City Of San Francisco Tax Rate

The city of San Francisco, nestled on the picturesque West Coast of the United States, boasts a vibrant culture, diverse population, and a robust economy. One of the key aspects that defines the financial landscape of this metropolitan hub is its tax system. San Francisco's tax rates are a critical component in shaping the city's economic climate, influencing both local businesses and residents alike. Understanding these rates is essential for anyone navigating the financial intricacies of life and commerce within this iconic city.

Unraveling San Francisco's Tax Structure

San Francisco, like many other U.S. cities, operates under a comprehensive tax system that encompasses various types of levies, each designed to fund specific aspects of the city's operations and development. These taxes can be broadly categorized into income taxes, property taxes, sales taxes, and various other business-specific taxes.

Income Taxes: A Snapshot of San Francisco's Earnings Levy

For individuals and businesses earning income within San Francisco's borders, income taxes are a significant consideration. The city levies an additional income tax on top of the state and federal income taxes. This personal income tax is calculated as a percentage of an individual's or business's taxable income. As of [Date], the city's personal income tax rate stands at [Rate]%, making it a notable contributor to the city's overall tax revenue.

The city's income tax structure is designed to be progressive, meaning that higher income earners are taxed at a higher rate. This approach aims to ensure that the tax burden is distributed equitably across the city's diverse population. Additionally, San Francisco offers various deductions and credits to reduce the tax liability for individuals and businesses, including those focused on encouraging sustainable practices and supporting local businesses.

Property Taxes: A Look at San Francisco's Real Estate Levy

Property taxes are another crucial component of San Francisco's tax landscape. These taxes are levied on the assessed value of real estate properties within the city limits. The property tax rate in San Francisco is determined annually and is applied uniformly across all properties. As of [Date], the city's property tax rate is set at [Rate]% of the assessed value.

San Francisco's property tax system follows a two-tiered assessment process. This means that when a property changes ownership, it is reassessed at its current market value, and the new owner pays taxes based on this new value. However, for existing property owners, the assessed value can only increase by a maximum of 2% annually, providing some stability for long-term residents and businesses. This system aims to balance the need for revenue with the desire to maintain affordability and stability for property owners.

| Assessment Type | Tax Rate |

|---|---|

| New Property Owners | [Rate]% of Market Value |

| Existing Property Owners | Maximum 2% Annual Increase |

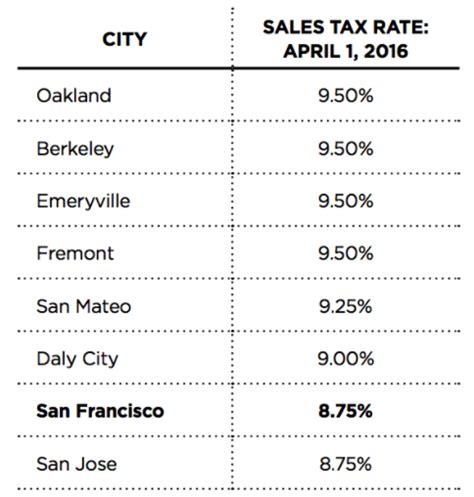

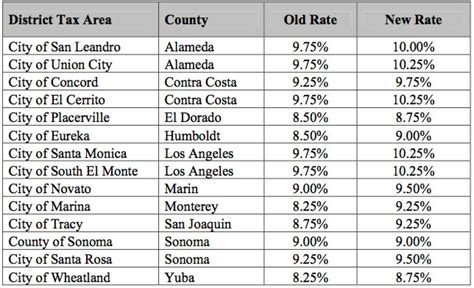

Sales Taxes: Understanding San Francisco's Retail Levy

San Francisco, like many other California cities, imposes a sales and use tax on the sale of tangible personal property and certain services. This tax is collected by businesses at the point of sale and remitted to the city and state. As of [Date], the combined sales tax rate in San Francisco is [Rate]%, which includes both the state and city sales tax rates.

The city's sales tax revenue is vital for funding essential services and infrastructure projects. It is allocated towards various public works, such as road maintenance, public transportation, and other civic improvements. Additionally, sales tax revenue helps support local businesses by funding initiatives that promote tourism and economic development.

Business Taxes: A Glimpse at San Francisco's Commercial Levies

San Francisco's tax structure extends beyond income, property, and sales taxes. The city also imposes specific taxes on businesses operating within its boundaries. These taxes are designed to support the local economy and ensure a level playing field for all businesses. One notable example is the Gross Receipts Tax, which is levied on the total income received by a business from all sources within San Francisco.

Furthermore, San Francisco has implemented various business registration fees and license taxes to regulate and support different industries. These fees and taxes vary depending on the type of business and its specific activities. For instance, restaurants and hotels might be subject to additional taxes to support local tourism and hospitality initiatives.

| Business Tax Type | Rate or Fee |

|---|---|

| Gross Receipts Tax | [Rate]% of Total Income |

| Business Registration Fee | $[Amount] per year |

| Hotel Occupancy Tax | [Rate]% of Room Revenue |

| Restaurant Tax | [Rate]% of Food and Beverage Sales |

Frequently Asked Questions

How do San Francisco’s tax rates compare to other major cities in the U.S.?

+

San Francisco’s tax rates, particularly its income and property tax rates, are generally higher compared to many other major U.S. cities. This is partly due to the city’s high cost of living and the need for substantial revenue to support its robust infrastructure and public services.

Are there any tax incentives or credits available for businesses in San Francisco?

+

Yes, San Francisco offers a range of tax incentives and credits to support local businesses. These include tax breaks for businesses that create jobs, promote sustainability, or operate in certain targeted industries. The city also provides tax credits for businesses that invest in affordable housing or community development projects.

How does San Francisco’s sales tax rate affect online shopping?

+

San Francisco’s sales tax applies to online purchases that are delivered to an address within the city limits. This means that online shoppers in San Francisco will see the combined city and state sales tax rate applied to their purchases. However, certain online retailers may be exempt from collecting sales tax depending on their business structure and sales volume.

What are the consequences for businesses that fail to comply with San Francisco’s tax regulations?

+

Non-compliance with San Francisco’s tax regulations can result in significant penalties and fines. Businesses found to be in violation may face audits, legal action, and even revocation of their business licenses. It is crucial for businesses to understand and adhere to the city’s tax laws to avoid these repercussions.

Are there any tax exemptions or deductions available for San Francisco residents?

+

Yes, San Francisco offers various tax exemptions and deductions to its residents. These include homestead exemptions for property taxes, which reduce the taxable value of a primary residence, and income tax deductions for certain expenses such as student loan interest, medical expenses, and charitable contributions.