Do Not For Profits Pay Taxes

In the world of philanthropy and social impact, a common question arises: Do not-for-profit organizations have to pay taxes? The answer is not as straightforward as one might think, as it involves understanding the unique tax structures and regulations governing these entities. This article aims to shed light on the tax obligations of not-for-profits, offering a comprehensive guide to help readers navigate this complex topic.

Understanding the Tax Status of Not-for-Profits

Not-for-profit organizations, also known as nonprofits or charitable organizations, are entities established with the primary purpose of benefiting the public or a specific cause rather than generating profits for owners or shareholders. These organizations play a vital role in society, addressing a wide range of issues, from education and healthcare to environmental conservation and social justice.

The tax status of not-for-profits is a critical aspect of their operations, as it determines their financial obligations and the extent to which they can channel funds towards their missions. While these organizations are often associated with tax-exempt status, the reality is more nuanced. Let's delve into the various tax considerations for not-for-profits.

Tax-Exempt vs. Tax-Deductible

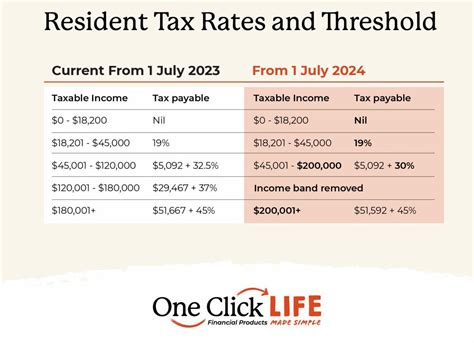

It’s essential to differentiate between tax-exempt and tax-deductible status. Tax-exempt organizations are generally exempt from paying federal income taxes on their earnings and may also be exempt from certain state and local taxes. This exemption is granted by the Internal Revenue Service (IRS) in the United States and similar tax authorities in other countries, provided the organization meets specific criteria.

On the other hand, tax-deductible refers to the donations made to these organizations. Individuals or businesses that contribute to a qualified not-for-profit can often deduct those donations from their taxable income, thus reducing their tax liability. This tax-deductibility is a powerful incentive for donors, encouraging financial support for charitable causes.

Qualifying for Tax-Exempt Status

Obtaining tax-exempt status is a critical step for not-for-profit organizations. In the United States, the IRS recognizes several types of tax-exempt organizations under Section 501© of the Internal Revenue Code. The most common categories relevant to not-for-profits include:

- 501(c)(3) Organizations: These are charitable organizations that focus on religious, educational, scientific, literary, or other specified purposes. They can receive tax-deductible donations and are often the go-to structure for foundations, charities, and advocacy groups.

- 501(c)(4) Organizations: Social welfare organizations fall under this category, allowing them to engage in political activities to a limited extent. While they can receive tax-deductible donations for certain purposes, their primary focus is on promoting social welfare rather than direct charity.

- 501(c)(6) Organizations: This category covers business leagues, chambers of commerce, real estate boards, and boards of trade. These organizations promote the common business interests of their members and can provide valuable support to local industries.

Each country has its own set of criteria and regulations for granting tax-exempt status to not-for-profits. Organizations must carefully review and comply with these requirements to maintain their tax-exempt privileges.

Tax Obligations for Not-for-Profits

While tax-exempt status offers significant advantages, it does not exempt not-for-profits from all taxes. These organizations may still have to pay various taxes, including:

- Employment Taxes: Not-for-profits are responsible for withholding and remitting payroll taxes, such as Social Security and Medicare taxes, for their employees. These taxes are essential for funding social safety nets and healthcare programs.

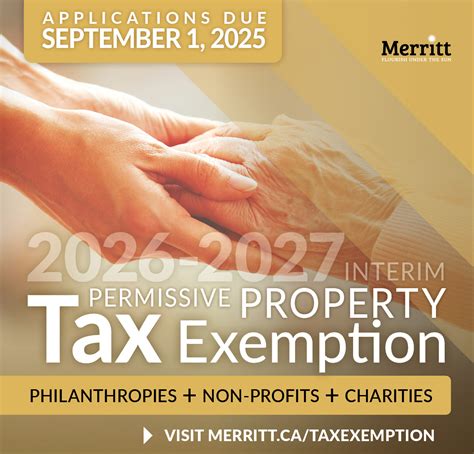

- Property Taxes: Depending on the jurisdiction and the use of the property, not-for-profits may be subject to property taxes. However, many organizations are granted tax exemptions for their owned properties, especially if they are used exclusively for charitable purposes.

- Sales and Use Taxes: Not-for-profits may be required to collect and remit sales taxes on certain goods and services they provide. However, they can often claim exemptions for purchases made for their charitable activities.

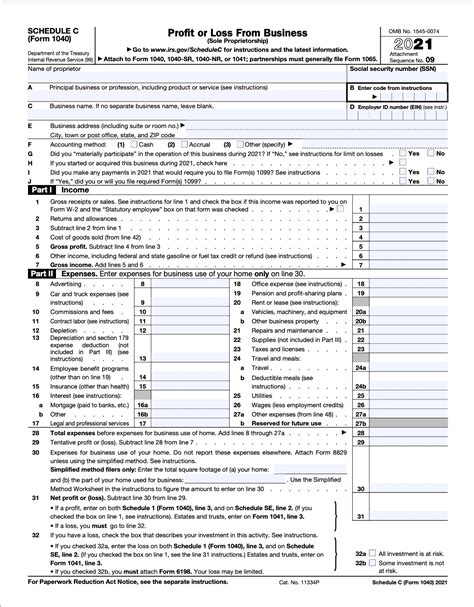

- Unrelated Business Income Tax (UBIT): This is a critical consideration for not-for-profits. UBIT applies to income generated from activities not directly related to the organization's charitable purpose. For example, if a nonprofit operates a gift shop as a fundraising endeavor, the income from that shop may be subject to UBIT.

Navigating these tax obligations requires a thorough understanding of the applicable laws and regulations, and many not-for-profits seek professional advice to ensure compliance.

Maintaining Tax-Exempt Status

Obtaining tax-exempt status is just the beginning. Not-for-profits must continuously demonstrate their compliance with the requirements to maintain their tax-exempt privileges. This includes:

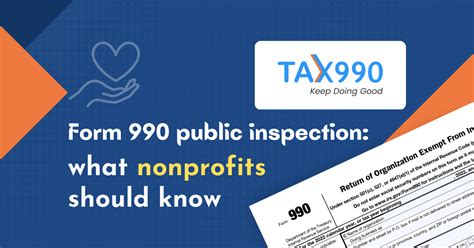

- Filing Annual Returns: Organizations must file annual information returns, such as Form 990 in the United States, to provide financial and operational transparency. These returns are publicly available, allowing stakeholders to assess the organization's activities and financial health.

- Complying with Prohibited Transactions: Not-for-profits must adhere to strict rules regarding self-dealing and prohibited transactions. Engaging in activities that benefit officers, directors, or substantial contributors can result in the loss of tax-exempt status and significant penalties.

- Public Support Test: To maintain 501(c)(3) tax-exempt status, organizations must pass the public support test. This test ensures that a significant portion of their support comes from the general public, government grants, or other qualified sources rather than from a few large donors.

Failure to comply with these requirements can lead to the revocation of tax-exempt status, which can have severe financial consequences for the organization.

The Impact of Tax Policies on Not-for-Profits

The tax landscape for not-for-profits is not static; it evolves with changes in government policies and economic conditions. Understanding these impacts is crucial for organizations to adapt their strategies and ensure long-term sustainability.

Tax Reform and Its Effects

Major tax reforms, such as the Tax Cuts and Jobs Act (TCJA) in the United States, can significantly influence the financial landscape for not-for-profits. The TCJA, for example, brought about several changes, including:

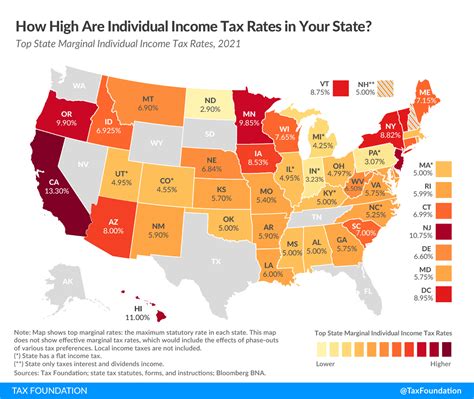

- Lower corporate tax rates, which can affect the financial contributions received by not-for-profits from businesses.

- An increased standard deduction, potentially reducing the number of taxpayers itemizing their deductions and, consequently, the pool of donors claiming tax benefits for charitable contributions.

- New limitations on deductions for state and local taxes (SALT), which may impact high-income individuals' ability to claim deductions for their charitable contributions.

These changes require not-for-profits to adapt their fundraising strategies and engage in financial planning to mitigate potential losses in revenue.

The Role of Government Grants and Funding

Government grants and funding play a significant role in supporting not-for-profit organizations. These grants can provide stable funding sources for specific projects or operational expenses. However, they also come with their own set of tax considerations.

For instance, grants may be subject to UBIT if they are used for unrelated business activities. Additionally, not-for-profits receiving government funding must comply with specific regulations, such as the Single Audit Act in the United States, which requires an annual audit for organizations that expend $750,000 or more of federal awards.

Donor Behavior and Tax Incentives

The tax deductibility of donations is a powerful tool for encouraging philanthropic contributions. However, changes in tax policies can influence donor behavior. For instance, with the increased standard deduction in the TCJA, fewer taxpayers are itemizing their deductions, which may lead to a decrease in charitable giving for some organizations.

Not-for-profits must stay abreast of these changes and adapt their fundraising approaches to appeal to a broader range of donors, including those who may not be claiming tax benefits for their contributions.

Best Practices for Not-for-Profit Tax Management

Effectively managing tax obligations is crucial for the long-term success and sustainability of not-for-profit organizations. Here are some best practices to consider:

- Seek Professional Guidance: Engaging the services of tax professionals who specialize in not-for-profit tax matters can provide invaluable support. These experts can help organizations navigate complex tax regulations, ensure compliance, and develop tax-efficient strategies.

- Maintain Transparent Financial Records: Accurate and transparent financial records are essential for not-for-profits. This transparency not only aids in tax compliance but also builds trust with donors, stakeholders, and the public.

- Regularly Review Tax Status and Compliance: Organizations should conduct periodic reviews of their tax status and compliance with applicable regulations. This includes staying updated on any changes in tax laws and consulting with tax advisors to ensure continued eligibility for tax-exempt status.

- Diversify Funding Sources: Relying solely on tax-deductible donations can be risky, especially with changes in tax policies. Not-for-profits should explore diverse funding streams, including government grants, corporate sponsorships, and individual donations, to ensure financial stability.

- Educate and Engage Donors: Not-for-profits should educate their donors about the tax benefits of charitable giving and how their contributions make a difference. This engagement can foster a sense of community and encourage long-term support.

Conclusion: Navigating the Complex World of Not-for-Profit Taxes

The tax landscape for not-for-profit organizations is intricate and ever-evolving. While tax-exempt status offers significant advantages, it also comes with a set of responsibilities and obligations. By understanding these tax considerations and implementing best practices, not-for-profits can thrive and continue their vital work in serving the public and making a positive impact on society.

As organizations navigate this complex terrain, they can rely on professional support and a commitment to transparency and compliance to ensure their long-term success and ability to make a difference.

What is the difference between a tax-exempt organization and a tax-deductible donation?

+A tax-exempt organization is exempt from paying certain taxes, such as federal income taxes, while a tax-deductible donation refers to the ability of donors to deduct their contributions from their taxable income, reducing their tax liability.

How can not-for-profits maintain their tax-exempt status?

+Not-for-profits must comply with specific requirements, such as filing annual returns, avoiding prohibited transactions, and passing the public support test, to maintain their tax-exempt status. Failure to meet these criteria can result in the loss of tax-exempt privileges.

What are the potential impacts of tax reform on not-for-profits?

+Tax reforms can influence not-for-profits by affecting donor behavior, changing tax rates, and altering the deductibility of contributions. Organizations must adapt their fundraising strategies and financial planning to navigate these changes effectively.

How can not-for-profits ensure tax compliance and transparency?

+To ensure compliance and transparency, not-for-profits should seek professional guidance, maintain accurate financial records, and regularly review their tax status and obligations. Staying informed about tax regulations and consulting experts can help organizations navigate these complexities successfully.