Is There Tax On Overtime

In the realm of employment and labor laws, the question of taxation on overtime earnings is a pertinent and complex matter. The treatment of overtime pay from a tax perspective varies across jurisdictions and can significantly impact the take-home pay of employees who work beyond their regular hours. This article delves into the intricacies of overtime tax, shedding light on its application, calculations, and potential implications for both employees and employers.

Understanding Overtime Tax

Overtime tax refers to the deductions and contributions applied to the additional income earned by employees when they work beyond their standard working hours. It is a crucial aspect of employment law and tax regulations, as it ensures that individuals are fairly compensated for their extra efforts while also contributing to various tax obligations.

The concept of overtime is typically defined by the legal framework within a specific jurisdiction. In many cases, overtime is considered any work performed beyond the standard workweek, which is often set at 40 hours. However, this definition can vary, and it is essential to understand the specific regulations in your region.

Overtime Pay Rates

Overtime pay rates are usually calculated at a higher rate than regular hourly wages to incentivize employees and ensure fair compensation for their extra efforts. In many countries, the overtime pay rate is set at time-and-a-half, which means employees receive 1.5 times their regular hourly rate for each hour worked in excess of the standard workweek. Some jurisdictions may even mandate a double-time rate for work on certain days or during specific hours.

| Overtime Pay Rate | Description |

|---|---|

| Time-and-a-half | 1.5 times the regular hourly rate |

| Double-time | 2 times the regular hourly rate |

Overtime Eligibility

Not all employees are eligible for overtime pay. The eligibility criteria can depend on various factors, including the employee’s job role, the nature of their work, and the specific labor laws in their jurisdiction. Some occupations, such as managerial positions or certain exempt professions, may not be entitled to overtime pay.

Overtime Tax Calculations

The taxation of overtime income involves several steps and considerations. Here’s a simplified breakdown of the process:

- Calculate Overtime Earnings: Determine the number of overtime hours worked and multiply them by the applicable overtime pay rate to find the gross overtime earnings.

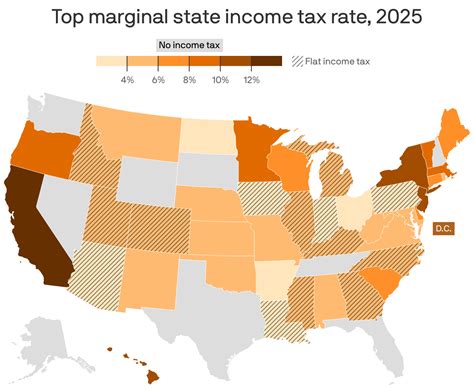

- Apply Tax Withholding: Employers are responsible for withholding taxes from employees' paychecks. This includes federal income tax, state income tax (if applicable), Social Security tax, and Medicare tax. The amount withheld depends on the employee's tax bracket and the relevant tax rates.

- Consider Tax Credits and Deductions: Overtime earnings may be eligible for certain tax credits or deductions, which can reduce the overall tax liability. For instance, employees may claim deductions for work-related expenses or take advantage of tax credits for dependent care or education.

- Submit Tax Returns: Employees must accurately report their overtime earnings on their annual tax returns. Employers provide relevant tax documents, such as W-2 forms, to help employees calculate their tax obligations.

Implications for Employees and Employers

The taxation of overtime pay has significant implications for both employees and employers. For employees, understanding the tax implications of overtime work is crucial to managing their finances effectively. They need to be aware of their tax obligations and ensure they receive the correct deductions and credits.

For employers, accurate calculation and withholding of taxes from overtime pay are essential to comply with tax laws and avoid legal issues. Employers must stay updated on the latest tax regulations and ensure their payroll systems are equipped to handle overtime calculations correctly.

Strategies for Managing Overtime Tax

Both employees and employers can employ strategies to optimize the management of overtime tax:

- Employees: Keep track of overtime hours and earnings to ensure accurate tax calculations. Consider seeking professional tax advice to maximize deductions and credits.

- Employers: Implement robust payroll systems that accurately calculate overtime pay and tax withholdings. Regularly review and update tax policies to stay compliant with changing regulations.

Case Study: Impact of Overtime Tax on Industries

The taxation of overtime pay can have a significant impact on specific industries, particularly those that rely heavily on overtime work. For instance, in the construction industry, where projects often require long hours and unpredictable schedules, the tax implications of overtime can be substantial. Construction companies must carefully manage their payroll and tax obligations to ensure they remain competitive while also meeting their tax responsibilities.

Future Trends and Considerations

The landscape of overtime tax is constantly evolving, and several trends and considerations are worth noting:

- Increasing Focus on Fair Labor Practices: There is a growing emphasis on ensuring fair labor conditions and compensation, which may lead to further regulation of overtime pay and its taxation.

- Digitalization of Payroll and Tax Systems: The adoption of digital payroll and tax management systems can streamline the process of calculating and withholding taxes from overtime pay, improving accuracy and efficiency.

- Potential Tax Reform: Changes in tax policies and rates can significantly impact the taxation of overtime income. It is crucial for both employees and employers to stay informed about any upcoming tax reforms.

Conclusion

The taxation of overtime pay is a complex yet essential aspect of employment and tax law. Understanding the intricacies of overtime tax, from calculation methods to eligibility criteria, is crucial for both employees and employers. By staying informed and adopting strategic approaches to managing overtime tax, individuals and businesses can navigate this complex landscape effectively, ensuring compliance and financial well-being.

Are there any tax benefits for employees working overtime?

+Yes, employees may be eligible for certain tax credits or deductions related to their overtime work. These can include credits for dependent care, education, or work-related expenses. Consulting a tax professional can help identify applicable benefits.

How often should employers calculate and withhold taxes from overtime pay?

+Employers should calculate and withhold taxes from overtime pay on a regular basis, typically with each payroll cycle. This ensures accurate tax withholding and helps employees avoid unexpected tax liabilities.

What happens if an employee’s overtime earnings exceed a certain threshold?

+In some cases, overtime earnings may push an employee’s total income above certain tax thresholds, leading to higher tax rates or the need to make estimated tax payments. It is crucial for employees to monitor their earnings and consult tax advisors for guidance.