Tax Accountant Salary

In the realm of financial management, the role of a tax accountant is pivotal, impacting not only individuals but also businesses and the broader economy. The salary expectations of tax accountants are influenced by various factors, including their expertise, the industry they serve, and their geographical location. This article aims to delve into the intricacies of tax accountant salaries, providing an in-depth analysis of the factors that influence them and offering a comprehensive understanding of this crucial profession.

The Scope of Tax Accounting

Tax accounting is a specialized field within the broader domain of financial accounting. Tax accountants are responsible for ensuring that their clients comply with tax laws and regulations. They provide expertise in tax planning, preparation of tax returns, and representation in tax audits or disputes. The complexity of tax laws and the ever-changing nature of tax policies make tax accounting a challenging and dynamic field.

The demand for tax accountants is driven by both individuals and businesses. For individuals, tax accountants help minimize tax liabilities, optimize deductions, and ensure compliance with personal tax obligations. Businesses, on the other hand, rely on tax accountants to navigate complex corporate tax structures, manage international tax obligations, and implement tax-efficient strategies for business operations.

Factors Influencing Tax Accountant Salaries

The salary of a tax accountant can vary significantly based on several key factors. Understanding these factors provides insight into the earning potential and career prospects within this field.

Education and Experience

The level of education and experience are fundamental determinants of a tax accountant’s salary. A Bachelor’s degree in accounting, finance, or a related field is the minimum educational requirement. However, many tax accountants pursue advanced degrees, such as a Master’s in Taxation or a CPA (Certified Public Accountant) certification, which can significantly enhance their earning potential.

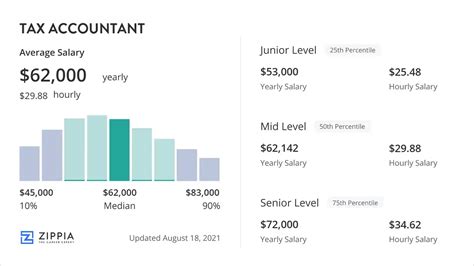

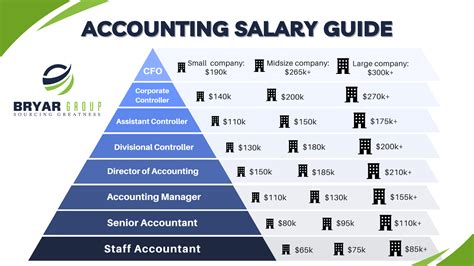

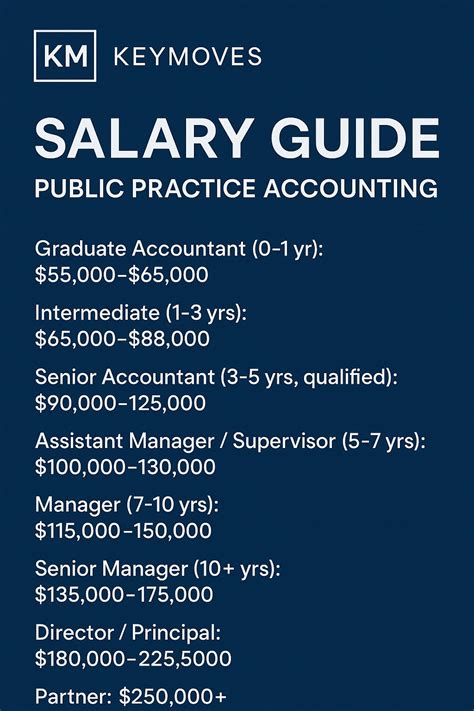

Experience plays a crucial role in salary determination. Entry-level tax accountants, fresh out of college, can expect to earn a starting salary of around $45,000 to $60,000 annually. However, as they gain experience and expertise, their earning potential increases. Senior tax accountants with several years of experience can command salaries in the range of $80,000 to $120,000, while highly experienced partners or directors in tax accounting firms may earn well over $200,000 per year.

| Experience Level | Salary Range |

|---|---|

| Entry-Level | $45,000 - $60,000 |

| Mid-Career | $65,000 - $100,000 |

| Senior Level | $80,000 - $120,000 |

| Partner/Director | $200,000+ per year |

Industry and Sector

The industry and sector in which a tax accountant works can significantly impact their salary. Tax accountants working in the public sector, such as government agencies or non-profit organizations, often have stable salaries and benefits but may not earn as much as their counterparts in the private sector. In contrast, tax accountants working for large corporations or accounting firms can expect higher salaries, especially if they specialize in complex tax matters or work with international clients.

Geographical Location

Geographical location is a critical factor in determining tax accountant salaries. The cost of living and the demand for tax accounting services vary across different regions. Tax accountants working in major metropolitan areas or financial hubs tend to earn higher salaries due to the higher cost of living and the increased demand for their expertise. Conversely, those in smaller towns or rural areas may have lower salaries but also enjoy a lower cost of living.

| Location | Average Salary |

|---|---|

| New York City, NY | $85,000 - $120,000 |

| Los Angeles, CA | $78,000 - $110,000 |

| Chicago, IL | $70,000 - $95,000 |

| Houston, TX | $65,000 - $90,000 |

| Miami, FL | $60,000 - $85,000 |

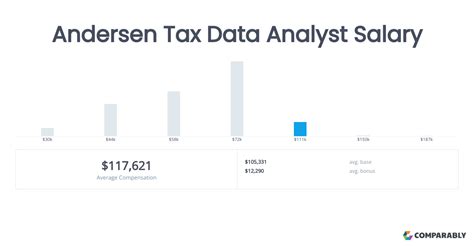

Specialization and Expertise

Specialization in tax accounting can lead to higher earning potential. Tax accountants who develop expertise in specific areas, such as international tax, estate planning, or corporate tax restructuring, can command premium salaries. These specialists are in high demand due to their unique skills and knowledge, which are essential for navigating complex tax scenarios.

Firm Size and Structure

The size and structure of the accounting firm or organization also influence tax accountant salaries. Large, multinational accounting firms often offer higher salaries and more extensive benefits packages, as they can afford to invest in talent and provide competitive compensation. However, smaller firms or boutique tax practices may offer a more personalized work environment and the opportunity to take on more diverse responsibilities, which can be appealing to certain professionals.

Career Progression and Opportunities

The tax accounting field offers a range of career progression opportunities. Entry-level tax accountants can expect to gain experience and develop their skills through on-the-job training and mentorship. As they advance, they may take on more complex projects and client engagements, leading to increased responsibility and higher salaries.

For those interested in specialization, the tax accounting field offers numerous avenues. Tax accountants can focus on specific industries, such as healthcare, real estate, or technology, or they can develop expertise in international tax, transfer pricing, or tax litigation. These specializations often lead to higher-level positions and increased earning potential.

Additionally, tax accountants can explore career paths beyond traditional accounting firms. They may find opportunities in tax consulting firms, government agencies, or even start their own tax advisory practices. The versatility of the tax accounting field allows professionals to tailor their careers to their interests and aspirations.

Challenges and Rewards in Tax Accounting

The tax accounting profession is not without its challenges. Tax laws are complex and ever-evolving, requiring tax accountants to stay abreast of the latest regulations and updates. The pressure to meet deadlines, especially during tax seasons, can be intense. Additionally, tax accountants must maintain a high level of ethical standards and integrity, as they handle sensitive financial information and represent their clients’ interests.

However, the rewards of a career in tax accounting are significant. Tax accountants play a crucial role in helping individuals and businesses navigate the complexities of tax laws, minimize their tax liabilities, and make informed financial decisions. The satisfaction of providing valuable tax advice and ensuring compliance with the law is a rewarding aspect of the profession.

Furthermore, tax accountants have the opportunity to develop strong relationships with their clients, offering personalized tax planning and strategic advice. This level of trust and collaboration can lead to long-term client relationships and a sense of professional fulfillment.

How does the demand for tax accountants fluctuate throughout the year?

+The demand for tax accountants typically peaks during tax seasons, which vary depending on the type of tax return. For instance, the demand for individual tax return preparation is highest in the first quarter of the year, while corporate tax returns often have later deadlines, leading to increased demand in the second quarter. During these peak periods, tax accountants may work longer hours and have more opportunities for overtime pay.

Are there opportunities for remote work in tax accounting?

+Yes, the COVID-19 pandemic has accelerated the trend of remote work in the accounting industry, including tax accounting. Many accounting firms now offer remote work options, allowing tax accountants to work from home or flexible locations. This flexibility can enhance work-life balance and attract professionals who value remote work opportunities.

What are the prospects for career growth in tax accounting?

+Tax accounting offers excellent prospects for career growth. With experience and expertise, tax accountants can advance to senior positions, become partners in accounting firms, or even start their own practices. Additionally, the demand for specialized tax services is increasing, providing opportunities for tax accountants to niche their skills and command higher salaries.