Tax Rate For La County

Understanding the intricacies of tax systems is essential, especially when navigating the complex landscape of a county as diverse and populous as Los Angeles County. In this comprehensive guide, we will delve into the specifics of the tax rate for LA County, exploring the factors that influence it, the categories it covers, and how it impacts individuals and businesses alike.

Tax Rate Dynamics in LA County

The tax rate in Los Angeles County is a multifaceted concept, encompassing various types of taxes and varying based on specific circumstances. It is important to note that the county’s tax structure is influenced by state and federal regulations, creating a unique tax environment for its residents and businesses.

Income Tax Rates

Income taxes are a significant aspect of the tax landscape in LA County. The county operates under a progressive tax system, meaning that the tax rate increases as taxable income rises. For individuals, the tax rate ranges from 1% to 12.3% based on income brackets set by the state. These rates are applied to taxable income after deductions and credits.

Similarly, businesses in LA County are subject to income tax rates that vary depending on their legal structure and revenue. Corporations, for instance, face a franchise tax rate of 8.84%, while partnerships and LLCs are generally taxed at the individual member's income tax rate.

Sales and Use Taxes

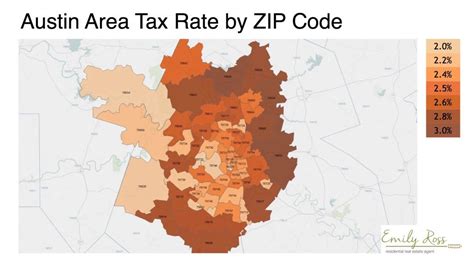

Sales and use taxes are another crucial component of LA County’s tax system. These taxes are applied to the sale of goods and services within the county and are collected by businesses, which then remit the funds to the appropriate tax authorities. The sales tax rate in LA County is currently 9.5%, which includes both state and local taxes. This rate can vary slightly depending on the specific city or district within the county.

Use taxes, on the other hand, are applied to goods or services purchased from out-of-state vendors and used within LA County. This ensures that all purchases are taxed fairly, regardless of where they originate.

| Tax Type | Rate |

|---|---|

| Sales Tax | 9.5% |

| Use Tax | 9.5% |

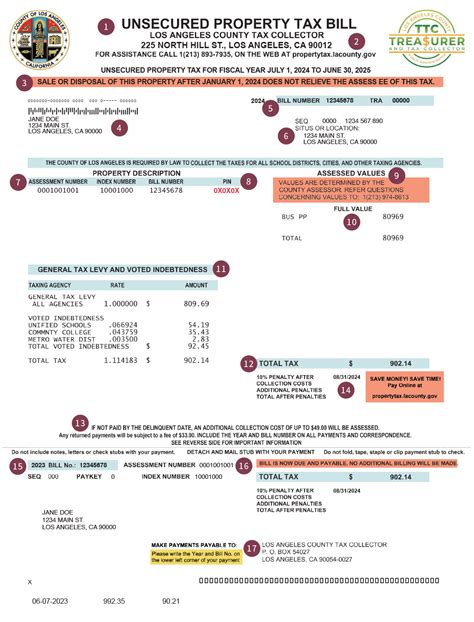

Property Taxes

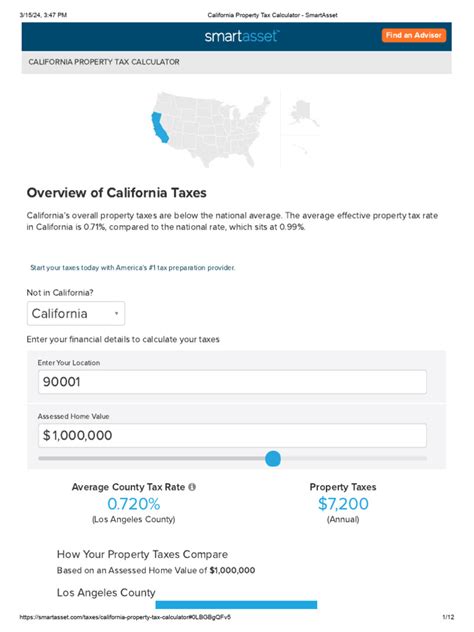

Property taxes are an essential revenue stream for LA County and are used to fund various public services and infrastructure projects. The property tax rate is typically expressed as a percentage of the assessed value of the property. The current rate in LA County is set at 1% of the assessed value, with additional taxes levied by various special districts and cities within the county.

It is worth noting that property taxes in LA County are subject to Proposition 13, a state constitutional amendment that limits the annual increase in assessed value for real property to 2% or the inflation rate, whichever is lower. This measure provides stability for property owners but also limits the county's ability to increase tax revenue through property taxes.

The Impact of Tax Rates on Residents and Businesses

The tax rates in LA County have a significant impact on both residents and businesses. For individuals, the progressive income tax structure means that higher earners pay a larger proportion of their income in taxes. This can influence financial planning and investment strategies, as well as impact the overall cost of living in the county.

Businesses, on the other hand, must consider the tax environment when making decisions about location, expansion, and operations. The sales and use tax rates, for instance, can impact pricing strategies and the overall competitiveness of a business within the county. Additionally, the property tax rate and its limitations under Proposition 13 can influence real estate decisions and investment opportunities.

Comparative Analysis

Comparing LA County’s tax rates to those of other counties and states provides valuable context. While the income tax rates in LA County are generally in line with those of other large metropolitan areas in California, the sales tax rate is higher than the state average. This disparity can influence consumer behavior and business operations, particularly for those engaged in cross-county or cross-state commerce.

Furthermore, the property tax rate in LA County, while influenced by Proposition 13, is generally lower than many other counties in California. This can make LA County an attractive location for businesses and individuals seeking more stable and predictable property tax rates.

Future Implications and Potential Changes

The tax landscape in LA County is subject to change, influenced by various factors such as economic conditions, political decisions, and demographic shifts. While the current tax rates provide a stable foundation for the county’s finances, there are ongoing discussions and proposals that could lead to modifications in the future.

One potential area of change is the sales tax rate. With the increasing popularity of e-commerce and the changing nature of consumer behavior, there are discussions about how to fairly tax online sales and ensure that all businesses, regardless of their physical location, contribute to the county's revenue. This could lead to changes in the sales tax structure or the implementation of new taxes specific to online transactions.

Additionally, the income tax rates could be subject to adjustment, particularly if the state's fiscal situation changes or if there are shifts in the political landscape. The progressive nature of the tax system means that changes in the highest tax brackets could have a significant impact on the county's revenue.

Lastly, the property tax rate, while protected by Proposition 13, is not immune to potential changes. There are ongoing debates about the fairness and effectiveness of the proposition, particularly in light of changing real estate values and the need for increased public funding. Any modifications to Proposition 13 could have a profound impact on LA County's tax revenue and the property tax rates paid by residents and businesses.

How do I calculate my income tax in LA County?

+To calculate your income tax in LA County, you need to determine your taxable income after deductions and credits. This amount is then subject to the progressive tax rates set by the state, ranging from 1% to 12.3%. It’s important to consult a tax professional or use reliable tax calculation tools to ensure accuracy.

Are there any tax incentives or credits available in LA County?

+Yes, LA County offers various tax incentives and credits to support businesses and encourage specific economic activities. These can include tax credits for hiring veterans, investing in certain industries, or engaging in energy-efficient practices. It’s advisable to consult with a tax advisor or the county’s economic development department for more information.

How often do tax rates change in LA County?

+Tax rates in LA County can change periodically, typically as a result of legislative decisions or economic factors. While some rates, like the property tax rate under Proposition 13, are relatively stable, other rates, such as sales and use taxes, can be adjusted more frequently to address revenue needs or economic changes. It’s essential to stay informed about any potential changes through official sources.