Somerville Tax Bills

The topic of tax bills is an important one, especially for residents and property owners in Somerville, Massachusetts. Understanding the intricacies of tax bills, their components, and the processes involved can help individuals navigate their financial obligations and plan their finances effectively. This article aims to provide an in-depth analysis of Somerville tax bills, covering everything from assessment procedures to payment options and the impact of these bills on the local community.

Unraveling the Somerville Tax Bill: A Comprehensive Guide

Somerville, a vibrant city in Middlesex County, Massachusetts, is known for its diverse population, thriving arts scene, and innovative spirit. However, like any other municipality, it relies on property taxes to fund essential services and infrastructure. In this section, we will delve into the world of Somerville tax bills, shedding light on the processes, calculations, and implications for the city's residents.

Understanding the Assessment Process

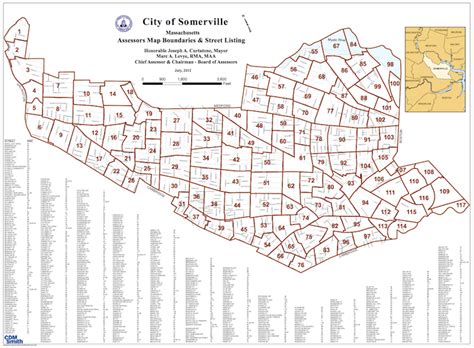

The foundation of any tax bill lies in the assessment process. Somerville, like many other cities, employs a professional assessor to evaluate the value of each property within its boundaries. This valuation is crucial as it determines the tax liability for each property owner. The assessor takes into account various factors, including the property's location, size, age, condition, and recent sales of comparable properties.

The assessment process in Somerville is a comprehensive one, ensuring fairness and accuracy. It involves regular physical inspections, data analysis, and the application of complex algorithms to determine fair market values. The assessor's office also considers any improvements or alterations made to the property, as these can impact its value and, subsequently, the tax bill.

| Assessment Category | Description |

|---|---|

| Residential Properties | Homes, apartments, and condos are assessed based on their unique characteristics and recent sales data. |

| Commercial Properties | Businesses, offices, and retail spaces are valued based on their income-generating potential and market trends. |

| Land Value | The value of vacant land is determined separately, considering factors like location, zoning regulations, and potential development opportunities. |

The assessment process is not a one-time event; it is an ongoing cycle. Somerville's assessor's office conducts regular reviews and updates to ensure that property values remain current and reflective of the dynamic real estate market. This dynamic approach helps maintain fairness and prevents any sudden, significant increases in tax liabilities for property owners.

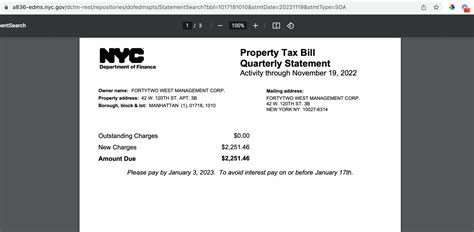

Tax Bill Components: Breaking Down the Numbers

Once the assessment process is complete, the city calculates the tax bill based on the assessed value of the property. This calculation involves several key components, each playing a vital role in determining the final amount due.

- Tax Rate: The tax rate, also known as the "mill rate," is set annually by the Somerville City Council. It is expressed in mills, where one mill equals $1 of tax for every $1,000 of assessed value. The tax rate is determined based on the city's budget requirements and the assessed value of all properties within Somerville.

- Assessed Value: As mentioned earlier, the assessed value is the estimated fair market value of the property as determined by the assessor. It serves as the basis for calculating the tax liability.

- Taxable Value: In some cases, Somerville may offer exemptions or abatements to certain properties. These reductions in taxable value can be for various reasons, such as homestead exemptions or senior citizen discounts. The taxable value is the assessed value minus any applicable exemptions.

- Special Assessments: Occasionally, property owners may encounter special assessments on their tax bills. These are charges levied for specific improvements or services directly benefiting the property, such as road repairs or sewer line upgrades. Special assessments are in addition to the regular property taxes.

To illustrate, let's consider an example. Imagine a residential property in Somerville with an assessed value of $500,000. If the city's tax rate is set at 25 mills, the property owner's tax liability would be calculated as follows:

Assessed Value: $500,000

Tax Rate: 25 mills

Tax Liability: $500,000 x 0.025 = $12,500

This example demonstrates how the tax rate and assessed value directly impact the tax bill. However, it's important to note that Somerville offers various exemptions and abatement programs to eligible property owners, which can further reduce their tax liability.

Payment Options and Deadlines

Somerville provides property owners with several convenient payment options to settle their tax bills. These options include:

- Online Payment: Residents can pay their tax bills securely online through the city's official website. This method offers a quick and convenient way to make payments using a credit or debit card.

- Mail-In Payment: Property owners can mail their payments to the designated address, ensuring they are received by the due date. It is recommended to use a trackable mailing service to confirm timely delivery.

- In-Person Payment: Somerville residents can visit the city's tax office to make payments in person. This option allows for direct interaction with tax officials and provides an opportunity to clarify any queries or concerns.

- Payment Plans: For those facing financial difficulties, Somerville offers payment plans to help manage tax obligations. These plans allow property owners to pay their taxes in installments, providing some flexibility and relief.

It's crucial for property owners to be aware of the tax bill due dates to avoid late fees and penalties. Somerville typically sends out tax bills twice a year, with specific due dates for each installment. Failure to pay by the deadline can result in additional charges and may even lead to legal consequences.

Impact on the Community and Local Economy

Somerville tax bills play a pivotal role in the city's financial ecosystem, influencing various aspects of the community and local economy. The revenue generated from property taxes funds essential services and infrastructure projects that benefit residents directly.

Here are some key ways in which Somerville tax bills impact the community:

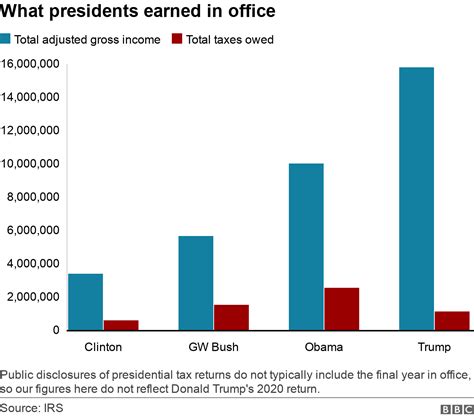

- Education: A significant portion of property tax revenue is allocated to the Somerville Public School District. This funding ensures that schools receive the necessary resources to provide quality education to students, fostering academic excellence and community development.

- Public Safety: Property taxes support the city's police and fire departments, ensuring that Somerville residents have access to efficient emergency services and a safe living environment.

- Infrastructure: Tax revenue contributes to the maintenance and improvement of Somerville's infrastructure, including roads, bridges, parks, and recreational facilities. These investments enhance the quality of life for residents and attract businesses and visitors.

- Community Programs: Somerville utilizes tax revenue to fund various community programs and initiatives. These may include after-school programs, senior citizen services, cultural events, and support for local arts and culture organizations, fostering a vibrant and inclusive community.

Moreover, Somerville's tax system promotes fairness and equity. The city's commitment to regular assessments and transparent processes ensures that property owners are treated fairly, and their contributions are distributed equitably among various services and projects.

Staying Informed and Engaged

For Somerville residents, staying informed about tax bills and their implications is essential. The city's official website provides a wealth of resources, including tax rate information, assessment records, and payment guidelines. Property owners can access their individual assessment records and explore various tax relief programs offered by the city.

Additionally, Somerville hosts community meetings and workshops to engage residents in discussions about tax policies and budget allocations. These events provide an opportunity for residents to voice their concerns, ask questions, and actively participate in shaping the city's financial decisions.

By staying informed and engaged, Somerville residents can make informed choices about their tax obligations and contribute effectively to the city's development and growth.

Frequently Asked Questions (FAQ)

How often are tax assessments conducted in Somerville?

+Somerville conducts tax assessments annually to ensure that property values remain up-to-date and fair. This process helps maintain the accuracy of tax bills and ensures that the city's revenue is distributed equitably among property owners.

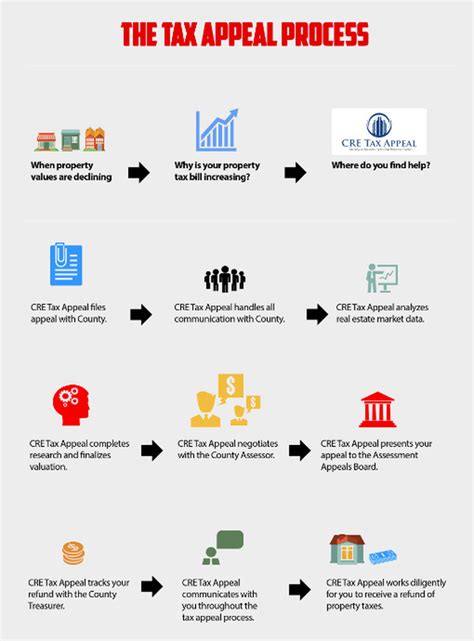

Can I appeal my tax assessment if I believe it is inaccurate?

+Absolutely! Somerville encourages property owners to review their assessment records and provides a formal appeals process. If you have concerns about your assessment, you can schedule an appointment with the assessor's office to discuss your case and potentially seek a revision.

Are there any tax relief programs available for senior citizens in Somerville?

+Yes, Somerville offers several tax relief programs tailored for senior citizens. These programs provide exemptions or abatements based on age, income, and property ownership. To learn more about these programs and determine your eligibility, you can visit the city's official website or contact the assessor's office.

What happens if I fail to pay my tax bill by the due date?

+Late payment of tax bills can result in additional fees and penalties. Somerville takes a serious approach to tax collection, and failure to pay may lead to further legal actions, including liens on your property. It's crucial to stay informed about payment deadlines and explore available payment options to avoid any penalties.

In conclusion, Somerville tax bills are a vital component of the city’s financial landscape, influencing the lives of residents and the development of the community. By understanding the assessment process, tax bill components, and payment options, property owners can navigate their tax obligations with confidence. Additionally, staying engaged and informed allows residents to actively contribute to Somerville’s growth and prosperity.