Orange County Tax Percent

In Orange County, California, taxes play a significant role in funding essential services and infrastructure, making the tax rates a topic of interest for both residents and businesses alike. The tax structure in Orange County is comprehensive and includes various taxes, such as property taxes, sales taxes, and business taxes, among others. Understanding these tax percentages is crucial for financial planning and making informed decisions.

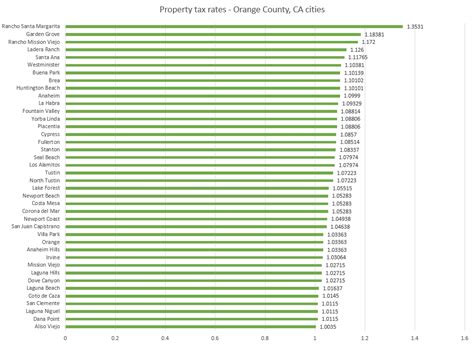

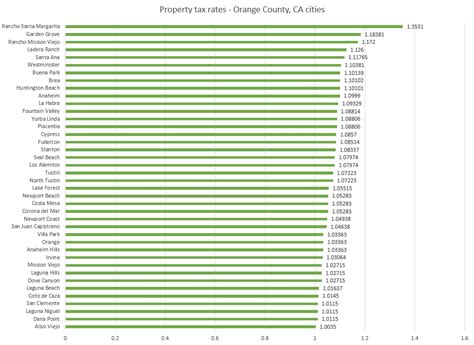

Property Taxes in Orange County

Property taxes are a major source of revenue for local governments in Orange County. The tax rate for property owners is based on the assessed value of their property and is determined annually. As of 2023, the general property tax rate in Orange County is set at 1.04%, which includes the base rate of 1% as mandated by the California Constitution, along with additional voter-approved assessments and special taxes.

Assessed Value and Tax Calculation

The assessed value of a property is determined by the Orange County Assessor’s Office. It takes into account factors such as the property’s location, size, improvements, and market conditions. The assessed value is then multiplied by the applicable tax rate to calculate the annual property tax bill.

For instance, consider a residential property in Orange County with an assessed value of $500,000. Applying the 1.04% tax rate, the annual property tax would amount to $5,200. This calculation does not include any potential exemptions or deductions that may be applicable to the property.

| Property Type | Assessed Value | Tax Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential | $500,000 | 1.04% | $5,200 |

| Commercial | $2,000,000 | 1.12% | $22,400 |

| Industrial | $800,000 | 1.08% | $8,640 |

Exemptions and Deductions

Orange County offers various exemptions and deductions to property owners, which can significantly reduce their tax liabilities. Common exemptions include the Homeowner’s Exemption, which provides a reduction in assessed value for owner-occupied residences, and the Senior Citizen’s Exemption, which offers tax relief to qualifying elderly homeowners.

Additionally, Orange County allows for the transfer of the base year value of a property to a new location within the county under specific circumstances, a process known as the Parent-Child Exemption. This exemption can help homeowners avoid a significant increase in property taxes when moving.

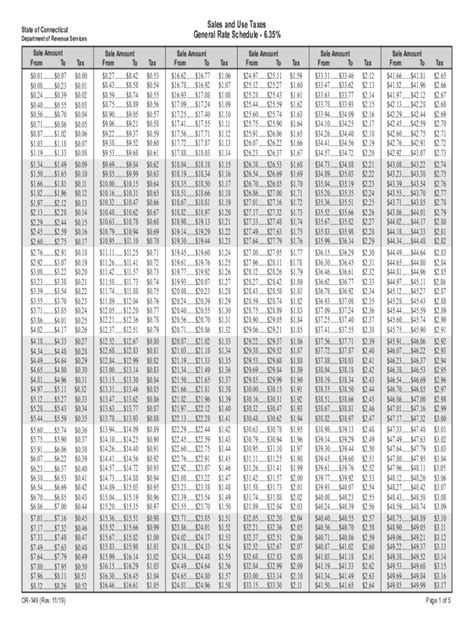

Sales and Use Taxes

Sales and use taxes are another significant source of revenue for Orange County. These taxes are applied to the sale of goods and services within the county and are collected by businesses, which then remit the funds to the state and local governments.

Sales Tax Rates

As of 2023, the combined sales tax rate in Orange County is 7.25%, which includes the state sales tax rate of 7.25%. This rate can vary slightly depending on the specific city within the county, as some cities impose additional local sales taxes.

For example, the city of Anaheim has a local sales tax rate of 1%, bringing the total sales tax rate to 8.25% within the city limits. Similarly, the city of Newport Beach has a slightly higher rate of 8.75% due to additional city and district taxes.

| City | Sales Tax Rate |

|---|---|

| Orange County Average | 7.25% |

| Anaheim | 8.25% |

| Newport Beach | 8.75% |

| Santa Ana | 7.25% |

Use Tax

The use tax is applied to goods and services purchased outside of Orange County but used or stored within the county. It ensures that businesses and individuals pay taxes on items they acquire from other jurisdictions, preventing tax evasion. The use tax rate mirrors the sales tax rate, currently set at 7.25%.

Business Taxes and Fees

Orange County also levies various taxes and fees on businesses operating within its boundaries. These taxes contribute to the funding of local infrastructure, services, and economic development initiatives.

Business License Tax

Most businesses in Orange County are required to obtain a business license and pay an annual license tax. The tax rate varies depending on the type of business and its gross receipts. For example, a retail business with gross receipts between 100,000 and 200,000 may be subject to a tax rate of 0.25%.

| Business Type | Gross Receipts | Tax Rate |

|---|---|---|

| Retail | $100,000 - $200,000 | 0.25% |

| Wholesale | $500,000 - $1,000,000 | 0.125% |

| Service | $250,000 - $500,000 | 0.1875% |

Transitional Housing Tax

Orange County imposes a Transitional Housing Tax on businesses with 50 or more employees. This tax funds the development and maintenance of transitional housing for homeless individuals and families. The tax rate is 0.005% of the business’s gross receipts, with a minimum tax of $250.

Hotel Occupancy Tax

The Hotel Occupancy Tax is applied to the rental of hotel rooms within Orange County. The tax rate varies depending on the city, with rates ranging from 10% to 15% of the room charge. These funds are used to support tourism-related initiatives and marketing efforts.

Other Taxes and Assessments

In addition to the aforementioned taxes, Orange County residents and businesses may encounter other specific taxes and assessments, such as:

- Vehicle License Fee: A fee based on the vehicle's value, assessed annually.

- Telephone Users Tax: A tax applied to telephone services, varying by provider.

- Emergency Medical Services Assessment: A fee to support emergency medical services in the county.

- Mello-Roos Assessments: Special assessments for certain communities to fund infrastructure and services.

Tax Relief and Assistance

Orange County offers several programs and resources to assist residents and businesses in managing their tax obligations. These include tax relief programs for low-income individuals and families, tax deferral options for senior citizens, and tax incentives for businesses investing in certain industries or hiring locally.

Additionally, the county provides tax workshops and educational resources to help taxpayers understand their rights and responsibilities, ensuring compliance and minimizing potential penalties.

What happens if I don’t pay my property taxes in Orange County?

+Failure to pay property taxes can result in penalties, interest, and potential tax liens. In extreme cases, the county may initiate foreclosure proceedings to recover the outstanding taxes.

Are there any tax incentives for renewable energy installations in Orange County?

+Yes, Orange County offers a Property Tax Exemption for Solar Energy Systems, which provides a reduction in property taxes for eligible solar installations.

How often do property tax rates change in Orange County?

+Property tax rates can change annually, typically in response to budgetary needs or voter-approved initiatives. However, the base rate of 1% remains constant as mandated by the California Constitution.