Sales Tax In New Jersey

Sales tax is an essential component of the revenue system in the United States, with each state implementing its own tax laws and regulations. New Jersey, known as the "Garden State," has a unique sales tax structure that impacts both residents and businesses. Understanding the intricacies of sales tax in New Jersey is crucial for individuals and companies operating within its borders.

The Basics of Sales Tax in New Jersey

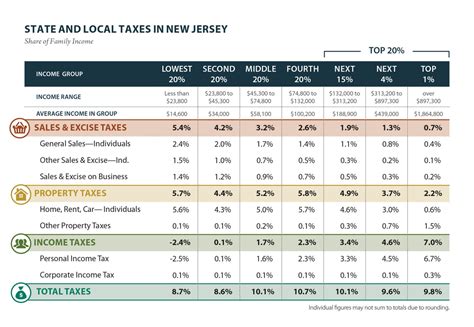

Sales tax in New Jersey is a consumption tax levied on the sale of tangible personal property and certain services. It is an important source of revenue for the state, contributing to the funding of various public services and infrastructure projects. The state’s sales tax is administered by the New Jersey Division of Taxation, which oversees compliance and collects tax revenues.

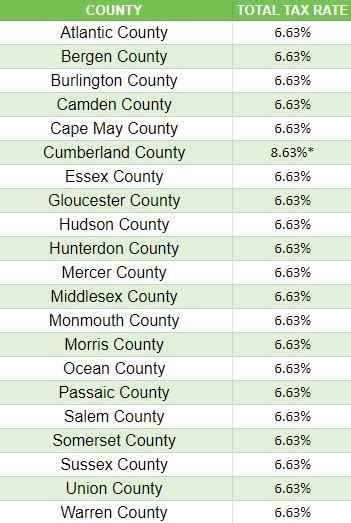

The sales tax rate in New Jersey is a flat 6.625% as of my last update in January 2023. This rate is applicable across the state and is imposed on the total purchase price, including any applicable discounts or promotions. However, it's important to note that there are specific exemptions and additional local taxes that can impact the overall sales tax burden.

Exemptions and Special Considerations

New Jersey offers a range of sales tax exemptions to certain goods and services. These exemptions are designed to provide relief to specific industries, promote economic growth, and support social causes. Here are some notable exemptions in the state:

- Food and beverages intended for home consumption are exempt from sales tax, including groceries, non-alcoholic beverages, and most prepared foods.

- Prescription and non-prescription medications are tax-free, as are medical devices and equipment.

- Clothing and footwear purchases under $100 are exempt from sales tax, providing a benefit to shoppers.

- Books, regardless of format (print or electronic), are exempt, encouraging literacy and education.

- Certain agricultural products and farm machinery are exempt, supporting the state's agricultural industry.

- Sales of tangible personal property to businesses for use in manufacturing or research and development are exempt.

Additionally, New Jersey allows for the collection of local sales taxes by municipalities. These local taxes can be added to the state sales tax rate, resulting in varying tax rates across different regions. As of my last update, several municipalities in New Jersey have local sales tax rates, with some exceeding the state's base rate. For example, the city of Atlantic City imposes an additional 3.5% local tax, bringing the total sales tax rate to 10.125%.

Registration and Compliance

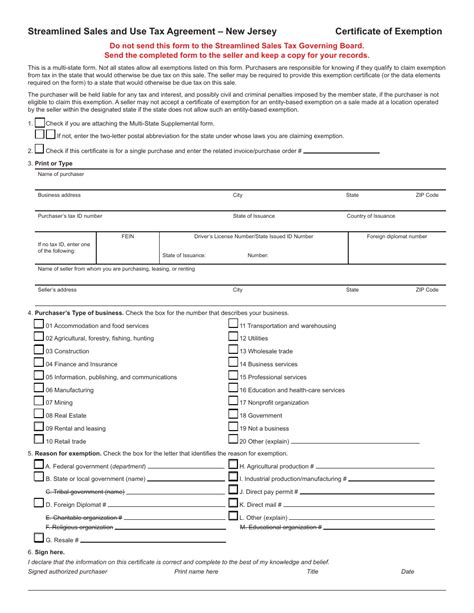

Businesses operating in New Jersey are required to register with the Division of Taxation to obtain a Seller’s Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state. Failure to register and comply with sales tax regulations can result in penalties and legal consequences.

Registered businesses must collect sales tax from customers at the point of sale and remit the collected tax to the state on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to quarterly filings.

Sales Tax Filing and Payment

Sales tax filing and payment in New Jersey is a straightforward process for registered businesses. The state provides online tools and resources to facilitate accurate and timely compliance.

Online Filing and Payment

The New Jersey Division of Taxation offers an online portal, NJ TAXPAYER ACCESS POINT (TAP), which allows registered businesses to file and pay sales tax electronically. TAP provides a secure and convenient platform for tax administration, enabling businesses to manage their tax obligations efficiently.

Through TAP, businesses can:

- File sales tax returns and make payments online.

- View and manage tax account information.

- Access forms, publications, and other tax-related resources.

- Receive email notifications and alerts regarding tax due dates and updates.

Filing Deadlines and Due Dates

Sales tax returns in New Jersey are due on the 25th day of the month following the reporting period. For example, sales tax collected in January would be due on February 25th. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Businesses with a high sales volume may be required to file more frequently, such as monthly or biweekly. The Division of Taxation determines the filing frequency based on the business's sales history and other factors.

Penalties and Interest

Late filing or payment of sales tax can result in penalties and interest charges. The state imposes a penalty of 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 0.75% per month, or 9% annually.

It's important for businesses to stay compliant with their sales tax obligations to avoid these penalties and maintain a positive tax standing with the state.

Sales Tax Audits and Enforcement

The New Jersey Division of Taxation conducts sales tax audits to ensure compliance with the state’s tax laws. Audits can be random or targeted based on various factors, including industry sector, sales volume, and potential tax risks.

Audit Process

During an audit, the Division of Taxation may request various records and documentation from the business, including sales records, invoices, and purchase orders. The business is required to cooperate and provide the requested information within a specified timeframe.

The audit process typically involves a review of the business's sales tax returns, a comparison of sales data to tax returns, and an examination of the business's accounting and record-keeping practices.

Audit Findings and Remedies

If an audit identifies errors or discrepancies in the business’s sales tax filings, the Division of Taxation will issue a notice of assessment. This notice details the additional tax due, along with any penalties and interest accrued.

Businesses have the right to dispute the assessment by providing additional information or requesting a formal hearing. However, it's important to note that the burden of proof lies with the business to demonstrate that the assessment is inaccurate.

Sales Tax and E-commerce

With the growth of e-commerce, New Jersey, like many other states, has implemented regulations to ensure the collection of sales tax on online transactions. The state’s sales tax laws apply to remote sellers, including out-of-state businesses that make sales to New Jersey residents.

Economic Nexus and Sales Tax Collection

New Jersey has adopted the economic nexus standard, which requires out-of-state sellers to collect and remit sales tax if they meet certain thresholds of economic activity within the state. These thresholds are based on factors such as the number of transactions or the total sales revenue generated in New Jersey.

Out-of-state sellers that exceed these thresholds are required to register with the Division of Taxation and collect sales tax on their New Jersey sales. This ensures that e-commerce businesses contribute to the state's revenue stream, similar to traditional brick-and-mortar stores.

Marketplace Facilitator Rules

New Jersey has also implemented marketplace facilitator rules, which hold online marketplaces and third-party sellers accountable for sales tax collection. Under these rules, online marketplaces that facilitate sales to New Jersey residents must collect and remit sales tax on behalf of their sellers.

Marketplace facilitators are responsible for registering with the state, collecting the appropriate sales tax from buyers, and remitting the tax to the Division of Taxation. This simplifies the tax collection process for both the state and small online sellers who may not have the resources to navigate complex tax regulations.

Impact of Sales Tax on Consumers and Businesses

Sales tax has a direct impact on both consumers and businesses operating in New Jersey. Understanding these impacts can help individuals make informed purchasing decisions and assist businesses in managing their tax obligations effectively.

Consumer Perspective

For consumers, sales tax adds to the overall cost of goods and services. It is an additional expense that can influence purchasing behavior and budget planning. The flat sales tax rate in New Jersey provides predictability for consumers, allowing them to estimate the total cost of their purchases accurately.

The exemptions and special considerations in New Jersey's sales tax structure can also benefit consumers. For example, the exemption on food and beverages for home consumption can result in significant savings for households, particularly those with larger families.

Business Perspective

Businesses in New Jersey are responsible for collecting and remitting sales tax on behalf of the state. This adds administrative overhead to their operations, as they must ensure accurate tax collection and timely filing of returns.

The state's sales tax laws, including economic nexus and marketplace facilitator rules, impact businesses engaged in e-commerce. These regulations require businesses to navigate complex tax obligations across multiple jurisdictions, which can be challenging for small and medium-sized enterprises.

Additionally, businesses must stay informed about changes in sales tax rates and exemptions to ensure compliance and avoid penalties. This ongoing compliance effort requires dedicated resources and attention.

Sales Tax in New Jersey: Future Considerations

As with any tax system, the sales tax landscape in New Jersey is subject to change and evolution. Several factors can influence future developments in the state’s sales tax structure.

Potential Rate Changes

Sales tax rates can be adjusted to meet the state’s revenue needs or to provide economic stimulus. While the current rate of 6.625% is relatively stable, there is always a possibility of future rate changes, either upward or downward, depending on economic conditions and legislative decisions.

Exemption Reviews

The state may periodically review its list of sales tax exemptions to ensure that they align with current economic priorities and social needs. Exemptions can be added, removed, or modified to reflect changing circumstances. For example, new exemptions may be introduced to support emerging industries or to provide relief to specific sectors impacted by economic downturns.

Digital Economy and E-commerce

The continued growth of the digital economy and e-commerce presents ongoing challenges for sales tax collection. New Jersey, along with other states, will need to adapt its tax regulations to keep pace with the evolving landscape of online sales. This may involve further refinement of economic nexus rules and marketplace facilitator obligations to ensure fair tax collection from remote sellers.

Streamlining Tax Administration

Efforts to streamline tax administration and enhance compliance can be expected in the future. The state may invest in technology upgrades and improved data analytics to enhance its tax collection processes and reduce the burden on businesses. Additionally, the Division of Taxation may explore partnerships with other states to harmonize tax regulations and simplify compliance for businesses operating across state lines.

Public Policy Considerations

The state’s sales tax structure is influenced by public policy considerations, including economic development goals, social equity, and environmental initiatives. As these policies evolve, the sales tax system may be adjusted to support the state’s broader objectives. For example, sales tax exemptions or incentives may be introduced to promote sustainable practices or encourage investment in specific industries.

Conclusion

Sales tax in New Jersey is a critical component of the state’s revenue system, impacting both residents and businesses. Understanding the state’s sales tax laws, rates, and exemptions is essential for compliance and effective tax management. As the Garden State continues to evolve, its sales tax structure will adapt to meet the changing needs of its economy and citizens.

What is the current sales tax rate in New Jersey as of my last update in January 2023?

+The current sales tax rate in New Jersey is a flat 6.625%.

Are there any sales tax exemptions in New Jersey?

+Yes, New Jersey offers various sales tax exemptions, including food and beverages for home consumption, prescription medications, clothing and footwear under $100, books, agricultural products, and sales of tangible personal property to businesses for manufacturing or R&D.

Do local governments in New Jersey have the authority to impose additional sales taxes?

+Yes, certain municipalities in New Jersey have the authority to impose additional local sales taxes. These local taxes can be added to the state sales tax rate, resulting in varying tax rates across different regions.

How often do businesses in New Jersey need to file and pay sales tax?

+Sales tax returns in New Jersey are due on the 25th day of the month following the reporting period. The filing frequency can vary based on sales volume, with some businesses required to file monthly or biweekly.

What happens if a business fails to register or comply with sales tax regulations in New Jersey?

+Businesses that fail to register or comply with sales tax regulations in New Jersey may face penalties and legal consequences. It’s important for businesses to obtain a Seller’s Permit and stay compliant with their tax obligations.