Michigan Income Tax Payment

When it comes to managing your finances and staying compliant with state regulations, understanding the intricacies of Michigan income tax payments is crucial. In this comprehensive guide, we will delve into the world of Michigan's tax system, providing you with expert insights and practical knowledge to navigate this essential aspect of financial management. From the fundamentals of income tax to the unique features of Michigan's tax structure, we'll cover everything you need to know to make informed decisions.

Unraveling Michigan’s Income Tax Landscape

Michigan, like many other states, imposes an income tax on its residents and businesses. This tax is a critical component of the state’s revenue stream, funding various public services and infrastructure projects. Understanding the specifics of Michigan’s income tax system is essential for individuals and businesses alike, as it directly impacts their financial planning and obligations.

Key Features of Michigan’s Income Tax System

Michigan operates on a graduated income tax system, which means that the tax rate increases as your income rises. This progressive structure aims to ensure that higher-income earners contribute a larger share of their income towards state revenue. The state currently employs a 4.25% flat tax rate for individuals and businesses, which is applicable to all forms of taxable income, including wages, salaries, and business profits.

In addition to the flat tax rate, Michigan also offers certain tax credits and deductions to alleviate the tax burden for eligible taxpayers. These incentives can significantly reduce the overall tax liability, making it crucial for individuals and businesses to stay informed about the available options.

Michigan’s Taxable Income Categories

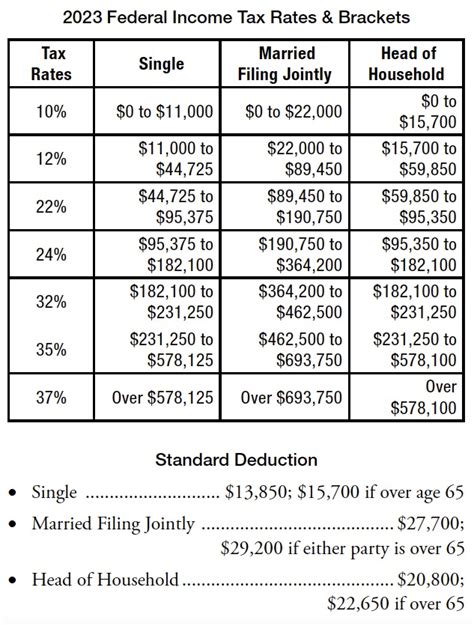

Michigan’s tax system categorizes income into various brackets, each carrying its own tax rate. These brackets are designed to ensure fairness and proportionality in tax payments. The current tax brackets for Michigan’s income tax are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $35,650 | 4.25% |

| $35,651 - $53,475 | 4.25% |

| $53,476 - $213,900 | 4.25% |

| Above $213,900 | 4.25% |

It's important to note that these tax brackets are subject to periodic adjustments to account for inflation and economic changes. Staying updated on these modifications is essential for accurate tax planning.

Navigating Michigan Income Tax Payments

Now that we’ve covered the fundamentals of Michigan’s income tax system, let’s explore the practical aspects of making these tax payments.

When and How to Pay Michigan Income Tax

Michigan’s tax year aligns with the federal tax year, spanning from January 1st to December 31st. Taxpayers are generally required to file their state income tax returns by April 15th of the following year. However, it’s crucial to stay updated on any potential deadline extensions or changes, especially during unique circumstances like the COVID-19 pandemic.

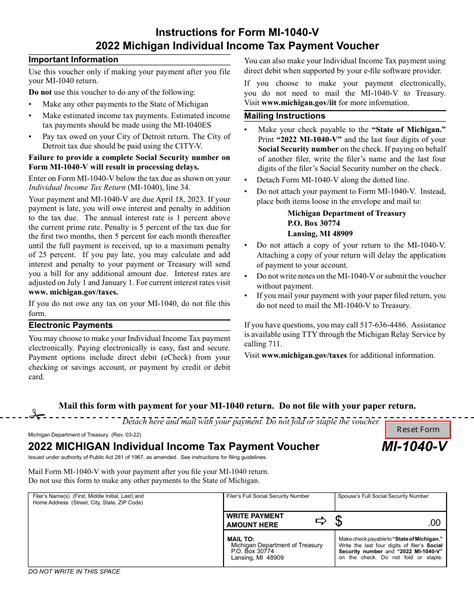

Michigan offers a range of payment options to accommodate different taxpayer preferences. These include:

- Electronic Payments: Taxpayers can make secure online payments through the Michigan Department of Treasury's website. This method is convenient and often preferred for its efficiency and accessibility.

- Credit Card Payments: Michigan accepts credit card payments for income tax, providing an alternative for those who prefer this payment method.

- Check or Money Order: Traditional methods of payment are also available. Taxpayers can mail their checks or money orders directly to the Michigan Department of Treasury, ensuring they include the necessary information for accurate processing.

It's important to note that Michigan imposes penalties and interest on late payments, so timely submission is crucial to avoid additional financial burdens.

Filing Michigan Income Tax Returns

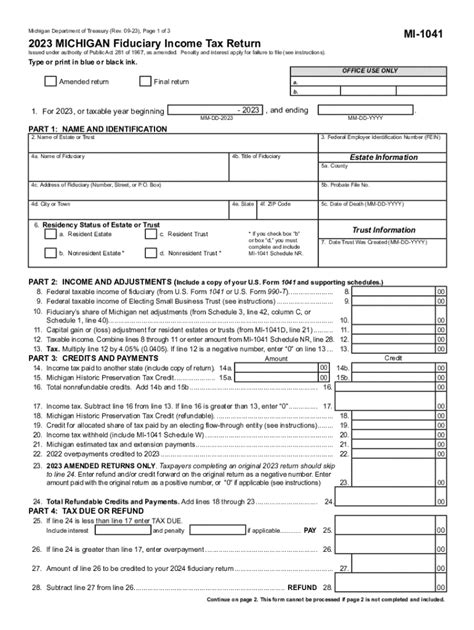

Filing your Michigan income tax return is a critical step in the process. The state provides various resources and forms to assist taxpayers in completing their returns accurately and efficiently. These forms include:

- Form 1040: The standard income tax return form for individuals.

- Form 1065: Designed for partnerships and limited liability companies (LLCs) to report their income and expenses.

- Form 1120: The corporate income tax return form for C-corporations.

- Form 1120S: Used by S-corporations to report their income and losses.

Each form is tailored to the specific needs of different taxpayer categories, ensuring that the tax return process is as straightforward as possible. The Michigan Department of Treasury's website provides comprehensive guides and resources to assist taxpayers in selecting and completing the appropriate forms.

Understanding Michigan’s Tax Benefits and Incentives

Michigan’s tax system is designed not only to collect revenue but also to provide incentives and support to its taxpayers. These tax benefits and incentives play a crucial role in shaping the state’s economic landscape and can significantly impact an individual’s or business’s financial planning.

Michigan Tax Credits and Deductions

Michigan offers a range of tax credits and deductions to alleviate the tax burden on eligible taxpayers. These incentives are designed to support specific industries, promote economic growth, and provide relief to certain segments of the population. Some of the key tax credits and deductions available in Michigan include:

- Michigan Business Tax Credit (MBTC): This credit is available to businesses that invest in Michigan and create new jobs. It provides a tax credit for a portion of the wages paid to new employees, encouraging economic development and job creation.

- Research and Development (R&D) Tax Credit: Michigan offers a tax credit for businesses that engage in qualifying research and development activities. This credit aims to incentivize innovation and technological advancements, fostering a competitive business environment.

- Low-Income Tax Credit: Michigan provides a tax credit for low-income individuals and families, offering financial relief and support to those with limited means. This credit can significantly reduce the tax liability for eligible taxpayers.

- Senior Citizen Property Tax Exemption: Senior citizens who meet certain age and income requirements may be eligible for a property tax exemption. This incentive helps reduce the financial burden of property taxes for Michigan's senior population.

These tax credits and deductions highlight Michigan's commitment to supporting its residents and businesses, making the state an attractive destination for economic growth and investment.

Michigan’s Tax Incentive Programs

In addition to tax credits and deductions, Michigan has implemented several tax incentive programs to attract businesses and promote economic development. These programs offer significant tax benefits to businesses that meet specific criteria, often related to job creation, investment, and industry-specific contributions.

- Michigan Business Development Program (MBDP): This program provides tax credits to businesses that create new jobs and invest in Michigan. It offers a competitive advantage to businesses looking to expand their operations and create economic opportunities.

- Michigan Main Street Program: Focused on revitalizing downtown areas and historic districts, this program offers tax incentives to businesses that locate or expand in designated Main Street districts. It aims to stimulate economic growth and preserve the unique character of Michigan's urban centers.

- Michigan Enterprise Zone Program: This program provides tax incentives to businesses that locate or expand in designated Enterprise Zones. These zones are typically areas of economic distress, and the program aims to encourage investment and job creation in these communities.

These tax incentive programs demonstrate Michigan's proactive approach to economic development, creating a supportive environment for businesses to thrive and contribute to the state's growth.

Staying Informed and Up-to-Date

In the ever-evolving world of tax regulations, staying informed is crucial. Michigan’s tax landscape is subject to periodic changes, updates, and amendments to ensure fairness and adaptability. Here are some key considerations to keep in mind to stay compliant and make informed financial decisions.

Tax Rate Changes and Adjustments

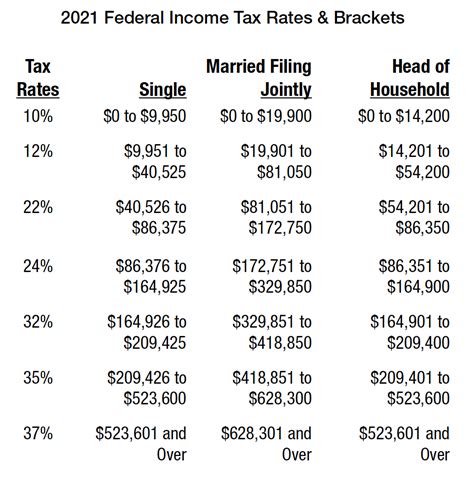

Michigan’s tax rates are not static and may undergo adjustments to account for economic factors, inflation, and legislative decisions. It’s essential to stay updated on any changes to the state’s tax rates, as these adjustments can significantly impact your tax liability.

The Michigan Department of Treasury regularly communicates tax rate updates through official channels, including their website and news releases. Subscribing to these updates and staying engaged with tax-related news ensures that you're aware of any changes affecting your financial planning.

Tax Law Amendments and Updates

Tax laws are subject to periodic amendments and updates, reflecting changes in economic policies and legislative priorities. Michigan’s tax laws are no exception, and staying informed about these amendments is crucial for accurate tax planning.

The Michigan Legislature and the Department of Treasury play pivotal roles in shaping and updating tax laws. Following their official websites, news releases, and subscribing to relevant newsletters ensures that you receive timely information about any changes to tax regulations.

Seeking Professional Tax Advice

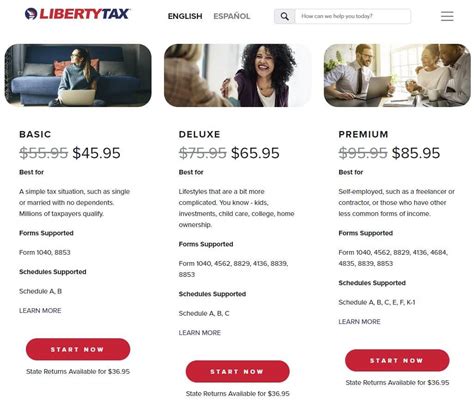

Navigating the complexities of tax regulations can be challenging, especially for individuals and businesses with unique financial circumstances. In such cases, seeking professional tax advice is highly recommended.

Engaging the services of a certified public accountant (CPA) or a tax attorney can provide valuable insights and guidance tailored to your specific needs. These professionals are well-versed in Michigan's tax laws and can assist with tax planning, compliance, and identifying potential tax-saving opportunities.

Additionally, seeking professional advice can help you navigate complex tax scenarios, such as business entity selection, investment strategies, and estate planning. Their expertise ensures that you make informed decisions and maximize your tax benefits.

Conclusion

Michigan’s income tax system is a critical component of the state’s economic framework, shaping the financial landscape for its residents and businesses. By understanding the fundamentals of Michigan’s tax structure, navigating the payment process, and leveraging the available tax benefits, individuals and businesses can effectively manage their financial obligations.

As you embark on your tax journey, remember that staying informed, seeking professional advice when needed, and staying compliant are key to successful tax management. Michigan's tax system, with its graduated income tax, tax credits, and incentives, provides a supportive environment for economic growth and financial stability.

We hope this comprehensive guide has provided you with the knowledge and insights needed to navigate Michigan's income tax landscape with confidence. Stay informed, stay compliant, and make informed financial decisions to thrive in Michigan's thriving economy.

What is the current income tax rate in Michigan for individuals and businesses?

+Michigan currently employs a flat tax rate of 4.25% for individuals and businesses. This rate applies to all forms of taxable income.

Are there any tax brackets in Michigan’s income tax system?

+Yes, Michigan’s income tax system has graduated tax brackets. The current brackets are: Up to 35,650, 35,651 - 53,475, 53,476 - 213,900, and above 213,900, with a flat tax rate of 4.25% across all brackets.

When is the deadline for filing Michigan income tax returns?

+The deadline for filing Michigan income tax returns is typically April 15th of the following year. However, it’s important to stay updated on any potential deadline extensions or changes.

What are some common tax credits and deductions available in Michigan?

+Michigan offers various tax credits and deductions, including the Michigan Business Tax Credit, Research and Development Tax Credit, Low-Income Tax Credit, and Senior Citizen Property Tax Exemption. These incentives aim to support businesses and provide relief to eligible taxpayers.

How can I stay updated on changes to Michigan’s tax laws and rates?

+To stay informed about tax law amendments and rate changes, subscribe to official updates from the Michigan Department of Treasury and the Michigan Legislature. Their websites and news releases provide valuable information on tax-related matters.