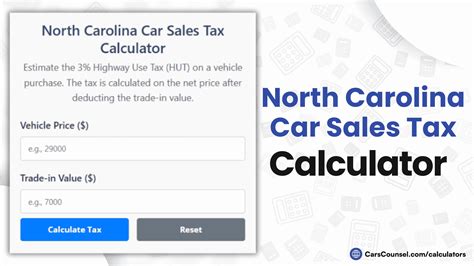

Car Sales Tax In North Carolina

In the vibrant state of North Carolina, the sales tax landscape for car purchases is an important aspect for both residents and visitors to understand. The tax structure varies across the United States, and North Carolina has its own unique system in place. Let's delve into the specifics of car sales tax in this southern state, exploring the rates, exemptions, and other crucial details.

Understanding Car Sales Tax in North Carolina

North Carolina imposes a sales and use tax on the purchase of vehicles, which includes cars, trucks, motorcycles, and certain types of recreational vehicles. This tax is a percentage of the vehicle’s purchase price and is collected by the state and local governments.

The sales tax rate in North Carolina is composed of two parts: the state sales tax and the local sales tax. The state sales tax rate is a uniform 4.75% across the state, as mandated by the North Carolina Department of Revenue. This state-level tax applies to all vehicle purchases regardless of the location within the state.

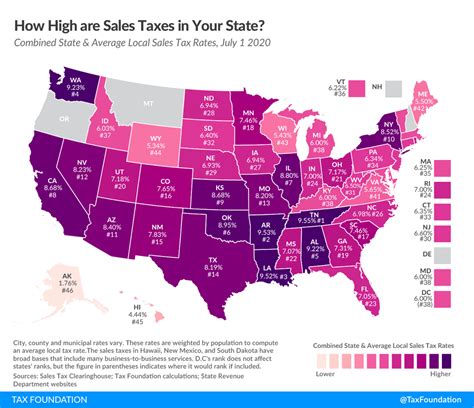

In addition to the state sales tax, there is a local sales tax component, which varies depending on the county where the vehicle is registered. Local sales tax rates in North Carolina can range from 0% to 2.5%, resulting in a combined state and local sales tax rate that varies across the state. For instance, the total sales tax rate in Mecklenburg County, which includes the city of Charlotte, is 7.25%, consisting of the state sales tax of 4.75% and a local sales tax of 2.5%.

Calculating Sales Tax for Car Purchases

To calculate the sales tax for a car purchase in North Carolina, you need to consider both the state and local tax rates. Here’s a step-by-step breakdown:

- Determine the purchase price of the vehicle, including any additional costs like dealer fees and options.

- Apply the state sales tax rate of 4.75% to the purchase price. This calculation will give you the state sales tax amount.

- Next, find out the local sales tax rate for the county where you plan to register the vehicle. You can refer to the North Carolina Department of Revenue's website for a comprehensive list of local sales tax rates by county.

- Apply the local sales tax rate to the purchase price of the vehicle. This calculation will provide you with the local sales tax amount.

- Add the state sales tax amount and the local sales tax amount together to get the total sales tax you'll need to pay for your car purchase.

For example, if you're purchasing a car with a price tag of $30,000 in Mecklenburg County, you'd calculate the sales tax as follows:

| Calculation | Amount |

|---|---|

| State Sales Tax (4.75%) | $1,425 |

| Local Sales Tax (2.5%) | $750 |

| Total Sales Tax | $2,175 |

So, for this particular car purchase in Mecklenburg County, you'd need to pay a total sales tax of $2,175 on top of the purchase price.

Exemptions and Special Cases

It’s important to note that there are certain exemptions and special cases when it comes to car sales tax in North Carolina. Here are a few scenarios to consider:

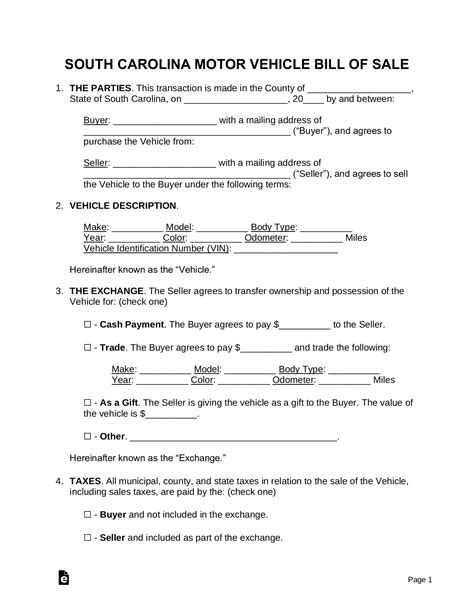

- Trade-Ins: If you're trading in your old vehicle as part of the purchase of a new one, the sales tax is calculated based on the net purchase price, which is the difference between the new vehicle's purchase price and the trade-in allowance. This ensures that you're not taxed twice on the same vehicle.

- Leased Vehicles: For leased vehicles, the sales tax is calculated on the capitalized cost reduction amount, which is the amount paid upfront at the beginning of the lease. This amount typically includes any down payment, security deposit, and any other fees.

- Military Personnel: Active-duty military personnel stationed in North Carolina may be eligible for certain tax exemptions or reductions. It's recommended that military members consult with their finance office or a tax professional to understand their specific tax obligations.

- Electric Vehicles: North Carolina offers a Clean Energy Vehicle Income Tax Credit, which provides a tax credit for the purchase of certain qualifying electric vehicles. This credit can reduce the amount of tax owed, making electric vehicles a more attractive option for environmentally conscious consumers.

Tips for Car Buyers in North Carolina

When purchasing a car in North Carolina, here are a few tips to keep in mind to ensure a smooth and informed transaction:

- Research Local Sales Tax Rates: Before finalizing your car purchase, research the local sales tax rate for the county where you'll register the vehicle. This information is readily available on the North Carolina Department of Revenue's website and will help you accurately estimate the total sales tax you'll need to pay.

- Negotiate the Price: Sales tax is calculated based on the purchase price of the vehicle, so negotiating a lower price can directly impact the amount of sales tax you'll owe. Don't be afraid to haggle and ask for discounts or incentives to reduce the overall cost of the car.

- Consider Trade-Ins: If you have a vehicle to trade in, make sure to discuss the trade-in value with the dealer. A higher trade-in value can reduce the net purchase price of your new vehicle, resulting in lower sales tax obligations.

- Explore Financing Options: Financing a car can impact the sales tax calculation. Different financing options, such as loans or leases, may have different tax implications. Understand the financing terms and how they affect your sales tax liability.

- Stay Informed on Tax Credits: Keep an eye out for tax credits or incentives offered by the state or local government. These credits can reduce the amount of tax you owe and make purchasing a new car more affordable. Check the North Carolina Department of Revenue's website for any available credits or rebates.

The Future of Car Sales Tax in North Carolina

As with any tax system, the car sales tax landscape in North Carolina is subject to change. The state and local governments may introduce new legislation, tax reforms, or incentives to encourage certain behaviors, such as the purchase of electric vehicles or hybrid cars. Staying informed about these potential changes is essential for both car dealers and consumers.

Additionally, with the rise of online car sales and the potential for cross-border purchases, there may be future discussions around how to equitably collect sales tax on these transactions. North Carolina, like many other states, will need to navigate these complexities to ensure fair taxation and compliance.

In the ever-evolving world of taxation, it's important for car buyers and sellers in North Carolina to stay updated on the latest regulations and changes to the sales tax system. By understanding the current tax rates, exemptions, and potential future developments, individuals can make more informed decisions when purchasing or selling vehicles in the state.

What is the state sales tax rate for car purchases in North Carolina?

+The state sales tax rate for car purchases in North Carolina is a uniform 4.75%.

How is the local sales tax rate determined in North Carolina?

+The local sales tax rate in North Carolina varies by county and is set by local governments. You can find the specific local sales tax rate for your county on the North Carolina Department of Revenue’s website.

Are there any tax exemptions for car purchases in North Carolina?

+Yes, there are certain exemptions and special cases, such as trade-ins, leased vehicles, military personnel, and electric vehicles, which may qualify for tax credits or reduced tax obligations. It’s recommended to consult with a tax professional for detailed information.