Montana State Taxes

Montana, a beautiful state known for its vast landscapes and outdoor adventures, offers a unique tax system that differs significantly from many other states in the US. Understanding Montana's state taxes is crucial for residents, businesses, and even tourists, as it impacts their financial planning and obligations.

An Overview of Montana’s Tax System

Montana’s tax system is designed to fund essential services and infrastructure while keeping the burden on taxpayers relatively low. The state collects various taxes, including income tax, sales tax, property tax, and several specialized taxes. Let’s delve into each of these tax categories to provide a comprehensive understanding.

Income Tax: A Progressive Approach

Montana imposes an income tax on its residents and non-residents with income sourced from the state. The income tax is progressive, meaning the tax rate increases as taxable income rises. As of [insert date of accuracy], Montana has six income tax brackets, ranging from 0% to 6.9%. Here’s a breakdown of the income tax brackets for individuals:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $3,550 | 0% |

| $3,551 - $7,100 | 2% |

| $7,101 - $10,650 | 3% |

| $10,651 - $18,000 | 4% |

| $18,001 - $36,000 | 5% |

| $36,001 and above | 6.9% |

These rates apply to single filers, while married couples may enjoy a slightly lower tax rate depending on their combined income. It's important to note that Montana's income tax laws are subject to periodic updates, so it's advisable to refer to the official Montana Department of Revenue website for the most current information.

Sales Tax: A Statewide Flat Rate

Sales tax in Montana is a flat 4% rate applied to most goods and services. This rate is consistent across the state, making it simple for businesses and consumers to understand. However, there are some notable exceptions and additional taxes that may apply:

- Certain goods, such as food, prescription drugs, and medical supplies, are exempt from sales tax.

- Local jurisdictions, like cities and counties, can impose additional sales taxes, resulting in a higher total tax rate.

- Specific industries, like lodging and vehicle sales, may have additional taxes or fees on top of the base sales tax.

For instance, if you're staying in a hotel in the city of Billings, you might pay a combined sales tax rate of around 7%, including the state sales tax and local lodging tax.

Property Tax: A Local Matter

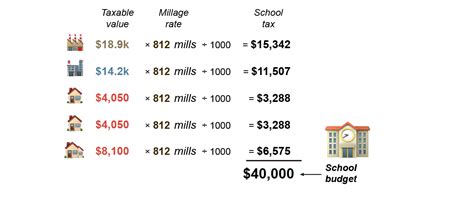

Property tax in Montana is primarily a local tax, with rates varying significantly between counties and even within counties. The tax is levied on the assessed value of real property, which includes land and improvements like buildings. Here’s a general overview:

- The assessed value is typically a percentage of the market value, and this rate can vary from 5% to 10% depending on the county.

- The taxable value is then calculated by subtracting any applicable exemptions, such as the homeowner's exemption or the farm/ranch exemption.

- The tax rate is applied to the taxable value to determine the property tax owed. These rates can range from 3 mills to 20 mills (where 1 mill equals $1 per $1,000 of taxable value) and are set by local governments.

For example, a property in Gallatin County with an assessed value of $300,000 and a taxable value of $240,000 (after exemptions) would have a property tax bill of approximately $720 if the mill rate is 3 mills.

Specialized Taxes: From Lodging to Tobacco

Montana also imposes various specialized taxes to fund specific services and programs. These include:

- Lodging Tax: A 7% tax on the cost of lodging, including hotels, motels, and vacation rentals. This tax is often used to support tourism-related initiatives.

- Vehicle License Tax: This tax is based on the value of a vehicle and is due when registering or renewing vehicle registration. The tax rate varies but is typically around 1.5% of the vehicle's value.

- Tobacco Tax: Montana imposes a tax on the sale of cigarettes and other tobacco products. As of [insert date of accuracy], the tax rate is $2.00 per pack of cigarettes and 20% of the wholesale price for other tobacco products.

- Severance Tax: This tax is levied on the extraction of natural resources, such as oil, gas, and minerals. The rates vary depending on the resource and are used to fund natural resource management and conservation efforts.

Tax Benefits and Incentives

Montana offers several tax benefits and incentives to encourage economic development, support businesses, and assist individuals. These include:

Business Tax Incentives

- Enterprise Zone Tax Credits: Businesses operating in designated Enterprise Zones can qualify for tax credits, including income tax credits and sales tax exemptions, to promote job creation and investment.

- Research and Development Tax Credits: Montana provides tax credits for businesses engaged in research and development activities, encouraging innovation and technological advancements.

- Manufacturing and Processing Tax Credits: Manufacturers and processors can benefit from tax credits to offset their Montana income tax liability, fostering economic growth in these sectors.

Individual Tax Benefits

- Homeowner’s Exemption: Qualified homeowners can apply for a homeowner’s exemption, which reduces the taxable value of their property by up to $2,000, resulting in lower property taxes.

- Veteran’s Exemption: Montana offers property tax exemptions to eligible veterans, providing relief for those who have served our country.

- Farm and Ranch Land Tax Relief: Owners of agricultural land can apply for tax relief, ensuring that farm and ranch lands are taxed at a lower rate, promoting the state’s agricultural industry.

Tax Filing and Payment

Taxpayers in Montana have various options for filing and paying their taxes. The Montana Department of Revenue provides an online filing system, allowing individuals and businesses to submit their tax returns electronically. For those who prefer traditional methods, paper returns can be mailed. Payment options include electronic funds transfer, credit card, check, or money order.

Due Dates

The tax year in Montana runs from January 1st to December 31st. Individual income tax returns are due on April 15th of the following year, while business tax returns have varying due dates depending on the type of business.

Conclusion

Montana’s tax system is designed to be fair and supportive of the state’s economy and residents. By offering a progressive income tax, a simple sales tax structure, and a range of specialized taxes, the state ensures a steady revenue stream for essential services while providing tax benefits and incentives to promote growth and development. Understanding these tax laws is crucial for individuals and businesses operating in or planning to relocate to Montana.

What is the average effective tax rate in Montana for individuals?

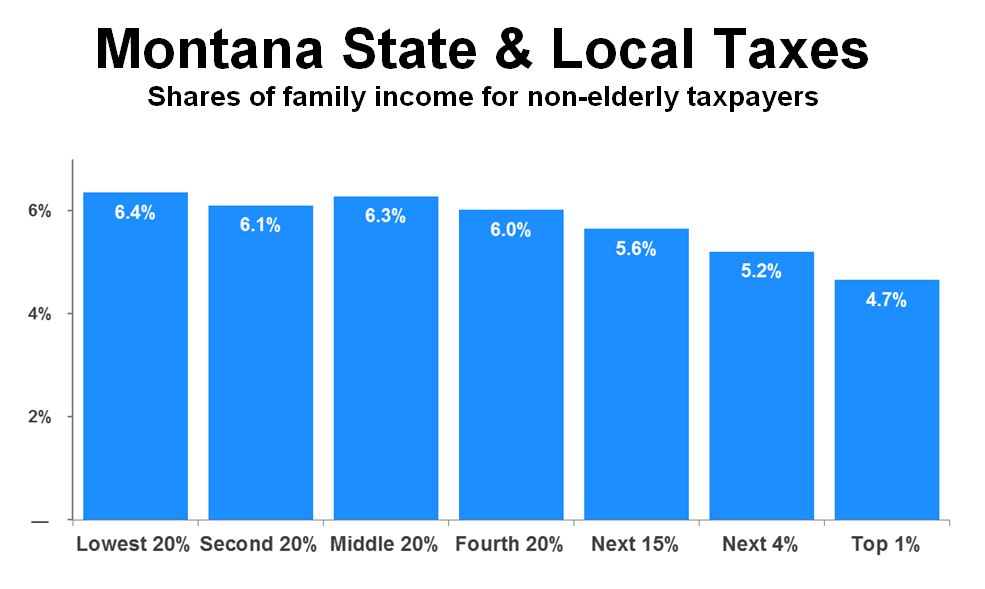

+The average effective tax rate for individuals in Montana varies based on income and specific circumstances. However, it generally falls within the range of 4% to 7%, including income tax, sales tax, and property tax.

Are there any tax breaks for retirees in Montana?

+Yes, Montana offers several tax benefits for retirees. These include a partial exemption on retirement income and a property tax exemption for qualified seniors. These incentives make Montana an attractive retirement destination.

How often are Montana’s tax laws updated?

+Montana’s tax laws are subject to periodic updates and changes. The Montana Legislature convenes annually, and tax-related bills can be introduced and passed during these sessions. It’s important to stay informed and refer to official sources for the latest tax information.