the property’s assessed value.

Equalization Factor

To ensure equitable taxation across different townships and municipalities, Lake County applies an equalization factor to assessed values. This factor is designed to account for variations in assessment practices and ensure that properties with similar characteristics are taxed similarly, regardless of their location within the county.

Tax Rate Calculation

Once the assessed value is determined, the applicable tax rate is applied to calculate the property’s tax liability. The tax rate is a complex calculation that considers the revenue needs of various taxing districts, including the county, municipalities, schools, and special districts. The resulting tax rate is then multiplied by the assessed value to determine the property tax bill.

Tax Bills and Payment

Property owners in Lake County receive their tax bills twice a year, typically in March and September. These bills outline the property’s assessed value, the applicable tax rate, and the total tax liability. Property owners have the option to pay their taxes in full or in installments, with payment due dates clearly specified on the bill. Late payments may incur penalties and interest.

Strategies for Managing Property Taxes

Understanding the property tax landscape in Lake County is just the first step. To effectively manage your property tax obligations, it’s essential to explore strategies that can help reduce your tax burden and ensure you’re not overpaying.

Review and Appeal

Property owners in Lake County have the right to review their property’s assessment and, if necessary, file an appeal. This process involves a thorough examination of the assessment, identifying any discrepancies or errors. If you believe your property’s assessed value is inaccurate or excessive, you can gather evidence and present your case to the Lake County Board of Review. Successful appeals can lead to a reduction in your property’s assessed value, resulting in lower tax bills.

Understand Exemptions and Deductions

Lake County offers various exemptions and deductions that can help reduce your property tax liability. These include homestead exemptions for primary residences, senior citizen exemptions, and deductions for certain types of properties, such as agricultural land. It’s crucial to understand the eligibility criteria and application process for these exemptions to maximize your tax savings.

Strategic Property Improvements

While improvements to your property can increase its assessed value, some strategic enhancements may provide tax benefits. For example, energy-efficient upgrades or accessibility modifications can qualify for tax credits or deductions. Additionally, certain improvements, such as adding a garage or expanding living space, may increase the property’s value without significantly impacting its assessed value, especially if the improvements are in line with the prevailing market trends.

Stay Informed about Market Trends

The real estate market in Lake County is dynamic, and keeping up with the latest trends and developments can help you make informed decisions about your property. Understanding market fluctuations, new construction projects, and demographic changes can provide insights into how these factors may influence your property’s assessed value and, consequently, your tax liability. Staying informed allows you to anticipate and plan for potential changes in your tax obligations.

Conclusion

Navigating the complexities of Lake County property taxes is an essential aspect of homeownership and investment in this vibrant region. By understanding the factors that influence tax assessments, the assessment process itself, and the strategies available to manage your tax obligations, you can make more informed decisions about your real estate ventures.

Remember, property taxes are a critical component of the community's overall well-being, funding essential services that enhance the quality of life for residents. By staying informed and proactive, you can ensure that your tax obligations are fair and manageable, allowing you to enjoy all that Lake County has to offer.

How often are property tax assessments conducted in Lake County?

+

Property tax assessments in Lake County are typically conducted every three years. However, certain changes to the property, such as significant improvements or damage, may trigger a reassessment outside of this cycle.

Can I pay my property taxes online in Lake County?

+

Yes, Lake County offers online payment options for property taxes. You can visit the Lake County Treasurer’s website to make payments, view your tax bill, and manage your account.

What happens if I don’t pay my property taxes on time?

+

Late payment of property taxes in Lake County may result in penalties and interest. Additionally, if taxes remain unpaid, the county may place a lien on the property, which can lead to foreclosure proceedings.

Are there any property tax relief programs available in Lake County?

+

Lake County offers several property tax relief programs, including the Senior Citizen Assessment Freeze Homestead Exemption and the Senior Citizen Homestead Exemption. These programs provide tax relief for eligible seniors, helping them manage their property tax obligations.

Can I appeal my property’s assessed value if I believe it is inaccurate?

+

Yes, property owners in Lake County have the right to appeal their property’s assessed value. The appeal process involves presenting evidence to the Lake County Board of Review, demonstrating why the assessed value is inaccurate. Successful appeals can lead to a reduction in the property’s assessed value and, consequently, lower tax bills.