Arkansas Income Tax Rate

Arkansas, a state known for its natural beauty and diverse economy, has a unique approach to taxation. The Arkansas income tax system is an essential component of the state's fiscal landscape, impacting residents and businesses alike. This article delves into the intricacies of the Arkansas income tax rate, exploring its structure, variations, and implications for taxpayers.

Understanding the Arkansas Income Tax Structure

Arkansas operates a progressive income tax system, which means that as income levels increase, so do the tax rates. This progressive nature ensures that individuals with higher earnings contribute a larger proportion of their income to the state’s revenue. The Arkansas Department of Finance and Administration (DFA) is responsible for administering and enforcing the state’s tax laws, including income tax.

The state's income tax rates are divided into brackets, with each bracket corresponding to a specific range of taxable income. As of the 2023 tax year, Arkansas has five income tax brackets, each with its own tax rate. These brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| 0 - $2,000 | 1.0% |

| $2,001 - $3,500 | 2.0% |

| $3,501 - $4,750 | 3.0% |

| $4,751 - $7,500 | 4.0% |

| Above $7,500 | 6.0% |

These rates apply to both single and joint filers, ensuring a fair and balanced taxation system. It's worth noting that Arkansas, like many other states, also offers various deductions and credits that can reduce the taxable income and, consequently, the tax liability.

Deductions and Credits in Arkansas

Arkansas provides a range of deductions and credits to help alleviate the tax burden on individuals and families. Some of the notable deductions and credits include:

- Standard Deduction: All Arkansas taxpayers are entitled to a standard deduction, which reduces their taxable income. The standard deduction varies based on filing status, with higher deductions for joint filers and heads of households.

- Personal Exemptions: Arkansas allows personal exemptions for the taxpayer, spouse, and each dependent. These exemptions further reduce taxable income.

- Dependent Care Credit: Taxpayers who incur expenses for child or dependent care may be eligible for a credit, which can help offset some of these costs.

- Property Tax Credit: Arkansas residents can claim a credit for a portion of their property taxes paid during the tax year, providing relief for homeowners.

These deductions and credits can significantly impact an individual's tax liability, making it essential for taxpayers to understand and utilize these benefits effectively.

Taxation for Businesses in Arkansas

Arkansas’s taxation system not only affects individuals but also businesses operating within the state. The state imposes a corporate income tax on C corporations, limited liability companies (LLCs), and other business entities. The tax rate for these entities is 6%, which is applied to the taxable income generated within Arkansas.

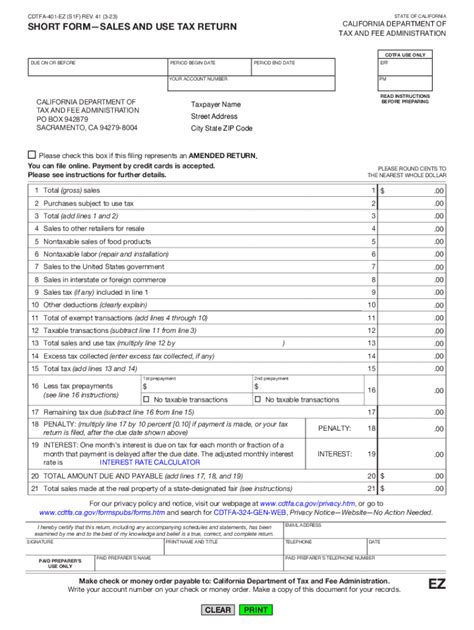

In addition to the corporate income tax, businesses in Arkansas are also subject to various other taxes, including sales and use tax, franchise tax, and property tax. These taxes contribute to the state's revenue and fund essential services and infrastructure development.

Sales and Use Tax in Arkansas

Arkansas has a robust sales and use tax system, which is an important source of revenue for the state. The sales tax rate in Arkansas is 6.5%, with additional local taxes that can bring the total rate to as high as 11.5%. This sales tax applies to the sale of tangible personal property and certain services within the state.

Businesses operating in Arkansas are responsible for collecting and remitting sales tax to the Arkansas DFA. Failure to comply with sales tax regulations can result in penalties and interest, underscoring the importance of accurate record-keeping and timely tax filings.

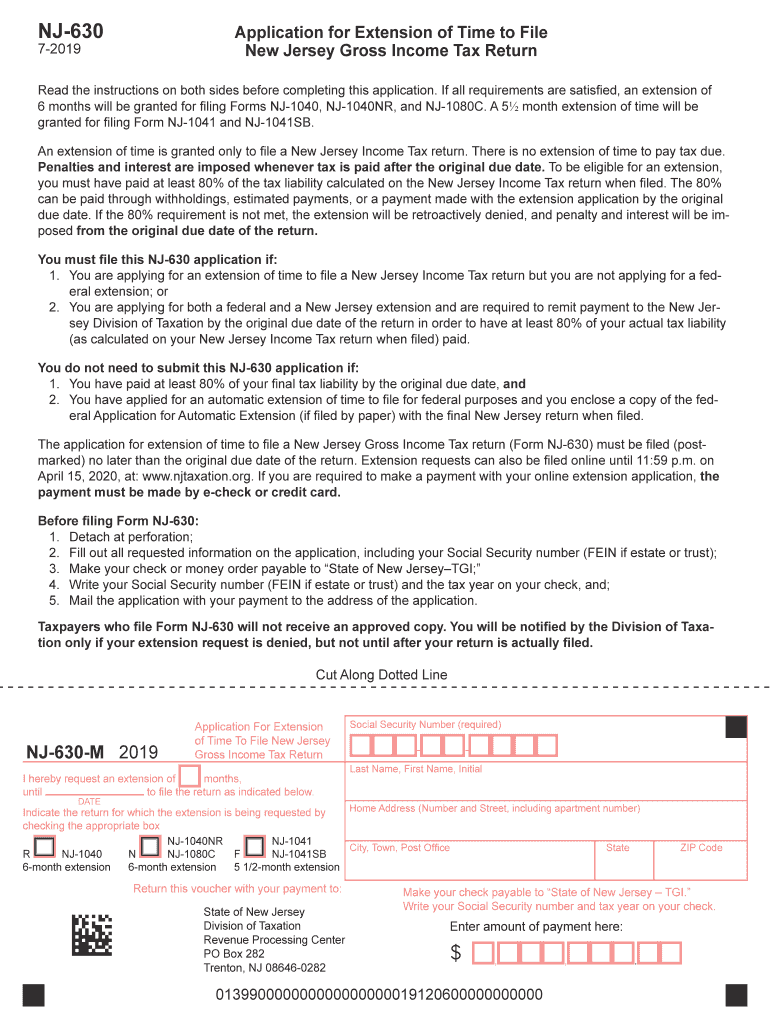

Filing and Payment Options

Arkansas offers a variety of methods for taxpayers to file their income tax returns and make payments. The state provides both electronic and paper filing options, catering to the preferences and needs of different taxpayers.

For electronic filing, Arkansas residents can use the state's online tax system, which is secure and efficient. This system allows taxpayers to file their returns, make payments, and track the status of their refunds or payments. Additionally, taxpayers can opt for direct deposit, ensuring a faster and more secure refund process.

Paper filing is also an option, with taxpayers able to download and print tax forms from the DFA website. These forms can be completed and mailed to the DFA along with any necessary payments. It's crucial for taxpayers to ensure they meet the filing deadlines to avoid late fees and penalties.

Tax Relief and Assistance Programs

Arkansas recognizes that some taxpayers may face financial difficulties or require additional support when it comes to meeting their tax obligations. As such, the state offers a range of tax relief and assistance programs to help ease the burden.

- Payment Plans: Taxpayers who are unable to pay their tax liability in full can request a payment plan. This allows them to make regular payments over a specified period, reducing the financial strain.

- Tax Amnesty Programs: From time to time, Arkansas may offer tax amnesty programs, which provide a window for taxpayers to settle their outstanding tax debts without penalties or interest.

- Low-Income Taxpayer Clinics: These clinics provide free representation and assistance to low-income taxpayers who are facing disputes with the IRS or state tax authorities.

These programs demonstrate Arkansas's commitment to supporting taxpayers and ensuring a fair and equitable tax system.

Future Outlook and Tax Reform

As with any tax system, Arkansas’s income tax rates and structure are subject to potential changes and reforms. The state’s legislature and tax authorities regularly review and adjust tax laws to ensure they remain competitive, fair, and in line with the state’s economic goals.

In recent years, there have been discussions and proposals for tax reform in Arkansas, with a focus on simplifying the tax code, reducing rates, and providing additional tax relief to individuals and businesses. These reforms aim to boost economic growth, attract investment, and improve the overall business climate.

Staying informed about these potential changes is crucial for taxpayers and businesses to ensure they can plan their financial strategies effectively and make the most of any new tax incentives or deductions.

The Impact of Tax Policy on Arkansas’s Economy

Arkansas’s tax policy plays a pivotal role in shaping the state’s economic landscape. The state’s progressive income tax system, combined with its business-friendly environment, has contributed to economic growth and development.

A stable and competitive tax structure attracts businesses and investors, leading to job creation and increased economic activity. Additionally, the availability of tax incentives and credits can encourage businesses to locate or expand their operations within Arkansas, further boosting the state's economy.

However, it's essential to strike a balance between revenue generation and tax competitiveness to ensure Arkansas remains an attractive destination for businesses and individuals alike. This delicate balance is a key consideration for policymakers when crafting and amending tax laws.

Conclusion

The Arkansas income tax rate is a crucial aspect of the state’s fiscal framework, impacting individuals, families, and businesses. The progressive tax system, coupled with a range of deductions and credits, ensures a fair and equitable taxation process. Understanding these tax rates and structures is essential for taxpayers to plan their finances effectively and make the most of the available benefits.

Arkansas's commitment to tax reform and its efforts to create a business-friendly environment position the state for continued economic growth and development. As taxpayers, it's our responsibility to stay informed, comply with tax laws, and contribute to the state's prosperity.

What is the deadline for filing Arkansas income tax returns?

+

The deadline for filing Arkansas income tax returns is typically April 15th of each year. However, if this date falls on a weekend or a state holiday, the deadline is extended to the next business day.

Are there any special tax rates for certain industries in Arkansas?

+

Arkansas does not have special tax rates for specific industries. The state’s income tax rates apply uniformly to all taxpayers, regardless of their industry or profession.

Can I e-file my Arkansas income tax return if I don’t have access to a computer or the internet?

+

Yes, you can e-file your Arkansas income tax return even if you don’t have access to a computer or the internet. You can visit a local tax preparation office or a public library that offers computer and internet access to complete and submit your return electronically.

What happens if I miss the deadline to file my Arkansas income tax return?

+

If you miss the deadline to file your Arkansas income tax return, you may be subject to penalties and interest. It’s important to file as soon as possible to minimize these additional costs and avoid further complications.

Are there any tax incentives or credits available for renewable energy projects in Arkansas?

+

Yes, Arkansas offers tax incentives and credits for renewable energy projects. These incentives aim to promote the development and adoption of renewable energy sources, such as solar and wind power. Businesses and individuals can take advantage of these credits to reduce their tax liability.