Real Estate Tax Vs Property Tax

The concepts of real estate tax and property tax are often used interchangeably, but they have distinct meanings and implications within the realm of property ownership and taxation. This article aims to clarify the differences between these two terms, shedding light on their definitions, applications, and the impact they have on homeowners and investors alike.

Understanding Real Estate Tax

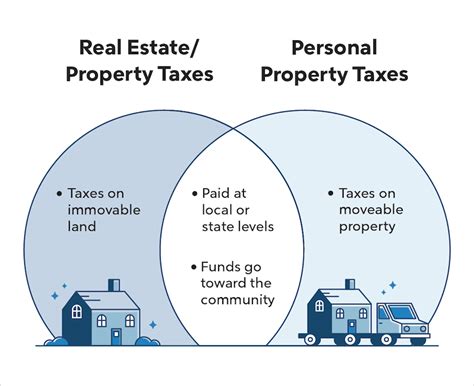

Real estate tax, a broader term, encompasses a range of taxes levied on various aspects of real property ownership. It serves as an umbrella term for different types of taxes that homeowners and real estate investors encounter. These taxes are integral to the real estate industry and play a significant role in the economy, influencing investment decisions and the overall market dynamics.

Key Components of Real Estate Tax

Real estate tax comprises several components, each serving a specific purpose:

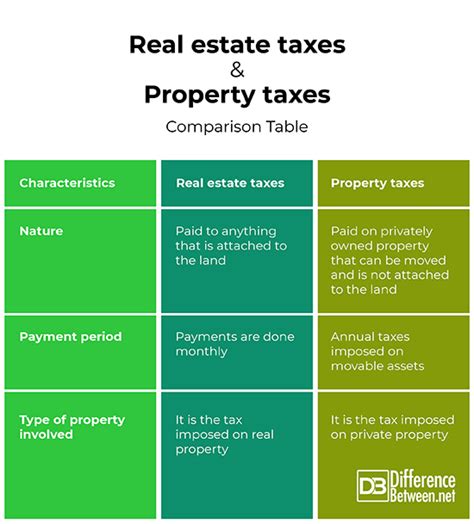

- Property Tax: The cornerstone of real estate taxation, property tax is assessed on the value of a property, including both land and improvements (buildings, structures, etc.). It is a recurring tax, typically levied annually, and is a significant source of revenue for local governments.

- Transfer Taxes: These taxes are incurred when ownership of a property changes hands. They are applied to the sale or transfer of real estate and can vary depending on the jurisdiction and the type of property being transferred.

- Mortgage Taxes: Some jurisdictions impose taxes on mortgage loans, adding an additional cost for homeowners or investors who finance their property purchases. These taxes can impact the overall cost of homeownership.

- Special Assessments: Special assessments are levied for specific improvements or services that benefit a particular property or neighborhood. These could include infrastructure projects, local amenities, or maintenance of common areas.

- Income Taxes: For real estate investors, income generated from rental properties or the sale of real estate is subject to income taxes. This includes capital gains taxes and taxes on rental income.

Real Estate Tax in Practice

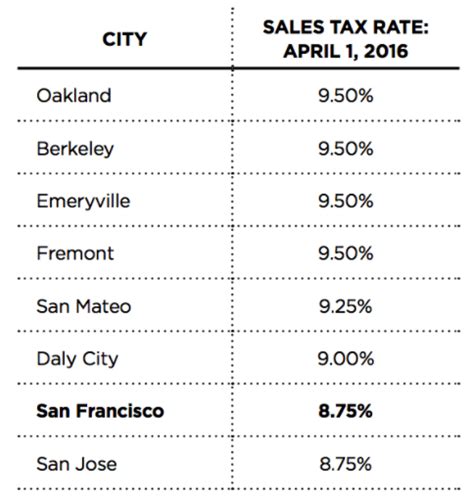

The application of real estate tax varies widely across jurisdictions. In some regions, property taxes are a primary source of revenue for local governments, funding essential services like education, public safety, and infrastructure maintenance. Transfer taxes, on the other hand, can be used to regulate property market activity and discourage frequent property turnover.

For real estate investors, understanding the tax landscape is crucial. The various components of real estate tax can significantly impact the profitability of investment properties. Strategies such as depreciation, tax deductions for improvements, and timing of property sales can be employed to optimize tax liabilities.

| Real Estate Tax Component | Description |

|---|---|

| Property Tax | Annual tax based on property value |

| Transfer Taxes | Taxes on property sales or transfers |

| Mortgage Taxes | Taxes on mortgage loans |

| Special Assessments | Charges for specific property improvements |

| Income Taxes | Taxes on rental income and capital gains |

The Focus: Property Tax

Property tax, as mentioned earlier, is a specific type of tax within the broader real estate tax category. It is a mandatory assessment on the value of a property, serving as a primary source of revenue for local governments.

How Property Tax Works

Property tax assessments are typically conducted by local government agencies, often referred to as assessors or tax assessors. These professionals are responsible for determining the value of a property, taking into account factors such as:

- Market Value: The current market price of similar properties in the area.

- Improvements: Any additions or upgrades made to the property, such as renovations or new constructions.

- Land Value: The value of the land itself, independent of any structures on it.

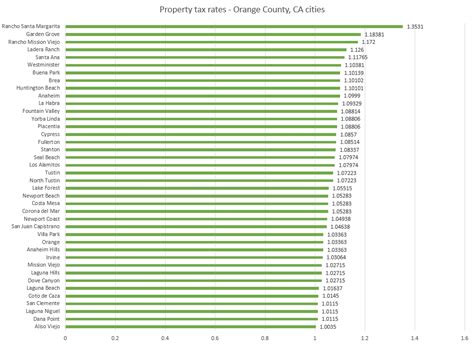

Once the property's value is assessed, a tax rate is applied. This rate, set by local governments, represents the percentage of the property's value that the owner must pay in taxes. The tax rate can vary widely depending on the jurisdiction and the specific purpose of the tax.

Property Tax Calculation

The formula for calculating property tax is straightforward:

Property Tax = Assessed Value x Tax Rate

For example, if a property is assessed at $500,000 and the tax rate is 1.5%, the annual property tax would be $7,500.

Impact on Homeowners

Property tax is a significant expense for homeowners. It is typically paid annually and is often included in the monthly mortgage payment through an escrow account. This ensures that homeowners have sufficient funds to cover their tax obligations when they become due.

For those purchasing a home, understanding the property tax liability is crucial. It can significantly impact the overall cost of homeownership and should be considered when budgeting for a new property. Additionally, property taxes can fluctuate over time due to changes in property value or tax rates, affecting the homeowner's financial planning.

Challenging Property Tax Assessments

Homeowners have the right to dispute their property tax assessments if they believe the value assigned to their property is inaccurate. This process, known as a tax appeal, allows homeowners to present evidence and argue for a lower assessed value. Successful appeals can result in reduced property taxes, providing financial relief to homeowners.

| Property Tax | Assessed Value | Tax Rate | Annual Tax |

|---|---|---|---|

| Residential Property | $400,000 | 1.2% | $4,800 |

| Commercial Building | $1,200,000 | 1.8% | $21,600 |

| Vacant Land | $80,000 | 1.0% | $800 |

Conclusion

In the realm of real estate and property ownership, taxes play a crucial role. While real estate tax encompasses a broad range of levies, property tax is a specific assessment based on a property’s value. Understanding the differences and implications of these taxes is essential for homeowners, investors, and anyone involved in the real estate market. By grasping the nuances of real estate taxation, individuals can make informed decisions and effectively manage their financial obligations related to property ownership.

How often are property taxes assessed and paid?

+Property taxes are typically assessed annually, and the assessment is based on the property’s value as of a specific date, often referred to as the “assessment date.” The assessed value is then used to calculate the tax amount for the following year. Payment schedules vary, but many jurisdictions require property taxes to be paid in installments, with due dates throughout the year.

Can property taxes be deducted on tax returns?

+Yes, in many countries, including the United States, property taxes are often deductible on personal income tax returns. This means that the amount paid in property taxes can be used to reduce the taxpayer’s taxable income, potentially resulting in a lower tax liability. However, the deductibility of property taxes may be subject to certain limitations and conditions, so it’s important to consult with a tax professional for specific guidance.

What happens if property taxes are not paid on time?

+Failure to pay property taxes on time can have serious consequences. Late payments often incur penalties and interest, increasing the overall amount owed. In some cases, if taxes remain unpaid for an extended period, the local government may place a lien on the property, which can affect the owner’s ability to sell or refinance. In extreme cases, the property could be subject to tax foreclosure, resulting in the loss of ownership.