Clay County Property Tax

In the United States, property taxes are a significant source of revenue for local governments, including counties, municipalities, and school districts. These taxes are essential for funding various public services and infrastructure. This article aims to delve into the intricacies of Clay County's property tax system, exploring its rates, assessment processes, and the impact it has on homeowners and the local economy.

Understanding Clay County’s Property Tax Structure

Clay County, nestled in the heart of [State], is renowned for its vibrant communities, diverse landscapes, and thriving economy. The property tax system in Clay County is designed to ensure a fair and equitable distribution of tax burdens among property owners while providing the necessary funds for local services and infrastructure development.

Property Tax Rates and Assessments

The property tax rate in Clay County is determined by the county commissioners and is typically expressed as a millage rate. As of [current year], the millage rate for Clay County is set at [millage rate] mills. This rate is applied to the assessed value of a property to calculate the annual property tax due.

Property assessments in Clay County are conducted by the Clay County Property Appraiser's Office. The appraiser's team is responsible for evaluating each property within the county to determine its fair market value. This process involves analyzing recent sales of comparable properties, taking into account factors such as location, size, age, and improvements made to the property.

Once the assessed value is determined, it is multiplied by the applicable millage rate to arrive at the property tax liability. For instance, if a homeowner's property is valued at $250,000 and the millage rate is 10 mills, the annual property tax due would be calculated as follows:

| Assessed Value | Millage Rate | Property Tax |

|---|---|---|

| $250,000 | 10 mills | $2,500 |

Exemptions and Discounts

Clay County offers various exemptions and discounts to certain property owners to reduce their tax burden. These incentives aim to support specific groups and promote economic development within the county.

- Homestead Exemption: Clay County provides a homestead exemption, which reduces the assessed value of a property by a certain amount if it is the owner's primary residence. This exemption helps homeowners keep their property taxes manageable and encourages homeownership.

- Senior Citizen Discount: Eligible senior citizens in Clay County may qualify for a discount on their property taxes. This initiative aims to support older residents and ease the financial burden of property ownership as they age.

- Agricultural and Greenbelt Exemptions: Properties used for agricultural purposes or designated as greenbelts may qualify for special assessment methods that reduce their taxable value. These exemptions encourage land preservation and support local farming communities.

The Impact on Homeowners

Property taxes can significantly impact a homeowner’s financial planning and overall cost of living. In Clay County, the property tax system plays a crucial role in shaping the real estate market and influencing homeowners’ decisions.

For instance, the availability of exemptions and discounts can make homeownership more affordable, particularly for first-time buyers or those on fixed incomes. On the other hand, rising property values can lead to increased tax liabilities, impacting a homeowner's cash flow and budget.

Additionally, the property tax system influences investment decisions. Investors considering real estate opportunities in Clay County must carefully evaluate the potential tax implications, as these can significantly impact the profitability of their ventures.

Economic Implications and Local Development

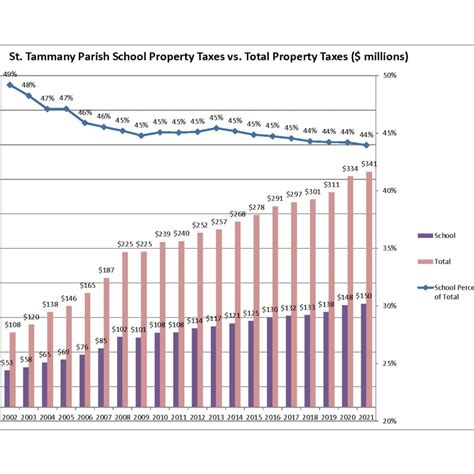

The revenue generated from property taxes is a vital component of Clay County’s overall financial health and plays a critical role in funding essential services and infrastructure projects.

Funding Local Services

Property tax revenue in Clay County is allocated to various public services, including law enforcement, fire protection, emergency medical services, and public works. These funds ensure that residents have access to critical services and contribute to the overall safety and well-being of the community.

For instance, a portion of the property tax revenue may be earmarked for improving public transportation, enhancing recreational facilities, or investing in local schools and education initiatives.

Infrastructure Development

Property taxes are a primary source of funding for infrastructure projects in Clay County. These projects encompass a wide range of initiatives, from road repairs and bridge maintenance to the construction of new public buildings and utilities.

By investing in infrastructure, Clay County aims to enhance the quality of life for its residents, attract new businesses, and foster economic growth. Well-maintained infrastructure improves accessibility, reduces commute times, and creates a more appealing environment for businesses and investors.

Economic Growth and Development

The property tax system in Clay County is intricately linked to the county’s economic growth and development. A stable and predictable tax environment can attract businesses and investors, leading to job creation and increased economic activity.

Furthermore, the availability of exemptions and incentives can encourage business expansion and promote the growth of specific industries, such as renewable energy or technology sectors. By strategically allocating property tax revenue, Clay County can shape its economic landscape and create a competitive advantage in the region.

Transparency and Accountability

To ensure transparency and accountability, Clay County provides resources and information to property owners regarding their tax obligations. This includes access to assessment records, tax rates, and information on exemptions and discounts.

The Clay County Property Appraiser's Office maintains an online portal where homeowners can easily access their property's assessed value and view the calculation of their property taxes. This transparency empowers homeowners to understand their tax liability and ensures fairness in the assessment process.

Conclusion: A Balanced Approach to Property Taxation

Clay County’s property tax system is designed to strike a balance between funding essential local services and infrastructure projects while providing incentives and support to homeowners and businesses. By offering exemptions and discounts, the county encourages homeownership and economic development, making it an attractive place to live and invest.

As Clay County continues to thrive and evolve, its property tax system will remain a crucial component of its economic and community development strategies. By maintaining transparency, fairness, and a focus on the needs of its residents, Clay County can ensure a sustainable and prosperous future for all.

How often are property assessments conducted in Clay County?

+Property assessments in Clay County are typically conducted annually. However, in certain circumstances, such as significant improvements or damage to a property, reassessments may be triggered.

Can property owners appeal their assessed value or tax liability?

+Yes, property owners in Clay County have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process is handled by the Clay County Value Adjustment Board, and specific guidelines and deadlines apply.

Are there any online resources available for property tax information in Clay County?

+Absolutely! Clay County provides an online property tax portal, where homeowners can access their assessment records, calculate their tax liability, and find information on exemptions and discounts. The portal is user-friendly and offers a convenient way to manage property tax-related matters.