Nc Vehicle Tax

Vehicle taxation is an essential aspect of owning and operating a motor vehicle in any jurisdiction, and North Carolina is no exception. The North Carolina Department of Transportation (NCDOT) imposes various taxes and fees on vehicles to fund transportation infrastructure, safety programs, and other vital services. This article will delve into the intricacies of the North Carolina vehicle tax, covering its structure, calculation methods, exemptions, and the impact it has on vehicle owners in the state.

Understanding the North Carolina Vehicle Tax

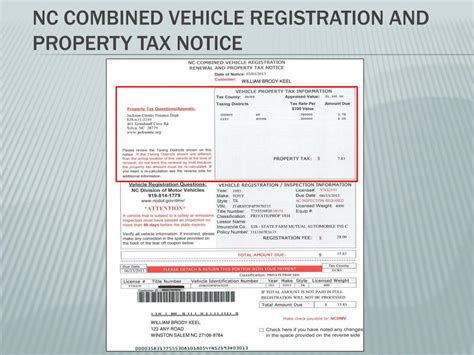

The North Carolina vehicle tax is a form of ad valorem tax, meaning it is based on the value of the vehicle. The tax is levied annually and is typically due at the time of vehicle registration or renewal. It is important to note that the vehicle tax in North Carolina is distinct from the sales tax applied when purchasing a vehicle.

Tax Rate and Assessment

The vehicle tax rate in North Carolina is determined by the vehicle’s value, which is assessed by the North Carolina Division of Motor Vehicles (NCDMV). The tax rate varies depending on the vehicle’s classification and can be calculated using the following formula:

Vehicle Tax = Vehicle Value x Tax Rate

The tax rate for passenger vehicles is 1% of the vehicle's value, while commercial vehicles, motorcycles, and certain other vehicle types have different rates. For instance, the tax rate for commercial trucks is 3% of the value. The NCDMV uses the National Automobile Dealers Association (NADA) guidelines to determine the vehicle's value, considering factors such as make, model, year, and mileage.

Exemptions and Special Considerations

Like many other states, North Carolina offers certain exemptions and reduced tax rates for specific vehicle types and situations. These exemptions are designed to alleviate the financial burden on certain groups or to promote environmentally friendly transportation options.

One notable exemption is for electric vehicles (EVs). To encourage the adoption of sustainable transportation, North Carolina offers a 100% tax exemption for the first $2,500 of the vehicle's value for the initial registration. This exemption is available for both new and used EVs and is valid for five years from the date of initial registration.

Additionally, the state provides reduced tax rates for hybrid vehicles. The tax rate for hybrid vehicles is set at 0.5% of the vehicle's value, which is half the rate for traditional passenger vehicles. This incentive aims to promote the use of more fuel-efficient vehicles and reduce carbon emissions.

| Vehicle Type | Tax Rate |

|---|---|

| Passenger Vehicles | 1% of Vehicle Value |

| Commercial Trucks | 3% of Vehicle Value |

| Electric Vehicles (First $2,500) | 0% (Exempt) |

| Hybrid Vehicles | 0.5% of Vehicle Value |

Impact on Vehicle Owners

The vehicle tax in North Carolina can significantly impact vehicle owners, especially those with high-value vehicles. While the tax rate is relatively low compared to some other states, the cumulative effect of annual payments can be substantial. For instance, a luxury car with a high resale value could incur a tax bill of several hundred dollars annually.

Compliance and Payment Options

Vehicle owners in North Carolina have several options for complying with the vehicle tax requirement. The most common method is to pay the tax when registering or renewing the vehicle’s registration. This can be done online through the NCDMV’s website or at a local license plate agency.

For those who prefer to pay in installments, North Carolina offers a Vehicle Property Tax Deferred Payment Program. This program allows eligible taxpayers to defer their vehicle tax payments for up to two years, with interest accruing on the deferred amount. This option can provide financial relief for individuals facing temporary financial difficulties.

Late Payment Penalties

Failure to pay the vehicle tax by the due date can result in late payment penalties. North Carolina imposes a 1.5% monthly interest charge on the unpaid tax amount. Additionally, a 10% penalty may be assessed if the tax remains unpaid after a certain grace period. It is crucial for vehicle owners to stay aware of their payment deadlines to avoid these penalties and maintain compliance with state regulations.

Vehicle Tax and Environmental Initiatives

The North Carolina vehicle tax system also aligns with the state’s environmental initiatives and goals. By offering incentives for electric and hybrid vehicles, the state encourages the transition to more sustainable transportation options. This not only reduces carbon emissions but also promotes the development of a cleaner, more efficient transportation infrastructure.

Electric Vehicle Infrastructure

To support the growing number of electric vehicles on the road, North Carolina has invested in the development of an extensive charging infrastructure. The state has partnered with various organizations and businesses to install charging stations across the state, ensuring that EV owners have access to reliable charging options during their travels.

Additionally, the North Carolina Department of Environmental Quality (NCDEQ) has implemented the Clean Energy Vehicle Program, which provides grants and incentives to support the adoption of electric and other clean energy vehicles. This program aims to accelerate the transition to sustainable transportation and reduce the state's carbon footprint.

Future Implications and Conclusion

The North Carolina vehicle tax system is an integral part of the state’s transportation funding and environmental initiatives. While the tax rate may be relatively low, the incentives for electric and hybrid vehicles demonstrate the state’s commitment to sustainability and clean energy. As the adoption of electric vehicles continues to rise, the tax system will likely play a crucial role in shaping the state’s transportation landscape.

For vehicle owners in North Carolina, understanding the vehicle tax structure and staying informed about exemptions and payment options is essential. By staying compliant with the tax requirements, vehicle owners can contribute to the state's transportation infrastructure and support the transition to a greener, more sustainable future.

When is the vehicle tax due in North Carolina?

+The vehicle tax is typically due at the time of vehicle registration or renewal. North Carolina operates on a staggered registration system, so the exact due date depends on the last digit of the vehicle’s license plate number.

How is the value of my vehicle determined for tax purposes?

+The North Carolina Division of Motor Vehicles (NCDMV) uses the National Automobile Dealers Association (NADA) guidelines to determine the vehicle’s value. Factors such as make, model, year, and mileage are considered in the assessment process.

Are there any exemptions or reduced tax rates for certain vehicle types?

+Yes, North Carolina offers exemptions and reduced tax rates for electric vehicles and hybrid vehicles. Electric vehicles are exempt from tax on the first $2,500 of the vehicle’s value for the initial registration, while hybrid vehicles have a reduced tax rate of 0.5%.

What happens if I don’t pay my vehicle tax on time?

+Late payment of vehicle tax can result in penalties and interest charges. North Carolina imposes a 1.5% monthly interest charge on the unpaid tax amount, and a 10% penalty may be assessed if the tax remains unpaid after a certain grace period.