Tax Filing Start Date 2025

The tax season is an annual event that marks the beginning of the tax filing process for individuals and businesses across the United States. It is a crucial period for taxpayers to gather their financial records, calculate their taxable income, and determine their tax liabilities. The start date of the tax season can vary from year to year, and for the upcoming tax year 2025, there are some important dates and considerations to be aware of.

Tax Filing Start Date for 2025: A Comprehensive Guide

The Internal Revenue Service (IRS) typically announces the official start date for tax filing each year, and this date serves as a critical reference point for taxpayers. In this article, we will delve into the specifics of the 2025 tax filing start date, explore the factors influencing this date, and provide valuable insights for taxpayers to navigate the process effectively.

Understanding the 2025 Tax Filing Season

The tax filing season for the year 2025 is expected to commence on January 2, 2025, assuming no significant changes or delays in the IRS's scheduling. This date aligns with the typical start of the tax season, which usually falls in early January. However, it is essential to note that the IRS may make adjustments based on various factors, such as system updates, holidays, or unforeseen circumstances.

For taxpayers, the start date serves as a crucial reminder to begin preparing their tax documents and understanding the requirements for the upcoming filing season. It is advisable to stay informed about any official announcements from the IRS regarding the exact start date and any potential changes.

Key Dates to Note for the 2025 Tax Season

In addition to the tax filing start date, there are several other important dates that taxpayers should be aware of during the 2025 tax season:

-

Last Day to File 2024 Taxes: The deadline for filing your 2024 tax returns is April 15, 2025, unless an extension is granted. This date is crucial for taxpayers to ensure they meet their legal obligations and avoid penalties.

-

Estimated Tax Payment Deadlines: If you are a business owner or an individual with self-employment income, you may need to make estimated tax payments throughout the year. The IRS sets specific deadlines for these payments, typically in April, June, September, and January. For the 2025 tax year, these deadlines are expected to fall on April 15, 2025, June 15, 2025, September 15, 2025, and January 15, 2026.

-

Extension Deadlines: In certain circumstances, taxpayers may require additional time to file their tax returns. The IRS offers the option to request an extension, which extends the filing deadline to October 15, 2025 for the 2025 tax year. However, it is important to note that an extension only grants more time to file; it does not extend the deadline for paying any taxes owed.

By being aware of these key dates, taxpayers can plan their tax filing process accordingly and ensure they meet their obligations in a timely manner.

Preparing for the 2025 Tax Season: A Step-by-Step Guide

As the 2025 tax filing season approaches, it is beneficial to start preparing early to make the process smoother and more efficient. Here is a step-by-step guide to help you get ready:

Step 1: Gather Your Tax Documents

The first step in tax preparation is to collect all the necessary documents that will be required for filing your taxes. This includes:

- W-2 forms from your employer(s) for the previous year.

- 1099 forms if you have received any income from self-employment, investments, or other sources.

- Records of any deductions or credits you may be eligible for, such as medical expenses, charitable contributions, or education-related expenses.

- Documentation of any capital gains or losses from investments.

- Receipts and records related to business expenses (if applicable).

Organize these documents in a systematic manner to make the filing process more straightforward.

Step 2: Understand Your Tax Obligations

Familiarize yourself with the tax laws and regulations applicable to your situation. This includes understanding the tax brackets, standard deductions, and any changes or updates introduced by the IRS for the 2025 tax year. Consult reliable sources, such as the IRS website or seek advice from a tax professional, to ensure you have accurate and up-to-date information.

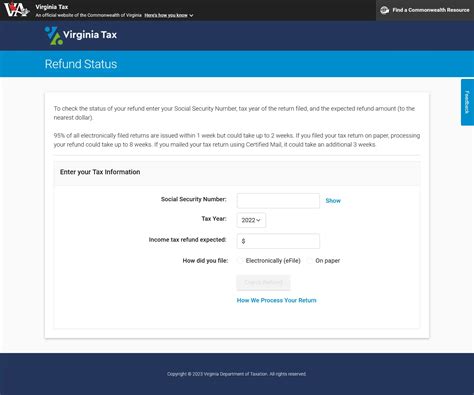

Step 3: Choose Your Filing Method

Decide whether you prefer to file your taxes manually or opt for electronic filing. The IRS encourages taxpayers to use electronic filing methods, as they are faster, more secure, and reduce the risk of errors. Consider using tax preparation software or seeking assistance from a tax professional to ensure accuracy and efficiency.

Step 4: Stay Informed and Seek Assistance

Stay updated with the latest tax news, announcements, and guidelines from the IRS. Follow reputable tax resources and consider subscribing to their newsletters to receive timely updates. If you have complex tax situations or require specialized advice, consult a tax professional who can provide personalized guidance and support.

Tips for a Successful Tax Filing Experience

To ensure a smooth and stress-free tax filing process, here are some additional tips to keep in mind:

- Start early: Begin gathering your tax documents and preparing your returns well in advance of the filing deadline. This allows for a more relaxed and thorough approach.

- Double-check your calculations: Accuracy is crucial when it comes to tax filing. Review your calculations and double-check your figures to avoid errors.

- Take advantage of tax credits and deductions: Familiarize yourself with the various tax credits and deductions you may be eligible for. These can help reduce your tax liability and maximize your refund.

- Consider professional assistance: If you are unsure about certain aspects of your tax situation or have complex financial affairs, consider seeking the expertise of a tax professional. They can provide valuable guidance and ensure compliance with tax laws.

- Stay organized: Maintain a well-organized system for your tax-related documents and records. This will make it easier to locate specific information when needed and simplify the filing process.

By following these tips and staying informed, you can navigate the 2025 tax filing season with confidence and ensure a successful outcome.

Future Implications and Potential Changes

The tax landscape is subject to ongoing changes and updates, and taxpayers should be aware of potential future implications. While it is challenging to predict specific changes, here are some factors that may influence the tax filing process in the coming years:

Tax Reform and Policy Changes

Tax policies and reforms can significantly impact the tax filing process. Governments may introduce new tax laws, modify existing ones, or make adjustments to tax rates and deductions. It is essential to stay informed about any proposed or enacted changes that may affect your tax obligations.

Technological Advancements

The IRS and tax preparation software providers are continuously improving their systems and technologies. These advancements can streamline the tax filing process, enhance security measures, and introduce new features to make filing more efficient. Keep an eye on technological developments to leverage the latest tools and resources.

Economic and Social Factors

Economic conditions, such as inflation, interest rates, and market fluctuations, can indirectly impact tax policies and filing requirements. Additionally, social and political factors may influence tax laws and the allocation of tax revenues. Staying informed about these broader economic and social trends can provide insights into potential tax-related changes.

Global Tax Standards

In an increasingly interconnected world, global tax standards and agreements can also influence domestic tax policies. The United States, along with other countries, may adopt or adapt international tax standards, which could impact the tax filing process for multinational corporations and individuals with cross-border transactions.

By staying vigilant and keeping abreast of these potential changes, taxpayers can adapt their tax planning strategies and ensure compliance with evolving tax regulations.

Conclusion

The tax filing start date for the year 2025 is an important milestone for taxpayers, marking the beginning of a critical process. By understanding the key dates, preparing early, and staying informed, individuals and businesses can navigate the tax season with confidence and efficiency. Remember to consult reliable sources, seek professional advice when needed, and stay updated on any changes or developments in the tax landscape.

When will the IRS announce the official start date for the 2025 tax season?

+The IRS typically announces the official start date for the tax season in the preceding year. It is advisable to stay tuned to official IRS communications and news outlets for the most accurate and up-to-date information.

Can I file my taxes before the official start date?

+No, the IRS does not accept tax returns before the official start date. It is important to wait until the designated start date to ensure a smooth filing process and avoid any potential errors or delays.

What should I do if I’m unable to meet the tax filing deadline?

+If you anticipate being unable to meet the tax filing deadline, it is recommended to request an extension. The IRS offers an automatic six-month extension for filing, but it is important to note that an extension only grants more time to file, not to pay any taxes owed. It is crucial to estimate your tax liability and make any necessary payments by the original deadline to avoid penalties.

How can I stay updated on tax-related news and changes?

+To stay informed about tax-related news and changes, consider subscribing to the IRS email updates and following reputable tax resources and publications. Additionally, consulting a tax professional or tax preparation service can provide valuable insights and guidance on any updates that may impact your specific tax situation.