California Business Tax

California, the Golden State, is not only known for its diverse landscapes, vibrant cities, and entertainment industry but also for its thriving business environment. With a robust economy and a wide range of industries, the state attracts businesses of all sizes, from startups to multinational corporations. However, with the benefits come the complexities of California's tax system, which can be a challenging aspect for entrepreneurs and business owners.

Understanding and navigating the California business tax landscape is crucial for any entity operating within the state's borders. This comprehensive guide aims to shed light on the intricacies of California's tax regulations, offering valuable insights and practical advice to help businesses manage their tax obligations effectively.

Unraveling the California Business Tax Structure

California’s tax system is a comprehensive framework designed to support the state’s various government operations and services. While it may appear daunting at first glance, breaking it down into its core components can provide a clearer understanding of how it works.

Sales and Use Tax

One of the most prominent taxes in California is the Sales and Use Tax. This tax is levied on the sale of tangible goods and certain services within the state. It’s a consumption tax, meaning it’s paid by the end consumer, but it’s collected and remitted by businesses. The tax rate varies depending on the location of the sale, with a state-wide base rate and additional local rates.

For instance, consider a tech startup selling electronic devices online. If the device is shipped to a customer in Los Angeles, the business would need to calculate the tax based on the combined state and city rates, ensuring compliance with the local tax laws.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Los Angeles County Sales Tax | 2.25% |

| Los Angeles City Sales Tax | 1.25% |

This example highlights the complexity of sales tax, especially for businesses operating in multiple locations or selling products with varying tax rates.

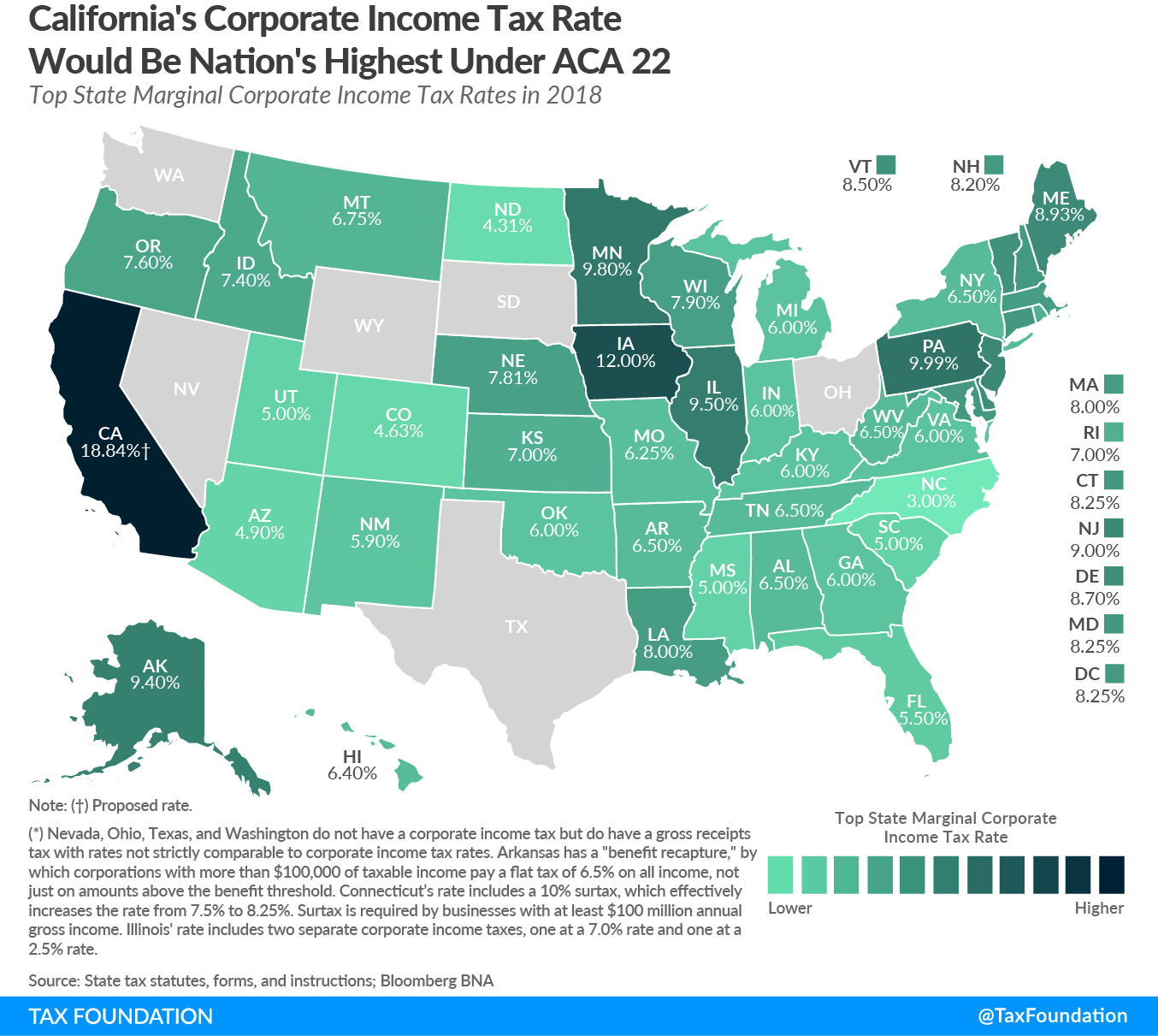

Income Tax

California imposes an income tax on businesses, similar to the federal income tax. This tax applies to various entities, including corporations, partnerships, and sole proprietorships. The income tax rate is progressive, meaning it increases as the taxable income rises. For instance, a corporation with a taxable income of over $250,000 would be subject to a higher tax rate than a smaller business.

Consider a software development company based in San Francisco. Despite its success, the company's profits are affected by the state's income tax rates. Understanding the tax brackets and planning strategies can help businesses like this one optimize their tax liabilities.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $250,000 | 8.84% |

| $250,001 - $500,000 | 9.3% |

| $500,001 and above | 11.3% |

Franchise Tax

The Franchise Tax is a unique aspect of California’s tax system. It’s an annual tax levied on the privilege of doing business in the state. This tax applies to most business entities, including corporations, LLCs, and even certain partnerships. The tax rate for corporations is 8.84% of the net income, with potential surcharges for larger businesses.

Imagine a small business owner who recently registered their LLC in California. They now face the responsibility of understanding and complying with the franchise tax, an additional layer of complexity in their tax obligations.

Navigating California’s Tax Obligations

With the diverse tax landscape in California, it’s crucial for businesses to stay informed and proactive in managing their tax obligations. Here are some key strategies and considerations to navigate the system effectively.

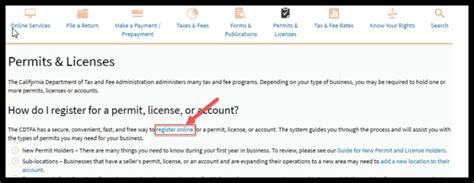

Registration and Compliance

The first step for any business operating in California is to register with the state’s tax agencies. This process ensures that the business is recognized and can comply with the necessary tax regulations. Registration typically involves providing basic business information and obtaining tax identification numbers.

For example, an online retailer selling health and beauty products would need to register with the California Department of Tax and Fee Administration to obtain a Seller's Permit, enabling them to collect and remit sales tax.

Staying compliant with tax regulations is an ongoing responsibility. Businesses must regularly update their records, file tax returns on time, and pay the appropriate taxes. Non-compliance can lead to penalties and legal issues, affecting the business's operations and reputation.

Tax Planning and Strategy

Proactive tax planning is a valuable tool for businesses in California. By understanding the tax landscape and potential deductions or incentives, businesses can optimize their tax strategies. This may involve seeking professional advice from tax consultants or accountants who specialize in California’s unique tax system.

Consider a manufacturing company planning to expand its operations. A well-thought-out tax strategy could involve leveraging tax incentives for job creation or investing in certain industries. This proactive approach can not only reduce tax liabilities but also support the business's growth and development.

Electronic Filing and Payment Options

California offers electronic filing and payment options for most tax types, providing convenience and efficiency for businesses. Online platforms allow businesses to file tax returns, make payments, and manage their tax accounts digitally.

For instance, a tech startup can utilize the California Electronic Tax System (CalEFile) to file its income tax returns, saving time and reducing the risk of errors compared to traditional paper filing.

The Impact of California Business Tax

California’s business tax system has a significant impact on the state’s economy and the businesses operating within its borders. While it provides essential revenue for state operations, it also influences business decisions and strategies.

Economic Impact and Business Growth

The tax revenue generated by businesses in California funds various state services, including education, healthcare, infrastructure, and more. This support is crucial for maintaining a strong economy and providing essential services to residents.

However, the tax system can also impact business growth and investment decisions. High tax rates may discourage businesses from expanding or relocating to California, while tax incentives and deductions can attract new investments and support existing businesses.

For instance, a renewable energy company may consider California for its clean energy initiatives and potential tax benefits. On the other hand, a manufacturing business might face challenges due to the state's high tax rates, affecting its ability to compete in the global market.

International Business and Trade

California’s position as a global trade hub means that its tax system also impacts international businesses and trade relations. The state’s tax laws, especially those related to sales and use tax, can affect cross-border transactions and the cost of doing business.

Consider an international e-commerce platform with customers in California. They must comply with the state's sales tax laws, including collecting and remitting taxes on sales to California residents. This adds a layer of complexity to their business operations and tax compliance.

Tax Reform and Future Outlook

California’s tax system is not static; it evolves over time, influenced by economic conditions, political decisions, and changing business landscapes. The state has undergone tax reforms in the past, and future changes are always a possibility.

Recent tax reforms have focused on simplifying the tax system, reducing complexities, and providing more clarity for businesses. These reforms aim to improve tax compliance and make California more attractive for businesses.

Looking ahead, the state's focus on innovation and technology is likely to influence tax policies. As new industries emerge and traditional industries evolve, California's tax system will need to adapt to support these changes and ensure a fair and sustainable tax environment.

What are the key differences between California’s business tax and federal business tax?

+California’s business tax system differs from the federal system in several ways. While both have income taxes, California’s rates are generally higher and more progressive. Additionally, California has unique taxes like the Franchise Tax, which is not part of the federal system. Federal taxes often have more standardized rates and regulations, while California’s taxes can vary based on location and industry.

How can businesses stay updated with California’s changing tax laws and regulations?

+Businesses can stay informed by regularly checking official government websites, such as the California Department of Tax and Fee Administration and the Franchise Tax Board. These sites provide updates on tax law changes, deadlines, and new regulations. Additionally, subscribing to tax newsletters or utilizing tax software with built-in update features can ensure businesses are aware of any changes.

Are there any tax incentives or deductions available for businesses in California?

+Yes, California offers a range of tax incentives and deductions to support businesses. These can include tax credits for research and development, job creation, and investment in certain industries. There are also deductions for business expenses, such as advertising, travel, and certain types of equipment. It’s important for businesses to research and understand the available incentives to optimize their tax strategies.