Invest In Tax Liens

In the world of investing, tax liens present a unique and intriguing opportunity for those seeking an alternative path to financial growth. This method of investing involves purchasing a government's claim on a property due to the owner's failure to pay property taxes. While it may sound complex, the process of investing in tax liens offers a secure and potentially lucrative venture for those willing to navigate the intricacies of real estate and taxation. This comprehensive guide aims to delve into the depths of tax lien investing, providing an expert-level analysis of its mechanisms, potential benefits, and strategies for success.

Understanding Tax Liens: A Legal and Financial Perspective

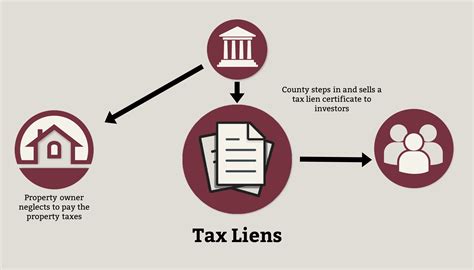

Tax liens are a powerful tool for governments to ensure tax compliance among property owners. When an individual fails to pay their property taxes, the government places a lien on the property, essentially a legal claim, allowing it to recover the unpaid taxes. This lien grants the government priority over other creditors and gives it the right to sell the property to recoup the unpaid taxes. For investors, this process opens up a window of opportunity to secure properties at potentially discounted rates.

The process of investing in tax liens involves several key steps. First, an investor must identify properties with tax liens. This often involves accessing public records and attending lien sales, where the government auctions off these properties. The investor then has the opportunity to purchase the lien, paying the amount of the unpaid taxes. Once the lien is purchased, the investor has the right to foreclose on the property if the owner fails to pay the taxes plus any additional fees and penalties within a specified period.

From a legal perspective, investing in tax liens involves understanding the complex web of local, state, and federal laws governing property taxes and foreclosure procedures. These laws can vary significantly, making it crucial for investors to conduct thorough research and, often, seek legal counsel to navigate the specific regulations in their target areas.

Legal and Financial Considerations

Before diving into tax lien investing, it’s imperative to consider the legal and financial risks. These include the possibility of the property owner paying off the lien before the investor can foreclose, thus reducing potential profits. Additionally, investors must be aware of the potential for environmental or structural issues with the property, which could result in significant costs for remediation or repairs.

From a financial perspective, tax lien investing can be capital-intensive. The initial investment to purchase the lien is often substantial, and investors may need to pay additional fees and taxes to maintain the lien and initiate the foreclosure process. Moreover, the timeline for recouping the investment can be uncertain, with some properties taking years to resolve.

| Consideration | Description |

|---|---|

| Property Value | The property's market value should exceed the lien amount to ensure a profitable investment. |

| Legal Fees | Investors should factor in potential legal costs for foreclosure proceedings. |

| Interest Rates | Some jurisdictions offer high interest rates on tax liens, which can be a significant source of return. |

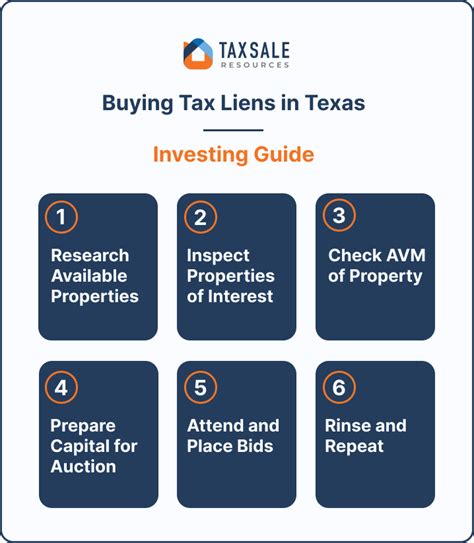

The Tax Lien Investment Process: A Step-by-Step Guide

The process of investing in tax liens can be intricate, but with careful planning and research, it can be a rewarding endeavor. Here’s a detailed guide to walk you through each step:

Step 1: Research and Due Diligence

The first step in tax lien investing is thorough research. Investors should identify target areas where property taxes are high and the likelihood of tax liens is greater. This often involves analyzing local property tax rates and historical data on tax lien sales.

Due diligence is critical. Investors should research the properties they're considering, checking for any outstanding debts, environmental issues, or structural problems. This due diligence can involve reviewing public records, conducting property inspections, and even speaking with local residents or business owners to gauge the area's desirability.

Step 2: Attending Tax Lien Sales

Once you’ve identified your target properties, it’s time to attend tax lien sales. These sales are typically public auctions where the government sells the liens on properties with unpaid taxes. The process can vary by jurisdiction, but often involves registering as a bidder, providing a deposit, and then bidding on the liens.

During the auction, investors should focus on properties with the highest potential for profit. This often involves assessing the property's value, the amount of the lien, and the likelihood of foreclosure. Investors should also consider the competition and adjust their bidding strategies accordingly.

Step 3: Purchasing the Lien

If you’re the successful bidder at a tax lien sale, the next step is to purchase the lien. This typically involves paying the amount of the unpaid taxes, plus any fees and penalties. The exact process can vary by jurisdiction, and investors should be aware of the specific requirements and timelines for purchasing the lien.

Once the lien is purchased, the investor becomes the holder of the government's claim on the property. This means they have the right to initiate the foreclosure process if the property owner fails to pay the taxes within a specified period.

Step 4: Foreclosure and Property Acquisition

If the property owner fails to pay the taxes and fees within the specified redemption period, the investor can initiate the foreclosure process. This involves filing the necessary legal documents and following the foreclosure procedures as outlined by the jurisdiction’s laws.

The foreclosure process can be complex and time-consuming. Investors should be prepared for potential legal challenges and should consult with legal professionals to ensure they're complying with all relevant laws. Once the foreclosure is complete, the investor becomes the owner of the property, which can then be sold, rented, or developed for profit.

Maximizing Returns: Strategies for Successful Tax Lien Investing

Investing in tax liens can offer significant returns, but it requires a strategic approach. Here are some key strategies to maximize your profits and minimize risks:

Focus on High-Value Properties

When selecting properties for tax lien investing, focus on those with high market values. The higher the property’s value, the greater the potential for profit if you acquire the property through foreclosure. This strategy ensures that even if the property owner pays off the lien, you’ve still made a substantial return on your investment.

Diversify Your Portfolio

Diversification is a key principle in any investment strategy, and tax lien investing is no exception. By investing in a variety of properties across different locations and with varying lien amounts, you reduce your risk exposure. This strategy can help protect your portfolio against potential losses from individual properties and ensure a more stable return on investment.

Research Local Laws and Procedures

The legal landscape of tax lien investing can vary significantly by jurisdiction. Understanding the local laws and procedures is crucial for successful investing. This includes knowing the redemption periods, foreclosure processes, and any unique requirements or restrictions in your target areas. Consulting with local legal experts can provide invaluable insights and ensure compliance with all relevant regulations.

Utilize Technology and Data

In today’s digital age, technology can be a powerful tool for tax lien investors. Online platforms and databases offer efficient ways to research properties, track lien sales, and monitor foreclosure proceedings. These tools can provide real-time data and insights, helping investors make more informed decisions and stay ahead of the competition.

Build a Network

Investing in tax liens can be a collaborative endeavor. Building a network of like-minded investors, legal professionals, and real estate experts can provide valuable insights, resources, and potential partnership opportunities. Networking can also lead to the sharing of best practices and strategies, helping investors navigate the complexities of this unique investment niche.

Future Outlook and Implications for Tax Lien Investing

The landscape of tax lien investing is evolving, and several factors are shaping its future. One key aspect is the increasing digital transformation of the industry. Online platforms and digital tools are making the process of researching, bidding, and managing tax liens more efficient and accessible, attracting a broader range of investors.

Additionally, the economic climate and real estate market fluctuations can significantly impact the tax lien investment landscape. Economic downturns can increase the number of tax liens, presenting more opportunities for investors. However, these periods also bring increased competition and potential risks, such as higher default rates and longer foreclosure timelines.

From a regulatory perspective, changes in tax laws and foreclosure procedures can significantly affect the tax lien investment process. Investors must stay abreast of these changes to ensure compliance and adapt their strategies accordingly. For instance, some jurisdictions may introduce new protections for property owners, which could lengthen the redemption period or make foreclosure more challenging.

Sustainable Investing

Another emerging trend is the integration of sustainability and environmental considerations into tax lien investing. As the world moves towards more sustainable practices, investors are increasingly factoring in the environmental impact of properties. This can involve assessing a property’s energy efficiency, its potential for green renovations, or its proximity to environmentally sensitive areas.

Moreover, the concept of sustainable investing extends beyond environmental considerations. It also involves investing in communities, supporting local businesses, and promoting economic development. Tax lien investors can contribute to these efforts by strategically investing in properties that can drive positive change in their communities, such as affordable housing or commercial spaces that support local entrepreneurs.

FAQ

How do tax liens differ from tax deeds?

+Tax liens and tax deeds are related but distinct concepts in the realm of real estate and taxation. A tax lien is a legal claim placed on a property by a government entity when the property owner fails to pay their property taxes. It gives the government the right to sell the property to recoup the unpaid taxes. In contrast, a tax deed is the actual process by which the government sells the property to satisfy the unpaid taxes. When an investor purchases a tax deed, they are buying the property itself, not just the right to foreclose as in the case of a tax lien.

What are the potential risks of investing in tax liens?

+Investing in tax liens carries several risks. These include the possibility of the property owner paying off the lien before the investor can foreclose, thus reducing potential profits. Additionally, investors may encounter environmental or structural issues with the property, resulting in unexpected costs. The process can also be time-consuming and complex, with potential legal challenges. Lastly, the investment can be capital-intensive, requiring significant upfront costs and potential additional fees and taxes.

How can I find tax lien investment opportunities?

+Finding tax lien investment opportunities involves thorough research. Investors can start by identifying target areas with high property tax rates and a history of tax liens. This often involves analyzing local property tax data and historical tax lien sales. Online platforms and databases can also be valuable resources for researching and tracking tax lien opportunities. Additionally, attending tax lien sales and networking with other investors can provide insights into potential investment properties.

What are the key considerations when choosing properties for tax lien investing?

+When selecting properties for tax lien investing, several key considerations come into play. First, investors should focus on properties with high market values to ensure a substantial return if foreclosure occurs. Diversification is also crucial, with investors spreading their investments across different locations and lien amounts to reduce risk exposure. Additionally, understanding the local laws and procedures governing tax liens and foreclosures is essential. Utilizing technology and data to research properties and monitor lien sales can provide valuable insights. Finally, building a network of fellow investors, legal professionals, and real estate experts can offer valuable resources and potential partnership opportunities.