Cook County Tax Sale

Welcome to an in-depth exploration of the Cook County Tax Sale, a process that has significant implications for property owners and investors in the Chicago area. This article aims to provide a comprehensive understanding of the tax sale process, its mechanics, and its potential outcomes, shedding light on a crucial aspect of real estate transactions in Cook County.

Understanding the Cook County Tax Sale

The Cook County Tax Sale is an annual event organized by the Cook County Treasurer’s Office. It is a public auction where properties with delinquent property taxes are offered for sale to the public. This unique auction process provides an opportunity for investors to acquire properties at potentially discounted prices while also helping the county recover unpaid taxes.

The tax sale is a critical mechanism for the county to ensure the timely collection of property taxes, which are essential for funding public services and infrastructure. By auctioning off properties with delinquent taxes, the county aims to enforce tax compliance and maintain a stable revenue stream.

How the Cook County Tax Sale Works

The process begins with the identification of properties that have outstanding property taxes. The Cook County Treasurer’s Office maintains a comprehensive database of these properties, which are then scheduled for auction. Properties are typically offered for sale after two years of non-payment, and the auction is open to the public, attracting a mix of seasoned investors and first-time buyers.

Prior to the auction, potential bidders are encouraged to conduct thorough research on the properties of interest. This research phase is crucial as it involves understanding the property's condition, its location, and the potential for future development or rental income. Bidders often engage in extensive due diligence, including property inspections and title searches, to ensure they are making informed decisions.

During the auction, bidders participate in a competitive bidding process, with the highest bidder winning the right to purchase the property. The winning bid price includes both the outstanding taxes and any additional fees associated with the sale. Once the auction is complete, the successful bidder is given a certificate of purchase, which serves as proof of their winning bid.

The certificate of purchase grants the bidder the right to acquire the property after a redemption period, which typically lasts for approximately two years. During this period, the original property owner has the opportunity to reclaim the property by paying off the delinquent taxes, penalties, and any other associated costs. If the property owner successfully redeems the property, the bidder's certificate is canceled, and the sale is nullified.

However, if the property owner fails to redeem the property within the specified time frame, the bidder has the right to initiate the foreclosure process and obtain full ownership of the property. This process involves additional legal steps and may require further involvement from the bidder to finalize the ownership transfer.

Key Considerations for Participants

Participating in the Cook County Tax Sale requires a strategic approach and a solid understanding of the local real estate market. Investors should consider various factors, including the potential for property appreciation, rental income prospects, and the overall demand for real estate in the area. Additionally, the condition of the property and any necessary renovations should be carefully evaluated to determine the feasibility of the investment.

Furthermore, investors should be aware of the potential risks associated with tax sales. Properties offered at these auctions may have unknown issues, such as liens or encumbrances, which could affect their value or future use. Conducting a thorough title search and seeking legal advice is crucial to mitigate these risks and ensure a successful investment.

| Year | Number of Properties Auctioned | Total Amount Collected |

|---|---|---|

| 2022 | 1,250 | $10.5 million |

| 2021 | 1,500 | $12.8 million |

| 2020 | 1,050 | $8.2 million |

Preparing for the Cook County Tax Sale

Successful participation in the Cook County Tax Sale requires meticulous preparation and research. Potential bidders should start by familiarizing themselves with the auction process and understanding the various steps involved, from the initial property listing to the final foreclosure process. This includes staying updated on the auction schedule and the specific properties available for sale.

Conducting Due Diligence

Due diligence is a critical aspect of preparing for the tax sale. Bidders should thoroughly investigate each property of interest, assessing its physical condition, the surrounding neighborhood, and any potential issues or liens associated with the property. This research phase often involves on-site visits, inspections, and thorough title searches to identify any encumbrances or outstanding debts.

Additionally, bidders should analyze the property's tax history, including the amount of delinquent taxes, penalties, and interest accrued. This information is crucial for understanding the potential costs associated with the purchase and for making informed bidding decisions. It is recommended to consult with tax professionals or real estate experts who specialize in tax sale properties to gain a comprehensive understanding of the financial implications.

Setting Realistic Investment Goals

Before participating in the Cook County Tax Sale, it is essential for investors to define their investment goals and strategies. Are they primarily interested in acquiring properties for rental income, flipping them for a quick profit, or holding them for long-term appreciation? Understanding these objectives will guide their bidding strategy and help them focus on properties that align with their investment profile.

Investors should also consider their financial capabilities and set realistic budgets. The tax sale can present opportunities for acquiring properties at discounted prices, but it is important to assess the potential costs associated with renovations, legal fees, and other post-sale expenses. By setting clear financial boundaries, investors can ensure they are making sound investment decisions and managing their financial risks effectively.

Seeking Professional Guidance

Navigating the complexities of the Cook County Tax Sale can be challenging, especially for first-time participants. Engaging the services of experienced real estate professionals, such as brokers or tax sale specialists, can provide valuable insights and support throughout the process. These professionals can offer expert advice on property valuation, market trends, and the legal aspects of tax sale transactions.

Additionally, seeking legal counsel is crucial to understand the legal implications and potential risks associated with tax sale properties. Attorneys with expertise in real estate law can review the title search results, identify any potential issues, and guide investors through the legal requirements and obligations associated with the purchase and ownership of these properties.

The Auction Process and Bidding Strategies

The Cook County Tax Sale auction is a competitive event, and bidders need to develop effective strategies to maximize their chances of success. Understanding the auction rules, bidding mechanics, and potential outcomes is essential for making informed decisions.

Understanding Auction Rules

Before participating in the auction, bidders should thoroughly review the auction rules and guidelines provided by the Cook County Treasurer’s Office. These rules outline the bidding process, payment procedures, and the conditions under which the auction will take place. Familiarity with these rules ensures a smooth and compliant bidding experience.

Bidders should pay close attention to the minimum bid requirements, which vary depending on the property and its assessed value. Understanding these requirements is crucial for determining the starting point for their bids and ensuring they meet the minimum threshold to be considered for the property.

Developing Bidding Strategies

Developing a bidding strategy involves careful consideration of several factors. Bidders should analyze the property’s potential value, taking into account its location, condition, and market demand. They should also evaluate the competition for the property and adjust their bidding approach accordingly. A strategic bidding strategy may involve starting with a conservative bid and incrementally increasing it based on the competition and their assessment of the property’s worth.

It is essential for bidders to remain disciplined and stick to their predetermined budget and investment goals. Over-bidding can lead to financial strain and may not align with the property's actual value or the investor's long-term objectives. By setting clear bidding limits and adhering to them, bidders can make informed decisions and avoid unnecessary risks.

Managing Risk in Bidding

While the Cook County Tax Sale presents attractive investment opportunities, it also carries inherent risks. Bidders should be aware of the potential for unexpected issues with the property, such as undisclosed liens or structural problems. To mitigate these risks, thorough due diligence is crucial, and bidders should consider obtaining professional inspections and conducting comprehensive title searches.

Additionally, bidders should diversify their investments by considering multiple properties rather than concentrating all their capital on a single auction. This diversification strategy helps manage risk and provides a balance between potential returns and financial exposure.

Post-Auction Procedures and Property Ownership

The Cook County Tax Sale auction is just the beginning of the process. After successfully winning a bid, bidders must navigate the post-auction procedures to finalize the property ownership transfer.

Certificate of Purchase and Redemption Period

Upon winning the auction, bidders receive a certificate of purchase, which serves as proof of their successful bid. This certificate entitles them to acquire the property after the redemption period, which is typically a two-year timeframe. During this period, the original property owner has the opportunity to reclaim the property by paying off the delinquent taxes, penalties, and any associated costs.

Bidders should monitor the redemption period closely and stay updated on any developments. If the property owner successfully redeems the property, the bidder's certificate is canceled, and the sale is nullified. However, if the redemption period expires without any action from the property owner, the bidder can initiate the foreclosure process to obtain full ownership.

Foreclosure Process and Ownership Transfer

Initiating the foreclosure process requires careful adherence to legal procedures. Bidders should consult with legal professionals who specialize in tax sale transactions to ensure they are complying with all the necessary steps. This process typically involves filing a petition for foreclosure, serving the necessary notices, and appearing in court to finalize the ownership transfer.

Throughout the foreclosure process, bidders should continue to research and understand the property's condition and any potential issues that may arise. This phase may involve further inspections, title searches, and negotiations with the property owner or other parties involved. It is crucial to manage expectations and be prepared for potential delays or complications that may arise during the transfer of ownership.

Managing the Newly Acquired Property

Once the foreclosure process is complete, and the bidder has obtained full ownership of the property, the real work begins. Depending on the property’s condition and the investor’s objectives, various management strategies may be required.

For properties intended for rental income, investors should consider tenant screening, lease agreements, and property maintenance. Regular property inspections and timely repairs are essential to ensure the property's value and provide a positive living experience for tenants. Additionally, staying compliant with local housing regulations and maintaining open communication with tenants are crucial aspects of effective property management.

If the property is intended for resale, investors should focus on enhancing its value through renovations, upgrades, or strategic marketing. Working with real estate professionals to determine the optimal timing for the sale and setting a competitive asking price can maximize the potential return on investment.

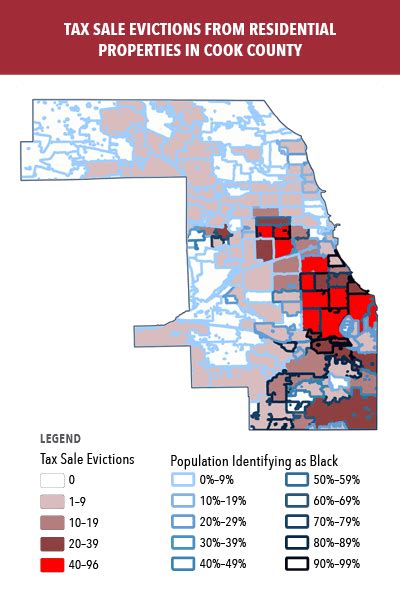

The Impact of Cook County Tax Sale on the Local Real Estate Market

The Cook County Tax Sale has a significant impact on the local real estate market, influencing both property values and investor behavior. Understanding this impact is crucial for participants and market observers alike.

Effect on Property Values

The tax sale can influence property values in several ways. Properties offered at auction may be priced below market value due to the delinquent taxes and the urgency of the sale. This presents an opportunity for investors to acquire properties at potentially discounted rates, which can drive up demand and contribute to an increase in property values over time.

However, the impact on property values is not uniform across the market. Factors such as location, property condition, and market demand play a significant role in determining the potential for value appreciation. Properties in desirable neighborhoods or those with strong rental demand may experience higher value increases compared to less desirable areas.

Investor Behavior and Market Dynamics

The Cook County Tax Sale attracts a diverse range of investors, from experienced real estate professionals to first-time buyers. The auction process can influence investor behavior, with some investors focusing on long-term value appreciation, while others prioritize short-term gains through flipping or rental income. This diversity of investment strategies contributes to the overall dynamics of the local real estate market.

Additionally, the tax sale can introduce new properties into the market, providing opportunities for both buyers and sellers. For sellers, it can serve as a last resort to dispose of properties with delinquent taxes, while for buyers, it offers a unique avenue to acquire properties at potentially attractive prices. The increased market activity during the tax sale period can lead to heightened competition and influence pricing trends.

Long-Term Implications for the Community

The Cook County Tax Sale has broader implications for the local community beyond the real estate market. By enforcing tax compliance and recovering unpaid taxes, the auction process helps maintain a stable revenue stream for the county, which is crucial for funding public services and infrastructure development.

Moreover, the tax sale can contribute to neighborhood revitalization efforts. Properties acquired through the auction process may undergo renovations or improvements, enhancing the overall aesthetic and value of the surrounding community. This can lead to increased property values, improved housing conditions, and a sense of community pride and investment.

Conclusion

The Cook County Tax Sale is a complex yet fascinating aspect of the local real estate landscape. It provides an opportunity for investors to acquire properties at potentially discounted prices while contributing to the enforcement of tax compliance and community development. Understanding the process, conducting thorough research, and developing strategic bidding strategies are essential for successful participation.

As the auction process continues to evolve, it remains a crucial mechanism for Cook County to manage delinquent taxes and maintain a healthy real estate market. By staying informed and engaged, investors can navigate the complexities of the tax sale and capitalize on the unique opportunities it presents.

FAQ

What is the Cook County Tax Sale and why is it important?

+

The Cook County Tax Sale is an annual event where properties with delinquent property taxes are auctioned off to the public. It is important as it helps the county recover unpaid taxes, enforces tax compliance, and provides opportunities for investors to acquire properties at potentially discounted prices.

How does the Cook County Tax Sale process work?

+

Properties with delinquent taxes are identified and scheduled for auction. Potential bidders conduct due diligence, including property inspections and title searches. During the auction, competitive bidding takes place, and the highest bidder wins the right to purchase the property. After the auction, there is a redemption period, and if the property owner fails to redeem, the bidder can initiate the foreclosure process to obtain ownership.

What are the key considerations for participants in the Cook County Tax Sale?

+

Participants should consider factors such as property appreciation potential, rental income prospects, and market demand. They should also be aware of the risks associated with tax sale properties, including potential liens or encumbrances. Conducting thorough due diligence, setting realistic investment goals, and seeking professional guidance are crucial for a successful investment.

How can bidders prepare for the Cook County Tax Sale?

+

Bidders should familiarize themselves with the auction process, conduct due diligence on properties of interest, analyze tax histories, and set realistic investment goals. Engaging professional services, such as real estate brokers or tax sale specialists, can provide valuable insights and support throughout the process.

What are some effective bidding strategies for the Cook County Tax Sale auction?

+

Bidders should understand auction rules, develop a bidding strategy based on property potential and competition, and remain disciplined in their bidding. Managing risk is crucial, and bidders should consider diversifying their investments and conducting thorough due diligence to mitigate potential issues with the property.

What happens after the Cook County Tax Sale auction is complete?

+

<