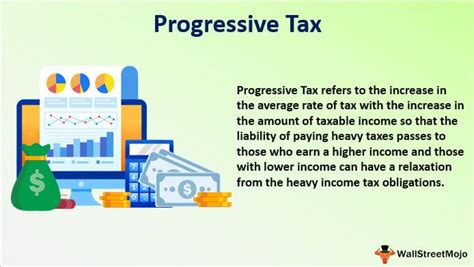

Define Progressive Tax

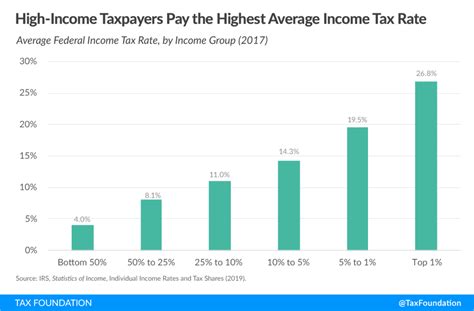

Progressive tax is a fundamental concept in the realm of taxation, designed to ensure fairness and equity in the distribution of financial responsibilities among individuals and entities within a society. It is a cornerstone of many modern tax systems, including those in the United States and various other countries worldwide. The core principle of a progressive tax system is that the tax rate increases as the taxable income or asset value increases, meaning those with higher incomes or assets contribute a larger proportion of their earnings to the tax system.

The Mechanism of Progressive Taxation

Progressive tax systems are structured around the concept of tax brackets, which are income ranges associated with specific tax rates. As an individual’s income rises, they move through these brackets, and their effective tax rate gradually increases. For instance, a person’s income might be taxed at 10% for the first 10,000 earned, 15% for the next 10,000, and so on, with the rates progressively increasing as income rises.

Example: Progressive Tax Brackets in the United States

In the U.S., the Internal Revenue Service (IRS) determines tax brackets and rates each year. For the 2022 tax year, these are the marginal tax rates for single filers:

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $10,275 | 10% |

| $10,276 - $41,775 | 12% |

| $41,776 - $89,075 | 22% |

| $89,076 - $170,050 | 24% |

| $170,051 - $215,950 | 32% |

| $215,951 - $539,900 | 35% |

| Over $539,900 | 37% |

This system ensures that those with higher incomes pay a larger percentage of their income in taxes, creating a more equitable distribution of tax burdens.

Key Advantages of Progressive Taxation

Progressive taxation offers several benefits that contribute to the overall stability and fairness of a nation’s economy.

Redistribution of Wealth

By taxing higher incomes at a higher rate, progressive tax systems help reduce income inequality. This redistribution of wealth can contribute to a more equitable society, where the benefits of economic growth are shared more widely.

Encouraging Economic Growth

Progressive taxation can stimulate economic growth by providing incentives for lower-income earners to work and invest more. As their income rises, they move into higher tax brackets, but the marginal tax rate increases at a slower pace, thus encouraging continued economic participation.

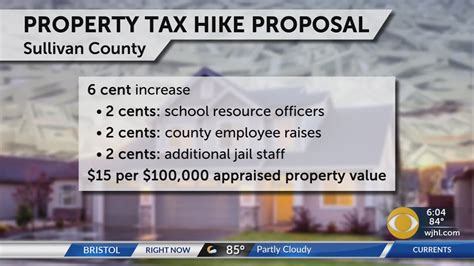

Funding for Public Services

The additional revenue generated from progressive taxation can be directed towards essential public services, such as education, healthcare, infrastructure development, and social safety nets. These investments can further stimulate economic growth and improve the overall quality of life for citizens.

Potential Challenges and Considerations

While progressive taxation has many advantages, it also presents certain challenges and complexities that policymakers must navigate.

Complexity in Tax Code

Progressive tax systems can lead to complex tax codes, as they require detailed regulations to define tax brackets, rates, and eligibility criteria. This complexity can make tax compliance more challenging for individuals and businesses.

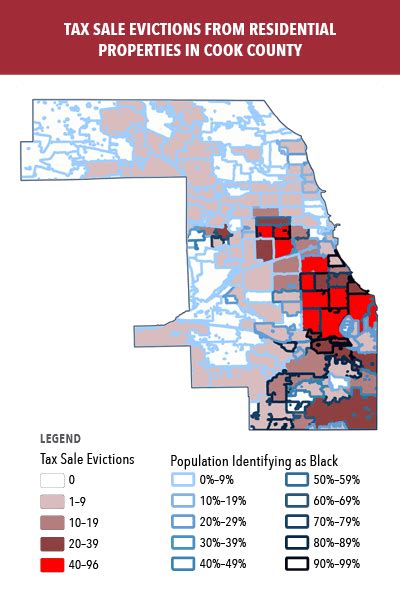

Income Inequality Concerns

While progressive taxation aims to reduce income inequality, it does not address all forms of inequality. For instance, it may not effectively address wealth inequality, where assets and investments are not subject to the same progressive rates as income.

International Competitiveness

In a global economy, countries with high tax rates may face challenges attracting businesses and high-income earners, who could choose to relocate to jurisdictions with lower tax rates. This can lead to a “race to the bottom” where countries lower tax rates to remain competitive, potentially undermining the benefits of progressive taxation.

The Future of Progressive Taxation

As societies evolve and economic landscapes shift, the role and design of progressive taxation will continue to be a subject of debate and policy reform. Key considerations for the future include:

- The impact of automation and technological advancements on income distribution and the potential need for new tax structures.

- Addressing wealth inequality through potential reforms such as wealth taxes or inheritance taxes.

- Ensuring the tax system remains fair and efficient in the context of a growing gig economy and remote work.

- International cooperation to address tax avoidance and ensure a level playing field for businesses operating across borders.

How does a progressive tax system differ from a flat tax system?

+A flat tax system applies the same tax rate to all income levels, regardless of the amount earned. In contrast, a progressive tax system uses a series of tax brackets, with higher income levels subject to higher tax rates. This approach aims to ensure that individuals with higher incomes contribute a larger share of their income to the tax system, promoting fairness and redistribution.

What are the potential drawbacks of a progressive tax system?

+Progressive tax systems can be complex to administer and understand, potentially leading to compliance issues. They may also discourage high-income earners from working harder or investing, as they face higher tax rates. Additionally, progressive taxes might not effectively address wealth inequality, as they primarily target income rather than assets.

How does progressive taxation impact economic growth?

+Progressive taxation can stimulate economic growth by providing incentives for lower-income earners to participate in the economy. As they earn more, they move into higher tax brackets, but the marginal tax rate increases at a slower pace, encouraging continued economic activity. However, high tax rates on higher incomes could potentially discourage investment and economic growth.