Osceola Property Tax

Welcome to this comprehensive guide on understanding and navigating the Osceola County property tax system. In this article, we will delve into the intricacies of property taxes in Osceola County, Florida, providing you with expert insights and valuable information to help you make informed decisions regarding your property taxes. Whether you are a homeowner, investor, or simply interested in learning more about the tax landscape, this guide will equip you with the knowledge you need.

Unraveling the Osceola Property Tax System

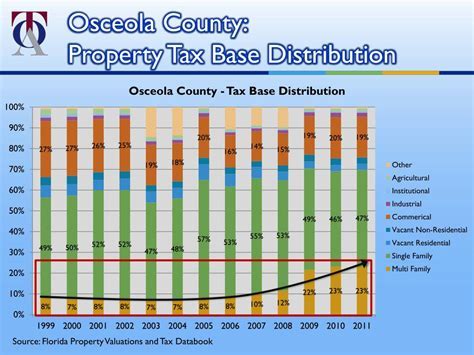

Osceola County, known for its vibrant communities and diverse attractions, also has a unique property tax system that requires careful understanding. Property taxes in Osceola County are an essential component of the local economy, contributing to the funding of vital services such as education, infrastructure, and public safety. As a property owner, it is crucial to be well-informed about your tax obligations and the various factors that influence your property tax assessment.

How Property Taxes are Determined in Osceola County

The property tax assessment process in Osceola County involves a systematic evaluation of each property's value. This value, often referred to as the assessed value, forms the basis for calculating the property tax liability. Here's a breakdown of the key steps involved in determining your property taxes:

- Property Appraisal: The first step is the appraisal of your property by the Osceola County Property Appraiser's Office. This appraisal considers various factors, including the property's size, location, improvements, and market conditions. The appraiser's role is to assign a fair market value to your property, ensuring consistency and accuracy.

- Assessment Ratio: Osceola County utilizes an assessment ratio to calculate the assessed value of your property. This ratio, typically a percentage of the fair market value, is applied to determine the taxable value. For instance, if the assessment ratio is set at 10%, your taxable value would be 10% of the fair market value.

- Millage Rate: Once the taxable value is determined, the millage rate comes into play. The millage rate, expressed in mills (where one mill equals $1 of tax for every $1,000 of taxable value), is set by local government entities, including the county, school district, and various special districts. These entities determine their millage rates based on their budgetary needs and the services they provide.

- Property Tax Calculation: To calculate your property tax, the taxable value is multiplied by the total millage rate. For example, if your taxable value is $100,000 and the total millage rate is 10 mills, your property tax would be $1,000. This calculation provides you with an estimate of your annual property tax liability.

It's important to note that the millage rate can vary from year to year, as local government entities adjust their budgets and tax rates to meet their financial requirements. Therefore, staying informed about any changes in the millage rate is crucial for accurate property tax planning.

Factors Influencing Property Tax Assessments

Several factors can impact the assessed value of your property and, consequently, your property tax liability. Understanding these factors can help you anticipate potential changes and plan accordingly. Here are some key influences on property tax assessments in Osceola County:

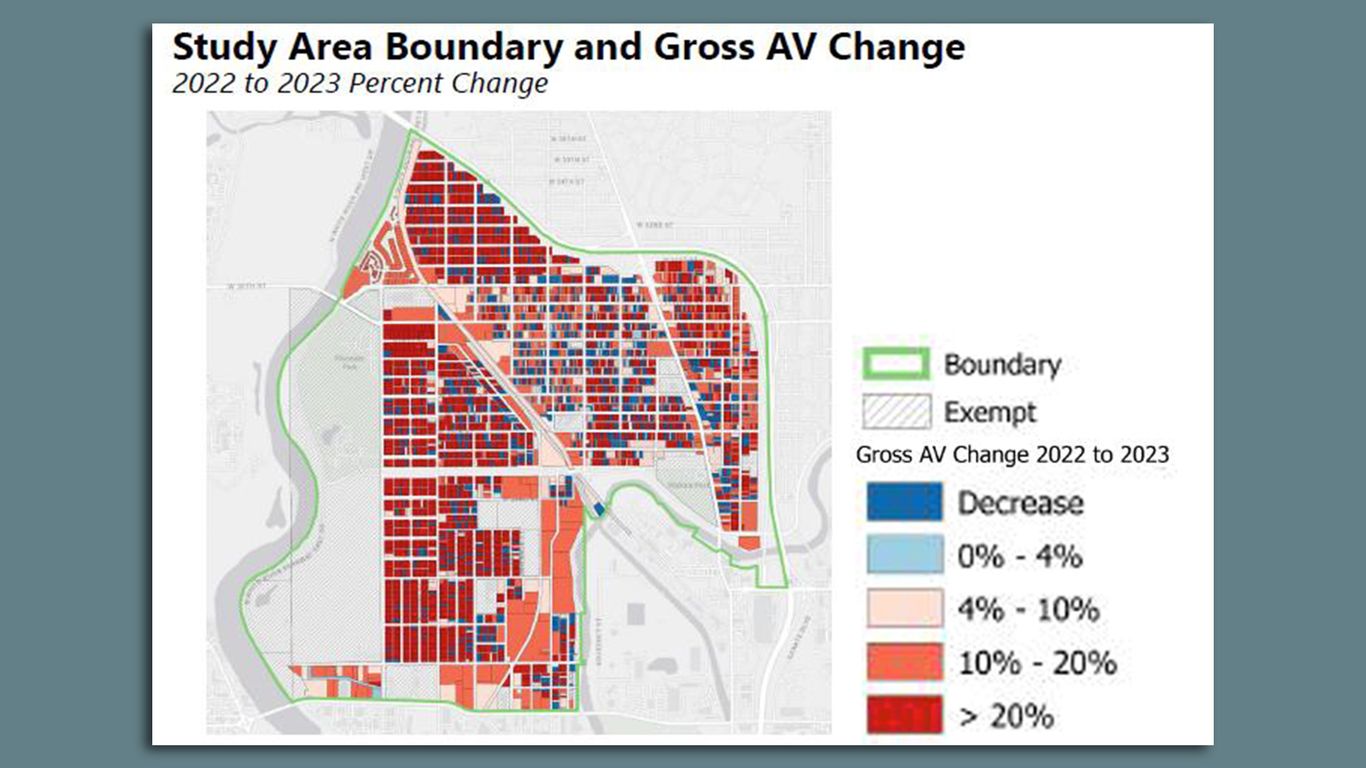

- Market Value Fluctuations: The fair market value of your property is influenced by the local real estate market. Factors such as supply and demand, economic conditions, and neighborhood developments can cause fluctuations in property values. As a result, your property's assessed value may increase or decrease over time, impacting your property taxes.

- Improvements and Additions: Any improvements or additions made to your property, such as renovations, expansions, or new construction, can affect its assessed value. These improvements often increase the property's value and, consequently, its taxable value. It's important to be aware of any changes you make to your property and their potential impact on your taxes.

- Property Characteristics: The unique characteristics of your property, including its size, location, age, and condition, play a significant role in its assessed value. Properties with desirable features, such as waterfront access or proximity to amenities, may command higher values and, therefore, higher property taxes.

- Tax Exemptions and Credits: Osceola County offers various tax exemptions and credits that can reduce your property tax liability. These may include homestead exemptions, which provide a reduction in taxable value for primary residences, and other exemptions for qualifying individuals or properties. Understanding the eligibility criteria and applying for these exemptions can help lower your property taxes.

Managing Your Property Taxes

As a property owner in Osceola County, it's essential to stay proactive in managing your property taxes. Here are some strategies and tips to help you navigate the process effectively:

Understanding Your Property Tax Bill

Receiving your property tax bill can sometimes be overwhelming, especially if you are new to the process. Familiarize yourself with the components of your tax bill to ensure a clear understanding of your obligations. Here's a breakdown of what you can expect:

| Component | Description |

|---|---|

| Taxable Value | The assessed value of your property after applying the assessment ratio. |

| Millage Rate | The combined millage rate for all taxing authorities in your area. |

| Property Tax Amount | The total property tax you owe, calculated by multiplying the taxable value by the millage rate. |

| Due Date | The deadline for paying your property taxes without incurring penalties. |

| Payment Options | The methods available for paying your property taxes, such as online payments, checks, or in-person transactions. |

Reviewing and Appealing Your Assessment

If you believe your property's assessed value is inaccurate or unfair, you have the right to appeal the assessment. Osceola County provides a formal process for property tax appeals, allowing you to challenge the valuation and seek a reduction in your taxable value. Here's a step-by-step guide to the appeal process:

- Obtain an Informal Review: Before filing a formal appeal, you can request an informal review with the Property Appraiser's Office. This review provides an opportunity to discuss your concerns and potentially resolve the issue without proceeding to a formal appeal.

- Gather Evidence: If an informal review is unsuccessful or not an option, gather evidence to support your appeal. This may include recent sales of similar properties, professional appraisals, or documentation of any errors in the assessment.

- File a Formal Appeal: Submit a formal appeal to the Value Adjustment Board (VAB) within the specified deadline. The VAB is an independent body responsible for hearing property tax appeals. Provide detailed documentation and evidence to support your case.

- Prepare for a Hearing: If your appeal proceeds to a hearing, be prepared to present your case. This may involve providing additional evidence, answering questions, and potentially testifying before the VAB. Seek guidance from legal professionals or tax advisors if needed.

- Receive the Decision: The VAB will issue a decision on your appeal, either upholding or adjusting your property's assessed value. If you are dissatisfied with the decision, you may have the option to pursue further legal remedies.

It's important to note that appealing your property tax assessment should be done carefully and with proper preparation. Seeking professional advice and understanding the appeal process can increase your chances of a successful outcome.

Utilizing Tax Exemptions and Credits

Osceola County offers a range of tax exemptions and credits that can provide significant savings on your property taxes. Understanding these exemptions and ensuring you meet the eligibility criteria is crucial for maximizing your tax benefits. Here are some key exemptions and credits to consider:

- Homestead Exemption: The homestead exemption is a widely utilized tax benefit for primary residence owners. To qualify, you must own and occupy the property as your permanent residence and meet certain residency requirements. The exemption reduces the taxable value of your property, resulting in lower property taxes.

- Senior Exemption: Osceola County provides an additional exemption for senior citizens. If you are 65 years or older and meet specific income and residency requirements, you may be eligible for a reduction in your property taxes. This exemption can provide significant savings for senior homeowners.

- Military Exemption: Active-duty military personnel and veterans may be eligible for property tax exemptions. These exemptions recognize the service and sacrifice of our military members and can reduce their property tax burden. Be sure to check the specific requirements and guidelines for this exemption.

- Disability Exemption: Individuals with disabilities may qualify for a property tax exemption if they meet certain criteria. This exemption aims to provide relief to those with disabilities who may face financial challenges. Consult the Property Appraiser's Office for detailed information on this exemption.

- Widow/Widower Exemption: Osceola County offers an exemption for surviving spouses of deceased homeowners. This exemption provides a reduction in property taxes for qualifying widows or widowers, helping them maintain their financial stability after the loss of their spouse.

It's essential to stay informed about the various tax exemptions and credits available in Osceola County and to ensure you meet the eligibility criteria. Consulting with tax professionals or the Property Appraiser's Office can help you navigate these exemptions and maximize your savings.

Staying Informed and Engaged

Understanding and managing your property taxes in Osceola County requires staying informed and engaged with the local tax landscape. Here are some additional tips and resources to help you stay up-to-date and make informed decisions:

Regularly Review Property Records

Keep track of your property records, including your deed, mortgage documents, and any improvements or additions you make. Regularly reviewing these records ensures that you have accurate information about your property's characteristics and helps you identify any potential issues or changes that may impact your property taxes.

Monitor Local Government Budget Decisions

Stay informed about local government budget decisions and tax rate changes. These decisions can directly impact your property taxes, so being aware of any proposed changes or adjustments can help you plan and budget accordingly. Attend public meetings, follow local news outlets, and engage with your elected officials to stay informed.

Seek Professional Advice

If you have complex tax situations or need specialized guidance, consider seeking advice from tax professionals or financial advisors. They can provide personalized insights and strategies tailored to your specific circumstances, helping you navigate the intricacies of property taxes effectively.

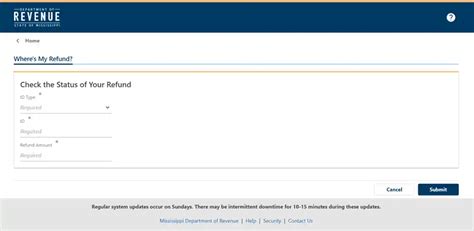

Explore Online Resources

Osceola County provides a wealth of online resources to assist property owners. Visit the official websites of the Property Appraiser's Office and the Tax Collector's Office to access valuable information, forms, and tools. These websites often offer property tax calculators, payment options, and guides to help you understand and manage your property taxes efficiently.

FAQs

How often are property tax assessments conducted in Osceola County?

+Property tax assessments in Osceola County are conducted annually. The Property Appraiser's Office evaluates each property's value based on various factors, ensuring that the assessed value reflects the current market conditions.

Can I appeal my property tax assessment if I disagree with the valuation?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or unfair. Osceola County provides a formal appeals process through the Value Adjustment Board (VAB). You can request an informal review first, and if that is unsuccessful, you can file a formal appeal. It's important to gather evidence and prepare your case carefully.

What are the key factors that influence my property tax liability in Osceola County?

+Your property tax liability in Osceola County is influenced by several factors, including the fair market value of your property, the assessment ratio, and the millage rate set by local government entities. Additionally, any improvements or additions to your property, as well as tax exemptions and credits you may qualify for, can impact your taxable value and property taxes.

Are there any tax relief programs available for low-income homeowners in Osceola County?

+Yes, Osceola County offers various tax relief programs to assist low-income homeowners. These programs aim to provide financial relief and ensure affordability. To explore your eligibility for these programs, contact the Property Appraiser's Office or visit their website for detailed information.

How can I stay updated on property tax-related news and changes in Osceola County?

+Stay informed by subscribing to newsletters or alerts from the Property Appraiser's Office and the Tax Collector's Office. These offices often provide updates on tax-related matters, including changes in tax rates, assessment procedures, and important deadlines. Additionally, local news outlets and community websites can be valuable sources of information.

In conclusion, understanding the Osceola County property tax system is crucial for property owners and investors alike. By staying informed, managing your property taxes effectively, and utilizing available resources, you can navigate the tax landscape with confidence. Remember to review your property records regularly, explore tax exemptions and credits, and seek professional advice when needed. With this comprehensive guide, you are equipped with the knowledge to make informed decisions and optimize your property tax management in Osceola County.