Is An Ein The Same As A Tax Id

The world of taxation and business identification can be a complex maze, often leaving entrepreneurs and small business owners with a myriad of questions. One common query that arises is the relationship between an EIN (Employer Identification Number) and a Tax ID. While these terms are sometimes used interchangeably, there are distinct differences and nuances that are important to understand. This article aims to unravel the mystery behind these identification numbers, providing clarity and insights for those navigating the business world.

Unraveling the EIN Enigma

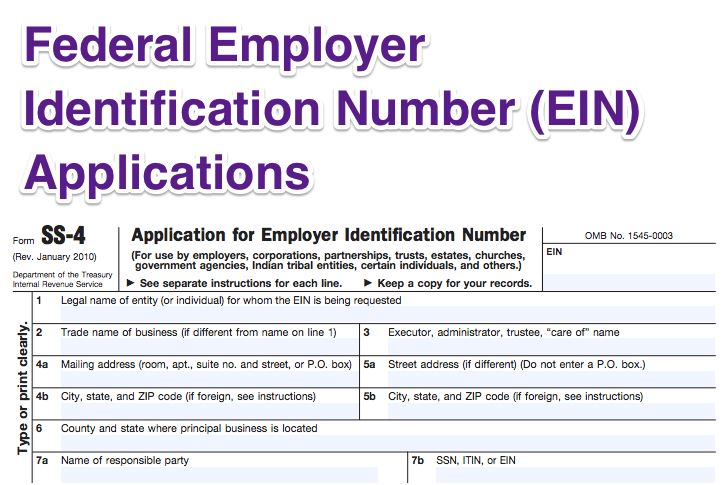

An Employer Identification Number (EIN), often referred to as a Federal Employer Identification Number, is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) in the United States. Its primary purpose is to identify a business entity for tax purposes. Every business that has employees, operates as a corporation, partnership, or limited liability company (LLC), or is otherwise involved in certain specific activities, is required to obtain an EIN.

The EIN is akin to a Social Security Number (SSN) for a business entity. It allows the IRS to keep track of a business's tax activities, such as filing tax returns, paying taxes, and reporting taxes withheld from employees' wages. It's a critical identifier that ensures the smooth functioning of the tax system for businesses.

The structure of an EIN is straightforward: it consists of two parts - the area number and the serial number. The area number identifies the IRS office that assigned the number, while the serial number is a seven-digit number that is unique to the business.

Key Functions of an EIN

- Tax Filing: An EIN is essential for filing various tax forms, including employment taxes, income taxes, and excise taxes.

- Banking and Financial Activities: Many financial institutions require an EIN for opening business bank accounts, applying for loans, or engaging in other financial transactions.

- Legal Compliance: It is a requirement for certain legal activities, such as obtaining licenses and permits, and can be used to identify the business in legal documents.

- Business Operations: An EIN can be used for various business operations, including hiring employees, establishing business credit, and registering for specific programs or services.

Understanding the Concept of a Tax ID

A Tax ID, on the other hand, is a broader term that encompasses various types of identification numbers used for tax purposes. It can refer to an EIN, but it can also include other identifiers, such as a Social Security Number (for sole proprietors) or a Taxpayer Identification Number (TIN) for individuals who don’t qualify for an SSN.

In simple terms, a Tax ID is any number that the IRS uses to track an individual's or business's tax-related activities. It serves as a key identifier for tax purposes, ensuring that tax payments, returns, and other financial transactions are properly attributed to the correct entity.

Different Types of Tax IDs

While the term “Tax ID” is often used generically, it’s important to understand the specific types of Tax IDs that exist:

- Social Security Number (SSN): This is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents. It is used for various purposes, including tax filing and employment. Sole proprietors who operate as the sole owner of their business typically use their SSN as their Tax ID.

- Individual Taxpayer Identification Number (ITIN): An ITIN is a processing number issued by the IRS to individuals who are required to have a U.S. taxpayer number but who don’t qualify for an SSN. This includes foreign nationals and their spouses and children, as well as certain non-resident aliens.

- Adoption Taxpayer Identification Number (ATIN): An ATIN is a temporary number issued to adoptive parents while they are in the process of adopting a child from another country. It is used for tax purposes until the child receives an SSN.

The Overlap: EIN and Tax ID in Practice

While an EIN is a specific type of Tax ID, the term “Tax ID” is often used more broadly to refer to any identifier used for tax purposes. This can lead to some confusion, especially for those new to the business world.

In practical terms, when someone asks for your "Tax ID," they are usually referring to your EIN if you operate as a business entity. However, if you are a sole proprietor operating as the sole owner of your business, your Tax ID would typically be your SSN.

When to Use Each Identifier

The choice of identifier depends on the specific context and requirements. Here are some general guidelines:

- EIN: Use your EIN when dealing with business-related tax matters, such as filing business tax returns, paying employment taxes, or opening a business bank account.

- SSN (for sole proprietors): If you are a sole proprietor and don’t have employees or operate as a business entity, use your SSN for tax filing and other business-related activities.

- ITIN: If you are a foreign national or a non-resident alien who needs to file taxes or engage in certain financial activities, you would use your ITIN.

Real-World Scenarios and Examples

Let’s consider a few practical scenarios to further illustrate the differences and uses of EINs and Tax IDs.

Scenario 1: Starting a New Business

You’ve decided to venture into the world of entrepreneurship and start your own business. You’ve chosen to operate as a limited liability company (LLC). In this case, you would need to obtain an EIN from the IRS. This EIN would be used for all your business tax filings, and you would provide it to banks, vendors, and other entities you engage with for business purposes.

Scenario 2: Freelancing as a Sole Proprietor

You’re a freelance writer working as a sole proprietor. In this scenario, you would use your Social Security Number (SSN) as your Tax ID. When filing your tax returns, you would report your income and expenses using your SSN. If you ever need to hire employees or convert your business into a formal entity, you would then need to obtain an EIN.

Scenario 3: International Business Operations

Imagine you’re a foreign national running a successful online business that serves clients worldwide. In this case, you might need to obtain an Individual Taxpayer Identification Number (ITIN) to comply with U.S. tax laws. Your ITIN would be your Tax ID for tax-related purposes, allowing you to file tax returns and report your business income.

The Bottom Line

In summary, while an EIN and a Tax ID are both used for tax purposes, they serve different functions and apply to different entities. An EIN is specific to business entities and is required for various tax and financial activities. On the other hand, a Tax ID is a broader term that can refer to an EIN, an SSN, or other identifiers like an ITIN, depending on the individual’s or business’s circumstances.

Understanding the distinctions between these identifiers is crucial for proper tax compliance and business operations. By using the correct identifier in the right context, you can ensure that your tax obligations are met and your business runs smoothly.

Can I use my SSN instead of an EIN for my business?

+If you are a sole proprietor operating as the sole owner of your business, you can use your Social Security Number (SSN) as your Tax ID. However, if you have employees or operate as a business entity (such as an LLC or corporation), you are required to obtain an EIN.

Do I need an EIN if I’m a freelancer with no employees?

+As a freelancer or sole proprietor with no employees, you typically use your SSN for tax purposes. However, if your business grows and you start hiring employees or convert your business into a formal entity, you would then need to obtain an EIN.

What happens if I use the wrong Tax ID for my business?

+Using the wrong Tax ID can lead to complications with tax filings and financial transactions. It’s important to use the correct identifier to ensure proper tax compliance and avoid potential penalties. If you’re unsure, consult with a tax professional for guidance.