Dc Income Tax Calculator

For residents of the District of Columbia (DC), understanding and calculating income taxes is an essential part of financial planning. The DC Income Tax Calculator is a valuable tool that simplifies the process of determining tax liabilities and offers insights into the city's tax system. In this comprehensive guide, we will delve into the intricacies of the DC Income Tax Calculator, exploring its features, functionality, and the unique aspects of DC's tax landscape.

Unveiling the DC Income Tax Calculator

The DC Income Tax Calculator is an online tool designed to assist individuals and businesses in calculating their tax obligations accurately. Developed by the District of Columbia Office of Tax and Revenue, this calculator serves as a user-friendly interface, providing a seamless experience for taxpayers. Let’s explore its key features and how it simplifies the tax calculation process.

User-Friendly Interface

The DC Income Tax Calculator boasts a clean and intuitive interface, making it accessible to taxpayers of all backgrounds. Users can navigate through the calculator with ease, inputting relevant information step by step. The calculator is optimized for both desktop and mobile devices, ensuring convenience and flexibility.

Upon accessing the calculator, users are greeted with a straightforward form. The form requests essential details such as:

- Income Type: Users can select from various income sources, including wages, self-employment income, rental income, and more.

- Income Amount: Here, taxpayers input their annual income figures.

- Filing Status: The calculator supports different filing statuses, including single, married filing jointly, and head of household.

- Number of Dependents: Taxpayers can specify the number of dependents they claim.

The calculator dynamically adjusts based on the selected income type, presenting relevant questions to gather all necessary information. This tailored approach ensures accuracy and efficiency in the tax calculation process.

Real-Time Calculations

One of the standout features of the DC Income Tax Calculator is its real-time calculation capability. As users input their data, the calculator instantly computes the estimated tax liability. This instantaneous feedback provides taxpayers with a clear understanding of their potential tax obligations.

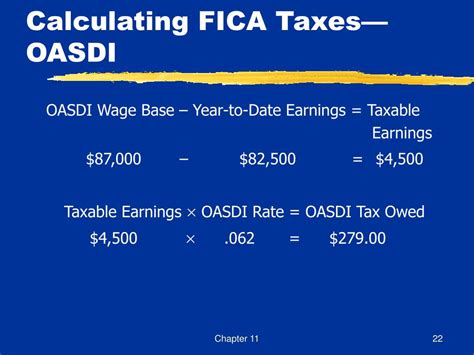

The calculator employs advanced algorithms that consider various factors, including tax rates, deductions, and credits. It takes into account the progressive nature of DC's tax system, applying different tax rates based on income brackets. This dynamic calculation ensures that taxpayers receive an accurate and up-to-date estimate of their tax liability.

Deductions and Credits

DC offers a range of deductions and credits to alleviate the tax burden on its residents. The Income Tax Calculator incorporates these deductions and credits, allowing taxpayers to maximize their tax savings. Here are some key deductions and credits that the calculator takes into account:

- Standard Deduction: The calculator applies the standard deduction, which varies based on filing status.

- Personal Exemptions: Taxpayers can claim personal exemptions for themselves and their dependents.

- Itemized Deductions: The calculator provides an option to input itemized deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Education Credits: DC offers education credits for eligible taxpayers pursuing higher education.

- Workforce Development Credit: Residents who participate in certain workforce development programs may qualify for this credit.

By considering these deductions and credits, the DC Income Tax Calculator empowers taxpayers to identify potential tax savings and optimize their financial planning.

Detailed Tax Estimate

Upon completing the form, the calculator presents a comprehensive tax estimate. This estimate includes a breakdown of the taxpayer’s income, deductions, and credits. It provides a clear picture of the tax liability, including the amount owed or the potential refund.

The estimate also offers insights into the taxpayer's tax bracket and the applicable tax rates. This information is invaluable for financial planning, as it allows taxpayers to understand their tax position and make informed decisions.

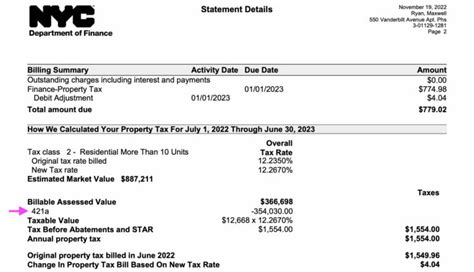

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 2.75% |

| $10,001 - $40,000 | 4% |

| $40,001 - $60,000 | 6% |

| Over $60,000 | 8.25% |

The table above provides an example of DC's progressive tax rates. The DC Income Tax Calculator applies these rates based on the taxpayer's income bracket, ensuring an accurate calculation.

Understanding DC’s Tax Landscape

DC’s tax system is unique, offering both challenges and opportunities for taxpayers. Let’s delve into some key aspects of DC’s tax landscape and how the Income Tax Calculator plays a role in navigating these intricacies.

Progressive Tax Rates

DC employs a progressive tax system, which means that higher incomes are taxed at higher rates. This approach aims to ensure fairness and contribute to the city’s revenue stream. The Income Tax Calculator reflects this system by applying the appropriate tax rates based on the taxpayer’s income bracket.

By understanding the progressive nature of DC's tax rates, taxpayers can make informed decisions about their financial strategies. The calculator's real-time calculations help taxpayers assess the impact of income adjustments on their tax liability.

Local Taxes and Deductions

In addition to federal taxes, DC residents must also consider local taxes. The city imposes a local income tax, which is separate from federal income tax. The Income Tax Calculator incorporates both federal and local tax obligations, providing a holistic view of the taxpayer’s tax responsibilities.

Furthermore, DC offers various local deductions and credits to promote economic development and support specific industries. These deductions and credits can significantly impact a taxpayer's overall tax liability. The calculator ensures that taxpayers are aware of these opportunities and can claim the applicable deductions and credits.

Tax Filing Requirements

DC residents are required to file tax returns annually, typically by April 15th. The Income Tax Calculator provides a convenient way to gather the necessary information for tax filing. It generates a detailed summary that taxpayers can use to prepare their tax returns accurately.

The calculator also offers guidance on the required forms and schedules for different income types. This assistance streamlines the tax filing process, reducing the likelihood of errors and ensuring compliance with DC's tax regulations.

Maximizing Tax Savings

The DC Income Tax Calculator is not just a tool for calculating tax liabilities; it’s also a powerful resource for maximizing tax savings. By understanding the deductions and credits available, taxpayers can optimize their financial strategies and minimize their tax burden.

Strategic Deduction Planning

DC offers a range of deductions that taxpayers can utilize to reduce their taxable income. The Income Tax Calculator provides a clear overview of these deductions, allowing taxpayers to assess their eligibility and plan accordingly.

For instance, taxpayers with significant medical expenses may benefit from the medical expense deduction. The calculator guides users through the process of claiming this deduction, ensuring they receive the maximum benefit.

Education and Workforce Credits

DC recognizes the importance of education and workforce development. As such, the city offers credits for taxpayers pursuing higher education or participating in workforce development programs.

The Income Tax Calculator highlights these credits and provides information on the eligibility criteria. Taxpayers can explore these opportunities and determine if they qualify for these valuable tax benefits.

Tax Planning Strategies

The DC Income Tax Calculator empowers taxpayers to engage in proactive tax planning. By understanding their tax liability in real time, taxpayers can make informed decisions about their financial choices.

For instance, taxpayers can assess the impact of contributing to tax-advantaged retirement accounts or making charitable donations. The calculator's instant feedback allows taxpayers to explore different scenarios and choose the most tax-efficient strategies.

Conclusion

The DC Income Tax Calculator is an invaluable tool for residents of the District of Columbia. It simplifies the tax calculation process, provides insights into DC’s tax landscape, and empowers taxpayers to maximize their tax savings. By utilizing this calculator, taxpayers can navigate the complexities of DC’s tax system with confidence and precision.

As you embark on your tax planning journey, remember to stay informed about the latest tax regulations and guidelines. Consult official resources and seek professional advice when needed. With the DC Income Tax Calculator as your companion, you can approach tax season with ease and ensure compliance with DC's tax requirements.

How accurate is the DC Income Tax Calculator?

+The DC Income Tax Calculator is designed to provide accurate tax estimates based on the information entered. However, it’s important to note that the calculator’s accuracy depends on the correctness and completeness of the input data. Taxpayers should carefully review their inputs and ensure they provide accurate details. Additionally, the calculator’s estimates may not account for certain complex tax situations or unique circumstances. It is recommended to consult a tax professional for personalized advice.

Can I use the calculator for business taxes?

+Yes, the DC Income Tax Calculator can be used to estimate business tax liabilities. It supports various income types, including business income, and takes into account applicable deductions and credits. However, it’s essential to note that business tax calculations can be more complex. For comprehensive business tax planning, it is advisable to seek guidance from a tax professional who specializes in business taxation.

What if I have multiple sources of income?

+The DC Income Tax Calculator accommodates taxpayers with multiple income sources. It allows you to input each income stream separately, considering different tax rates and deductions. This feature ensures that your tax estimate reflects the combined impact of your various income sources.

Are there any limitations to the calculator’s functionality?

+While the DC Income Tax Calculator is a powerful tool, it may have certain limitations. It is designed for general tax calculations and may not cover highly specialized tax situations or complex structures. For specific tax scenarios or detailed advice, it is recommended to consult a tax professional who can provide personalized guidance based on your unique circumstances.

How often should I use the calculator during the tax year?

+Using the DC Income Tax Calculator regularly throughout the tax year can be beneficial for tax planning. It allows you to assess the impact of financial decisions and adjust your strategy accordingly. However, the frequency of use depends on your personal preferences and the complexity of your financial situation. As a general guideline, it is advisable to use the calculator at least once during the tax year to ensure you are on track with your tax obligations.