Dc Office Of Tax

Welcome to this comprehensive guide on the DC Office of Tax, the dedicated governmental body responsible for managing and overseeing tax-related matters in the District of Columbia. As an expert in tax regulations and DC's financial landscape, I will take you through the intricacies of this essential government entity, shedding light on its role, functions, and impact on the district's fiscal health.

An Overview of the DC Office of Tax

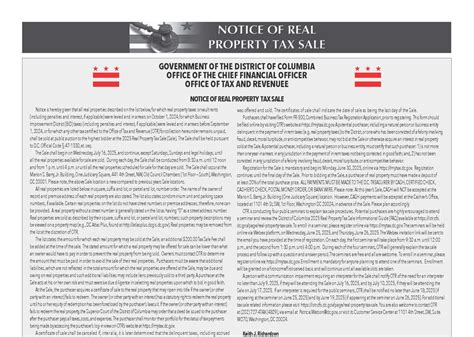

The DC Office of Tax, officially known as the Office of Tax and Revenue, is a critical division within the District’s Department of Finance and Revenue. Established with the primary objective of administering and enforcing tax laws in the district, it plays a pivotal role in ensuring fiscal stability and accountability.

The office's jurisdiction covers a diverse range of taxes, including but not limited to:

- Income Tax

- Sales and Use Tax

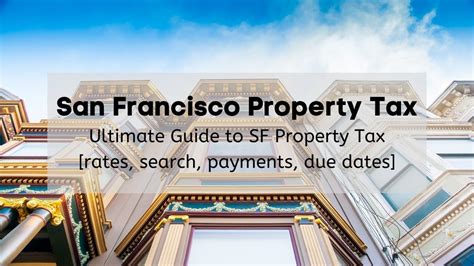

- Property Tax

- Excise Taxes

- Estate and Gift Taxes

By effectively managing these tax categories, the DC Office of Tax contributes significantly to the district's revenue generation and financial planning.

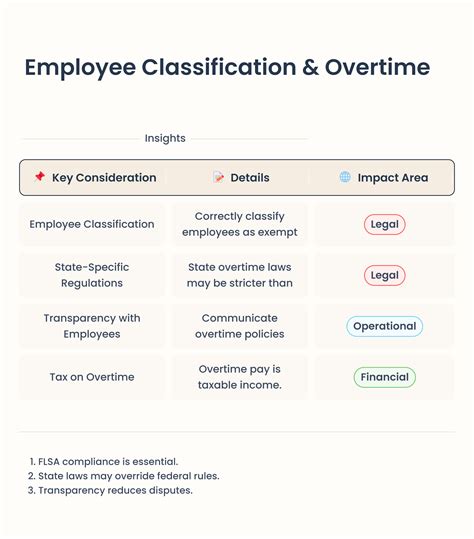

Key Functions and Responsibilities

The DC Office of Tax’s functions are multifaceted and vital to the district’s fiscal operations. Here’s an in-depth look at some of its key responsibilities:

Tax Assessment and Collection

At the heart of the office’s operations is the assessment and collection of taxes. This involves determining the taxable value of properties, assessing income and sales taxes, and ensuring compliance with tax laws. The office employs a range of tools and methodologies to accurately assess tax liabilities, including property appraisals, income audits, and sales tax monitoring.

Tax Policy Development

The DC Office of Tax plays a crucial role in shaping tax policies that align with the district’s economic goals and revenue needs. This includes researching, analyzing, and recommending tax initiatives to the District Council and the Mayor. By staying abreast of economic trends and best practices, the office ensures that DC’s tax policies remain competitive and equitable.

Taxpayer Services and Support

Recognizing the importance of taxpayer satisfaction and compliance, the office provides a range of services to assist taxpayers. This includes offering guidance on tax obligations, processing tax returns, and addressing taxpayer inquiries. The office also facilitates online tax filing, making it more convenient for taxpayers to meet their obligations.

Enforcement and Compliance

Ensuring tax compliance is a critical aspect of the office’s work. The DC Office of Tax employs enforcement measures to deter and detect tax evasion and non-compliance. This includes conducting audits, investigating tax fraud, and imposing penalties for non-compliance. By maintaining a robust enforcement framework, the office upholds the integrity of the district’s tax system.

Community Engagement and Outreach

The office understands the importance of engaging with the community to foster a culture of tax compliance and awareness. It organizes outreach programs, educational workshops, and public forums to inform taxpayers about their rights and responsibilities. By actively involving the community, the office promotes transparency and trust in the tax system.

Performance and Impact

The DC Office of Tax’s performance is a testament to its effectiveness in managing the district’s tax system. Over the years, the office has demonstrated a strong track record in revenue collection, with consistent growth in tax receipts. This has contributed significantly to the district’s overall financial health and its ability to invest in essential services and infrastructure.

| Tax Category | Revenue Generated (USD) |

|---|---|

| Income Tax | $3.2 billion |

| Sales and Use Tax | $2.1 billion |

| Property Tax | $1.6 billion |

| Excise Taxes | $450 million |

| Estate and Gift Taxes | $250 million |

The table above provides a snapshot of the revenue generated by various tax categories in the district. These figures highlight the substantial contribution of the DC Office of Tax to the district's overall revenue stream.

Future Prospects and Challenges

Looking ahead, the DC Office of Tax faces a range of opportunities and challenges. As the district’s economy continues to evolve, the office must adapt its strategies to address emerging trends and ensure the tax system remains competitive and fair. This includes keeping pace with technological advancements, such as blockchain and AI, to enhance tax administration and reduce administrative burdens.

Additionally, the office must navigate the complex landscape of tax policy changes, both at the local and federal levels. By actively engaging with policymakers and staying informed about legislative developments, the office can advocate for tax policies that benefit the district's residents and businesses.

Conclusion

The DC Office of Tax is an integral part of the district’s financial ecosystem, playing a vital role in ensuring fiscal stability and accountability. Through its multifaceted functions, the office contributes significantly to the district’s revenue generation, economic growth, and overall financial health. As the district continues to evolve, the office’s commitment to innovation, transparency, and taxpayer satisfaction will remain pivotal in shaping a sustainable and prosperous future for the District of Columbia.

How can I contact the DC Office of Tax for inquiries or assistance?

+You can reach the DC Office of Tax by calling their customer service line at (202) 727-4TAX (4829) or visiting their website at https://otr.dc.gov. The office also provides an online contact form and a physical address for written correspondence.

What are the key tax obligations for DC residents and businesses?

+DC residents are subject to income tax, property tax, and sales tax obligations. Businesses, on the other hand, may have additional tax liabilities, such as business and professional taxes, gross receipts taxes, and franchise taxes. It’s essential to stay informed about these obligations and comply with the applicable tax laws.

How does the DC Office of Tax address tax evasion and non-compliance?

+The office employs a range of enforcement measures to deter and detect tax evasion. This includes conducting audits, imposing penalties, and, in some cases, pursuing legal action. The office also works closely with taxpayers to resolve issues and ensure compliance through education and outreach programs.