Decoding Property Rules: What Is A Tax Deed?

When exploring the intricate landscape of property ownership and its associated legal frameworks, one encounters the specialized concept of a tax deed. This legal instrument encapsulates a critical phase within the broader system of municipal revenue collection, property foreclosure, and real estate transactions. Understanding what a tax deed is, how it functions within the property law ecosystem, and its implications for property rights is not merely academic but essential for investors, legal professionals, and property owners alike. By adopting a systems thinking perspective, we can map out the interconnected components—tax authorities’ revenue needs, the process of delinquency enforcement, statutory rules governing auction procedures, and the transfer of ownership rights—and evaluate how this specific instrument influences the stability, transparency, and fairness of property markets.

Unpacking the Tax Deed: An Essential Component of Property and Revenue Systems

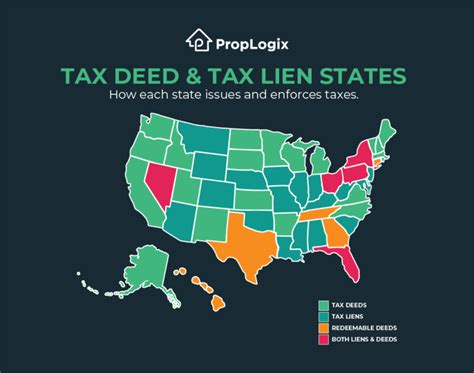

A tax deed represents a legal document issued through a foreclosure process initiated by local taxing authorities when property owners fail to pay their property taxes. It signifies a transfer of ownership—typically a county or municipality’s claim—over a delinquent property to a third party after a specified period of unpaid taxes, penalties, and interest accumulate to a threshold that triggers foreclosure proceedings. Unlike a tax lien, which is a security interest attached to the property for the unpaid taxes, a tax deed conveys actual title, granting the holder, often an investor or a subsequent property owner, legal ownership free of the prior owner’s interests (subject to certain statutory caveats).

The Role of Tax Deeds in Municipal Revenue Collection and Property Market Dynamics

This instrument operates at the nexus of municipal revenue needs, property law, and real estate market activity. Local governments rely heavily on property taxes as a main revenue stream to finance public services such as education, infrastructure, and safety. When taxpayers default on their obligations, municipalities initiate foreclosure proceedings to recover unpaid taxes, thereby safeguarding their fiscal stability. From a systems perspective, the process of issuing a tax deed dynamically influences property prices, investment strategies, and neighborhood stability, as it introduces a regulated method by which properties can move from delinquent owners to new ones. This process also impacts the liquidity of the real estate market and shapes investor perceptions about risk and yield derived from tax foreclosure sales.

| Relevant Category | Substantive Data |

|---|---|

| Frequency of Tax Deed Sales | In the United States, approximately 1-2% of taxable properties are sold via tax deeds annually, varying significantly by jurisdiction and economic conditions |

Legal Foundations and Procedural Mechanics of Tax Deeds

Understanding what a tax deed fundamentally entails requires an appreciation of the legislative and procedural structures that underpin its issuance. Most jurisdictions codify their procedures within state statutes or municipal ordinances, establishing timelines, notices, public sales, and deed issuance protocols. The process generally unfolds through these interconnected stages:

- Delinquency and Notice: The taxing authority sends notices of delinquency to the property owner, often multiple times, offering opportunities for voluntary payment.

- Tax Sale Announcement: When taxes remain unpaid after the statutory grace period, the authority schedules a public auction, advertised publicly, to sell the tax lien or directly the property in some jurisdictions.

- Tax Sale and Bidding: Interested bidders purchase tax certificates or the property itself, often through a competitive bidding process, which may involve premium bidding above the owed tax amount.

- Redemption and Foreclosure: Before or during the sale, the property owner or third-party can often redeem the property by paying the owed taxes plus interest and costs, although this is less common once a tax deed sale occurs.

- Deed Issuance: After the sale, if the property remains unredeemed, the taxing authority issues a tax deed to the highest bidder, transferring full ownership rights.

Legal Challenges and Consumer Protections

Tax deed statutes often include provisions for challenge rights by previous owners, safeguards against fraudulent sales, and requirements for clear, timely notices. Courts have historically scrutinized the fairness and transparency of the sale process, emphasizing due process protections—especially in cases involving vulnerable owners or complex property portfolios.

| Relevant Category | Substantive Data |

|---|---|

| Minimum Redemption Period | Typically ranges from 6 months to 2 years post-sale, varying by jurisdiction |

Interdependencies: How Tax Deeds Influence and Are Influenced by Broader Systems

Viewing tax deeds through a system thinking lens reveals complex interdependencies: tax enforcement actions affect overall property ownership stability, which in turn influences social equity and economic development. The issuance of a tax deed can catalyze a sequence of events including neighborhood revitalization when properties are returned to productive use, or increased blight if properties are abandoned post-foreclosure.

In effect, the system comprises multiple interconnected elements:

- Municipal fiscal health: Determines the volume of delinquent properties and the aggressiveness of tax enforcement.

- Legal environment: Includes statutory rules, court rulings, and policy changes influencing foreclosure procedures.

- Market acceptance: The willingness of investors and neighboring property owners to participate, which feeds back into market stability and property values.

Tax Deed Auctions as Market Signals

Beyond their legal function, tax deed auctions serve as market indicators—reflecting economic stress levels, investor confidence, and the effectiveness of local governance. High volumes of tax deed sales may unveil economic distress, while low volumes often suggest stable fiscal management and property markets.

Key Points

- Mechanism of a tax deed: Legal transfer of ownership following unpaid property taxes after statutory procedures.

- Procedural safeguards: Ensure due process, transparency, and legal validity of the foreclosure sale.

- Systemic impact: Influences municipal finance, neighborhood stability, and real estate market dynamics.

- Market significance: Acts as an indicator of economic health and investor confidence.

- Interconnectedness: Interacts with legal, economic, and social systems shaping property rights ecosystems.

Conclusion: Navigating the Complex Web of Property Rules through the Lens of a Tax Deed

The function and significance of a tax deed extend beyond mere statutory language; they embody a vital mechanism for balancing municipal revenue needs, protecting property rights, and maintaining market integrity. Appreciating the interconnected components—legal procedures, economic influences, social implications—allows stakeholders to navigate and potentially optimize this complex system. As jurisdictions refine their statutory frameworks, the ongoing challenge remains to ensure transparency, fairness, and efficiency, which collectively uphold trust in the legal authority’s capacity to regulate property rights amidst evolving economic conditions.

What is a tax deed in relation to property ownership?

+A tax deed is a legal document transferring ownership of a property to a new holder after the owner fails to pay property taxes, following a formal foreclosure process conducted by local taxing authorities.

How does the process of issuing a tax deed work?

+The process involves notifying the delinquent owner, conducting a public auction or sale, and, if unpaid, issuing a deed to the highest bidder, following statutory procedures designed to ensure legality and fairness.

What are the economic implications of tax deed sales?

+Tax deed sales act as indicators of economic stress and influence neighborhood stability, market liquidity, and municipal revenue stability, shaping investor confidence and community development over time.