Sales Tax In Long Beach

Welcome to Long Beach, California, a vibrant coastal city known for its diverse culture, stunning beaches, and thriving economy. As a local resident or a business owner looking to establish a presence here, it's essential to understand the intricacies of sales tax, a key component of doing business in this bustling metropolis.

Sales tax is an important revenue source for the city and state, and its proper collection and remittance are crucial for the functioning of local governments and public services. This guide will provide an in-depth exploration of sales tax in Long Beach, covering its rates, regulations, and implications for businesses and consumers alike.

Understanding Sales Tax in Long Beach

Sales tax in Long Beach, like the rest of California, is a consumption tax imposed on the sale of tangible personal property and some services. It is a percentage of the sale price that is collected from the buyer by the seller and then remitted to the state and local governments. This tax is a crucial component of the city's revenue, helping to fund vital services and infrastructure.

The sales tax system in Long Beach is a combination of state, county, and city taxes, each with its own rate. This layered structure can make the tax system complex, but understanding it is essential for businesses to comply with the law and for consumers to understand the total cost of their purchases.

Sales Tax Rates in Long Beach

The sales tax in Long Beach is made up of several components, including the state tax rate, the Los Angeles County tax rate, and the Long Beach city tax rate. As of [current year], the breakdown is as follows:

| Tax Jurisdiction | Tax Rate |

|---|---|

| California State | 7.25% |

| Los Angeles County | 1.25% |

| Long Beach City | 1.50% |

| Total Sales Tax Rate | 10.00% |

This means that when you make a purchase in Long Beach, you can expect to pay a sales tax of 10.00% on top of the purchase price. This rate is applicable to most goods and certain services, although there are exemptions and special rules for specific items and industries.

Exemptions and Special Rules

While most tangible goods are subject to sales tax in Long Beach, there are some notable exceptions. These include:

- Grocery items, including most foods for home consumption.

- Prescription and non-prescription drugs.

- Certain clothing and footwear items under a specific price threshold.

- Some services, such as legal and medical services, are generally exempt from sales tax.

It's important to note that while these items are exempt from sales tax, they may still be subject to other taxes or fees, such as a use tax or a local utility user tax.

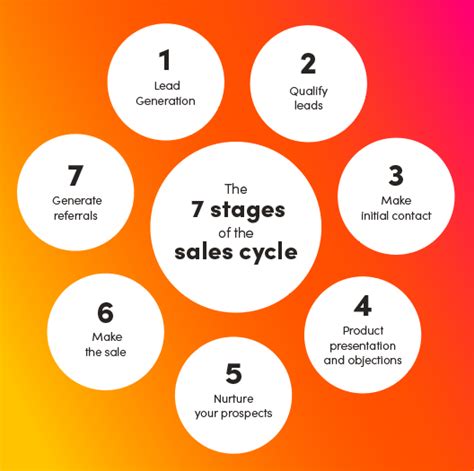

Compliance and Remittance for Businesses

For businesses operating in Long Beach, understanding and complying with sales tax regulations is a critical aspect of their financial and legal obligations. Failure to collect and remit sales tax accurately can lead to significant penalties and legal repercussions.

Registering for a Sales Tax Permit

Any business that sells taxable goods or services in Long Beach is required to register with the California Department of Tax and Fee Administration (CDTFA) and obtain a seller's permit. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments.

The application process involves providing detailed information about the business, including its legal name, physical address, and the nature of its operations. Once approved, the business will receive a unique permit number and will be required to collect sales tax on all applicable transactions.

Calculating and Collecting Sales Tax

Businesses are responsible for calculating the sales tax due on each transaction based on the total purchase price and the applicable tax rate. This can be done manually or, more commonly, through the use of point-of-sale (POS) systems that automatically calculate and display the tax due.

It's crucial for businesses to ensure they are collecting the correct amount of tax. Under-collecting can lead to a shortfall in tax revenue for the city and state, while over-collecting can result in a negative experience for customers and may require a refund.

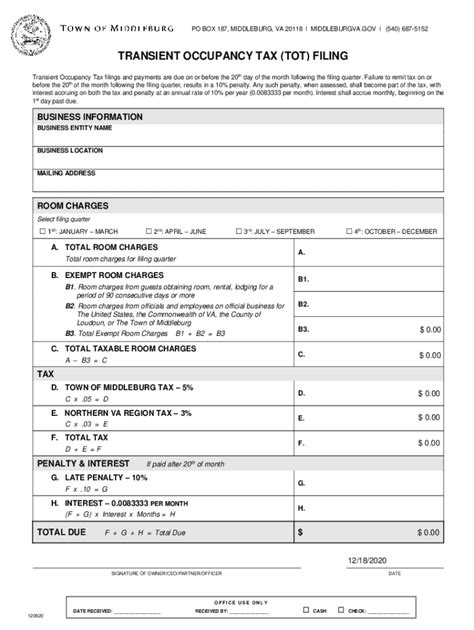

Filing and Remittance

Once the sales tax has been collected, businesses must file regular returns with the CDTFA and remit the collected tax. The frequency of these filings depends on the business's sales volume and can range from monthly to annually. Late or incorrect filings can result in penalties and interest charges.

Businesses can file their sales tax returns and make payments online through the CDTFA's website. This platform also provides resources and tools to help businesses understand and comply with sales tax regulations.

Impact on Consumers

For consumers in Long Beach, sales tax is an added cost to the price of goods and services they purchase. While it may seem like a minor inconvenience, sales tax plays a crucial role in funding the city's infrastructure, public services, and local projects.

Understanding the Total Cost

When making a purchase, consumers should be aware of the total cost, which includes the sales tax. This is especially important for larger purchases, as the tax can significantly increase the final price. Businesses are required to display the tax amount separately on receipts to ensure transparency for consumers.

Tax-Free Shopping

There are occasions when consumers can avoid paying sales tax. One such example is during the California Sales Tax Holiday, which typically occurs for a few days in July. During this period, certain items, such as clothing and school supplies, are exempt from sales tax, providing a great opportunity for consumers to save.

Additionally, some retailers may offer tax-free promotions throughout the year to boost sales. These promotions can be a great way for consumers to save, but it's important to understand the terms and conditions, as they may only apply to specific items or have spending limits.

Future Implications and Trends

The sales tax system in Long Beach, like many other jurisdictions, is subject to ongoing changes and developments. These changes can be driven by a variety of factors, including economic trends, political decisions, and technological advancements.

Potential Rate Changes

While the current sales tax rate in Long Beach is stable, there is always the possibility of rate changes in the future. These changes could be influenced by factors such as budget shortfalls, infrastructure needs, or changes in state or federal tax policies.

For instance, in response to the economic challenges posed by the COVID-19 pandemic, some cities and states have considered or implemented temporary sales tax increases to boost revenue and fund recovery efforts.

The Impact of E-Commerce

The rise of e-commerce has significantly impacted the sales tax landscape. Online retailers, especially those without a physical presence in a state, have historically been able to avoid collecting sales tax on out-of-state sales. However, recent court rulings and legislative changes have begun to address this "tax gap."

In California, the Marketplace Fairness Act was passed in 2017, requiring remote sellers to collect and remit sales tax on sales to California residents. This has had a significant impact on online retailers, especially those that previously did not collect sales tax in the state.

Simplification and Modernization Efforts

There are ongoing efforts at both the state and national levels to simplify and modernize sales tax systems. These efforts aim to reduce the complexity of the current system, especially for small businesses, and to ensure a more level playing field between online and brick-and-mortar retailers.

In Long Beach, as in many other cities, the use of technology, such as automated tax calculation software and electronic filing systems, is becoming increasingly common. These tools can help businesses comply with sales tax regulations more efficiently and accurately.

Conclusion

Sales tax in Long Beach is a complex but crucial aspect of doing business and making purchases in the city. It plays a vital role in funding public services and infrastructure, and its proper collection and remittance are essential for the city's financial health.

For businesses, understanding and complying with sales tax regulations is a key part of their financial obligations. It requires careful attention to detail and a commitment to staying up-to-date with changing tax laws and regulations. For consumers, understanding sales tax helps them make informed purchasing decisions and supports the local economy.

As Long Beach continues to evolve, its sales tax system will likely undergo further changes and adaptations. Staying informed about these changes will be crucial for both businesses and consumers to ensure they are compliant and make the most of their financial resources.

Frequently Asked Questions

What is the current sales tax rate in Long Beach, California?

+

The total sales tax rate in Long Beach, as of [current year], is 10.00%. This includes the California state tax rate of 7.25%, the Los Angeles County tax rate of 1.25%, and the Long Beach city tax rate of 1.50%.

Are there any items exempt from sales tax in Long Beach?

+

Yes, there are several categories of items that are exempt from sales tax in Long Beach. These include most grocery items, prescription and non-prescription drugs, and certain clothing and footwear items under a specific price threshold. Additionally, some services, such as legal and medical services, are generally exempt.

How often do businesses need to file and remit sales tax in Long Beach?

+

The frequency of sales tax filings and remittances depends on the business’s sales volume. It can range from monthly to annually. Businesses should refer to the guidelines provided by the California Department of Tax and Fee Administration (CDTFA) for specific filing requirements based on their sales volume.

What happens if a business fails to collect or remit sales tax correctly in Long Beach?

+

Failure to collect or remit sales tax correctly can result in significant penalties and interest charges. The CDTFA has a range of enforcement actions it can take, including audits, assessments, and even legal action. It’s crucial for businesses to understand their sales tax obligations and comply with the law to avoid these consequences.

Are there any tax-free shopping opportunities in Long Beach?

+

Yes, there are occasions when consumers can shop tax-free in Long Beach. The California Sales Tax Holiday, typically held in July, offers a tax-free period for certain items, such as clothing and school supplies. Additionally, some retailers may offer tax-free promotions throughout the year, providing savings opportunities for consumers.