Virginia State Tax Refund Status

Are you a resident of Virginia and eagerly awaiting your state tax refund? It's a common scenario for taxpayers, and understanding the process and status of your refund is crucial. This comprehensive guide will walk you through everything you need to know about checking the status of your Virginia state tax refund, offering expert insights and real-world examples to ensure a smooth and informed experience.

Navigating the Virginia Tax Refund Journey

The Virginia Department of Taxation plays a pivotal role in managing tax refunds for the state’s residents. Each year, millions of Virginians navigate the process of filing their taxes, with many eligible for refunds. The journey begins with the filing of tax returns, and understanding the timeline and procedures is essential for a stress-free experience.

The Filing Process: A Step-by-Step Guide

Filing your taxes in Virginia typically involves a straightforward process. You can choose between paper filing and electronic filing, with the latter being the preferred method due to its efficiency and faster processing times.

- Step 1: Gather your tax documents, including W-2 forms, 1099s, and any relevant receipts.

- Step 2: Complete the necessary tax forms, such as the Virginia Individual Income Tax Return (Form 760) and any applicable schedules.

- Step 3: Choose your filing method. Electronic filing is recommended, as it offers real-time updates and faster processing. You can use approved software providers or the Virginia eFile website.

- Step 4: Review and submit your return. Ensure all information is accurate and complete before finalizing your submission.

Understanding the Virginia Tax Refund Timeline

The Virginia Department of Taxation aims to process tax refunds within a reasonable timeframe. Generally, refunds are issued within 6-8 weeks from the date of filing. However, various factors can influence this timeline, such as the method of filing, the complexity of your return, and the accuracy of the information provided.

| Filing Method | Average Processing Time |

|---|---|

| Electronic Filing | 2-4 weeks |

| Paper Filing | 6-10 weeks |

It's important to note that these are average estimates, and actual processing times may vary. The Virginia Department of Taxation prioritizes timely refunds, but during peak tax season, delays can occur due to high volume.

Checking Your Virginia State Tax Refund Status

Now that you’ve filed your taxes, the anticipation of receiving your refund kicks in. Luckily, the Virginia Department of Taxation offers convenient methods to check the status of your refund, ensuring transparency and peace of mind.

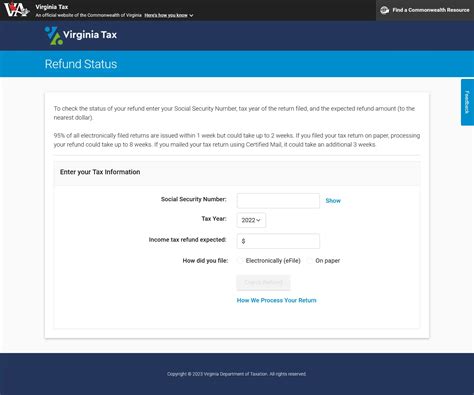

Online Refund Status Check

The most efficient way to check your Virginia state tax refund status is through the Virginia Tax Refund Status Lookup tool on the Department’s website. This tool provides real-time updates on the progress of your refund, offering clarity and convenience.

- Step 1: Visit the Virginia Tax Refund Status Lookup page.

- Step 2: Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with your refund amount and the exact refund amount in dollars and cents.

- Step 3: Click the “Submit” button to retrieve your refund status.

The tool will display one of the following messages:

- Refund Issued: Your refund has been processed and is on its way. You will receive it within a few business days.

- Processing: Your refund is still being processed. Check back later for an update.

- Error: There was an issue with the information provided. Double-check your details and try again.

Alternative Methods for Refund Status Updates

While the online tool is the quickest and most convenient method, there are alternative ways to check your Virginia state tax refund status:

- Phone Call: You can contact the Virginia Department of Taxation’s Refund Hotline at 804-367-8031 (or 866-879-8437 for toll-free calls) and provide your SSN or ITIN to retrieve your refund status.

- Email: Send an email to tax.refund.status@tax.virginia.gov with your SSN or ITIN and the exact refund amount. You will receive a response within 2-3 business days.

Common Issues and Troubleshooting

Despite the efficiency of the Virginia tax refund system, certain issues may arise. Here are some common problems and solutions to ensure a smooth refund process:

Delays in Refund Processing

While delays are rare, they can occur due to various reasons. If your refund is taking longer than expected, consider the following:

- Check for errors in your tax return. Inaccurate information or missing details can lead to processing delays.

- If you recently moved, ensure your address is updated with the Virginia Department of Taxation to avoid mail-related issues.

- For complex returns or those with potential audit flags, additional time may be required for review.

Error Messages During Status Check

If you encounter an error message while checking your refund status online, it’s essential to address it promptly:

- Double-check the information you entered, ensuring accuracy and consistency.

- If the issue persists, contact the Department of Taxation for assistance. They can guide you through resolving the error.

Maximizing Your Virginia Tax Refund

Understanding the factors that influence your tax refund is crucial for maximizing your return. Here are some strategies to consider:

Filing Early

Filing your taxes early in the season offers several advantages. Not only do you receive your refund sooner, but you also benefit from reduced wait times and a lower risk of errors or delays.

Claiming All Eligible Deductions and Credits

Ensure you’re taking advantage of all the deductions and credits you’re entitled to. Common deductions include mortgage interest, medical expenses, and charitable contributions. Additionally, Virginia offers various state-specific credits, such as the Virginia Earned Income Tax Credit and the Virginia Property Tax Credit.

Direct Deposit for Faster Refunds

Opting for direct deposit when filing your taxes can significantly speed up the refund process. The Virginia Department of Taxation offers this option, ensuring your refund is deposited directly into your bank account within a matter of days.

Future of Virginia Tax Refunds

The Virginia Department of Taxation continues to innovate and improve its refund processes. With advancements in technology, taxpayers can expect even faster and more efficient refund journeys in the future. Here’s a glimpse at what’s on the horizon:

Enhanced Online Services

The Department is investing in upgrading its online platforms, making it easier and more intuitive to file taxes and check refund status. Expect a user-friendly interface and real-time updates, ensuring a seamless experience.

Expanded Payment Options

In addition to direct deposit, the Department is exploring alternative payment methods, such as mobile wallets and cryptocurrency, to offer taxpayers more flexibility and convenience.

Integration of AI and Machine Learning

Artificial intelligence and machine learning technologies are being leveraged to enhance refund processing. These tools can automate routine tasks, identify errors, and speed up the overall process, ensuring taxpayers receive their refunds promptly.

How long does it typically take to receive a Virginia state tax refund after filing electronically?

+On average, it takes 2-4 weeks to receive a Virginia state tax refund after filing electronically. However, this timeline can vary based on factors like the accuracy of your return and the time of year you file.

What should I do if I haven’t received my refund within the expected timeframe?

+If you haven’t received your refund within the expected timeframe, first check the status of your refund using the online lookup tool. If it indicates a delay or error, contact the Virginia Department of Taxation for further assistance. They can guide you through resolving any issues.

Can I check my refund status if I filed a joint return with my spouse?

+Yes, you can check the status of a joint refund using the online lookup tool. Simply enter the SSN or ITIN of one spouse and the exact refund amount to retrieve the status. The Department treats joint refunds as a single entity, so one spouse’s information is sufficient.