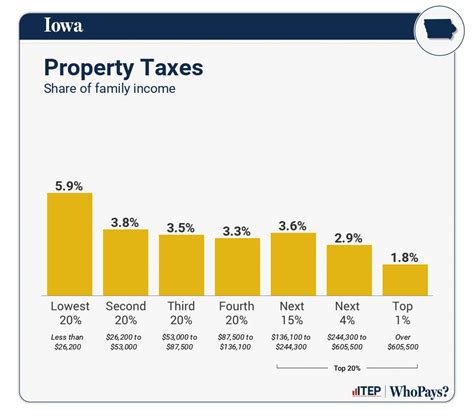

Understanding Property Taxes Iowa: How They Impact Your Finances

In the sweeping landscape of American property ownership, few states exemplify the nuanced interplay of taxation and fiscal policy quite like Iowa. For homeowners and investors alike, understanding property taxes in Iowa isn't merely an exercise in compliance—it's a critical component of financial planning that can influence decisions from purchasing property to long-term wealth accumulation. While often overshadowed by federal income taxes or state-wide income taxes, property taxes in Iowa wield substantial influence over personal budgets, local government funding, and community development. This exposé delves into the intricacies of Iowa’s property tax system, revealing how these levies are calculated, their impact on individual finances, and the broader implications for economic vitality within the state.

Deciphering Iowa’s Property Tax System: Foundations and Frameworks

The foundation of Iowa’s property tax system hinges on an intricate web of valuation methods, taxing authority structures, and legislative guidelines that ensure equitable fiscal distribution across counties, municipalities, and school districts. At its core, property taxes in Iowa are assessed as a percentage of the property’s assessed fair market value, a figure derived from both market comparables and statutory valuation limits. The process involves county assessors utilizing mass appraisal techniques, which combine sales data analysis, cost approaches, and income valuation models to estimate property worth with accuracy and consistency.

One of the defining characteristics of Iowa’s system is its adherence to the "uniform valuation" principle, ensuring that similar properties are taxed at comparable rates, thus fostering fairness. However, the ultimate tax burden falls upon centroidal local governments, which set millage rates within legislative caps. These rates, expressed in mills (one-thousandth of a dollar), fluctuate annually based on local budget needs, population shifts, and state-mandated revenue limits.

Taxable Property Delineation: What Counts and What Doesn’t

In Iowa, the scope of taxable property encompasses residential, commercial, industrial, and agricultural lands, as long as they meet certain legal criteria. Notably, homestead properties often benefit from exemptions or credits that reduce the effective tax burden, such as the Homestead Credit, which caps the taxable value of primary residences. Conversely, properties like vacant lots or unused land may face different valuation standards, affecting their contribution to municipal coffers.

| Relevant Category | Substantive Data |

|---|---|

| Average Effective Property Tax Rate | 1.55% in 2023, above national average of 1.07% |

The Mechanics of Property Tax Calculation in Iowa

The calculation of property taxes is a multi-step process that begins with the appraisal value, proceeds through the application of relevant assessment ratios, and concludes with the application of combined millage rates from various taxing authorities. For instance, if a residential property is appraised at 200,000, and the assessment ratio for residential land is 100%, its taxable value remains 200,000. Applying a total millage rate of 15 mills (or 15 per 1,000 of value), the annual property tax bill computes as follows:

Tax = (Assessed Value / 1,000) × Millage Rate

Therefore, 200,000 / 1,000 × 15 = 3,000 in annual property taxes. This straightforward calculation, however, conceals a complex web of local rate components, including county, city, school, and special district levies, each contributing variably to the total burden.

Impact of Assessment Appeals and Exemptions

Homeowners in Iowa have the right to appeal assessed values if they believe their property has been overvalued. These appeals undergo a formal review process, often requiring appraiser evaluations and evidence submission. Successful appeals can significantly lower annual tax liabilities, especially in fluctuating markets or during rapid appreciation periods.

The state also offers targeted exemptions and credits that directly influence tax payments. For instance, the Homestead Credit reduces the taxable value of primary residences by a certain percentage, currently set at 19%. Additional exemptions or abatements may be available for seniors, veterans, or disabled individuals, further modulating tax liabilities across demographic segments.

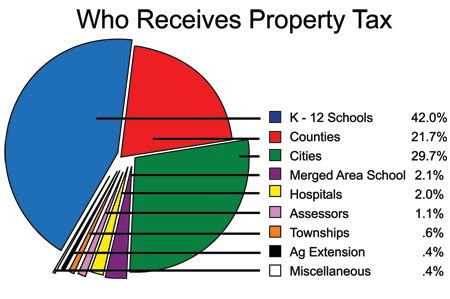

Interdependence of Local Funding and Property Tax Revenues

Property taxes serve as the bedrock of local government funding in Iowa, supporting critical services such as education, emergency services, infrastructure, and local governance. State law caps overall levy rates but mandates that local authorities allocate revenue to meet community needs while maintaining fiscal responsibility. A nuanced dynamic emerges where local taxation decisions directly influence the quality of public services, community development projects, and even property values.

Data reveals that Iowa’s reliance on property taxes is among the highest in the Midwest, with the average household spending approximately $2,300 annually on property taxes. This figure reflects both the valuation system and the local discretion exercised by taxing entities.

| Relevant Category | Substantive Data |

|---|---|

| Homeowner Average Annual Tax | $2,300 in 2023 |

| Municipal Revenue Share | Approximately 65% |

| Education Funding via Property Taxes | About 30% of school district budgets |

Long-term Impacts and Future Outlook

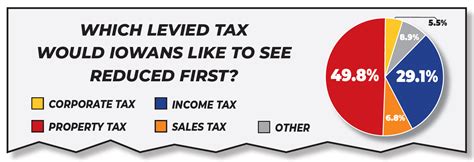

Understanding property taxes in Iowa is crucial for grasping how fiscal policy influences long-term wealth building and community stability. Rising property values, coupled with static or increasing millage rates, can exponentially inflate tax obligations, affecting affordability. Conversely, tax relief programs and reassessment adjustments serve as stabilizers in this dynamic environment.

Furthermore, demographic shifts, such as migration patterns or aging populations, exert pressure on the tax system, prompting legislative reevaluations of assessment practices, exemption criteria, and levy caps. For instance, recent proposals have debated adjusting the assessment ratio to better reflect current market realities, aiming to improve fairness and revenue stability.

Emerging Trends and Policy Discussions

Advancements in property valuation technology, including machine learning algorithms and big data analytics, are reshaping assessment accuracy and efficiency. Meanwhile, some policymakers advocate for broader use of income-based or market-value-based taxation models to mitigate the regressivity inherent in property tax systems. These debates often center around balancing local revenue needs with taxpayer burdens, particularly for vulnerable populations.

Key Points

- Property tax assessment accuracy directly influences taxpayer burden and government funding a nuanced balance between fairness and revenue sufficiency.

- Legislative caps on millage rates act as safeguard mechanisms but can also limit local governments’ capacity to adapt to changing financial demands.

- Technological innovations in valuation are transforming how assessments are conducted, promising increased precision but also raising questions about transparency.

- Policy reforms ongoing in Iowa aim to address property tax regressivity and funding inequities, reflecting broader national debates on tax fairness.

- Long-term planning must consider demographic shifts, market fluctuations, and technological advances to sustain fiscal health.

How are property taxes estimated in Iowa?

+Property taxes in Iowa are based on assessed fair market value, multiplied by local millage rates. Assessors employ mass appraisal methods, considering recent sales data, property features, and valuation standards, then local authorities set the specific tax rate within legislative limits.

What exemptions can reduce my property tax in Iowa?

+Notable exemptions include the Homestead Credit, which reduces taxable value for primary residences, and special exemptions for seniors, veterans, or persons with disabilities. The availability and extent depend on local policies and individual eligibility.

How does property valuation impact my annual taxes?

+The higher the assessed value of your property, the greater your tax obligation, provided the millage rate remains constant. Appeals can lower assessed values, reducing your tax bill, while market appreciation can increase it unless adjustments are made.