Nyc Clothing Tax

Welcome to an in-depth exploration of the New York City Clothing Tax, a topic that impacts both residents and retailers in the bustling city of New York. In this article, we will delve into the intricacies of this tax, its history, how it affects different types of clothing purchases, and the impact it has on the fashion industry and consumers alike. As an expert guide, I will provide a comprehensive analysis, shedding light on this often-overlooked aspect of retail in the Big Apple.

The Origins and Purpose of NYC Clothing Tax

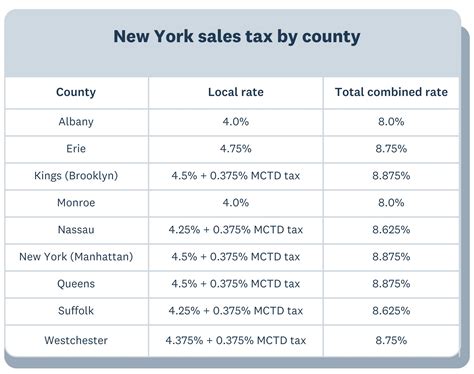

The NYC Clothing Tax, officially known as the New York City General Corporation Tax, is a unique levy that specifically targets clothing and footwear purchases within the five boroughs. Its origins can be traced back to 1990, when it was introduced as a measure to generate additional revenue for the city’s budget, particularly for essential services like education and infrastructure.

The tax, levied on retailers, is applied to the total sale price of clothing and footwear items, including any applicable discounts or promotions. It is distinct from the state sales tax, which is a broader tax applied to a wide range of goods and services.

While the primary purpose of the NYC Clothing Tax is revenue generation, it also serves as a tool for economic policy. By adjusting the tax rate, the city can influence consumer behavior, encouraging spending in certain sectors or promoting specific industries. This dynamic aspect of the tax adds a layer of complexity to its impact on the fashion industry and consumer choices.

Key Historical Milestones

-

1990: The NYC Clothing Tax is introduced, with an initial rate of 4.5% applied to all clothing and footwear sales.

-

2000: The tax rate is increased to 5.875%, a significant jump aimed at boosting city revenue amid economic challenges.

-

2010: A landmark decision exempts certain items of clothing, notably children’s apparel and footwear, from the tax, providing relief for families and promoting affordability.

-

2015: The tax rate is reduced to 4.375%, a strategic move to encourage spending and boost the retail sector’s competitiveness.

-

2022: In a bid to support local businesses, the tax rate is temporarily lowered to 4% for a limited period, stimulating post-pandemic economic recovery.

Understanding the Tax Structure and Exemptions

The NYC Clothing Tax is a complex system with various rules and exemptions, making it a significant consideration for both retailers and consumers. Here’s a detailed breakdown of its structure and the items it affects.

Taxable Items

The tax applies to a wide range of clothing and footwear, including:

-

Apparel for men, women, and children (excluding exempt items mentioned below)

-

Footwear of all types, from sneakers to formal shoes

-

Accessories such as hats, scarves, gloves, and belts

-

Jewelry and watches (although jewelry is often subject to additional luxury taxes)

-

Handbags and other leather goods

Exemptions and Special Considerations

Despite its broad reach, the NYC Clothing Tax does not apply to all items. Some notable exemptions include:

-

Children’s Clothing and Footwear: Items specifically designed for children under the age of 11 are exempt from the tax, providing a significant cost savings for families.

-

Protective Gear: Clothing and footwear with a primary purpose of protection, such as work boots, safety helmets, and reflective vests, are exempt. This exemption acknowledges the functional nature of these items.

-

Custom-Made Clothing: Items tailored specifically for an individual, often requiring unique measurements and design considerations, are exempt from the tax. This encourages the city’s thriving custom tailoring industry.

-

Rental and Secondhand Items: Clothing and footwear rented for special occasions or purchased secondhand are not subject to the tax. This exemption supports the growing trend of sustainable fashion and the resale market.

Impact on the Fashion Industry and Consumer Behavior

The NYC Clothing Tax has a profound influence on both the fashion industry and consumer choices within the city. Let’s explore its effects in detail.

Fashion Industry Dynamics

For retailers, the tax adds an additional layer of complexity to pricing strategies and inventory management. To remain competitive, stores must carefully consider their pricing, often absorbing the tax cost to offer competitive prices to consumers. This can impact profit margins, especially for smaller businesses.

The tax also influences inventory decisions. Retailers may opt to stock more tax-exempt items, such as children's clothing, to offer consumers a tax-free shopping experience. Alternatively, they might focus on high-end fashion, where the tax is less noticeable relative to the overall cost.

Consumer Shopping Behavior

Consumers, too, are affected by the NYC Clothing Tax. While it adds to the overall cost of their purchases, the tax has led to a shift in shopping habits. Many shoppers now compare prices more carefully, taking into account the tax, and may opt for online shopping to avoid the tax altogether.

The tax has also fostered a culture of smart shopping, with consumers seeking out tax-exempt items or taking advantage of sales and discounts to mitigate the tax's impact. This behavior has influenced the timing of purchases, with consumers often waiting for tax-free periods or sales events to make their clothing purchases.

Performance Analysis and Case Studies

To illustrate the impact of the NYC Clothing Tax, let’s examine a few case studies:

-

Small Boutique vs. Large Retailer: A small boutique specializing in custom men’s suits absorbs the tax on its high-end products to remain competitive. Despite the cost, the boutique thrives due to its unique offerings and personal service.

-

Online vs. Offline Shopping: An online retailer, offering a wide range of clothing, is able to undercut brick-and-mortar stores by avoiding the NYC Clothing Tax. This has led to a significant shift in consumer behavior, with many opting for online shopping for clothing purchases.

-

Children’s Clothing Store: A specialty store focusing on children’s apparel and footwear experiences strong sales due to the tax exemption on these items. Parents are willing to pay premium prices for quality children’s clothing without the added tax.

The Future of NYC Clothing Tax

As the fashion industry and consumer preferences continue to evolve, the NYC Clothing Tax will play a pivotal role in shaping the retail landscape. Here are some potential future implications and considerations:

Potential Tax Reform

With ongoing debates about tax fairness and economic stimulation, there is a possibility of future reforms to the NYC Clothing Tax. These could include further exemptions, adjustments to the tax rate, or even the elimination of the tax for certain sectors to boost the city’s competitiveness.

Impact of E-commerce

The rise of e-commerce and online shopping will continue to influence the tax’s effectiveness. As more consumers opt for online purchases to avoid the tax, the city may need to reevaluate its approach to ensure a level playing field for brick-and-mortar stores.

Sustainable Fashion and Secondhand Markets

The growing trend of sustainable fashion and the rise of secondhand markets present an opportunity for the city to explore new tax incentives. By encouraging these environmentally friendly practices, the city could promote a greener economy while supporting local businesses.

Industry Collaboration and Advocacy

The fashion industry and consumer groups can play a vital role in shaping the future of the NYC Clothing Tax. By advocating for tax reforms and collaborating with the city, they can ensure that the tax remains fair, supports local businesses, and promotes consumer interests.

| Year | Tax Rate | Key Events |

|---|---|---|

| 1990 | 4.5% | Introduction of the NYC Clothing Tax |

| 2000 | 5.875% | Rate increase for revenue generation |

| 2010 | 5.875% | Exemption for children's clothing and footwear |

| 2015 | 4.375% | Rate reduction to stimulate spending |

| 2022 | 4% | Temporary rate reduction for economic recovery |

How does the NYC Clothing Tax compare to sales tax in other states or cities?

+The NYC Clothing Tax is unique in that it specifically targets clothing and footwear purchases, while most other jurisdictions apply a general sales tax to a broader range of goods and services. This targeted approach allows for more nuanced economic policies but can also make pricing and tax compliance more complex for retailers.

Are there any efforts to eliminate the NYC Clothing Tax entirely?

+While there have been discussions and proposals to eliminate or reform the tax, no concrete plans have been implemented as of yet. The tax remains an important revenue source for the city, and any changes would require careful consideration of the potential impact on the budget and the fashion industry.

How does the tax affect online retailers and their pricing strategies?

+Online retailers operating within NYC must collect and remit the clothing tax on applicable sales. However, they have an advantage over brick-and-mortar stores as they can offer a tax-free shopping experience to customers outside of NYC. This often leads to online retailers becoming a popular choice for clothing purchases, especially for consumers looking to avoid the tax.

Are there any tax-free periods or events in NYC for clothing purchases?

+Yes, the city sometimes offers tax-free periods, typically during holidays or special events, to stimulate shopping and support local businesses. These tax-free events can be a significant boost for retailers, encouraging consumers to make larger purchases during these periods.