How To Appeal Property Taxes

Property taxes are a significant expense for homeowners, and many individuals seek ways to reduce their tax burden. Understanding the process and strategies to appeal property taxes can lead to potential savings. This comprehensive guide aims to provide an in-depth analysis of the property tax appeal process, offering valuable insights and practical steps to navigate this often complex undertaking.

Understanding Property Tax Assessments

Property tax assessments are an essential component of the taxation system, serving as the basis for determining the value of real estate properties. These assessments are conducted by local governments or municipalities, typically on an annual or biennial basis. The primary purpose of these evaluations is to establish the taxable value of a property, which in turn determines the amount of property taxes owed by the owner.

The assessment process involves a thorough examination of various factors, including the property's location, size, condition, and recent sales data of comparable properties in the area. Assessors consider both the physical characteristics of the property and its market value to arrive at a fair and accurate assessment. It is important to note that property tax assessments can vary significantly from one jurisdiction to another, as local tax rates and assessment methodologies may differ.

For homeowners, understanding the assessment process is crucial, as it directly impacts their financial obligations. By familiarizing themselves with the factors influencing their property's assessed value, homeowners can identify potential areas for appeal and take proactive steps to ensure an accurate and fair assessment. Regular monitoring of local property tax rates and keeping abreast of market trends can empower homeowners to make informed decisions regarding their property tax obligations.

Factors Influencing Property Tax Assessments

Property tax assessments are influenced by a multitude of factors, each playing a crucial role in determining the taxable value of a property. These factors can be broadly categorized into four main groups: location, property characteristics, market conditions, and government policies.

- Location: The location of a property is a significant determinant of its value. Properties situated in desirable neighborhoods, with access to excellent schools, amenities, and public transportation, often command higher assessments. Conversely, properties in less desirable areas or those with limited access to essential services may have lower assessments.

- Property Characteristics: The physical attributes of a property, such as its size, age, condition, and any recent improvements or renovations, are carefully considered during the assessment process. Properties with larger square footage, newer construction, or significant upgrades may be assessed at a higher value compared to similar properties in the same area.

- Market Conditions: The real estate market's current state significantly impacts property tax assessments. In a robust market with high demand and rising property values, assessments tend to increase. Conversely, during economic downturns or periods of low demand, assessments may remain stagnant or even decrease.

- Government Policies: Local government policies and regulations can also influence property tax assessments. Factors such as tax rates, assessment caps, and exemptions can significantly impact the final assessed value. For instance, some jurisdictions may offer tax breaks or incentives for energy-efficient improvements or historic preservation, which can lower a property's assessed value.

By understanding these factors and their potential impact on property tax assessments, homeowners can make informed decisions and take proactive measures to ensure fair and accurate evaluations. Regularly monitoring market trends, staying updated on local government policies, and maintaining the property's condition can all contribute to a more favorable assessment outcome.

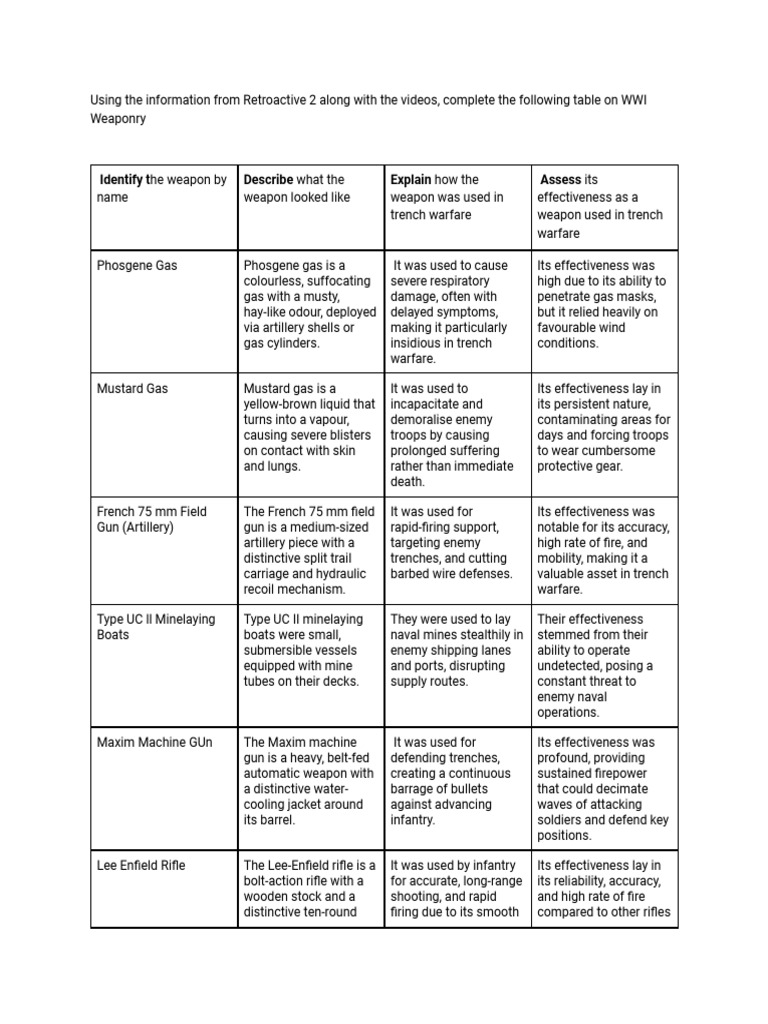

The Property Tax Appeal Process

The property tax appeal process provides homeowners with an opportunity to challenge the assessed value of their property, potentially leading to a reduction in their tax burden. This process varies across jurisdictions, but generally involves several key steps, including gathering evidence, filing an appeal, and attending a hearing or mediation.

Gathering Evidence for Your Appeal

When initiating a property tax appeal, it is essential to gather compelling evidence to support your case. This evidence should demonstrate that the assessed value of your property is inaccurate or unfair compared to similar properties in your area. Here are some key steps to gather the necessary evidence:

- Obtain a Copy of Your Property Assessment: Request a copy of your property assessment from the local tax assessor's office. This document will provide valuable information about your property's assessed value, including the factors considered during the assessment process.

- Research Comparable Properties: Identify and research properties similar to yours in terms of size, location, and features. Look for properties that have recently sold or are currently on the market. Compare their sale prices or listing prices to your property's assessed value. This comparison will help establish whether your property's assessment is consistent with the market.

- Document Property Condition and Improvements: Take photographs or videos of your property's interior and exterior, highlighting any unique features, improvements, or maintenance issues. Document any recent renovations or upgrades you have made, as these can impact the property's value and assessment.

- Gather Expert Opinions: Consider obtaining professional appraisals or expert opinions from real estate agents or property assessors. These professionals can provide valuable insights into your property's value and its comparison to other properties in the area.

- Review Recent Sales Data: Analyze recent sales data of comparable properties in your neighborhood or nearby areas. Look for properties with similar characteristics and compare their sale prices to your property's assessed value. This data can be a powerful tool to demonstrate any discrepancies in the assessment process.

By gathering this evidence, you can build a strong case for your property tax appeal. It is essential to present a comprehensive and well-documented argument to increase your chances of a successful appeal.

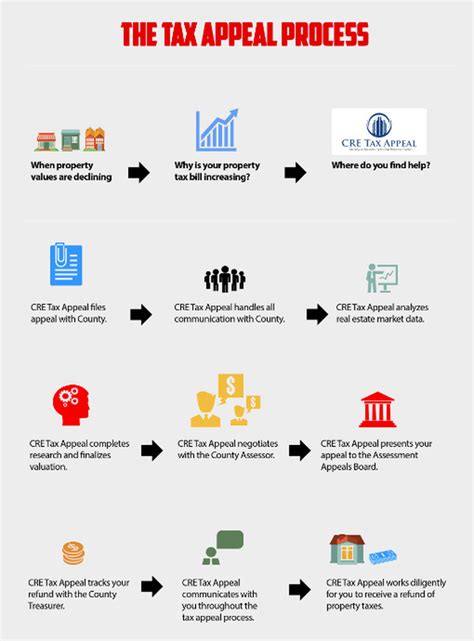

Filing Your Property Tax Appeal

Once you have gathered sufficient evidence to support your property tax appeal, the next step is to file the appeal with the appropriate authority. The process for filing an appeal may vary depending on your jurisdiction, so it is crucial to understand the specific requirements and timelines. Here are some key considerations when filing your appeal:

- Identify the Appeal Deadline: Determine the deadline for filing property tax appeals in your area. Missing this deadline can result in your appeal being rejected, so it is essential to act promptly. You can usually find this information on the website of your local tax assessor's office or by contacting them directly.

- Choose the Appropriate Appeal Form: Different jurisdictions may have specific appeal forms or applications. Ensure you are using the correct form for your appeal. These forms are typically available on the tax assessor's website or can be obtained from their office.

- Complete the Appeal Form: Carefully read and complete all sections of the appeal form. Provide accurate and detailed information about your property, including its address, assessed value, and the reasons for your appeal. Clearly state why you believe the assessment is inaccurate or unfair.

- Attach Supporting Documentation: Include all the evidence you have gathered to support your appeal. This may include copies of your property assessment, comparable property sales data, photographs or videos of your property, expert opinions, and any other relevant documentation.

- Submit the Appeal: Follow the instructions provided by the tax assessor's office to submit your appeal. This may involve mailing the completed form and supporting documents to their office or submitting them online through a designated portal. Ensure you keep a copy of everything you submit for your records.

By following these steps and submitting a well-prepared appeal, you increase your chances of a successful outcome. It is important to stay organized and provide clear and concise information to support your case.

Attending the Hearing or Mediation

After filing your property tax appeal, the next step is to attend the hearing or mediation, where you will have the opportunity to present your case and argue for a reduction in your property’s assessed value. This process can vary depending on your jurisdiction, but typically involves a panel or board of assessors, property tax officials, or an independent mediator.

- Understand the Hearing or Mediation Process: Familiarize yourself with the procedures and guidelines for the hearing or mediation process in your area. This may include understanding the roles of the panel members or mediator, the format of the hearing, and any specific rules or expectations. You can usually find this information on the website of the tax assessor's office or by contacting them directly.

- Prepare Your Presentation: Develop a clear and concise presentation to support your appeal. Organize your evidence and arguments logically, focusing on the key points that demonstrate why your property's assessed value is inaccurate or unfair. Practice your presentation to ensure you can deliver it confidently and persuasively.

- Bring Supporting Documentation: Bring all the evidence and documentation you submitted with your appeal, as well as any additional supporting materials. This may include photographs, expert reports, comparable property data, or any other relevant information that strengthens your case.

- Present Your Case: During the hearing or mediation, you will have the opportunity to present your arguments and evidence. Clearly and respectfully explain why you believe the assessed value of your property should be reduced. Address any questions or concerns raised by the panel or mediator, providing additional clarification or supporting evidence as needed.

- Listen and Respond: Pay close attention to the questions and feedback from the panel or mediator. Be open to constructive dialogue and consider their perspectives. If necessary, provide additional explanations or evidence to address any concerns they may have.

- Stay Professional and Courteous: Maintain a professional and respectful demeanor throughout the hearing or mediation. Remember that the panel or mediator is there to make an informed decision based on the evidence presented. Your conduct and attitude can impact their perception of your case.

By actively participating in the hearing or mediation process and presenting a well-prepared case, you increase your chances of a favorable outcome. It is important to remain calm, confident, and open to discussion to effectively advocate for a reduction in your property's assessed value.

Strategies for a Successful Appeal

To increase your chances of a successful property tax appeal, it is crucial to employ effective strategies and tactics. Here are some key strategies to consider:

Compare Your Assessment to Recent Sales

One of the most powerful strategies is to compare your property’s assessed value to the sale prices of similar properties in your area. By analyzing recent sales data, you can identify any discrepancies between the assessed value and the actual market value of your property. This comparison can serve as strong evidence to support your appeal.

Highlight Property Condition and Improvements

Documenting the condition of your property and any improvements or renovations you have made can significantly impact your appeal. Properties that require significant repairs or have outdated features may have a lower assessed value compared to similar properties in good condition. Highlighting these factors can strengthen your case for a reduction in assessed value.

Utilize Professional Appraisals

Obtaining a professional appraisal from a licensed appraiser can provide valuable insight into your property’s value. A detailed appraisal report can serve as persuasive evidence during your appeal, as it offers an independent and expert opinion on your property’s worth. Consider investing in a professional appraisal to bolster your appeal’s credibility.

Research Assessment Errors

Errors in property assessments are not uncommon. These errors can range from simple clerical mistakes to more significant miscalculations. By carefully reviewing your assessment for any inaccuracies, such as incorrect square footage, outdated property features, or misplaced decimal points, you can identify potential grounds for an appeal. Researching assessment errors specific to your area can help you identify common mistakes and increase your chances of a successful appeal.

Consider Hiring a Tax Professional

Navigating the property tax appeal process can be complex, and seeking professional assistance may be beneficial. Tax professionals, such as certified public accountants or tax attorneys, have extensive knowledge and experience in property tax matters. They can provide valuable guidance, help you gather evidence, and represent you during the appeal process. Consider consulting a tax professional to increase your chances of a successful appeal and ensure compliance with all legal requirements.

Conclusion: Empowering Homeowners

The property tax appeal process empowers homeowners to challenge unfair or inaccurate assessments, potentially leading to significant savings. By understanding the assessment process, gathering compelling evidence, and employing effective strategies, homeowners can increase their chances of a successful appeal. While the process may vary across jurisdictions, this comprehensive guide provides a roadmap for navigating the property tax appeal journey. Remember, staying informed, proactive, and persistent can make a difference in achieving a fair and accurate assessment of your property’s value.

Frequently Asked Questions

What is the deadline for filing a property tax appeal?

+

The deadline for filing a property tax appeal varies by jurisdiction. It is crucial to check with your local tax assessor’s office or their website to determine the specific deadline in your area. Missing the deadline may result in your appeal being rejected.

Can I appeal my property taxes if I recently purchased my home?

+

Yes, you can appeal your property taxes even if you recently purchased your home. The assessment process considers various factors, including the property’s value at the time of assessment, regardless of when you acquired it. However, it is important to understand that the appeal process may have different requirements and timelines for newly purchased properties.

What happens if my appeal is denied?

+

If your appeal is denied, you may have the option to file an administrative appeal or seek further legal recourse. The specific steps and options available to you will depend on your jurisdiction’s regulations. It is advisable to consult with a tax professional or attorney to explore your options and understand the next steps in the appeals process.

Can I appeal my property taxes if I have made improvements to my home?

+

Yes, you can appeal your property taxes if you have made significant improvements to your home that impact its value. However, it is important to understand that not all improvements may result in a reduction in taxes. The assessment process considers various factors, and improvements may not always lead to a lower assessed value. It is recommended to consult with a tax professional to determine the potential impact of your improvements on your property taxes.

How often can I appeal my property taxes?

+

The frequency of property tax appeals varies by jurisdiction. Some areas allow annual appeals, while others have specific assessment cycles or timeframes. It is essential to check with your local tax assessor’s office or their website to understand the appeal process and frequency in your area. Additionally, some jurisdictions may have limitations or restrictions on the number of appeals you can file within a certain period.