Minnesota Tax Refund Dates

The state of Minnesota, known for its picturesque landscapes and vibrant cities, offers a unique tax refund system that is often a topic of interest for its residents and businesses. The tax refund dates in Minnesota are an important aspect of the state's fiscal calendar, providing much-needed financial relief to individuals and contributing to the overall economic landscape.

Understanding the Minnesota Tax Refund Process

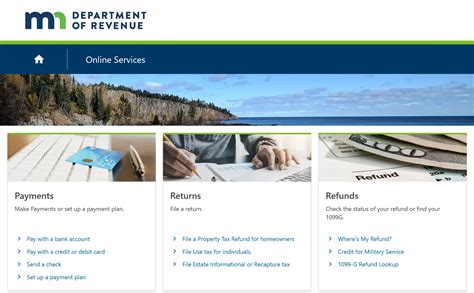

Minnesota’s tax refund process is governed by the Minnesota Department of Revenue, which administers state taxes and ensures compliance with the state’s tax laws. The process involves a systematic approach to calculating and distributing refunds to eligible taxpayers.

Each year, the state receives tax returns from individuals and businesses, which are then meticulously processed to determine the amount of refund due, if any. The complexity of this process can vary depending on the taxpayer’s income, deductions, and tax credits claimed.

Factors Influencing Refund Dates

Several factors come into play when determining the exact dates for tax refunds in Minnesota. Firstly, the state operates on a fiscal year, which runs from July 1st to June 30th. This means that the tax refund timeline is often aligned with this financial year cycle.

Additionally, the volume of tax returns received by the state can significantly impact the refund timeline. During peak tax season, the Minnesota Department of Revenue experiences a surge in tax return filings, which can slow down the processing time and subsequently delay refund issuance.

Furthermore, the state’s budgetary constraints and economic conditions can influence the timing of tax refunds. In years where the state faces financial challenges, there might be a delay in refund issuance to manage cash flow and budgetary requirements.

Historical Tax Refund Dates in Minnesota

Examining historical tax refund dates in Minnesota provides valuable insights into the state’s refund timeline. While the exact dates can vary from year to year, there is a general pattern that taxpayers can anticipate.

In recent years, Minnesota has made significant strides in streamlining its tax refund process. On average, taxpayers can expect their refunds within 30 to 45 days after the filing deadline. However, it’s important to note that this timeframe can extend during peak tax seasons or if there are any discrepancies in the tax return.

For instance, in the 2022 tax season, the Minnesota Department of Revenue aimed to process 9 out of 10 refunds within 45 days. This target was set to manage taxpayer expectations and ensure a timely refund distribution.

| Tax Season | Refund Processing Time |

|---|---|

| 2022 | 30 to 45 days |

| 2021 | 35 to 50 days |

| 2020 | 40 to 60 days |

Methods of Receiving Tax Refunds in Minnesota

Minnesota offers various methods for taxpayers to receive their refunds, providing flexibility and convenience.

Direct Deposit

Direct deposit is one of the most popular methods for receiving tax refunds in Minnesota. Taxpayers who opt for direct deposit can have their refund directly deposited into their bank account, eliminating the need for physical checks and ensuring a faster turnaround time.

To set up direct deposit, taxpayers need to provide their banking details, including the account number and routing number, on their tax return. This method is secure, efficient, and reduces the risk of lost or stolen refund checks.

Paper Checks

For taxpayers who prefer a traditional approach, Minnesota also issues tax refunds via paper checks. These checks are mailed to the taxpayer’s address as indicated on their tax return. While this method might take slightly longer, it provides a tangible refund that can be deposited or cashed at the taxpayer’s convenience.

It’s important for taxpayers to ensure their mailing address is accurate to avoid any delays or misdelivery of their refund check.

Other Refund Options

Minnesota also offers other refund options to cater to different taxpayer needs. For instance, taxpayers can choose to have their refund applied to their upcoming tax liability, reducing the amount they owe in the future.

Additionally, the state allows taxpayers to split their refunds, enabling them to have a portion directly deposited and the remaining amount sent as a paper check. This flexibility ensures taxpayers can manage their finances according to their unique circumstances.

Tips for Expediting Your Minnesota Tax Refund

While the Minnesota Department of Revenue strives to process refunds efficiently, there are certain steps taxpayers can take to expedite their refund.

File Electronically

Filing taxes electronically is one of the most effective ways to speed up the refund process. Electronic filing reduces the risk of errors and ensures a faster turnaround time compared to traditional paper filing.

Moreover, taxpayers who e-file their taxes can often track the status of their refund online, providing real-time updates and peace of mind.

Choose Direct Deposit

As mentioned earlier, opting for direct deposit can significantly reduce the time it takes to receive your refund. Direct deposit eliminates the processing time required for paper checks and ensures a quicker transfer of funds to your bank account.

By choosing direct deposit, taxpayers can receive their refunds within a matter of days, rather than waiting for weeks for a paper check to arrive.

Avoid Errors and Discrepancies

Errors and discrepancies in tax returns can lead to delays in refund processing. To expedite your refund, ensure that your tax return is accurate and complete. Double-check your calculations, verify your personal information, and ensure all necessary forms and schedules are included.

If you’re unsure about any aspect of your tax return, consider seeking professional assistance to avoid potential delays.

The Impact of Tax Refunds on Minnesota’s Economy

Tax refunds play a significant role in Minnesota’s economy, providing a boost to both individuals and businesses.

Individual Spending and Investment

For individuals, tax refunds can provide a much-needed financial cushion. Many taxpayers use their refunds to pay off debts, cover essential expenses, or invest in their future. This influx of funds can stimulate the local economy as individuals spend their refunds on goods and services, contributing to economic growth.

Additionally, tax refunds can provide an opportunity for individuals to invest in their education, start a business, or make home improvements, further contributing to long-term economic development.

Business Benefits and Stimulus

Tax refunds can also benefit businesses in Minnesota. For small businesses, a tax refund can provide much-needed capital to expand operations, hire new employees, or invest in new equipment. This stimulus can lead to job creation and economic growth within the state.

Moreover, tax refunds can encourage businesses to explore new ventures, innovate, and contribute to Minnesota’s reputation as a hub for business and entrepreneurship.

Economic Growth and Development

The collective impact of tax refunds on individuals and businesses can drive economic growth and development in Minnesota. The state’s fiscal policies, including the timely distribution of tax refunds, play a crucial role in maintaining a healthy economic climate.

By ensuring timely refunds, the state demonstrates its commitment to supporting its taxpayers and fostering an environment conducive to economic prosperity.

Future Outlook and Potential Changes

As Minnesota continues to evolve and adapt to changing economic conditions, there might be potential changes to the tax refund system in the future.

Technological Advancements

Advancements in technology can significantly impact the tax refund process. The Minnesota Department of Revenue might explore new digital platforms and tools to streamline refund processing, reduce errors, and enhance taxpayer experience.

For instance, the state could implement machine learning algorithms to automate certain aspects of tax refund processing, further expediting the timeline.

Economic Factors

The state’s economic health and budgetary constraints can influence the tax refund timeline. In years where the state faces financial challenges, there might be a need to prioritize budgetary requirements over refund issuance, potentially leading to delays.

However, the state’s commitment to timely refunds and its focus on taxpayer satisfaction could mitigate the impact of such economic factors.

Policy Changes

Policy changes at the state level can also impact the tax refund system. For instance, changes to tax laws, deductions, or credits can influence the refund amounts and the processing timeline.

It’s essential for taxpayers to stay informed about any potential policy changes that might impact their tax refunds.

How can I track the status of my Minnesota tax refund?

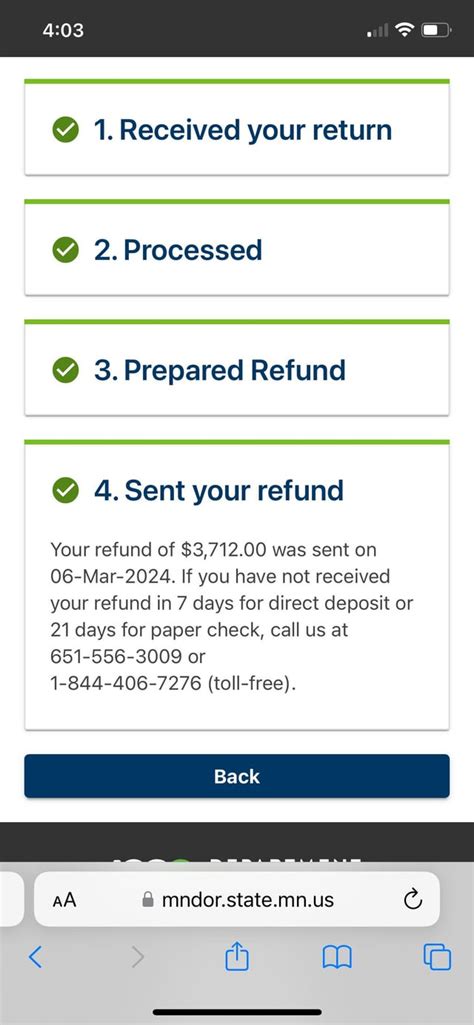

+You can track the status of your Minnesota tax refund by visiting the Minnesota Department of Revenue’s online portal. This portal provides real-time updates on the progress of your refund. You’ll need to provide your Social Security Number and either your Driver’s License Number or Individual Taxpayer Identification Number to access your refund information.

What if my tax refund is delayed or I haven’t received it within the expected timeframe?

+If your tax refund is delayed or you haven’t received it within the expected timeframe, it’s important to take action. First, verify your refund status using the online portal. If the status indicates a delay or issue, contact the Minnesota Department of Revenue’s Taxpayer Services to inquire about the status and potential resolution.

Are there any penalties for filing my tax return late in Minnesota?

+Yes, there are penalties for filing your tax return late in Minnesota. The state imposes a late filing penalty of 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, there might be interest charges on any unpaid tax amount. It’s important to file your tax return on time to avoid these penalties.