Rapid Tax Filings Llc Scam

The world of tax preparation and filing is a critical aspect of financial management, and unfortunately, it has become a breeding ground for scams and fraudulent activities. Among the various companies operating in this space, Rapid Tax Filings LLC has garnered attention, not for its efficiency but for the concerns and allegations of fraudulent practices that have been raised against it.

In this comprehensive analysis, we delve deep into the workings of Rapid Tax Filings LLC, examining its practices, the allegations made against it, and the impact it has had on individuals and businesses. By understanding the intricacies of this alleged scam, we aim to shed light on the potential dangers and empower readers to make informed decisions when choosing tax preparation services.

Unveiling Rapid Tax Filings LLC: A Comprehensive Overview

Rapid Tax Filings LLC, a tax preparation and filing company, operates in a highly regulated industry, where trust and accuracy are paramount. However, the company's operations and practices have come under scrutiny, raising serious questions about its legitimacy and ethical standards.

Rapid Tax Filings LLC presents itself as a reliable and efficient tax preparation service, promising quick turnaround times and affordable rates. On the surface, it appears to offer a convenient solution for individuals and businesses seeking tax assistance. However, a closer examination reveals a different story.

The company's website boasts a user-friendly interface, providing information on its services and a simple process for filing taxes. It claims to have a team of experienced tax professionals who can guide clients through the complex world of tax regulations. Additionally, Rapid Tax Filings LLC emphasizes its commitment to customer satisfaction and guarantees accuracy in its tax preparation services.

Services Offered by Rapid Tax Filings LLC

Rapid Tax Filings LLC offers a range of tax preparation and filing services, catering to individuals, small businesses, and even corporations. Here's an overview of the services they advertise:

- Individual Tax Returns: They assist with preparing and filing personal tax returns, including federal and state taxes. Their services cover various income types, such as wages, investments, and self-employment income.

- Business Tax Returns: For small businesses, Rapid Tax Filings LLC offers help with business tax returns, including sole proprietorships, partnerships, and limited liability companies (LLCs). They handle business income, expenses, and deductions.

- Corporation Tax Returns: The company extends its services to corporations, providing assistance with corporate tax returns and ensuring compliance with complex corporate tax regulations.

- Amended Returns: If clients need to make corrections to previously filed tax returns, Rapid Tax Filings LLC offers amended return services, guiding them through the process.

- Tax Planning: Beyond tax preparation, they claim to provide tax planning services, offering strategies to minimize tax liabilities and maximize deductions.

While these services appear comprehensive and cover a wide range of tax-related needs, the allegations and concerns surrounding Rapid Tax Filings LLC suggest that there may be more to the story than meets the eye.

Allegations and Concerns: Unraveling the Truth

Rapid Tax Filings LLC has faced a multitude of allegations and concerns, casting doubt on its legitimacy and ethical practices. Here, we explore some of the key issues that have raised red flags among consumers and industry experts.

Unfair Pricing and Hidden Fees

One of the primary concerns raised against Rapid Tax Filings LLC is its pricing structure. While the company initially promotes its services as affordable, clients often report unexpected and excessive fees. The pricing model is complex and lacks transparency, with additional charges popping up during the filing process.

For instance, clients have complained about being charged for services that were initially included in the advertised package. These hidden fees can significantly increase the overall cost of tax preparation, leaving clients with a bitter taste and a sense of being misled.

Moreover, the company's pricing seems to be inconsistent, with different clients reporting widely varying charges for similar services. This lack of transparency and fairness in pricing has led to numerous complaints and negative reviews.

Poor Customer Service and Communication

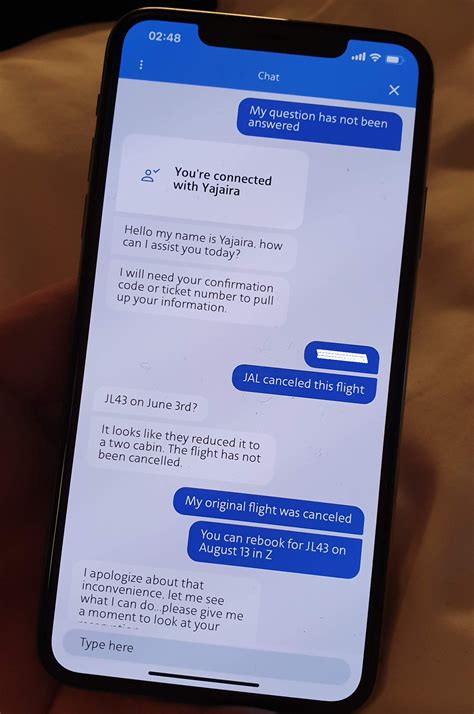

Effective communication and responsive customer service are crucial in the tax preparation industry, especially when dealing with sensitive financial information. However, Rapid Tax Filings LLC has received numerous complaints regarding its customer support.

Clients often report difficulty reaching the company's representatives, with long wait times and unanswered calls or emails. When they do manage to get through, the support staff is often unhelpful and provides vague or incorrect information. This lack of communication can lead to further complications and frustration for clients.

Additionally, there have been instances where clients have alleged that the company's representatives provide misleading or incorrect advice, potentially leading to inaccurate tax filings and potential legal issues.

Inaccurate Tax Filings and Errors

The core function of a tax preparation company is to ensure accurate and compliant tax filings. However, Rapid Tax Filings LLC has faced numerous allegations of inaccurate tax returns and errors in their filings.

Clients have reported instances where the company failed to claim eligible deductions or made mistakes in calculating tax liabilities. These errors can have significant financial implications, leading to overpayment of taxes or even legal penalties for non-compliance.

In some cases, the company's tax professionals have been accused of being inexperienced or lacking the necessary knowledge to handle complex tax situations. This lack of expertise can result in costly mistakes that impact clients' financial well-being.

Lack of Transparency and Trust

Trust is the foundation of any financial service, and Rapid Tax Filings LLC has struggled to build and maintain trust with its clients. The company's practices, including the aforementioned pricing issues and poor customer service, have eroded trust among its users.

Furthermore, there have been concerns raised about the company's data security and privacy practices. Clients have expressed worry about the safety of their sensitive financial information, especially in light of the company's lack of transparency regarding its data handling policies.

Impact and Potential Consequences

The allegations and concerns surrounding Rapid Tax Filings LLC have had far-reaching implications for individuals and businesses that have engaged its services. Understanding the potential consequences is crucial in assessing the severity of the situation.

Financial Losses and Penalties

Inaccurate tax filings and hidden fees can result in financial losses for clients. Overpayment of taxes, penalties for late filings or non-compliance, and additional charges can significantly impact an individual's or business's financial stability.

Moreover, the company's alleged lack of expertise in handling complex tax situations can lead to missed opportunities for tax savings. This means that clients may not only lose money due to errors but also miss out on potential tax benefits and deductions.

Legal and Compliance Issues

Inaccurate tax filings can have serious legal consequences. If a client's tax return contains errors or omissions, they may face audits, fines, or even criminal charges for tax evasion. The impact of such legal issues can be devastating, both financially and personally.

Additionally, the company's alleged lack of compliance with tax regulations can have broader implications. If Rapid Tax Filings LLC is found to be engaging in fraudulent practices, it could face legal action and be held liable for the consequences of its actions.

Reputation and Trust Damage

The negative reputation that Rapid Tax Filings LLC has acquired due to the allegations and concerns can have long-lasting effects. Clients who have had negative experiences are likely to share their stories, leading to a decline in the company's reputation and trustworthiness.

In an industry where trust is paramount, a damaged reputation can be detrimental. It may lead to a loss of business and a decline in the company's market share as potential clients opt for more reputable and reliable tax preparation services.

Expert Insights and Recommendations

Based on the analysis of the allegations and concerns surrounding Rapid Tax Filings LLC, industry experts offer the following insights and recommendations for individuals and businesses seeking tax preparation services.

Due Diligence and Research

It is crucial to conduct thorough research and due diligence before engaging any tax preparation company. Look for reviews and testimonials from trusted sources and pay attention to any red flags or recurring complaints.

Additionally, seek recommendations from trusted professionals or colleagues who have had positive experiences with reputable tax preparation services. Due diligence can help you avoid potential scams and ensure a smoother tax filing process.

Transparency and Clear Communication

Opt for tax preparation companies that prioritize transparency in their pricing, services, and data handling practices. Clear communication and responsive customer support are essential in ensuring a positive and stress-free experience.

Ask questions and seek clarification on any aspect of the tax preparation process. A reputable company should be willing to provide detailed information and address your concerns.

Expertise and Experience

Choose a tax preparation company with a team of experienced and knowledgeable professionals. Look for certifications and credentials that demonstrate their expertise in handling various tax situations.

Consider their track record and success stories. A company with a history of accurate and compliant tax filings is more likely to provide reliable services.

Data Security and Privacy

In today's digital age, data security is paramount. Ensure that the tax preparation company you choose has robust data security measures in place to protect your sensitive financial information.

Ask about their data handling practices and privacy policies. A reputable company should have clear guidelines and take proactive measures to safeguard your data.

Conclusion: Navigating the Tax Preparation Landscape

The allegations and concerns surrounding Rapid Tax Filings LLC serve as a stark reminder of the importance of due diligence and informed decision-making when choosing tax preparation services. While the company initially presents itself as a convenient and affordable solution, the reality may be far from ideal.

By understanding the potential risks and consequences, individuals and businesses can make more informed choices. Conducting thorough research, prioritizing transparency and expertise, and seeking recommendations from trusted sources are essential steps in ensuring a positive and secure tax filing experience.

In an industry where trust and accuracy are paramount, it is crucial to remain vigilant and choose tax preparation services that align with your financial goals and values. Remember, your financial well-being is at stake, and it is worth taking the time to find a reputable and reliable partner for your tax needs.

What are the key allegations against Rapid Tax Filings LLC?

+The key allegations against Rapid Tax Filings LLC include unfair pricing and hidden fees, poor customer service and communication, inaccurate tax filings and errors, and a lack of transparency and trust. Clients have reported being charged excessive fees, facing difficulty reaching support staff, and experiencing tax filing errors, leading to financial losses and legal consequences.

How can I avoid similar scams when choosing tax preparation services?

+To avoid scams, conduct thorough research, read reviews, and seek recommendations from trusted sources. Look for companies with transparent pricing, responsive customer support, and experienced professionals. Prioritize data security and ensure the company has robust measures to protect your financial information.

What steps should I take if I suspect a tax preparation company is engaging in fraudulent practices?

+If you suspect fraudulent practices, gather evidence and reach out to relevant authorities, such as tax regulatory bodies or consumer protection agencies. Document your experience and seek legal advice if necessary. Spreading awareness and reporting such incidents can help protect others from falling victim to similar scams.

Are there any reputable alternatives to Rapid Tax Filings LLC for tax preparation services?

+Yes, there are numerous reputable tax preparation companies and software providers in the market. Some popular alternatives include H&R Block, TurboTax, and TaxAct. It’s essential to compare their features, pricing, and user reviews to find the best fit for your tax needs.