Indianapolis Property Tax

The topic of property taxes is an essential aspect of homeownership, and understanding the specifics of these taxes in different regions can provide valuable insights for homeowners and prospective buyers. This article aims to delve into the intricacies of property taxes in Indianapolis, Indiana, offering a comprehensive guide to help individuals navigate this complex yet critical financial obligation.

Understanding Indianapolis Property Taxes

Indianapolis, the vibrant capital of Indiana, is renowned for its cultural diversity, vibrant sports scene, and thriving business environment. Amidst the allure of the city, property taxes emerge as a significant consideration for homeowners and investors alike. In this comprehensive guide, we’ll dissect the ins and outs of Indianapolis property taxes, providing an in-depth analysis to help readers make informed decisions.

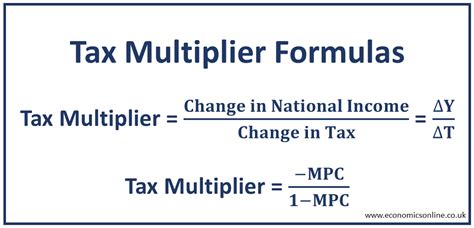

Property taxes in Indianapolis, like in many other cities, serve as a crucial revenue source for local governments, funding essential services and infrastructure development. These taxes are typically calculated based on the assessed value of a property and are levied annually. The specific tax rate can vary significantly, influenced by factors such as the property's location, type, and the local government's budgetary needs.

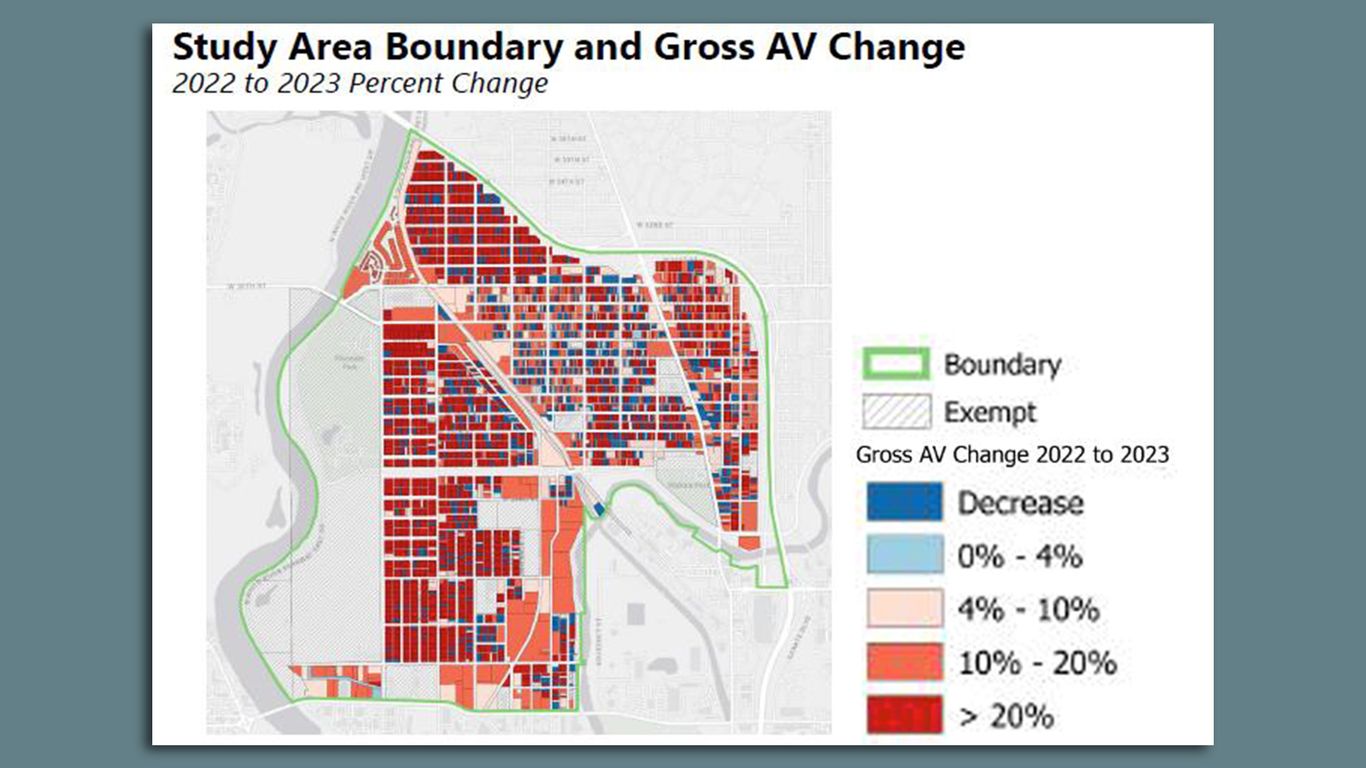

Assessed Value and Tax Rates

The assessed value of a property is determined through a meticulous process involving professional appraisers and assessment teams. They evaluate factors such as the property’s size, location, condition, and recent sales data of comparable properties in the area. This assessed value forms the basis for calculating the property tax owed.

In Indianapolis, the tax rate is expressed as a percentage of the assessed value. The exact rate can fluctuate from one area to another, influenced by the local government's financial requirements and the services it provides. For instance, areas with robust public schools or extensive municipal amenities might have higher tax rates to support these services.

| County | Tax Rate (2023) |

|---|---|

| Marion County | 0.97% |

| Hamilton County | 1.02% |

| Hancock County | 0.94% |

| Boone County | 0.98% |

| Johnson County | 1.01% |

These rates are indicative of the varying tax burdens across different counties within the Indianapolis metropolitan area. Homeowners can expect to pay taxes ranging from approximately 0.94% to 1.02% of their property's assessed value.

Property Tax Bills and Payment Options

Property tax bills are typically issued annually, with the due date varying depending on the county and local regulations. Homeowners can expect to receive their tax bills via mail or through online portals provided by the respective county tax offices.

Payment options for Indianapolis property taxes are designed to offer flexibility. Homeowners can choose to pay their taxes in full by the due date, often eligible for a slight discount if paid early. Alternatively, they can opt for installment plans, allowing them to spread the payment over several months, easing the financial burden.

Online payment portals and mobile apps provided by county tax offices have made the process more convenient, enabling homeowners to pay their taxes securely from the comfort of their homes.

Property Tax Exemptions and Deductions

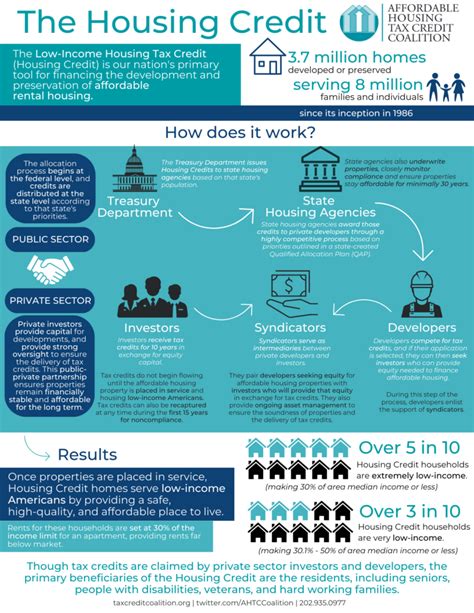

Indianapolis, like many other cities, offers various property tax exemptions and deductions to eligible homeowners. These incentives are designed to support specific groups, promote homeownership, and encourage investment in the local community.

- Homestead Deduction: Indianapolis provides a homestead deduction, reducing the assessed value of a primary residence. This deduction can significantly lower the property tax bill, providing financial relief to homeowners.

- Senior Citizen Deduction: Indianapolis offers a property tax deduction for senior citizens aged 65 and above. This deduction is applied to the assessed value of the property, reducing the tax liability for eligible homeowners.

- Veteran's Exemption: Indianapolis recognizes the service of veterans by offering a property tax exemption. This exemption reduces the assessed value of the property, resulting in lower tax obligations for veteran homeowners.

It's important for homeowners to understand the eligibility criteria and application processes for these exemptions and deductions. Consulting with local tax professionals or county tax offices can provide valuable guidance in maximizing these benefits.

Appealing Property Tax Assessments

In cases where homeowners believe their property’s assessed value is inaccurate or unfair, they have the right to appeal. The appeal process involves presenting evidence and justifications to support the claim that the assessed value is too high. This process can be complex and often requires professional assistance from tax consultants or attorneys.

Successful appeals can result in a reduction of the assessed value, leading to lower property taxes. However, it's important to approach the appeal process with careful consideration, as it can be time-consuming and may not always yield the desired outcome.

Impact of Property Taxes on the Indianapolis Housing Market

Property taxes play a pivotal role in shaping the Indianapolis housing market. They influence buyers’ decisions, impact investment strategies, and contribute to the overall economic landscape of the city.

Buyer Considerations

When prospective buyers evaluate properties in Indianapolis, they often consider the potential property tax liability. High property taxes can deter buyers, especially those on a tight budget or those seeking long-term affordability. On the other hand, lower tax rates can make a property more attractive, especially for buyers looking for long-term value.

Real estate agents and buyers often collaborate to analyze the potential tax implications of a property, factoring it into their decision-making process. This careful consideration ensures that buyers are fully informed about the financial obligations associated with their prospective homes.

Investment Strategies

For investors, property taxes are a critical factor in their decision-making process. They analyze the tax landscape to identify areas with competitive tax rates, which can significantly impact the profitability of their investments.

In Indianapolis, investors might consider properties in counties with lower tax rates, especially if they are purchasing multiple properties or aiming for long-term rentals. Lower taxes can translate to higher cash flow and improved return on investment.

Economic Impact

Property taxes in Indianapolis contribute significantly to the city’s economy. They fund essential services such as education, infrastructure development, public safety, and healthcare. These services, in turn, attract businesses and residents, fostering economic growth and development.

A robust property tax system ensures that the city can invest in its future, providing an attractive environment for businesses and individuals to thrive. It's a cyclical process where property taxes play a crucial role in maintaining and enhancing the city's economic vitality.

Conclusion

Indianapolis property taxes, like those in any city, are a complex but essential aspect of homeownership and investment. Understanding the tax landscape, the assessment process, and the available exemptions and deductions can empower homeowners and investors to make informed decisions.

As we've explored in this comprehensive guide, property taxes in Indianapolis vary across counties, influencing the financial obligations of homeowners and investors. The tax system, while complex, is designed to support the city's growth and development, making Indianapolis an attractive place to live, work, and invest.

For those navigating the Indianapolis property market, staying informed about tax rates, assessment processes, and available incentives is crucial. With this knowledge, homeowners and investors can make strategic decisions, ensuring they maximize the benefits and minimize the financial burdens associated with property taxes.

How often do property tax rates change in Indianapolis?

+Property tax rates in Indianapolis can change annually, influenced by the budgetary needs of the local government. However, significant fluctuations are generally uncommon, and any changes are typically announced in advance to allow homeowners to plan accordingly.

Are there any online resources to estimate my property tax bill in Indianapolis?

+Yes, many counties in Indianapolis provide online tools and calculators to estimate property tax bills. These tools consider factors like property value, location, and applicable exemptions. However, for an accurate estimate, it’s advisable to consult with a tax professional.

What happens if I miss the property tax payment deadline in Indianapolis?

+Missing the property tax payment deadline can result in penalties and interest charges. In some cases, prolonged non-payment can lead to tax liens on the property, which can impact its marketability and future sales. It’s crucial to stay informed about due dates and payment options to avoid such situations.