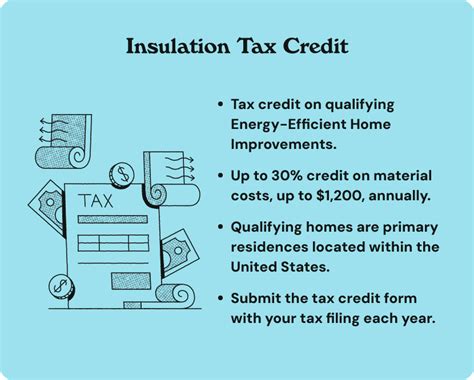

Insulation Tax Credit

Energy efficiency and sustainable practices have become increasingly important in today's world, and governments and organizations are taking steps to encourage homeowners and businesses to adopt eco-friendly measures. One such initiative is the Insulation Tax Credit, a financial incentive aimed at promoting energy conservation and reducing carbon footprints. This article explores the concept of the Insulation Tax Credit, its benefits, eligibility criteria, and its impact on homeowners and the environment.

Understanding the Insulation Tax Credit

The Insulation Tax Credit, also known as the Residential Energy Efficiency Tax Credit, is a government-sponsored program designed to incentivize homeowners to improve the energy efficiency of their properties. It provides a tax credit for specific energy-saving improvements made to residential buildings, with a primary focus on insulation. By offering a financial reward, this credit aims to encourage property owners to invest in better insulation, leading to reduced energy consumption and lower environmental impact.

The credit is a crucial part of the broader green initiatives and sustainability programs that governments worldwide are implementing to combat climate change and promote eco-friendly practices. It aligns with the global efforts to reduce greenhouse gas emissions and promote a more sustainable future.

Benefits of the Insulation Tax Credit

The Insulation Tax Credit offers a range of advantages to both homeowners and the environment. Here are some key benefits:

- Energy Savings: Improved insulation leads to better energy efficiency, reducing the amount of energy required to heat or cool a home. This results in lower utility bills and a more comfortable living environment.

- Environmental Impact: By reducing energy consumption, homeowners contribute to a significant decrease in greenhouse gas emissions. This credit encourages a greener lifestyle and helps combat climate change on an individual level.

- Financial Incentive: The tax credit provides a direct financial benefit to homeowners, making energy-efficient upgrades more affordable. It can cover a substantial portion of the costs associated with insulation improvements, making it an attractive option for many.

- Long-Term Value: Investing in insulation not only saves energy but also increases the value of a property. Well-insulated homes are more desirable and can command higher resale prices.

- Community Impact: Widespread adoption of energy-efficient practices can lead to a collective reduction in energy demand, benefiting the entire community. It can result in more stable energy prices and a reduced strain on local energy infrastructure.

Eligibility and Requirements

To qualify for the Insulation Tax Credit, homeowners must meet specific criteria and ensure that their insulation improvements meet certain standards. Here are the key eligibility requirements:

Residential Property Ownership

The tax credit is available to individuals who own their primary residence. Rental properties and secondary homes are typically not eligible for this incentive.

Qualified Improvements

Only specific types of insulation improvements are eligible for the tax credit. These include:

- Attic Insulation: Upgrading attic insulation to meet or exceed the recommended R-value for the region.

- Wall Insulation: Adding or improving insulation in exterior walls, including cavity wall insulation and exterior rigid foam insulation.

- Crawl Space Insulation: Insulating crawl spaces to prevent heat loss and moisture issues.

- Floor Insulation: Installing insulation beneath floors to reduce heat loss.

- Energy-Efficient Windows: Replacing old windows with energy-efficient models can also qualify for the credit.

Documentation and Verification

Homeowners must maintain proper documentation to support their insulation improvements. This includes receipts, invoices, and any relevant paperwork from the installation process. Additionally, some jurisdictions may require an inspection or certification to verify the improvements.

Income Tax Filing

To claim the Insulation Tax Credit, homeowners must file their income taxes and include the necessary documentation to support their claim. The credit is typically applied as a reduction in the tax liability for the year in which the improvements were made.

| Insulation Type | Eligible Improvements |

|---|---|

| Attic Insulation | Upgrading to recommended R-value |

| Wall Insulation | Cavity wall, exterior rigid foam |

| Crawl Space | Insulation for moisture control |

| Floor Insulation | Reducing heat loss beneath floors |

| Windows | Energy-efficient window replacements |

Impact and Case Studies

The Insulation Tax Credit has had a significant impact on promoting energy-efficient practices and reducing environmental footprints. Case studies and real-world examples highlight the effectiveness of this initiative.

Energy Savings and Comfort

Homeowners who have taken advantage of the Insulation Tax Credit report substantial energy savings. For instance, Mr. Johnson, a resident of a suburban area, upgraded his attic insulation and replaced old windows. He noticed a significant decrease in his heating bills during the winter months, resulting in an annual savings of over $500. Additionally, his home maintained a more consistent temperature, enhancing his overall comfort.

Environmental Benefits

The cumulative effect of energy-efficient improvements made by homeowners has led to a reduction in greenhouse gas emissions. According to a study conducted by the Environmental Protection Agency, energy-efficient measures, including insulation upgrades, have the potential to reduce carbon dioxide emissions by millions of metric tons annually. This reduction not only benefits the environment but also contributes to a more sustainable future.

Economic Impact

The Insulation Tax Credit has also had a positive economic impact on the construction and energy sectors. It has created a demand for insulation materials and installation services, providing job opportunities and supporting local businesses. Additionally, the credit has encouraged homeowners to invest in their properties, leading to increased home values and a boost in the real estate market.

Future Implications and Opportunities

The Insulation Tax Credit has proven to be a successful initiative in promoting energy conservation and sustainable practices. As governments and organizations continue to prioritize environmental initiatives, the future looks promising for similar programs.

Expanding Eligibility

There is an opportunity to expand the eligibility criteria for the Insulation Tax Credit to include a wider range of energy-efficient improvements. This could include incentives for renewable energy systems, such as solar panels and geothermal heating, as well as energy-efficient appliances. By broadening the scope, more homeowners can benefit from these incentives and contribute to a greener future.

Community Education and Awareness

Increasing awareness about the Insulation Tax Credit and its benefits can further encourage homeowners to adopt energy-efficient practices. Community education programs and initiatives can play a vital role in spreading the word. By hosting workshops, providing resources, and sharing success stories, communities can come together to embrace sustainable living.

Long-Term Sustainability

The Insulation Tax Credit has the potential to drive long-term sustainability by influencing building practices and policies. As more homeowners embrace energy-efficient upgrades, the demand for sustainable materials and technologies will increase. This, in turn, can lead to innovations in the construction industry, making eco-friendly practices more accessible and affordable for all.

Conclusion

The Insulation Tax Credit is a powerful tool in the fight against climate change and the promotion of energy conservation. By offering financial incentives, this credit encourages homeowners to take an active role in reducing their environmental impact. The benefits extend beyond energy savings, impacting the environment, local economies, and the overall well-being of communities. As we move towards a more sustainable future, initiatives like the Insulation Tax Credit play a crucial role in shaping a greener and more resilient world.

How much can I save with the Insulation Tax Credit?

+The savings depend on various factors, including the cost of improvements, your tax bracket, and the specific credit amount offered in your region. On average, homeowners can expect a significant reduction in their tax liability, ranging from a few hundred to several thousand dollars.

Are there any income restrictions for claiming the credit?

+Income restrictions vary by jurisdiction. Some regions may have income limits, while others may not. It’s important to check the specific guidelines for your area to understand any income-related requirements.

Can I claim the credit for multiple insulation improvements in the same year?

+Yes, as long as each improvement meets the eligibility criteria and is properly documented. You can claim the credit for multiple eligible improvements made within the same tax year.

How do I know if my insulation improvements meet the required standards?

+Refer to the official guidelines provided by your government or tax authority. They will outline the specific requirements for insulation R-values and other criteria. Additionally, you can consult with insulation professionals or energy auditors for guidance.

Are there any ongoing maintenance requirements to keep the credit valid?

+Generally, there are no ongoing maintenance requirements. However, it’s essential to maintain proper documentation and receipts for future reference, especially if you plan to sell your property or make additional improvements in the future.