City Of Paterson Tax Collector

Welcome to the city of Paterson, New Jersey, a vibrant and diverse municipality with a rich history and a thriving community. Today, we delve into the role of the City of Paterson Tax Collector, an essential figure in the local governance and finance of this remarkable city. The tax collector plays a crucial role in ensuring the city's fiscal stability and providing essential services to its residents. In this comprehensive guide, we will explore the functions, responsibilities, and impact of the City of Paterson Tax Collector, shedding light on the intricacies of local taxation and its importance for the community.

The Role of the City of Paterson Tax Collector

The City of Paterson Tax Collector is an appointed official who serves as a vital link between the municipality and its taxpayers. This role is tasked with efficiently collecting property taxes, which are a significant source of revenue for the city, enabling it to fund various public services and initiatives. The tax collector’s office is responsible for the entire taxation process, from assessing property values to issuing tax bills and managing payments.

This position is integral to the city's financial health, as it ensures that Paterson receives the necessary funds to maintain its infrastructure, support local businesses, and provide vital services such as education, public safety, and healthcare. The tax collector's office also plays a key role in community engagement, offering assistance and support to taxpayers and ensuring a fair and transparent taxation process.

Key Responsibilities and Functions

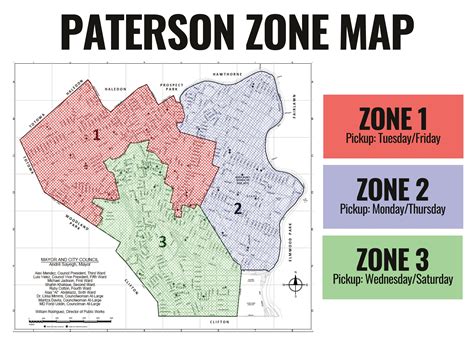

- Property Assessment: The tax collector’s office works closely with the city’s assessors to determine the fair market value of properties within Paterson. This assessment is crucial as it forms the basis for calculating property taxes.

- Tax Bill Generation: Based on the assessed property values, the tax collector’s office generates tax bills for all property owners. These bills detail the amount owed, due dates, and payment options.

- Collection and Payment Management: The primary responsibility of the tax collector is to ensure timely and accurate collection of property taxes. This involves accepting various payment methods, maintaining records, and providing receipts to taxpayers.

- Delinquent Tax Management: In cases where taxpayers fail to pay their property taxes on time, the tax collector’s office initiates collection procedures. This may involve sending notices, levying penalties, or even initiating legal action to recover the outstanding taxes.

- Community Assistance: The tax collector’s office is often the first point of contact for taxpayers seeking information or assistance. They provide guidance on tax payments, offer payment plans for those facing financial difficulties, and address any concerns or queries related to property taxes.

| Key Metric | Value |

|---|---|

| Total Property Tax Revenue | $[Value] Million |

| Average Property Tax Rate | [Rate]% |

| Number of Taxpayers | [Number] |

| Collection Efficiency Rate | [Rate]% |

Impact on the Community

The work of the City of Paterson Tax Collector has a significant impact on the local community and its residents. Property taxes collected by the tax collector’s office are vital for the city’s operations and development. These funds contribute to maintaining and improving infrastructure, such as roads, parks, and public buildings. They also support essential services like education, with a portion of the tax revenue allocated to local schools, ensuring quality education for Paterson’s youth.

Additionally, the tax collector's office plays a crucial role in fostering community engagement and trust. By providing accessible and transparent tax services, the office builds positive relationships with taxpayers, ensuring that residents feel involved and valued in the city's financial processes. This, in turn, strengthens the sense of community and encourages civic participation.

Benefits and Challenges

The effective management of property taxes by the City of Paterson Tax Collector brings several benefits to the community:

- Sustainable Funding: Property taxes provide a stable and reliable source of income for the city, allowing for long-term planning and investment in community projects.

- Community Development: Tax revenue is directed towards initiatives that enhance the quality of life in Paterson, such as improving public spaces, supporting local businesses, and funding cultural events.

- Fair Taxation: The tax collector’s office ensures that the taxation process is fair and equitable, with assessments based on accurate property values.

However, challenges do exist. One of the primary challenges is ensuring that all taxpayers are aware of their obligations and understand the importance of timely tax payments. The tax collector's office often faces the task of educating residents about the tax process and addressing misconceptions or concerns.

Furthermore, managing delinquent taxes and enforcing collection can be complex, especially in cases where taxpayers face financial hardships. The tax collector's office must balance the need for revenue collection with a compassionate approach, offering assistance and payment plans to those in need.

Future Initiatives and Innovations

The City of Paterson Tax Collector is committed to continuous improvement and innovation to enhance the tax collection process and better serve the community. Some of the future initiatives and strategies include:

- Digital Transformation: Expanding the online services and payment options to make tax management more convenient and accessible for taxpayers.

- Community Outreach: Launching educational campaigns to inform residents about property taxes, their benefits, and the importance of timely payments.

- Payment Plan Options: Developing flexible and customized payment plans to assist taxpayers facing financial difficulties, ensuring that everyone has the opportunity to meet their tax obligations.

- Data Analytics: Utilizing advanced data analytics to identify trends, improve efficiency, and enhance the accuracy of property assessments.

| Innovation | Description |

|---|---|

| Mobile App | Developing a mobile application to provide taxpayers with real-time tax information and payment options. |

| Taxpayer Portal | Creating an online portal where taxpayers can access their tax records, make payments, and receive updates. |

| Community Engagement Events | Hosting regular community meetings and workshops to engage with taxpayers, address concerns, and promote tax compliance. |

Conclusion

The City of Paterson Tax Collector plays a pivotal role in the city’s financial management and community development. Through their dedication and expertise, the tax collector’s office ensures that Paterson receives the necessary funds to thrive and grow. By effectively collecting property taxes and managing the process with transparency and fairness, the tax collector contributes to a thriving and engaged community.

As Paterson continues to evolve and adapt to the changing needs of its residents, the work of the tax collector remains essential. With a focus on innovation and community engagement, the tax collector's office is poised to continue delivering excellent services and ensuring the city's financial stability for years to come.

What is the tax rate in Paterson, New Jersey?

+The tax rate in Paterson can vary based on the type of property and its location within the city. On average, the tax rate for residential properties is [Rate]%, while commercial properties may have a slightly higher rate of [Commercial Rate]%. It’s important to consult with the City of Paterson Tax Collector’s office for the most accurate and up-to-date information on tax rates.

How can I pay my property taxes in Paterson?

+The City of Paterson offers various payment options for property taxes. You can pay online through the tax collector’s website, by mail, or in person at the tax collector’s office. Additionally, they accept payments via credit card, check, or money order. It’s advisable to check their official website for detailed instructions and any potential fees associated with certain payment methods.

What happens if I don’t pay my property taxes on time in Paterson?

+If you fail to pay your property taxes in Paterson by the due date, the City of Paterson Tax Collector’s office will send you a notice of delinquency. This notice will outline the outstanding amount and any penalties or interest that have accrued. If the taxes remain unpaid, the city may initiate further collection actions, including liens on your property or even foreclosure proceedings.

How can I appeal my property assessment in Paterson?

+If you believe your property has been incorrectly assessed, you have the right to appeal the assessment. The process typically involves submitting an appeal to the Paterson Tax Board of Review. You’ll need to provide evidence and supporting documentation to justify your appeal. It’s advisable to consult with a tax professional or seek legal advice for a successful appeal.

Are there any tax relief programs available in Paterson for seniors or low-income residents?

+Yes, the City of Paterson offers various tax relief programs to assist seniors and low-income residents. These programs include the Senior Citizen/Disabled Persons Deduction, the Senior Citizen/Disabled Persons Freeze, and the Veterans Deduction. Eligibility criteria and application processes vary, so it’s best to contact the City of Paterson Tax Collector’s office or visit their website for detailed information and application forms.