San Francisco Tax Rate

Welcome to the comprehensive guide to understanding the tax landscape of San Francisco, a vibrant city known for its innovation, diversity, and thriving economy. In this expert-led exploration, we delve into the intricate world of San Francisco's tax system, offering an in-depth analysis of the various tax rates that impact individuals, businesses, and real estate investors in this dynamic metropolis.

Navigating the San Francisco Tax Landscape

The city of San Francisco, nestled along the picturesque California coastline, boasts a unique and multifaceted tax structure. Understanding these taxes is crucial for both residents and businesses operating within the city limits. Let’s embark on a journey through the various tax categories and their implications.

Income Tax Rates in San Francisco

For individuals residing in San Francisco, income tax is a significant consideration. The city levies a local income tax in addition to the state and federal taxes. The San Francisco Office of the Treasurer & Tax Collector oversees the collection of these taxes, ensuring compliance with the city’s revenue regulations.

| Income Bracket | Local Tax Rate |

|---|---|

| $0 - $20,999 | 1.5% |

| $21,000 - $39,999 | 1.75% |

| $40,000 - $64,999 | 2.25% |

| $65,000 - $109,999 | 2.5% |

| $110,000 - $250,000 | 2.75% |

| $250,000 and above | 3.1% |

These income tax rates are applicable for the 2023 tax year and may be subject to adjustments in subsequent years. It's essential for individuals to stay updated with the latest tax regulations to ensure accurate filing.

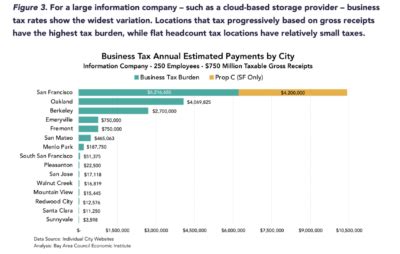

Business Taxes: A Comprehensive Overview

San Francisco’s business-friendly environment attracts a diverse range of enterprises, from startups to established corporations. The city imposes a Gross Receipts Tax (GRT) on businesses operating within its boundaries, with rates varying based on the industry and revenue thresholds.

| Business Category | Tax Rate |

|---|---|

| Retail Sales | 1.5% |

| Wholesale Sales | 0.75% |

| Manufacturing | 0.18% |

| Service Businesses | 0.5% |

| Hotels & Lodging | 1.5% |

| Financial Services | 1.35% |

Businesses should note that these rates are subject to change and may be impacted by various factors, including the city's economic policies and revenue needs. Staying informed about these tax regulations is crucial for accurate reporting and compliance.

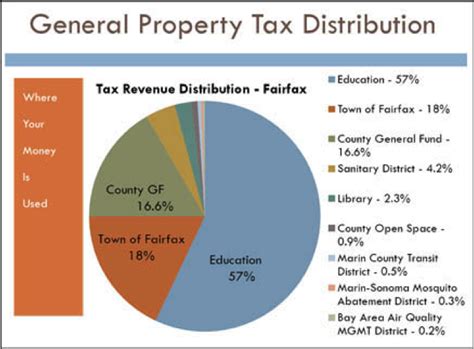

Property Taxes: Unlocking Real Estate Opportunities

San Francisco’s real estate market is renowned for its allure and investment potential. Property taxes play a significant role in the city’s revenue generation and impact both residential and commercial property owners. The tax rate is determined by the assessed value of the property and the applicable tax rate area.

| Property Type | Tax Rate |

|---|---|

| Residential Property | 1.1499% |

| Commercial Property | 1.5% |

| Industrial Property | 1.38% |

| Vacant Land | 1.125% |

It's important to note that property tax rates can vary within the city based on specific tax rate areas. Real estate investors should carefully assess these rates when considering property acquisitions in San Francisco.

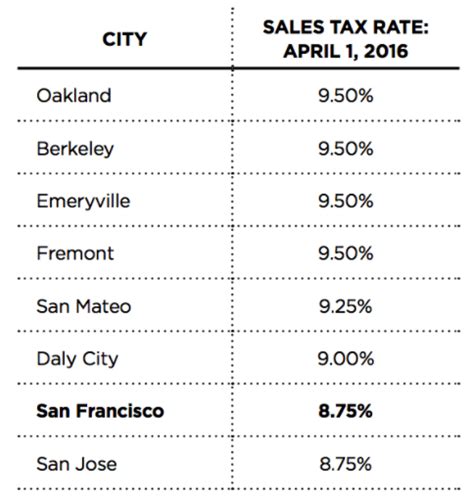

Sales and Use Taxes: Understanding Consumer Impact

Sales and use taxes are integral to the city’s revenue generation, impacting both businesses and consumers. San Francisco imposes a sales tax on retail transactions, while use taxes are levied on certain services and goods that are not subject to sales tax. These taxes contribute to the city’s overall financial health and fund essential public services.

| Tax Type | Rate |

|---|---|

| Sales Tax | 8.75% |

| Use Tax | 8.75% |

Consumers and businesses should be aware of these tax rates when making purchasing decisions or offering goods and services in San Francisco. Staying informed about these taxes ensures compliance and contributes to the city's sustainable development.

FAQ - Frequently Asked Questions

How do I calculate my San Francisco income tax liability?

+

To calculate your income tax liability in San Francisco, you need to consider your taxable income and the applicable tax rate based on your income bracket. The city’s tax rates range from 1.5% to 3.1%, and you can refer to the official tax guidelines or use online tax calculators to determine your liability accurately.

Are there any tax incentives for businesses operating in San Francisco?

+

Yes, San Francisco offers various tax incentives to attract and support businesses. These incentives include tax credits for job creation, research and development, and certain industry-specific initiatives. Businesses can explore these incentives through the city’s economic development programs and consult with tax professionals for eligibility and application processes.

How often do San Francisco’s tax rates change, and where can I find the latest updates?

+

San Francisco’s tax rates are subject to periodic reviews and adjustments. The city’s Office of the Treasurer & Tax Collector provides the most up-to-date information on tax rates and any changes. It’s recommended to visit their official website regularly or subscribe to their tax updates to stay informed about any modifications to the tax landscape.